Money feels different lately. You go to the shop, pick up the same loaf of bread you've bought for five years, and suddenly the price tag looks like a typo. It isn't. It's just the slow, grinding erosion of your purchasing power. If you want to see the damage in black and white, the inflation Bank of England calculator is probably the most sobering tool on the UK internet.

It's a time machine, basically. But instead of taking you back to see dinosaurs, it takes you back to when a pound actually bought a pound's worth of stuff.

Most people use it to settle bets. "I remember when a pint was two quid!" someone says at the pub. You plug it in, and the calculator tells you that in today's money, that "cheap" pint is actually more expensive than what you're drinking now. Or less. Economics is weird like that.

How the inflation Bank of England calculator actually works

The Bank of England doesn't just guess these numbers. They base the calculator on the Consumer Price Index (CPI), which is essentially a giant "shopping basket" of goods and services. We're talking everything from Netflix subscriptions and smartwatches to milk and petrol. They track how these prices shift over months and decades.

It’s a massive data project.

When you use the inflation Bank of England calculator, you're looking at historical averages. If you put in £100 from 1990, the tool tells you it would need to be roughly £250 today just to have the same "oomph" at the checkout. That’s a 150% increase.

But here’s the kicker: the calculator uses an average. Your personal inflation rate might be much higher. If you spend most of your money on rent and energy—two things that have skyrocketed faster than the average basket—the "official" inflation number might feel like a lie. It's not a lie; it's just a broad brushstroke.

The tool currently goes back to 1209. Yes, 1209. You can literally see what King John could have bought with a sack of silver, though the data gets a bit fuzzy the further you go back. For most of us, the interest starts around the 1970s or 80s, which is where the price spikes really start to look scary.

Why the 2% target feels like a pipe dream right now

The Bank of England has one main job: keep inflation at 2%.

They failed. Hard.

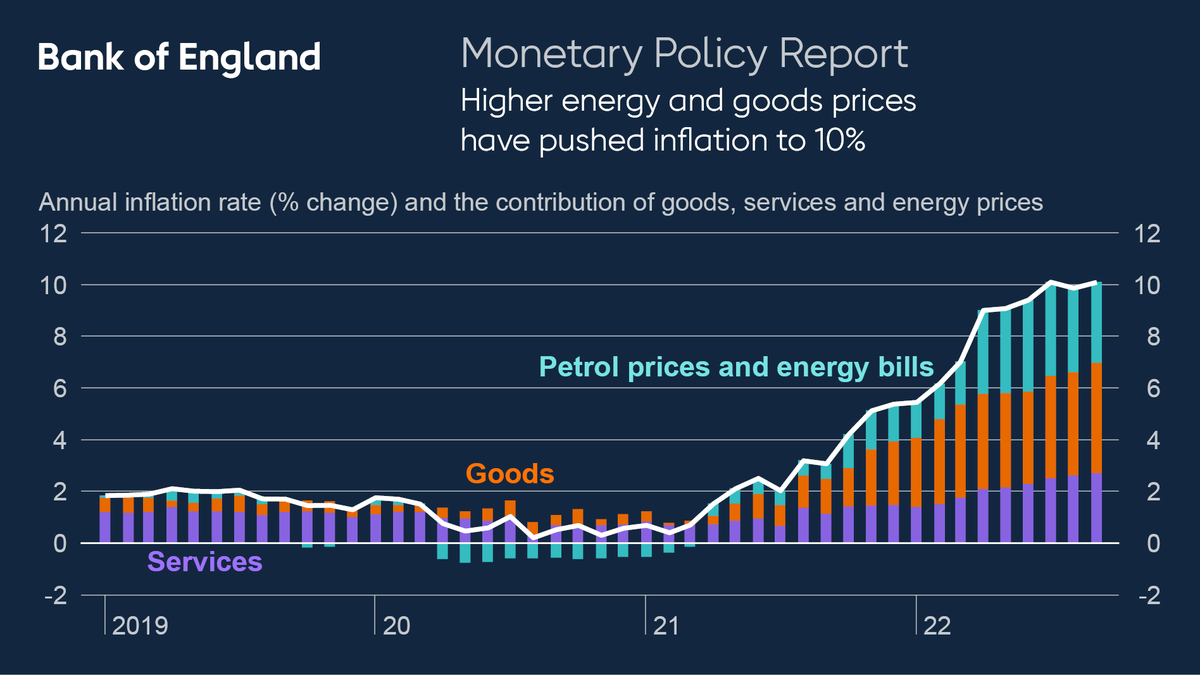

In 2022 and 2023, we saw double-digit inflation that left the 2% target in the dust. When inflation hits 10% or 11%, the inflation Bank of England calculator becomes a tool of depression. It shows you exactly how much of your savings evaporated while sitting in a "high-interest" account that was only paying 4%.

If inflation is 10% and your bank is giving you 4%, you aren't making 4%. You're losing 6% of your wealth every single year. This is what economists call "negative real interest rates." It’s the silent killer of retirement plans.

Why does the 2% target even exist? Why not 0%?

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Economists are terrified of deflation—where prices go down. If people think prices will be cheaper next month, they stop spending. The economy freezes. A little bit of inflation (that 2% sweet spot) encourages people to buy things now, keeping the wheels turning. But when it's too high, like we've seen recently, people can't afford the basics.

The real-world impact on your "Safe" savings

Let's talk about the "Cash is King" crowd. Honestly, if you've kept your life savings in a standard high-street savings account for the last decade, the inflation Bank of England calculator will show you a pretty grim picture.

