Markets are messy. If you're looking at the price of soybeans per bushel today, you aren't just looking at a number on a screen; you're looking at a global tug-of-war between South American weather, Chinese demand, and the ever-shifting biofuel policies in Washington D.C. It’s volatile. Honestly, "volatile" might be an understatement. For a farmer in Illinois or a trader in Chicago, a twenty-cent swing feels like a punch in the gut or a winning lottery ticket, depending on which way the wind blows.

Right now, the Chicago Board of Trade (CBOT) is the sun that everything else orbits. Prices have been hovering in a range that makes profit margins razor-thin for many producers. We aren't in the $17 highs of a few years back, but we aren't exactly in the basement either. It’s that middle ground that's the most stressful. You've got to decide: sell now and lock in a "meh" price, or hold out and pray for a rally that might never come.

What’s Actually Moving the Price of Soybeans Per Bushel Today?

Supply and demand. It’s the first thing they teach you in Econ 101, but in the grain markets, it’s never that simple. The "supply" side is currently dominated by Brazil. They’ve become a powerhouse. When Brazil has a record crop, the world is swimming in beans, and that puts a heavy lid on how high prices can go here in the States. If Mato Grosso gets a week of perfect rain, your local elevator price probably drops before you even finish your morning coffee.

Then there’s China. They are the whale in the room. They buy a staggering amount of the world's exported soy to feed their massive hog herds. If China decides to buy from Brazil instead of the U.S. because of a currency swing or a political spat, the price of soybeans per bushel today takes a hit. It’s a game of geopolitical chess played with oilseeds.

The Impact of the "Crush"

We need to talk about the crush spread. This is basically the difference between the price of raw soybeans and the value of the products you get after processing them—soybean meal and soybean oil.

Lately, the demand for soybean oil has been the real hero. Why? Renewable diesel. The push for greener fuels has created a massive new appetite for domestic soy oil. Refineries are popping up across the Midwest specifically to turn beans into fuel. This provides a "floor" for the price. Even if export demand is shaky, the domestic crush is working overtime. It’s a fundamental shift in the market that hasn't fully played out yet.

Weather Markets and the Fear Factor

Weather is the ultimate wild card. You can track every USDA report and analyze every export shipment, but a three-week drought in August changes everything.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

In the trade, they call it a "weather premium." Traders get nervous. They start buying futures because they're afraid the crop will shrivel up. This spikes the price of soybeans per bushel today, even if the actual damage hasn't happened yet. It’s all based on "what if." Then, the minute a rain cloud appears on the radar for Iowa, that premium evaporates. Prices crash back down. It’s a psychological rollercoaster that requires nerves of steel.

Understanding the Basis

Here is something most people overlook: the price you see on the news isn't the price you get.

The CBOT futures price is a benchmark. But then there’s the "basis." The basis is the difference between that national futures price and your local cash price. It accounts for transportation costs, storage capacity, and local demand. If the Mississippi River is too low for barges to move, the basis widens, and the price at your local terminal drops, even if the futures market is steady. It’s local reality versus global speculation.

The Role of the USDA Reports

Every month, the USDA drops the WASDE (World Agricultural Supply and Demand Estimates) report. It’s the closest thing the ag world has to a Super Bowl.

At exactly 12:00 PM ET on report days, the market often goes haywire. If the USDA says ending stocks—the amount of beans left over at the end of the season—are lower than expected, prices rocket up. If they find an extra 50 million bushels tucked away somewhere, look out below. These reports are often criticized for being "behind the curve," but they are still the gold standard for market data. You can't ignore them.

South American Competition

Brazil isn't just a competitor; they are the competitor. Their planting season is the opposite of ours. While we are harvesting in October and November, they are putting seeds in the ground. This means the world gets two "supply shocks" every year.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

If Brazil’s harvest is delayed by rain, it opens a window for U.S. exports to fill the gap. But if their logistics are smooth, they can often undercut U.S. prices. Argentina is the third player here, though they usually focus more on exporting soybean meal rather than the raw beans. Watching the Argentine Peso is almost as important as watching the weather in Nebraska.

