You’ve probably seen it. That flickering, neon-green digital display in Midtown Manhattan, or maybe a digital version embedded on a news site, where the numbers blur because they’re moving so fast. It's the live US debt counter. Most people glance at it, feel a momentary pit in their stomach, and then go back to ordering their latte. But if you actually stop and watch those digits spin, you're witnessing the most complex financial experiment in human history.

It moves at a clip that honestly defies the human brain's ability to process large scales. We aren't wired to understand trillions. A million seconds is 12 days. A billion seconds is 31 years. A trillion seconds? That's 31,688 years. Now realize the counter is sitting north of $34 trillion and adding roughly $1 trillion every 100 days lately.

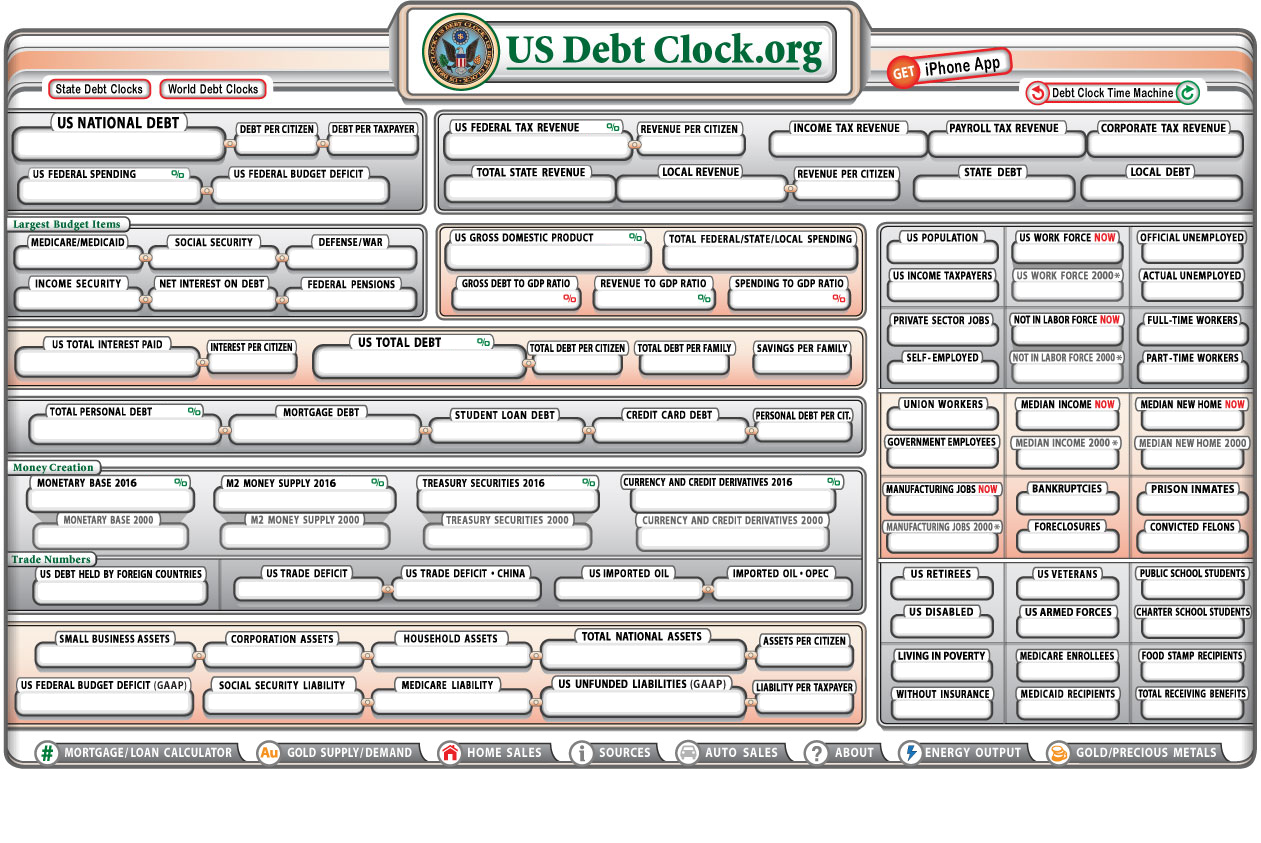

What the Live US Debt Counter is Actually Tracking

When you stare at a live US debt counter, you aren't just looking at one big credit card bill. It's a massive accumulation of several types of borrowing. Most of it is "public debt." This is the stuff held by people like you, big pension funds, insurance companies, and foreign governments like Japan or China. They buy Treasury bonds because, historically, the US has been the safest place on earth to park cash.

Then there’s the "intragovernmental" debt. This part is kinda weird. It’s basically the government borrowing from itself. For example, the Social Security Trust Fund takes in more tax money than it pays out right now, so it "lends" that extra cash to the rest of the government to spend on other stuff. It's an IOU written from one pocket to the other.

Critics, like those at the Committee for a Responsible Federal Budget (CRFB), point out that while the total number is flashy, the real thing to watch is the debt-to-GDP ratio. That’s the true measure of whether the country is living beyond its means. Right now, that ratio is hovering near record highs, reminiscent of the post-World War II era. But back then, we had a massive manufacturing boom to pay it off. Today? Things are a bit different.

