Investing is weird. Most people I talk to think they're "diversified" because they own a bunch of tech stocks and maybe an S&P 500 index fund. But honestly? If you're only betting on the United States, you're missing out on literally half the world’s economic engine. That is exactly where the FTSE All-World ex US Index comes into play. It's basically the "rest of the world" bucket.

It’s a massive list. We’re talking about roughly 2,500 companies spread across nearly 50 different countries. It captures the heavy hitters in developed markets like Japan, France, and the UK, but it also sneaks in the high-growth potential of emerging markets like China, India, and Brazil.

What the FTSE All-World ex US Index actually does for you

Think of this index as a giant filter. It takes the entire global stock market and systematically deletes every single company headquartered in the United States. Why would you want to do that? Simple: home bias. Most investors are way too heavy on their own country. If you live in the US, you likely have your job, your house, and your primary retirement account all tied to the American economy. If the US hits a rough patch—like a "lost decade" of flat growth—you're cooked.

The FTSE All-World ex US Index acts as a hedge. It gives you a piece of Nestlé in Switzerland, Toyota in Japan, and Samsung in South Korea. These aren't "small" companies. They're global titans.

The breakdown of what’s inside

When you look under the hood, the weighting is fascinating. Unlike the S&P 500, which is currently obsessed with "The Magnificent Seven" tech giants, the international market is a bit more balanced. You get a lot more exposure to sectors that the US often neglects.

- Financials: Banks in Europe and Canada often pay much higher dividends than their US counterparts.

- Industrials and Materials: Think of the massive manufacturing hubs in Germany or the mining giants in Australia.

- Consumer Staples: Brands that everyone on the planet uses, but aren't necessarily based in Silicon Valley.

Japan usually takes the top spot in terms of country weighting, often hovering around 14% to 16% of the index. Then you’ve got the UK, France, and Canada. It’s a mix. A real, messy, global mix that reflects how the world actually spends money.

Why international stocks have been a "tough sell" lately

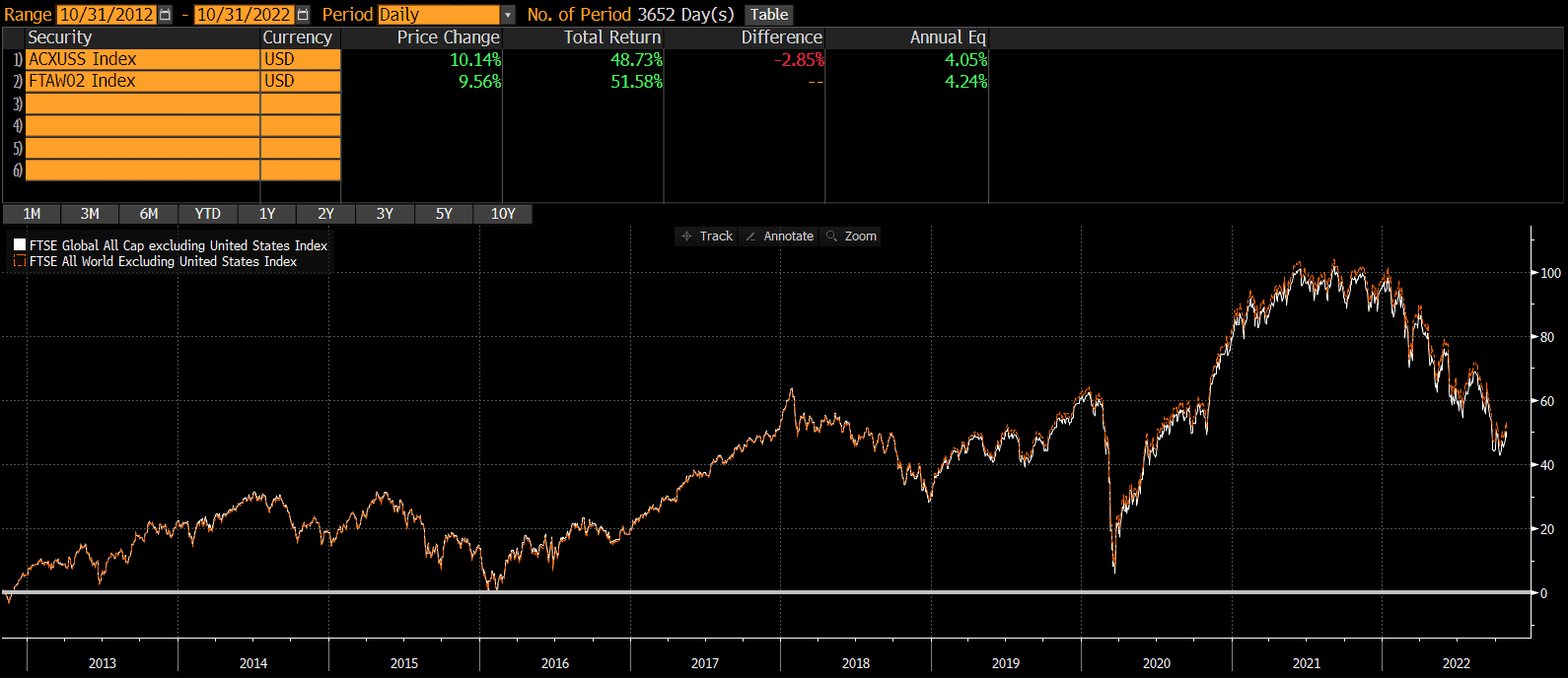

Let's be real for a second. If you look at the last ten years, the US market has absolutely crushed the international market. It hasn't even been close. Because of that, a lot of people think the FTSE All-World ex US Index is a waste of time. They see the chart of the Nasdaq going to the moon and then look at the FTSE ex-US looking like a flat mountain range.

