Most people think they’re "global investors" because they own a few shares of Apple or maybe a tech-heavy ETF. Honestly? They’re usually just betting on the Nasdaq with a different name. If you actually want to see how the world’s money is moving—from the banks in Zurich to the factories in Tokyo and the oil fields in Texas—you have to look at the S&P Global 1200 Index. It’s the heavyweight champion of benchmarks.

Think of it as a "super-index." It doesn't just look at one country. It’s a composite. It’s basically seven different regional indices mashed together into one massive, liquid, and surprisingly efficient gauge of the human economy.

It covers roughly 70% of the global equity market capitalization. That is a staggering amount of wealth. We are talking about 30 countries. This isn't just some niche list of companies; it's the actual engine of global commerce. If the S&P Global 1200 Index is twitching, the world’s retirement accounts are twitching too.

What Actually Lives Inside the S&P Global 1200 Index?

It’s easy to get lost in the jargon of "composite indices," but the structure of this thing is actually pretty logical once you peel back the sticker. S&P Dow Jones Indices didn't just throw 1,200 random stocks into a bucket. They took a modular approach.

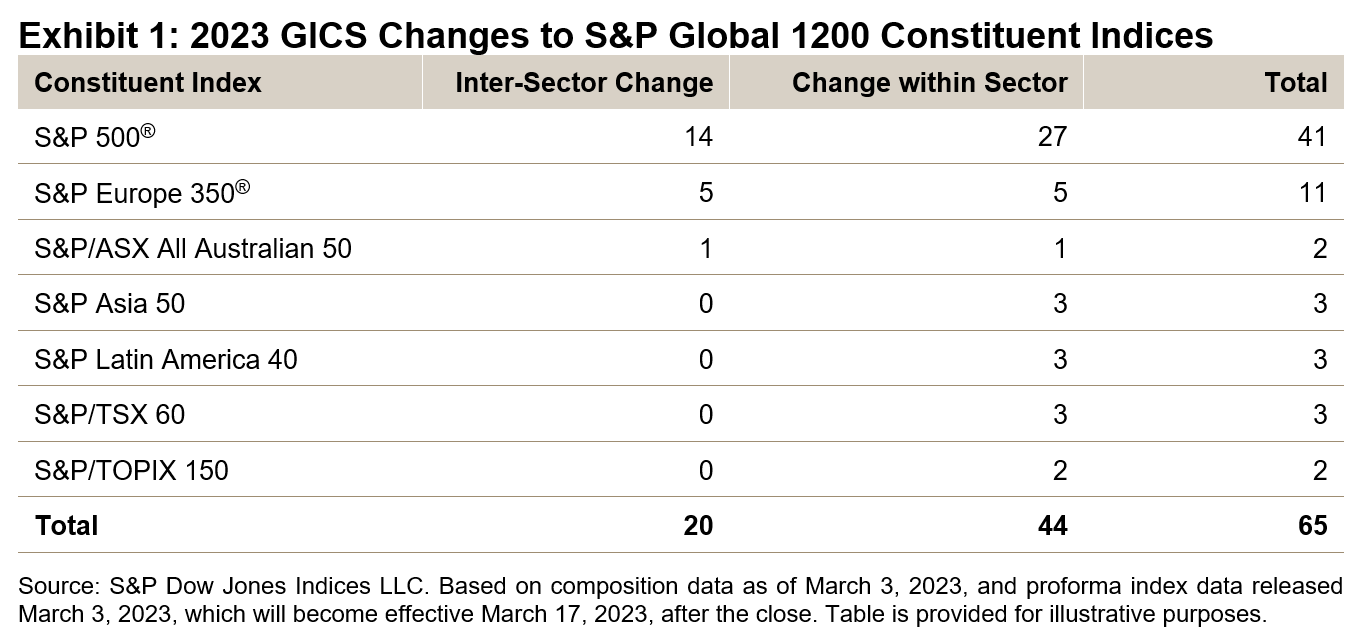

The backbone is the S&P 500. You know that one. It represents the US large-cap market. But then they added the S&P Europe 350, which captures the heavy hitters in the Eurozone and the UK. Then comes the S&P TOPIX 150 for Japan, the S&P/TSX 60 for Canada, the S&P/ASX 50 for Australia, the S&P Asia 50, and the S&P Latin America 40.

It’s weighted by float-adjusted market capitalization. This means the bigger the company’s total value available to the public, the more influence it has on the index’s daily movement.

Because the US market has been on such an absolute tear for the last decade, the S&P 500 portion carries a massive amount of weight here. You’ll see the usual suspects at the top: Microsoft, Apple, NVIDIA, and Amazon. But the magic happens in the other 700-odd stocks. You’re getting exposure to Nestlé in Switzerland, Samsung in South Korea, and BHP in Australia. These are companies that move on different cycles than Silicon Valley.

The Currency Headache Nobody Mentions

Here is something that kinda drives investors crazy: currency fluctuation. When you track the S&P Global 1200 Index, you aren't just betting on stock prices. You’re betting on the US Dollar versus... well, everything else.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

If the Japanese Yen craters but Toyota’s stock price in Tokyo stays flat, the value of that holding in the index (when measured in USD) actually goes down. It’s a double-edged sword. Some years, the underlying companies do great, but a strong Dollar eats all your gains. Other years, the companies are "meh," but a weak Dollar makes your international holdings look like they’re screaming higher.

