Everything felt a little sluggish on Wall Street this Friday, January 16, 2026. If you were looking for fireworks, you didn't find them. Markets basically coasted into the long weekend with a quiet, collective sigh. By the time the closing bell rang at the New York Stock Exchange, the Dow Jones Industrial Average had slipped 83.11 points, settling at a final price of 49,359.33.

That’s a 0.17% drop. Not exactly a crash, but enough to make folks pause over their coffee. Honestly, it’s just the nature of the beast right now. We're seeing the index hover near that tantalizing 50,000 mark, yet it just can't seem to find the extra fuel to crest the hill.

The day started with a bit more optimism, opening at 49,466.70. We even saw a high of 49,616.70 before things started to drift. It's interesting how the "blue-chip" stocks—the 30 massive companies that make up the Dow—can feel so heavy compared to the scrappy semiconductor stocks that were actually having a decent day. While the Dow was dipping, the Philadelphia Semiconductor Index (SOX) was up over 1%.

What Really Happened With the Dow Jones Average Today

If you’re wondering why the Dow Jones average today felt like it was walking through molasses, look at the bond market. Treasury yields are currently at a four-month high, with the 10-year yield hitting 4.23%. When bonds pay more, stocks often look a little less shiny.

It wasn't all gloom, though. We had some clear winners in the mix.

- Micron Technology (MU) jumped nearly 8% because a company director decided to buy $8 million worth of stock. When the "insiders" buy that much, everyone else usually follows.

- PNC Financial hit a four-year high. They beat earnings and told everyone they’re buying back more of their own shares.

- AST SpaceMobile caught a tailwind from a government defense contract.

On the flip side, power companies like Constellation Energy and Vistra got absolutely hammered—falling 10% and 8% respectively. There’s a lot of chatter about the Trump administration wanting to shake up how the national power grid works, and investors hate uncertainty. Especially when it involves the "magnificent" data centers that are gobbling up all our electricity.

Why 49,359.33 is a Number You Should Watch

We're in a weird spot. The market is weighing two very different stories. On one hand, corporate earnings are mostly okay. On the other, we have "political uncertainty" becoming the phrase of the week. Between the fallout from the U.S. government shutdown earlier this month and the looming question of who will take over the Federal Reserve when Jerome Powell’s term ends in May, traders are jumpy.

Kevin Warsh seems to be gaining ground as a potential Fed Chair candidate over Kevin Hassett. That kind of speculation moves billions.

The S&P 500 and the Nasdaq followed the Dow’s lead, both dropping about 0.1%. It was a synchronized drift lower. If you look at the weekly performance, all three major indexes are ending the week down slightly. It’s the kind of week that makes you want to just close the laptop and wait for Tuesday. (Remember, Monday is a holiday, so the markets are closed).