✨ Don't miss: Starting Pay for Target: What Most People Get Wrong

But markets are cyclical. History is a long game.

Back in the 2000s, from 2000 to 2009, the S&P 500 had a total return that was actually negative. It was called the "Lost Decade." During that same period, international stocks—especially emerging markets—were on fire. If you only owned US stocks back then, you were miserable. If you had exposure to the FTSE All-World ex US Index, your portfolio was breathing a lot easier.

Valuation matters (A lot)

Right now, US stocks are expensive. Like, "fancy dinner in Manhattan" expensive. The Price-to-Earnings (P/E) ratios for the S&P 500 are way above historical averages. Meanwhile, the stocks inside the FTSE All-World ex US Index are trading at what looks like a massive discount. You’re essentially buying the same level of earnings and dividends for a cheaper price per share.

Expert investors like Cliff Asness at AQR Capital have often pointed out that while the US has outperformed, it’s mostly because the valuations went up, not necessarily because the businesses grew that much faster than the rest of the world. Eventually, that gap tends to close. Regression to the mean is a powerful force in finance.

The Vanguard connection (VFWAX and VEU)

Most people don't actually go out and buy the index itself—they buy a fund that tracks it. The most famous one is the Vanguard FTSE All-World ex-US Index Fund. You can get it as a mutual fund (VFWAX) or an ETF (VEU).

It’s cheap. Really cheap. The expense ratio is usually around 0.07% to 0.11%. In the investing world, that’s basically free. Compare that to some "active" international fund that charges you 1.2% to try and beat the market (and usually fails). It’s a no-brainer.

🔗 Read more: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

One thing to keep in mind: this index includes "Emerging Markets." This is a big differentiator. Some other international indexes, like the MSCI EAFE, only look at "Developed" markets (think Europe and Japan). But the FTSE All-World ex US Index says, "Nah, we want it all." It includes the volatile but high-reward areas like India and Taiwan. That adds some spice—and some risk—to the mix.

Currency risk is the elephant in the room

You've gotta understand how the math works here. When you buy the FTSE All-World ex US Index, you aren't just betting on companies; you're betting against the US Dollar.

If the Dollar gets weaker, your international stocks become worth more in US terms. If the Dollar gets stronger, it eats into your gains. Lately, the Dollar has been incredibly strong, which has acted like a giant weight on international returns. If you think the Dollar can't stay this dominant forever, buying international stocks is one of the best ways to play that reversal.

How much should you actually own?

This is where the experts fight. Vanguard usually suggests that international stocks should make up about 40% of your total stock portfolio. That feels high to a lot of people. They get nervous. They want to stick with what they know.

Other pros, like Rick Ferri or the folks at Bogleheads, suggest anywhere from 20% to 30%. Honestly? The exact number matters less than just having some exposure. If you have 0%, you're making a massive bet that the United States will be the top-performing economy for the rest of your life. That’s a bold claim. No country stays on top forever.

The "Hidden" Benefits of the FTSE All-World ex US Index

Beyond just diversifying, there’s a tax benefit that people rarely mention: the Foreign Tax Credit.

💡 You might also like: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

Because these companies pay taxes to their home governments (like Germany or Japan), the IRS often lets you take a credit on your own tax return so you aren't getting double-taxed. If you hold a fund like VEU in a taxable brokerage account, you get a nice little kickback at the end of the year. It’s not going to make you a millionaire overnight, but it’s free money.

It’s about "Sequence of Returns"

If you're nearing retirement, the FTSE All-World ex US Index is even more important. You don't want to retire right as the US market enters a 10-year slump. By having international exposure, you're smoothing out the ride. When the US is down, maybe Europe is up. When Europe is stagnant, maybe Emerging Markets are booming.

It’s about not having all your eggs in one "Star-Spangled" basket.

Practical steps to get started

If you're looking to actually do something with this information, here is how the pro-level DIY investors handle it.

- Audit your current holdings. Look at your 401k or IRA. See what your "International" percentage is. If it’s under 10%, you’re likely under-diversified.

- Check the fund names. Look for "Total International" or "All-World ex-US." Make sure the expense ratio is low (under 0.20%).

- Don't "performance chase." It is incredibly tempting to sell your international stocks because they haven't done as well as Apple or Nvidia lately. Resist that urge. Investing is about buying low and selling high. Right now, international is "low."

- Consider your account type. If you want that Foreign Tax Credit, try to hold your FTSE All-World ex US Index funds in a regular taxable brokerage account rather than an IRA, if your overall strategy allows for it.

- Rebalance annually. Once a year, look at your percentages. If your US stocks grew so much that they now make up 90% of your portfolio, sell some of the winners and buy more of the international "underperformers" to get back to your target. This forces you to buy low.

The world is a big place. The US represents less than 5% of the global population and about 25% of global GDP. Limiting your investments to just one country is a choice, but it’s a risky one. Using an index like this simplifies the process of going global without needing to know the intricacies of the Japanese banking system or German manufacturing. You just buy the world, minus the US, and let it work.