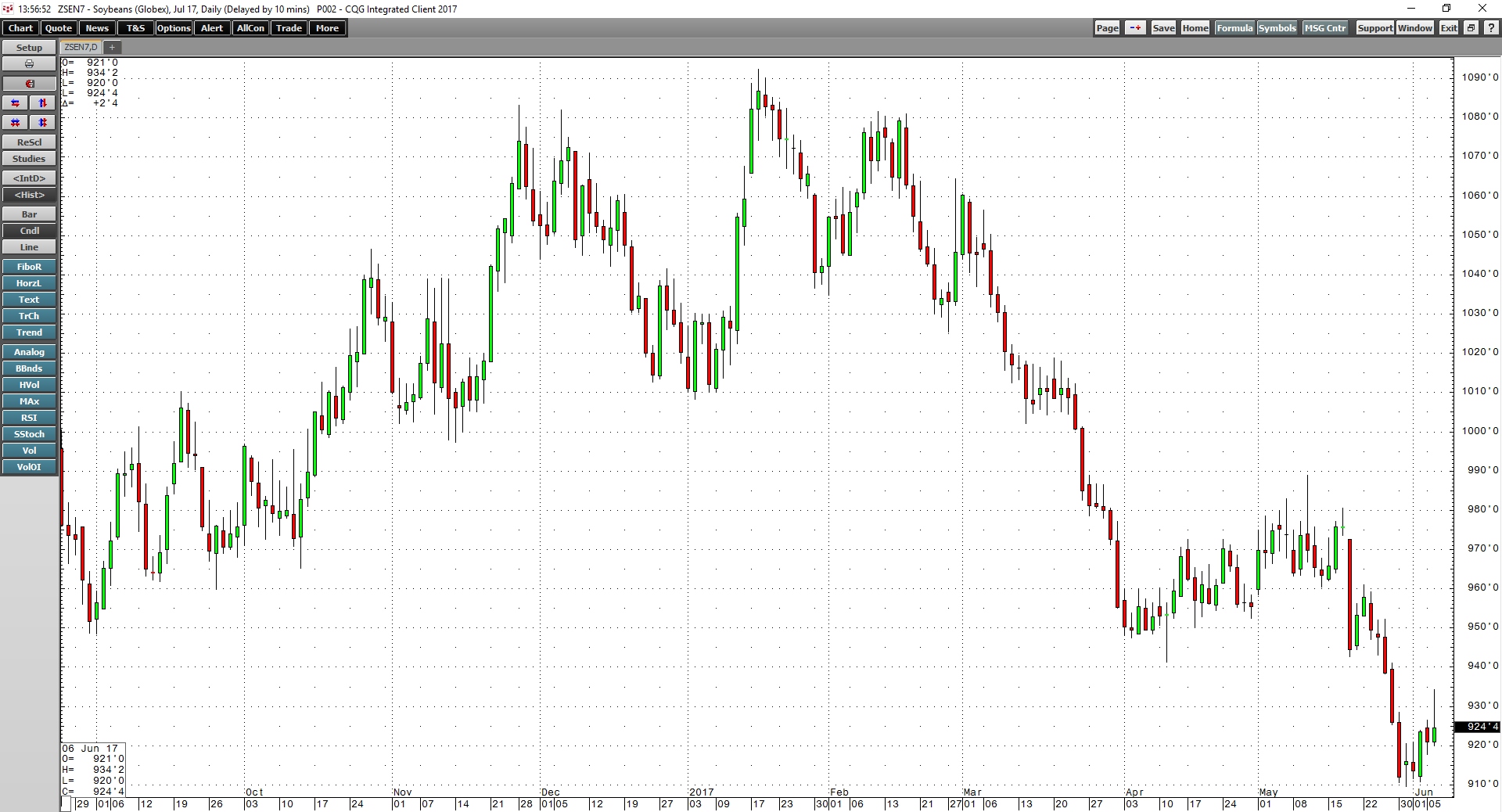

Why Technical Analysis Matters to You

A lot of folks think "charts" are for Wall Street guys in suits. In the soy market, charts matter because everyone is looking at the same ones.

When the price of soybeans per bushel today hits a "support" level—a price point where it has historically stopped falling—buyers tend to jump in. Conversely, if it hits "resistance," sellers flood the market. It becomes a self-fulfilling prophecy. Even if you don't believe in technical analysis, you have to respect it because the big institutional funds use it to drive billions of dollars in trades.

The "Funds" and Managed Money

Speaking of funds, let’s talk about "The Big Money." These aren't farmers. They are hedge funds and commodity index funds. They trade soybeans like they trade tech stocks or gold.

Sometimes, the price of soybeans per bushel today has nothing to do with beans. It might be because the US Dollar is strong, or because oil prices are falling, or because a fund manager decided to "risk off" and dump all their commodity positions. When the managed money decides to go "short" (betting prices will fall), they can drive the market lower than the fundamentals actually justify. It can be incredibly frustrating for producers.

Misconceptions About Soy Prices

People think high prices are always good for farmers. That’s not true.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

If the price is high because a drought wiped out half your crop, you're still losing money. You have nothing to sell. The "sweet spot" is a decent price with high yields. Also, high bean prices often mean high land rents and high fertilizer costs the following year. The input suppliers watch the markets too. When they see bean prices go up, the price of seed and chemicals usually follows right behind.

The Export Inspection Game

Every Monday, the USDA releases export inspection data. It tells us how many bushels actually left the country on ships.

This is the "proof in the pudding." Anyone can announce a "flash sale" to China, but the inspection data proves the beans are actually moving. If these numbers are consistently low, it suggests that the global market is finding cheaper options elsewhere, which eventually drags down the price of soybeans per bushel today.

Looking Toward the Next Growing Season

Planning starts months before a tractor hits the field. Farmers have to decide between planting corn or soybeans. This is the "Acreage Battle."

If the price of soybeans per bushel today is high relative to corn, farmers plant more beans. But if everyone plants more beans, the supply goes up, and the price eventually goes down. It’s a constant balancing act. Analysts look at the "new crop" futures—the prices for delivery in November—to guess how many acres will be dedicated to soy.

Practical Steps for Tracking the Market

Don't just stare at one number. You need a broader view to understand what's coming.

- Monitor the Brazilian Real: A weak Brazilian currency makes their soybeans cheaper for world buyers, which hurts U.S. prices.

- Watch the Energy Sector: Since soy oil is used for fuel, a spike in crude oil often pulls soybean prices higher.

- Check River Levels: For U.S. growers, the ability to move grain down the Mississippi is a massive price driver. Low water equals lower local prices.

- Listen to the "Crush" Margins: If processors are making a lot of money, they will bid more aggressively for your beans.

- Set a Target Price: Don't wait for the "top." It's impossible to time. Decide on a price that covers your costs and gives you a profit, and pull the trigger when the market hits it.

The market is a beast that never sleeps. It reacts to a tweet, a rain cloud in Brazil, or a policy change in a country you've never visited. Staying informed means looking past the daily headlines and understanding the deep, structural shifts in how the world uses this tiny, powerful bean.