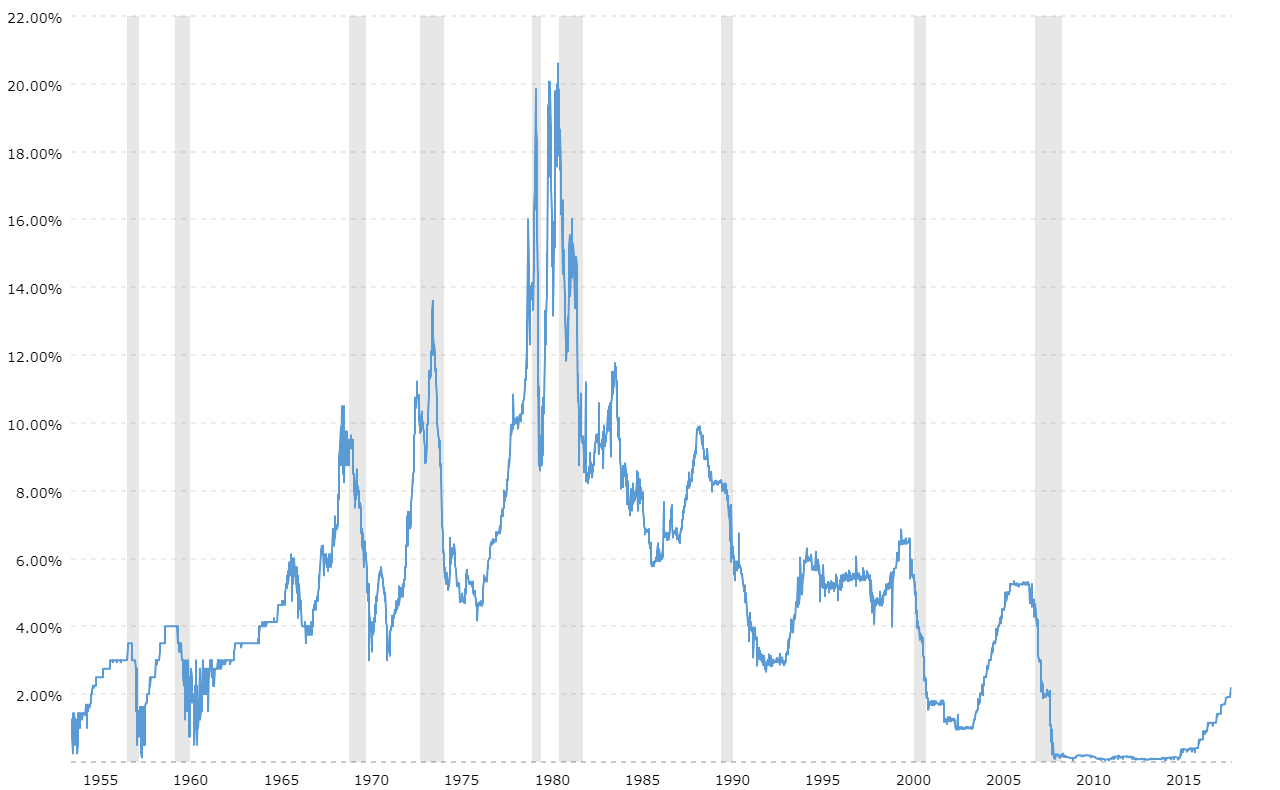

Look at a fed rate historical chart and you’ll see a heart monitor for the American economy. It’s got these wild spikes, sudden flatlines, and terrifying drops that look like a rollercoaster no one actually wants to ride. Most people think of interest rates as some abstract number decided by a group of people in suits in D.C., but honestly, it’s the most powerful lever in your daily life. It’s the reason your mortgage is expensive right now. It’s the reason your "high-yield" savings account was basically a joke for a decade.

The Federal Funds Rate is the interest rate at which banks lend to each other overnight. That’s it. But that tiny ripple turns into a massive wave. When the Federal Open Market Committee (FOMC) moves that needle, everything from credit card APRs to the price of a gallon of milk starts to shift.

The Volcker Era and the 20% Ghost

If you want to understand where we are, you have to look at the 1980s on the fed rate historical chart. This is the stuff of nightmares for modern economists. Paul Volcker, the Fed Chair at the time, was staring down double-digit inflation that was eating the country alive. His solution? He cranked the fed funds rate to an unbelievable 20% in 1981.

Imagine that.

You couldn't buy a house. Business loans were suicidal. But it worked. He "broke the back" of inflation, though he caused a massive recession in the process. It's a reminder that the Fed isn't always your friend; sometimes they’re the surgeon performing a painful operation to save the patient. Since those dizzying highs, we’ve mostly seen a long, jagged slide downward.

For the better part of forty years, money got cheaper. We got used to it. We built an entire global economy on the idea that borrowing money should cost almost nothing.

