It feels weird. You look at your brokerage account, see green everywhere, and instead of celebrating, you get this sinking feeling in your gut. We’ve been told for decades that what goes up must come down. So, seeing the stock market at an all time high usually triggers a frantic search for the "exit" button. Is it a bubble? Are we about to go over a cliff? Honestly, the anxiety is pretty normal, but the math tells a much different story than your nerves do.

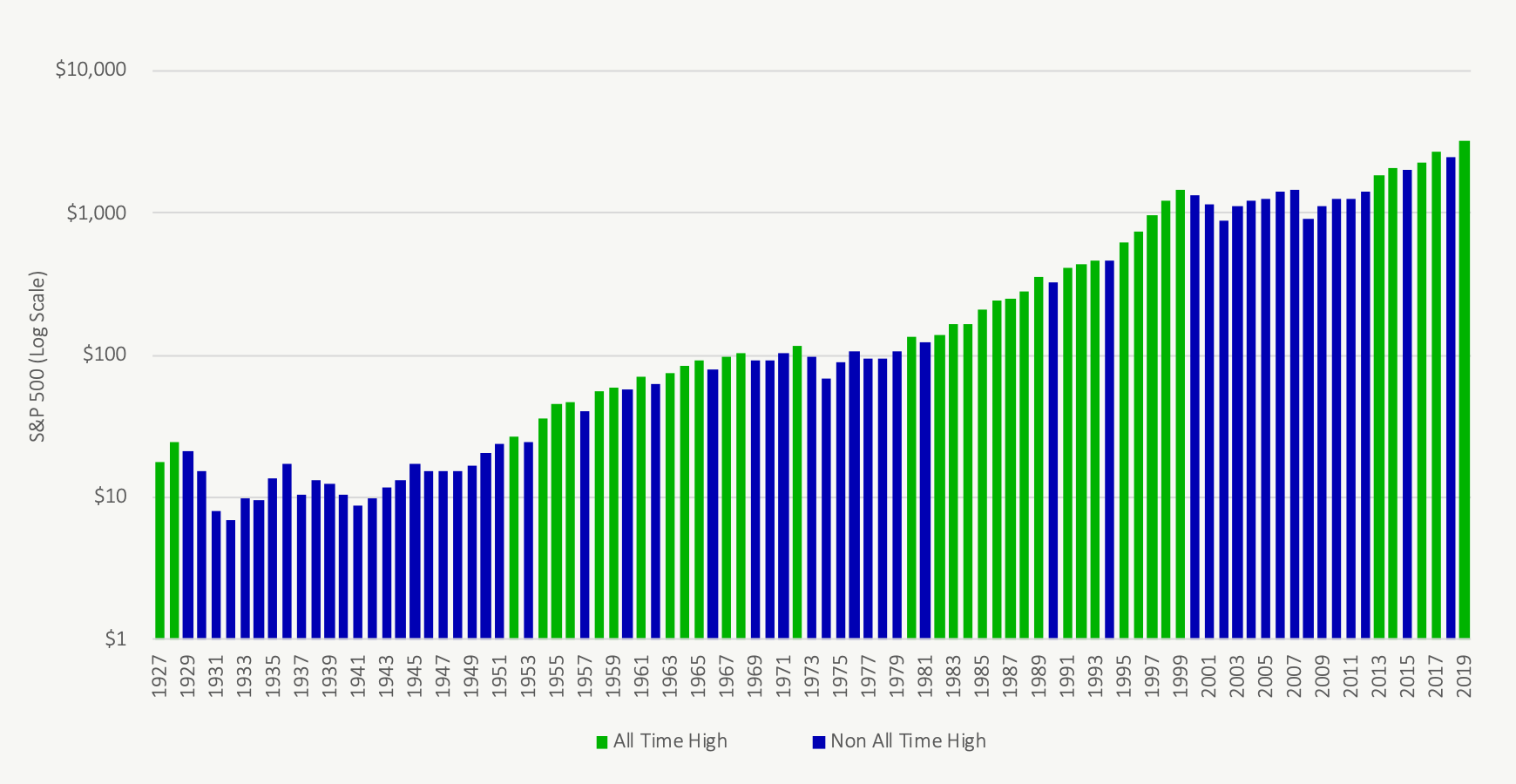

Markets hit new peaks way more often than people realize. Since 1926, the S&P 500 has spent roughly 5% of its trading days at an all-time high. That’s a lot of days. If you sold every time the market hit a record, you would have missed out on the massive compounding that happened during the late 90s or the post-2010 bull run. Being at the top isn't a signal that a crash is coming tomorrow. Usually, it's just a signal that the economy is actually growing.

The Psychological Trap of the Peak

Most of us are wired for loss aversion. We hate losing $100 more than we love making $100. When the stock market at an all time high starts dominating the headlines, our brains scream "expensive!" We compare today’s prices to the prices from two years ago and feel like we missed the boat.

