It’s dead. TC Energy officially pulled the plug years ago after President Biden yanked the permit on his very first day in office back in 2021. So why are we still talking about the Keystone XL pipeline 2024 landscape like it’s a living, breathing thing? Because in the world of North American energy, nothing stays buried forever, especially when gas prices and geopolitical tension keep hitting the headlines.

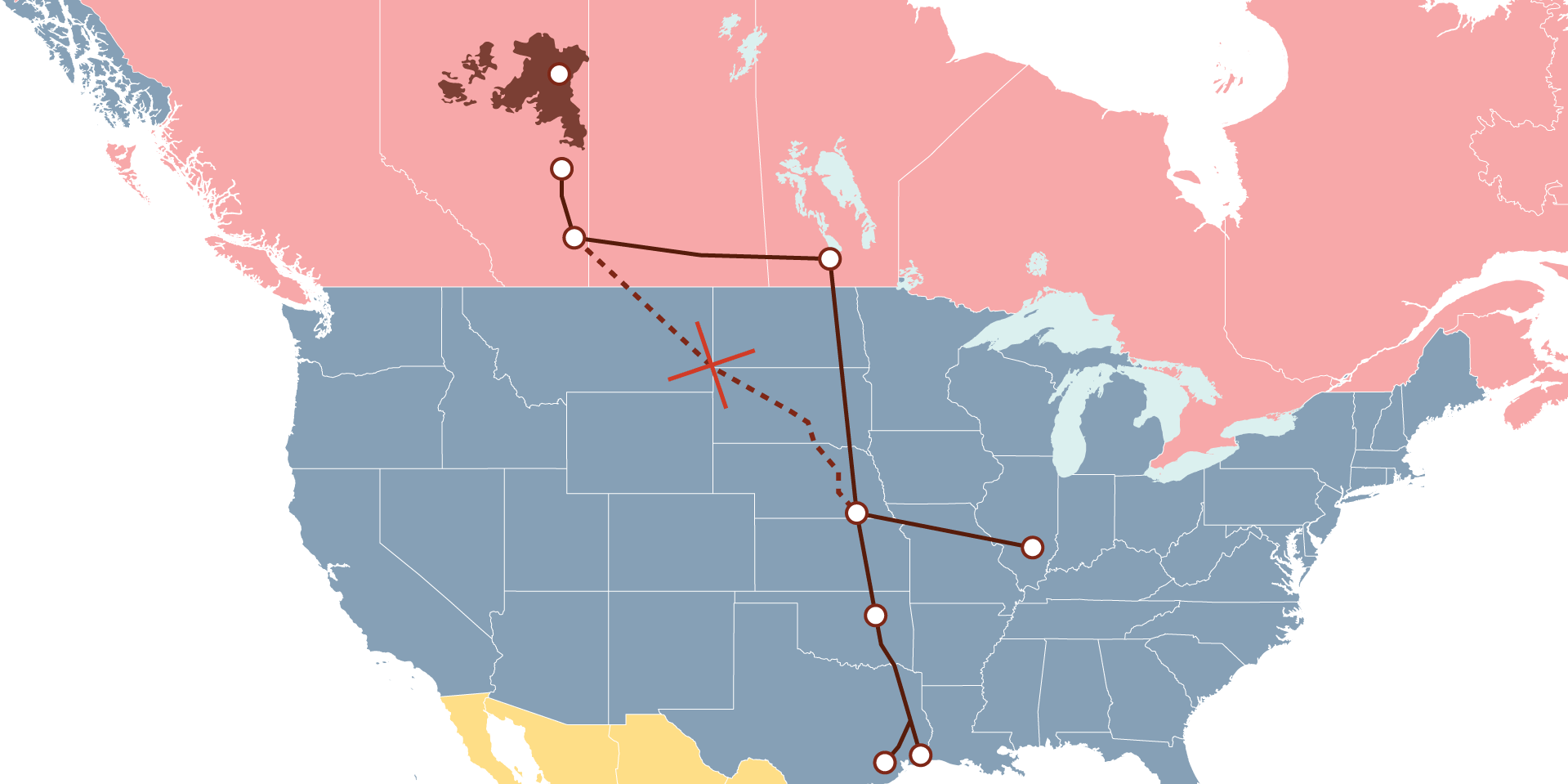

Honestly, the physical pipe—those 1,200 miles of steel that were supposed to haul 830,000 barrels of heavy crude daily from Alberta to Nebraska—is a ghost. But the legal and economic fallout? That’s still very much alive. If you look at the current state of play, the project has shifted from a construction site to a courtroom. It’s basically a massive, multi-billion-dollar lesson in sovereign risk and energy security that continues to haunt trade relations between the U.S. and Canada.

The $15 Billion Legal Hangover

TC Energy didn’t just walk away quietly. They launched a massive $15 billion claim under the North American Free Trade Agreement (NAFTA) legacy provisions. Think about that number for a second. That is a staggering amount of money. The company argued that the U.S. government’s decision to revoke the permit was arbitrary and unfair, especially after they had already sunk billions into the ground.

In 2024, we’ve seen the ripples of these legal challenges. While the specific NAFTA claim faced significant hurdles—largely because NAFTA was replaced by the USMCA—the precedent it set is what matters now. Investors are terrified. If a permit can be granted by one administration and snatched away by the next with the stroke of a pen, how does anyone plan a twenty-year energy project? You’ve got to wonder if any major cross-border infrastructure will ever be built again in this political climate.