The Bigger Picture for 2026

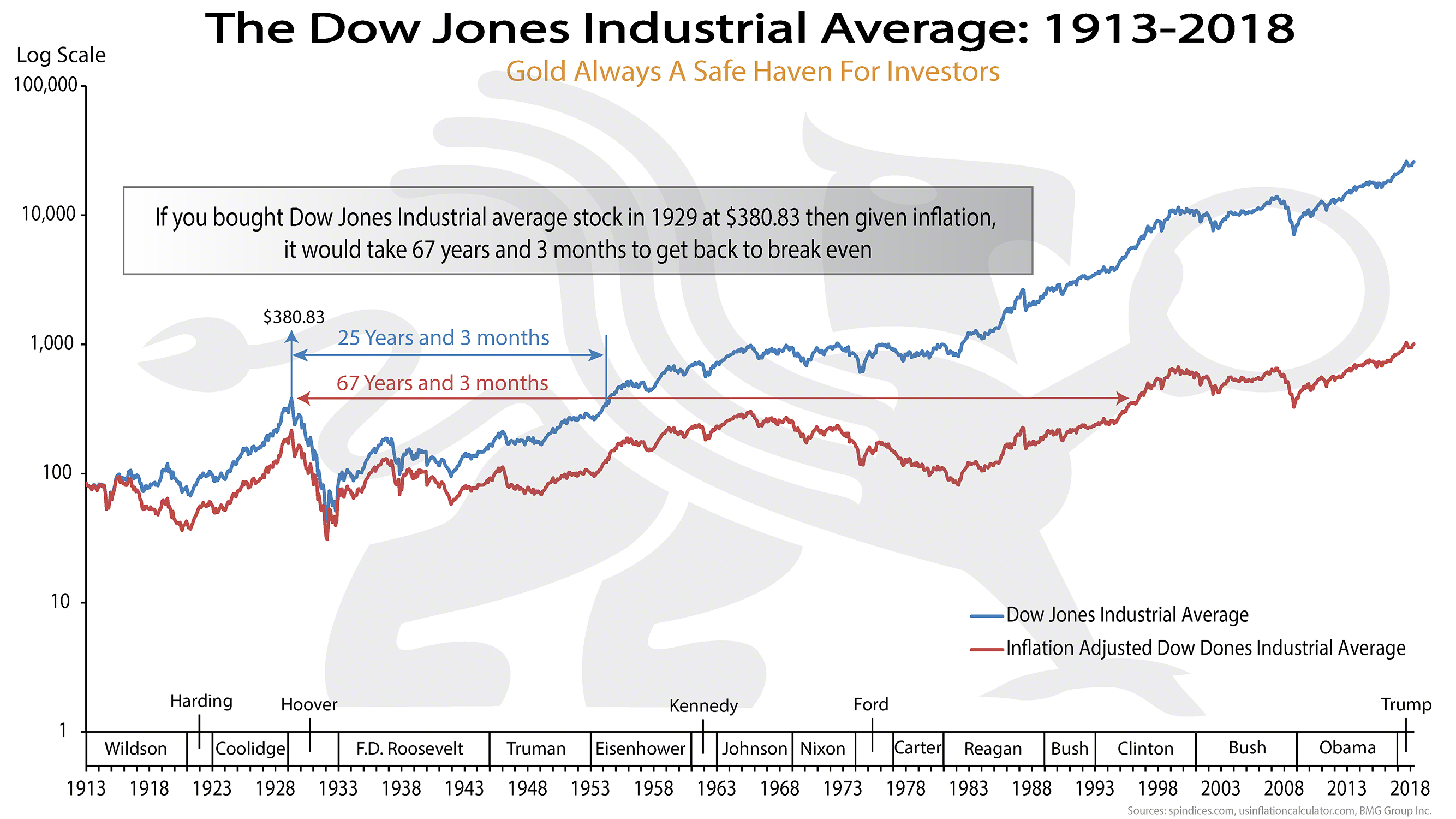

It’s easy to get obsessed with the daily decimal points. But zoom out. The Dow Jones average today is still remarkably high in historical terms. We are up significantly over the last 12 months. Some analysts, like Mark Hulbert, are pointing out that while the S&P 500 is trading at a price-to-earnings (P/E) ratio of 22.4, there are still "cheap" value stocks out there like Pfizer and GM that haven't been swept up in the AI hype.

Then there’s the "Buffett Indicator"—the ratio of total market cap to GDP. It’s sitting at 222% right now. Historically, when that number goes over 200%, Warren Buffett starts getting nervous. It suggests the market might be a bit "rich" compared to the actual economy.

📖 Related: Books by Elon Musk: What Most People Get Wrong

Actionable Steps for Your Portfolio

Don't panic about a 0.17% drop. It’s noise.

Check your exposure to the "Power Grid" stocks if you're worried about policy changes. The administration is looking closely at how tech giants pay for energy.

Keep an eye on the 50,000 level for the Dow. It’s a psychological barrier. If we break it, we might see a "melt-up" as FOMO (fear of missing out) kicks in for the retail crowd.

Audit your "AI" holdings. We saw Micron and TSMC do well this week because of real earnings and insider buying, not just hype. The market is starting to demand actual profits from AI, not just promises.

Lastly, enjoy the long weekend. The numbers will still be there on Tuesday morning. If you're looking for a safe place to park cash while yields are high, those 4.23% Treasuries are looking a lot more attractive than they did a few months ago. Diversification isn't just a buzzword; it's how you survive a week like this one.