But here is the thing: the market doesn't have a memory. It doesn't care that the S&P 500 was at 3,000 a few years ago. It only cares about future earnings, interest rates, and inflation. If companies like NVIDIA, Microsoft, or Apple are making more money now than they were then, it makes perfect sense for their stock prices to be higher. Valuation matters, sure, but a high price tag isn't the same thing as an overvalued one.

Think about it like real estate. If you bought a house in a great neighborhood in 1980, it was probably at an all-time high then. If you sold it because you were afraid it couldn't go higher, you’d be kicking yourself today. Stocks are just fractional ownership of businesses. As long as those businesses innovate and grow, the ceiling keeps moving up.

📖 Related: GeoVax Labs Inc Stock: What Most People Get Wrong

What History Actually Says About All-Time Highs

Finance researchers at JP Morgan Asset Management actually crunched the numbers on this. They looked at the S&P 500 returns since 1970. If you invested at a random day, your average return after one year was about 11.7%. If you invested only when the stock market was at an all time high, your average return after one year was... 14.6%.

That’s counterintuitive.

It feels like buying at the peak is the riskiest move you can make. In reality, momentum is a powerful force in finance. All-time highs often happen in clusters. One peak leads to another, then another, as investor confidence builds and corporate earnings surprise to the upside.

Take the period between 2013 and 2015. The market was hitting record after record. People were calling for a "correction" every single week. If you had sat on the sidelines waiting for a 10% dip, you would have waited years while the market climbed 30% or 40% higher. By the time the dip finally came, the "discounted" price was still way higher than the all-time high you were originally afraid of.

👉 See also: General Electric Stock Price Forecast: Why the New GE is a Different Beast

Why This Time Might Feel Different (But Probably Isn't)

Every bull market has a "wall of worry." Today, that wall is built out of concerns about AI hype, geopolitical tension in the Middle East, and whether the Federal Reserve can actually stick the "soft landing."

We see the stock market at an all time high and assume it's all "froth."

- Corporate Earnings: In 2024 and 2025, we saw a massive recovery in earnings per share (EPS). Companies got lean during the high-interest-rate scare and are now seeing the benefits.

- The AI Factor: It’s easy to call AI a bubble, but unlike the Dotcom era, the companies leading the charge are actually generating billions in real cash flow.

- Interest Rate Cycles: Historically, when the Fed starts cutting rates while the economy is still growing, it’s like pouring rocket fuel on the market.

It's not just "vibes." It’s liquidity.

The Danger of "Waiting for a Dip"

Waiting for a correction is a strategy that sounds smart at dinner parties but usually fails in a brokerage account. Let's say the market is at an all-time high today. You decide to hold onto your cash because you're "waiting for a 10% pullback."

✨ Don't miss: Fast Food Restaurants Logo: Why You Crave Burgers Based on a Color

The market might go up another 20% before that 10% pullback ever happens.

When the pullback finally arrives, the market will still be 10% higher than it is today. Plus, you’ll be too terrified to buy when the dip actually happens because the news will be full of "recession" and "market crash" headlines. It’s a cycle of hesitation that kills long-term wealth.

How to Manage Your Portfolio When Everything is Expensive

So, what do you actually do? You don't have to be reckless. Being at a peak is a great time to check your "risk tolerance." If your portfolio has grown so much that you're now 80% stocks when you should be 60%, it’s okay to rebalance. Sell some winners, buy some boring bonds or cash equivalents.

Don't "exit" the market. Just adjust the dials.

Another strategy? Dollar-cost averaging. If you have a lump sum and you’re terrified of buying the absolute top, break it up. Put a third in now, a third in next month, and a third the month after. If the stock market at an all time high turns into a minor correction, you’ll feel like a genius for having cash ready. If it keeps soaring, at least you got some skin in the game.

Actionable Steps for the High-Market Environment

- Check Your Asset Allocation: If your tech stocks have ballooned to 50% of your net worth, trim them back to your target percentage. This isn't "timing the market"; it's basic maintenance.

- Look at "Laggards": While the S&P 500 might be at a record, not every sector is. Small-cap stocks or international markets often trade at a discount even when the big indices are peaking.

- Automate Your Investing: Set up an automatic transfer. It removes the emotional burden of having to "decide" to buy when prices look high.

- Keep a Cash Buffer: Having 6 to 12 months of living expenses in a high-yield savings account makes market volatility a lot easier to stomach. You won't be forced to sell your stocks at a loss just to pay rent.

- Focus on Valuation, Not Price: Look at Price-to-Earnings (P/E) ratios compared to historical averages. A stock at $400 can be "cheaper" than it was at $200 if its earnings have tripled.

The most important thing to remember is that the market spends most of its time going up. Records are meant to be broken. If you’re a long-term investor with a horizon of 10, 20, or 30 years, the "high" of today will likely look like a bargain in the rearview mirror. Stop staring at the daily charts and let the math of compounding do the heavy lifting for you.