Nike has had a wild ride lately. Honestly, if you’ve been watching the ticker, it’s been a bit of a nail-biter. As of the close on Friday, January 16, 2026, the price of Nike stock (NKE) sat at $64.38. Because today is Sunday, the market is closed, but that number is the benchmark everyone is staring at before Monday’s opening bell.

It’s a far cry from the glory days of 2021 when the stock was flirting with $170. Back then, it felt like Nike couldn't lose. Now? It’s basically a story of a giant trying to find its footing again.

What’s actually happening with the NKE ticker?

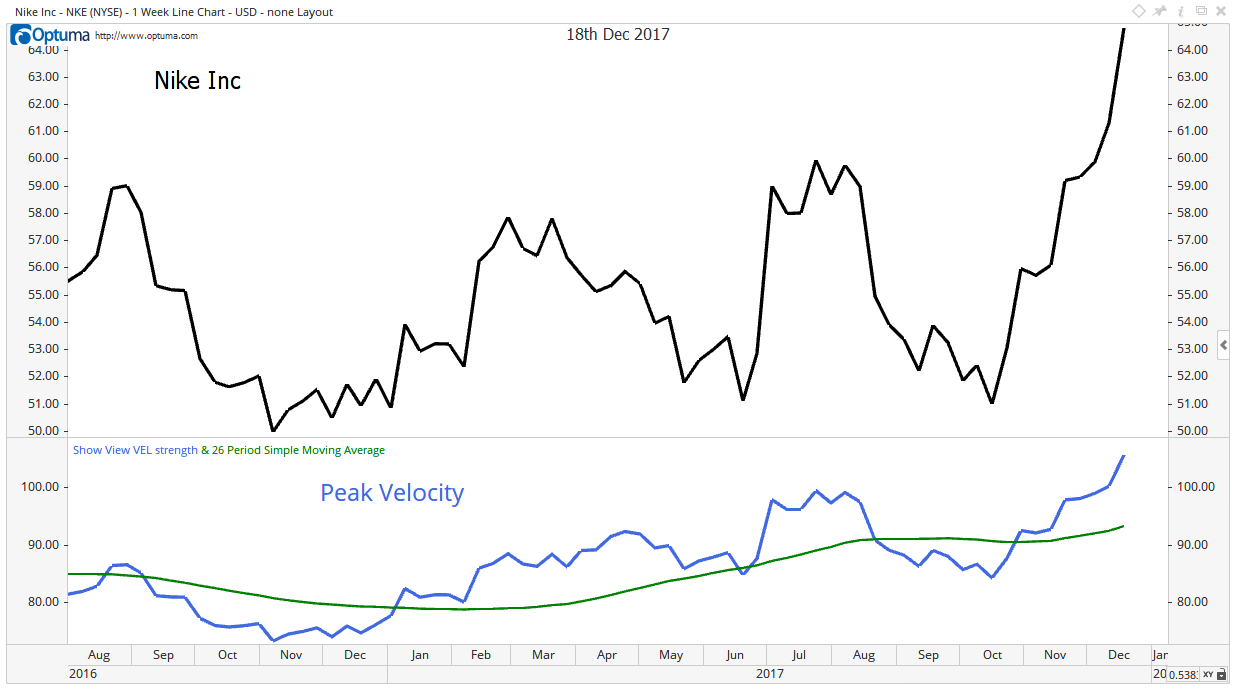

If you look at the day-to-day, the price of Nike stock has been bouncing around a 52-week range of roughly $52 to $82. On Friday alone, it saw a high of $64.59 and a low of $63.68. Not exactly a massive swing, but when you’re talking about a company with a market cap near $95 billion, every cent counts.

👉 See also: Modern Office Furniture Design: What Most People Get Wrong About Productivity

The company just wrapped up its fiscal 2026 second quarter in late December. The numbers were... okay. Revenue was around $12.4 billion, which is basically flat. CEO Elliott Hill has been talking a lot about "middle innings" of a comeback. It’s a sports metaphor, obviously. But for investors, it means "we're working on it, please don't sell yet."

Why the price of Nike stock is struggling to break out

The brand is fighting a war on two fronts. First, there's the internal stuff. They’ve been pivoting back to wholesale after realizing that going "all-in" on direct-to-consumer (DTC) maybe left some money on the table. Turns out, people still like buying sneakers at Foot Locker.

✨ Don't miss: US Stock Futures Now: Why the Market is Ignoring the Noise

Then there's the macro mess. China has been a tough nut to crack lately, with sales there dipping. Plus, North America is dealing with those annoying tariffs that keep eating into the gross margin—which dropped to about 40.6% recently.

- Wholesale is up: About 8% growth here, showing that the "back to basics" partner strategy is working.

- Digital is down: A 14% drop in Nike Brand Digital. Ouch.

- Dividends are steady: They just bumped the quarterly dividend to $0.41. At least they’re still paying you to wait.

What the experts are whispering

Wall Street is split. Kinda typical, right? You’ve got the bulls who see the average price target of $76.85 and think there's a 20% upside just sitting there. They point to the 20% growth in the running footwear category as a sign that the "innovation engine" is finally revving up again.

🔗 Read more: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

On the flip side, the bears are worried about the 300 basis point drop in gross margins. They see the heavy discounting—those "sale" racks at the outlets—and worry that Nike is losing its premium luster.

Honestly, the price of Nike stock right now reflects a company in transition. It’s not a growth darling anymore, but it’s too big to ignore as a value play.

Actionable moves for the retail investor

If you're holding NKE or thinking about jumping in, here is how to play the current levels:

- Watch the $60 floor: Historically, the stock has found some support around the $60 mark. If it dips below $58, it might be time to re-evaluate the "comeback" narrative.

- Focus on the Running category: This is Nike's soul. If they continue to see 20%+ growth in running, it means they are successfully fending off brands like Hoka and On.

- Check the inventory: Last report showed inventory was down 3%. That’s good! It means they aren't sitting on piles of old shoes they have to practically give away.

- Dividend Reinvestment: If you’re a long-term fan, the 2.5% yield isn't world-beating, but reinvesting those $0.41 payouts while the stock is under $70 can significantly lower your cost basis over time.

Don't expect a moonshot tomorrow. The turnaround plan, dubbed "Win Now," is more of a slow burn than a sprint. Keep a close eye on the next earnings report in March to see if those margin pressures are actually starting to ease up.