Imagine you tucked away £10,000 in 2014.

You felt safe.

You felt responsible.

But by 2024, that £10,000 needs to be nearly £13,500 just to keep up. If your bank account only grew to £11,000 in that time, you've effectively lost thousands of pounds in buying power. You can buy less car, less holiday, and fewer groceries than you could ten years ago.

This is why people move into "riskier" assets like stocks or property. They aren't necessarily trying to get rich; they're just trying to outrun the inflation monster.

Understanding the "Basket of Goods"

The ONS (Office for National Statistics) updates the basket used for the inflation Bank of England calculator every year. It’s a fascinating look at British culture.

In recent years, they’ve added things like:

- Electric vehicle charging

- Meat-free sausages (the rise of the vegans)

- Hand sanitiser (no prizes for guessing why)

They’ve removed things like:

- Dumbbells (we're back in the gym now)

- Landline telephones (rest in peace)

- Individual CDs

If your lifestyle doesn't match the basket, the calculator's results won't match your life. If you don't eat meat-free sausages but you do drive 50 miles a day in a petrol car, your personal "inflation" is going to be dictated by the global price of crude oil, not the price of Quorn.

The psychological trap of "Money Illusion"

There’s a term in behavioral economics called Money Illusion. It’s the tendency to think of currency in nominal terms rather than real terms.

You get a 3% raise at work. You feel great! You're making more money!

But wait.

Inflation is 5%.

You just took a 2% pay cut.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

Using the inflation Bank of England calculator helps break this illusion. It forces you to look at "Real Wages." In the UK, real wages were basically stagnant for over a decade after the 2008 financial crisis. People were working just as hard, getting "raises," but their ability to pay for a house or a family dinner wasn't actually improving.

It’s frustrating. It's why everyone feels squeezed even when the unemployment numbers look "good" on the news.

Interest rates: The Bank's only lever

When the calculator shows inflation is out of control, the Bank of England does the only thing it knows how to do: it raises interest rates.

The logic is simple, if a bit brutal. By making it more expensive to borrow money, people have less "spare" cash. Demand for goods drops. When demand drops, shops stop raising prices. Inflation slows down.

The side effect? Your mortgage payments go through the roof.

It’s a balancing act. Raise rates too much, and you trigger a recession. Keep them too low, and the inflation Bank of England calculator shows your currency becoming worthless. In 2023, the Bank had to hike rates repeatedly because they were caught off guard by how "sticky" inflation had become.

How to use this data for your own finances

Don't just play with the calculator and get sad. Use it to audit your life.

First, look at your "Emergency Fund." Most experts say you need 3–6 months of expenses. But if you calculated those expenses three years ago, your fund is now too small. The inflation Bank of England calculator tells us that £5,000 in 2021 is significantly less than £5,000 today. You need to top up that fund just to stay as "safe" as you were back then.

Second, look at your debt.

Here is the one "good" thing about inflation: it devalues debt. If you owe £100,000 on a fixed-rate mortgage and inflation is 10%, that £100,000 is "worth" less than it used to be. Your house price likely went up with inflation, but your debt stayed the same. In a weird way, inflation helps borrowers and hurts savers.

Third, negotiate your salary.

If your boss offers you a "cost of living" increase, check it against the calculator. If it's lower than the CPI rate for the year, they aren't giving you a raise; they're asking you to work for less money than you did last year. Having the data from the Bank of England makes that a much easier conversation to have with HR.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

What the future looks like

Predicting inflation is a fool's errand. Even the Bank of England gets it wrong constantly. They have hundreds of PhDs on staff, and they still didn't see the 11% spike coming until it was already hitting us.

However, we are moving into a more volatile era. The "Great Moderation"—that period of low, stable prices from the 90s to the 2010s—might be over. Deglobalisation, climate change, and aging populations all put upward pressure on prices.

This means the inflation Bank of England calculator isn't just a historical curiosity anymore. It's a vital tool for survival.

You have to be proactive.

Check your pension. If your pension provider is projecting you'll have £30,000 a year to live on in twenty years, use the calculator to see what £30,000 bought twenty years ago. It will give you a much more realistic idea of whether you'll be eating steak or beans on toast in your retirement.

Moving forward with your money

The smartest thing you can do right now is diversify. Don't rely on the "official" numbers to tell the whole story of your life.

Track your own spending for three months. Compare your personal price increases to the official CPI figures. If your costs are rising 8% but the Bank says inflation is 4%, you need to adjust your budget based on your reality, not their basket.

Stop thinking of "saving" as just putting money in a box. Think of it as "preserving purchasing power." If the money in the box can't buy the same amount of stuff next year, you haven't saved anything; you've just delayed the loss.

Check the Bank of England's website regularly for their Monetary Policy Reports. They explain why they think inflation is headed a certain way. It’s dry reading, but it’s the blueprint for your financial future.

Finally, look at your investments. If you’re not outperforming the inflation Bank of England calculator over a five-year period, it’s time to talk to a financial advisor or rethink your strategy. Staying still is the same as moving backwards when the floor is a treadmill moving the other way.

Understand the data.

Adjust your expectations.

Protect your "Real" wealth.

Next Steps for You:

- Run your salary through the calculator: Compare what you earned in 2019 to what you earn now in "real" terms to see if you've actually had a pay rise.

- Audit your savings accounts: Check your current APR against the latest CPI inflation rate. If the rate is lower than inflation, you are losing money every day.

- Adjust your retirement goal: If you had a "target number" for retirement, increase it by at least 15% to account for the massive price jumps we've seen since 2021.