It’s messy.

Why the Oil is Moving Anyway

Here is the part most people get wrong about the Keystone XL pipeline 2024 situation: the oil didn't just stay in the ground because the pipe wasn't built. Canada is producing record amounts of crude right now. They just found other ways to move it.

✨ Don't miss: Walmart Self Checkout Fee: What Most People Get Wrong

- The TMX Factor: The Trans Mountain Pipeline expansion in Canada finally came online recently. It’s a game-changer. It gives Alberta’s oil a path to the West Coast and, more importantly, to Asian markets.

- Rail is the fallback: When pipes aren't available, we use "oil-by-rail." It’s more expensive. It’s arguably more dangerous. But it gets the job done.

- Existing Keystone lines: People often forget there is an original Keystone pipeline that still operates. It just doesn't have the massive "XL" capacity extension.

Basically, the "XL" was about efficiency and volume. Without it, the market just got more complicated and expensive, but the flow of Canadian heavy crude into U.S. Gulf Coast refineries—which are literally designed to cook that specific type of "sour" oil—continues. We need their oil; they need our refineries. It’s a symbiotic relationship that a cancelled permit couldn't kill.

Environmental Victories and the Reality Check

For environmental advocates and Indigenous groups like the Rosebud Sioux Tribe and the Indigenous Environmental Network, the defeat of the project remains a landmark victory. It wasn't just about a pipe; it was about the "carbon bomb" of the oil sands. They successfully argued that locking in decades of fossil fuel infrastructure was incompatible with climate goals.

But there's a flip side.

The energy world in 2024 looks a lot different than it did in 2015. We have a massive push for renewables, yet global oil demand is still hitting record highs. This creates a weird tension. By blocking Keystone XL, did we actually lower emissions, or did we just shift the transport to more carbon-intensive methods like rail and tankers? The data is mixed. Some experts, like those at the Center for Strategic and International Studies (CSIS), have pointed out that energy policy is often more about signaling than actual chemistry.

Political Football: Will it ever come back?

Every time a Republican candidate hits the campaign trail, the Keystone XL pipeline 2024 discussion resurfaces. It’s the ultimate symbol of "energy independence." You'll hear promises to "fast-track" or "re-authorize" it.

But let’s be real. TC Energy has already sold off the pipe segments. They’ve settled land easements. The workforce has scattered. Restarting a project of this scale isn't like flipping a light switch. It would require a brand-new company, a brand-new permit process, and likely a brand-new set of lawsuits that would last another decade. Honestly, most industry insiders think the ship has sailed. The capital is moving toward hydrogen and carbon capture now.

What This Means for Your Wallet

Does the lack of this pipeline affect the price you pay at the pump? Sorta. It’s not a 1:1 correlation. Gas prices are set by global Brent crude benchmarks and refining capacity. However, having a direct, cheap straw from Canada to the Gulf Coast would have lowered the "midstream" costs. When transport is cheaper, the final product can be cheaper. But in 2024, the biggest bottleneck isn't just transport—it's the fact that no one is building new refineries in the U.S.

We are working with aging infrastructure. The Keystone XL pipeline 2024 saga is just one piece of a much larger, much more broken puzzle.

Actionable Insights for Following the Energy Market

If you're trying to make sense of where energy is going after the Keystone era, stop looking for one big pipe. Look at these specific areas instead:

✨ Don't miss: Laser Photonics Stock Price: What Most People Get Wrong

Watch the TMX throughput.

The Trans Mountain Expansion is the new bellwether for North American oil. If it stays at full capacity, the "need" for Keystone XL diminishes even further because Canada will have found its "drain" to the Pacific.

Follow the Enbridge Mainline.

This is the workhorse of the industry. Any tweaks or expansions to the Enbridge system (Line 3, Line 5) are far more relevant to today's energy prices than the ghost of Keystone XL.

Monitor U.S. Gulf Coast refinery spreads.

The gap between West Texas Intermediate (WTI) and Western Canadian Select (WCS) prices tells you how much "pain" the market is feeling from transport bottlenecks. If that gap widens significantly, expect more political screaming about pipelines.

Understand Sovereign Risk.

If you are investing in energy, the Keystone story is a warning. Midstream projects are now political targets. In 2024, "regulatory certainty" is an oxymoron. Factor that into any long-term energy play.

✨ Don't miss: U.S. Bank Customer Service Line: How to Actually Reach a Human

The era of the "mega-pipeline" might be over, replaced by incremental upgrades and a shift toward "green" molecules. Keystone XL is a monument to a transition period—a time when we weren't sure if we were doubling down on oil or sprinting away from it. Right now, we're doing a bit of both.

Strategic Next Steps

- Analyze the "Line 5" conflict: If you want to see the next big pipeline battle, look at Michigan and the Straits of Mackinac. It’s the current frontline of the same struggle that killed Keystone XL.

- Evaluate midstream stocks carefully: Focus on companies with existing "in-the-ground" assets rather than those relying on massive new permits. In the current regulatory environment, an existing pipe is worth ten "proposed" ones.

- Track Alberta's production: Watch the production caps and inventories in Western Canada. When storage gets full in Hardisty, Alberta, that’s when the "Bring back Keystone" rhetoric will spike, regardless of how realistic it actually is.