The Long Zero: 2008 to 2022

After the Great Recession in 2008, the fed rate historical chart did something it had never done before. It hit the "Zero Lower Bound." Ben Bernanke and later Janet Yellen kept rates at essentially 0% for years. This was the era of "easy money."

It was a strange time. If you had cash in a savings account, you were losing value every year because the interest was lower than inflation. But if you were a tech startup or someone looking for a 3% mortgage, you were living the dream. This period created a massive asset bubble. Stocks went up. Real estate went up. Everything felt like it was booming, but it was all fueled by the Fed’s refusal to raise the cost of borrowing.

Then came 2022.

Inflation didn't turn out to be "transitory" like Jerome Powell originally hoped. The Fed had to pivot, and they did it with the most aggressive hiking cycle we’ve seen in forty years. They hiked rates seven times in 2022 alone. If you look at the chart, it’s a vertical wall. It caught everyone off guard—homebuyers, regional banks, and especially tech companies that relied on cheap debt to stay afloat.

💡 You might also like: Finding a Webster Bank East Hartford Branch: What You Need to Know Before You Drive

Why the "Neutral Rate" is a Moving Target

Economists love to talk about the "R-star" or the neutral rate. Basically, it’s the interest rate where the economy is neither speeding up nor slowing down. It’s the Goldilocks zone. The problem? Nobody actually knows where it is until they’ve already passed it.

- In the 90s, the neutral rate felt like it was around 4% or 5%.

- In the 2010s, people argued it had dropped to 2%.

- Now, in 2026, the debate is raging again.

Some experts, like former Treasury Secretary Larry Summers, have argued that we might be entering a "higher for longer" regime. This means the days of 0% interest rates might be gone for good. Why? Because the world has changed. De-globalization, the green energy transition, and aging populations are all inflationary. If inflation stays "sticky," the Fed has to keep rates higher to keep a lid on things.

Real World Consequences of These Squiggly Lines

When you’re staring at a fed rate historical chart, remember that every 1% move represents trillions of dollars shifting hands.

When rates are high, the "discount rate" for future earnings goes up. This is why high-growth tech stocks often crash when the Fed gets aggressive. Investors would rather have a guaranteed 5% return from a government bond than bet on a risky AI startup that might not make money for five years.

✨ Don't miss: Price of Silver Per Ounce Right Now: Why the Metal is Smashing Records

It also changes how you should handle your own debt. In a rising rate environment, carrying a balance on a credit card is a literal emergency. APRs can easily jump from 15% to 24% without you even noticing the notification in your email. On the flip side, it’s a golden age for savers. For the first time in a generation, you can actually get a return on your cash without risking it in the casino of the stock market.

What History Tells Us About the Next Move

History shows that the Fed almost always overshoots. They wait too long to hike, and then they wait too long to cut. It’s called the "lag effect." It takes about 12 to 18 months for a rate change to actually work its way through the economy.

The Fed is essentially driving a bus while looking through the rearview mirror. By the time they see the recession in the data, they’ve already hit it. This is why the fed rate historical chart usually ends a hiking cycle with a sharp, jagged drop—the "emergency cut."

We’ve seen this pattern over and over:

- 1989: Rates peaked, then plummeted as the early 90s recession hit.

- 2000: The Dot-com bubble burst, and rates were slashed to save the markets.

- 2007: The housing market crumbled, leading to the fastest cuts in history.

The big question for right now is whether we get a "soft landing." That’s the unicorn of economics. It’s when the Fed raises rates just enough to kill inflation but doesn't accidentally kill the entire economy. It happened in 1994 under Alan Greenspan, but it's incredibly rare.

Actionable Insights for the Current Environment

Stop waiting for 3% mortgage rates to come back next month. They probably aren't coming back for a long time, if ever. The "Long Zero" was the anomaly, not the 5% rates we see now.

👉 See also: Why Did Sears Fail? What Most People Get Wrong About the Retail Giant’s Collapse

If you have a large amount of cash, lock in yields now. Use Certificates of Deposit (CDs) or long-term Treasuries. If the fed rate historical chart teaches us anything, it's that these windows of high interest for savers don't stay open forever. When the Fed decides to cut, they usually do it fast.

Audit your variable-rate debt today. HELOCs, some private student loans, and credit cards are all tied to the Prime Rate, which moves in lockstep with the Fed. If you're waiting for "the right time" to refinance, you need to be watching the 10-year Treasury yield more than the Fed itself, as the market usually bakes in Fed moves months before they actually happen.

The most important thing to remember is that the Fed is reactionary. They react to the labor market and they react to the Consumer Price Index (CPI). If unemployment starts to tick up, expect that chart to head south. If inflation stays at 3% or 4%, expect the "higher for longer" mantra to become your new reality. Diversification isn't just a buzzword; it's the only way to survive a Fed that is constantly changing its mind based on the latest data dump.