The Math Behind the Blur

How does the counter move so fast? It’s not just a random generator. Sites like the US Debt Clock use algorithms based on the Daily Treasury Statement. The Treasury Department actually releases a report every business day showing exactly how much cash came in and how much went out.

- Tax receipts from payroll and corporations.

- Spending on defense, Medicare, and interest.

- The "net" result determines how much the counter ticks up.

It’s almost never ticking down.

👉 See also: Getting a music business degree online: What most people get wrong about the industry

Why the Interest is the Real Killer

Forget the total number for a second. The real monster under the bed is the interest. For years, the US got away with massive borrowing because interest rates were basically zero. It was like having a massive mortgage with a 0.5% interest rate—you can handle a big principal if the monthly payment is tiny.

But then inflation hit. The Federal Reserve cranked up rates to fight it. Suddenly, all that debt became way more expensive to "service."

We are now spending over $2 billion a day just on interest. Think about that. That’s money not going to schools, not going to fixing bridges, and not going to scientific research. It’s just... gone. Just the cost of carrying the balance. According to the Congressional Budget Office (CBO), interest payments are on track to exceed the entire defense budget. That is a massive shift in how the American empire functions.

The Common Myths People Believe

You’ll hear people say, "China owns us." That’s actually not true. Most of our debt is owned by Americans. Domestic investors, the Federal Reserve, and state/local governments hold the vast majority. If the US defaulted, it wouldn't just be a "them" problem; it would wipe out the 401(k)s and pension funds of almost every working person in the country.

Another myth? "We can just print our way out of it."

Technically, yes, the Treasury could print a $1 trillion platinum coin. It’s a real legal loophole. But the economic fallout would be like trying to put out a fire with gasoline. It would likely trigger hyperinflation, making your $5 loaf of bread cost $50 within months. Economists like Milton Friedman spent decades explaining that you can't get something for nothing in the monetary world.

✨ Don't miss: We Are Legal Revolution: Why the Status Quo is Finally Breaking

Is There a Breaking Point?

Some experts, like those at the Wharton School (the Penn Wharton Budget Model), suggest the US has maybe 20 years to fix this before a default becomes unavoidable. Others are more optimistic. They argue that as long as the US Dollar remains the world’s reserve currency, we can keep the plates spinning.

But what happens if the world stops trusting the dollar?

If investors start demanding higher interest rates because they’re scared we won’t pay them back, the live US debt counter will start moving even faster. It creates a "debt spiral." More debt leads to more interest, which leads to more debt to pay the interest. It’s a vicious circle.

How This Actually Affects Your Wallet

It’s easy to think this is just a bunch of numbers on a screen in New York. It isn't. High national debt has a "crowding out" effect. When the government borrows trillions, it’s competing with you for loans. This can drive up interest rates for your mortgage, your car loan, and your credit cards.

It also limits what the government can do during a crisis. In 2008 and 2020, the government spent trillions to save the economy. If we’re already tapped out when the next recession hits, they might not be able to pull that lever again. You’re left without a safety net.

The Politics of the Counter

Nobody wants to be the "bad guy" who cuts spending or raises taxes. Democrats generally want to tax the wealthy more to cover the gap. Republicans generally want to cut domestic spending. Neither side wants to touch the "third rail" of politics: Social Security and Medicare.

🔗 Read more: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

The problem is that those two programs, along with interest, make up the lion's share of the budget. Everything else—the FBI, NASA, national parks, the military—is a smaller slice of the pie than people realize. You could fire every single government employee and close every national park tomorrow, and the live US debt counter would still keep ticking upward.

What Should You Do About It?

You can't stop the counter. But you can protect yourself.

First, look at your own debt. If the national economy gets shaky due to debt concerns, interest rates will remain volatile. Locking in fixed rates on your own loans is a smart move.

Second, diversify your assets. Don't keep everything in US-based stocks or just in cash. Historically, things like gold, real estate, or international equities have acted as a hedge when a country's currency devalues due to debt.

Third, stay informed but don't panic. The US has faced "ruin" before. We faced it in the 1790s, the 1860s, and the 1940s. Each time, growth or policy shifts saved the day.

Practical Steps to Take Now:

- Audit your fixed-rate exposure: If you have adjustable-rate debt, look into refinancing options before the next potential rate hike.

- Invest in "hard" assets: Consider if your portfolio has enough exposure to things that hold intrinsic value regardless of the dollar's strength.

- Watch the CBO reports: Don't just look at the debt clock; read the quarterly reports from the Congressional Budget Office. They provide the "why" behind the numbers.

- Adjust your retirement expectations: Understand that future tax rates are likely to be higher than they are today to pay for this debt. Using a Roth IRA can help you lock in today’s tax rates.

The numbers on that screen are just a reflection of choices made over decades. They represent wars, stimulus checks, tax cuts, and healthcare for the elderly. They represent us. Watching the counter isn't about rooting for failure; it's about acknowledging the reality of the price tag attached to the modern American lifestyle. Keep an eye on the digits, but keep your own financial house in order first. That’s the only part of the economy you actually control.