Expert traders use this index to spot "divergence." If the S&P 500 is hitting all-time highs but the S&P Global 1200 Index is lagging, it tells you the rest of the world is struggling. It’s a reality check. It prevents that "home bias" where we assume that because the local mall is busy, the whole world must be thriving.

Why 1,200 is the Magic Number

You might ask why 1,200? Why not the S&P 5,000?

Liquidity.

That is the short answer. S&P Global 1200 Index constituents are chosen because they are easy to buy and sell. Large institutional investors—the ones managing billions—need to be able to move in and out of positions without moving the price too much. By capping it at 1,200 of the world’s most dominant firms, the index remains "tradable."

It’s efficient.

If you go too deep into small-cap stocks in emerging markets, you run into "stale prices" or markets that close for holidays when others are open. The 1,200 keeps it clean. It focuses on the "blue chips." These are the companies with the most robust balance sheets and the most international reach.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

The Sector Breakdown: It’s Not Just Tech

People often complain that the US markets are too concentrated in Technology. They aren't entirely wrong. But when you zoom out to the S&P Global 1200 Index, the flavor changes.

- Information Technology still leads.

- Financials are a much bigger piece of the pie globally than they are in just the US tech-heavy indices.

- Health Care and Industrials provide a massive floor.

Think about it. In Europe, you have massive industrial conglomerates and luxury goods giants like LVMH. In Australia and Canada, the index is heavily influenced by materials and banking. When you combine them, you get a much more "balanced diet" of sectors.

It’s a hedge against a "tech bubble" popping. If software valuations go sideways but global trade in physical goods stays strong, the industrial components of the 1,200 act as a stabilizer.

The Performance Reality Check

Let’s be real for a second. If you had just put all your money in the S&P 500 over the last few years, you probably would have outperformed the S&P Global 1200 Index.

Why? Because the US has been an outlier.

But history is a long game. There have been entire decades—like the 2000s—where the US market was basically flat (the "Lost Decade"), while international markets were booming. Investors who were diversified into the global 1200 during that era were the ones who actually saw their portfolios grow.

Diversification is about admitting you don’t know who’s going to win next year.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

How to Actually Use This Information

You can’t buy "the index" directly. You have to buy a product that tracks it.

Most retail investors look for ETFs (Exchange Traded Funds) or mutual funds that use the S&P Global 1200 Index as their benchmark. The most famous one is likely the iShares Global 100 ETF (IOO), though that is a narrower slice. Many institutional funds use the full 1200 framework to build "World" funds.

What to check before you buy:

- Expense Ratio: How much is the fund charging you to hold these stocks? Since these are all large-cap stocks, the fee should be very low. Anything over 0.20% or 0.30% for a plain-vanilla global index fund is starting to look expensive.

- Tax Efficiency: Holding international stocks can sometimes lead to foreign tax withholdings.

- Overlap: If you already own an S&P 500 fund, remember that about 50-60% of the S&P Global 1200 Index is the US. You might be doubling down on the same stocks without realizing it.

The Counter-Argument: Is it "Global" Enough?

Critics will tell you the S&P Global 1200 Index is "old world."

It doesn’t include a massive amount of exposure to "Emerging Markets" like India or mainland China (though some parts are captured via the Asia 50). It’s heavily weighted toward "Developed" economies. If you think the next 50 years of growth are coming from Nigeria, Vietnam, or Brazil, this index might feel a bit too "stuffy" for you.

It’s a "safe" global bet. It’s for the person who wants to own the world’s winners, not the person trying to find the next "frontier" market.

Actionable Steps for the Global Investor

If you want to move beyond your home country and use the S&P Global 1200 Index as a guide, start with these specific moves:

- Audit your "Home Bias": Open your brokerage account. Look at the percentage of your stocks based in your home country. If it’s over 80%, you aren't diversified; you're just lucky (or unlucky) based on one economy.

- Compare the Yields: Often, the international components of the 1200 (like those in Europe and Australia) offer higher dividend yields than US tech stocks. If you need income, looking at the global index can reveal where the cash flow is hiding.

- Watch the Relative Strength: Use a charting tool to compare the S&P 500 (SPY) against a global fund (like IOO or a similar total world fund). When the ratio starts to flip, it’s a signal that capital is leaving the US and heading for international markets. That’s usually when you want to rebalance.

- Check Sector Weighting: Ensure you aren't over-exposed to one industry across the globe. If you own US banks and then buy a global fund that is heavy on European banks (which are a huge part of the S&P Europe 350), you’ve just multiplied your risk in the financial sector.

The S&P Global 1200 Index isn't just a list of numbers. It’s a map of where the world’s power sits right now. It tells you which countries are productive, which sectors are dominant, and where the smartest money on the planet is currently parked. Use it as your North Star for diversification, but always keep an eye on those currency shifts—they’ll sneak up on you every time.