Numbers lie. Or, at the very least, they don't tell the whole truth. When you see the news anchors shouting about the Dow Jones Industrial Average hitting another "all-time high," it feels like we're all getting richer. But honestly? If you aren't looking at the Dow Jones adjusted for inflation, you’re seeing a mirage.

Think about it this way. A gallon of milk in 1970 cost about $1.15. Today, you're lucky to find it under $4.00. The stock market works the same way. If the index goes up by 5% but the price of everything else goes up by 7%, you actually lost "purchasing power." You have more dollars, sure, but those dollars buy fewer sandwiches. That is the core of why looking at "nominal" prices—the raw numbers—is kinda dangerous for your long-term planning.

The Massive Gap Between Nominal and Real Returns

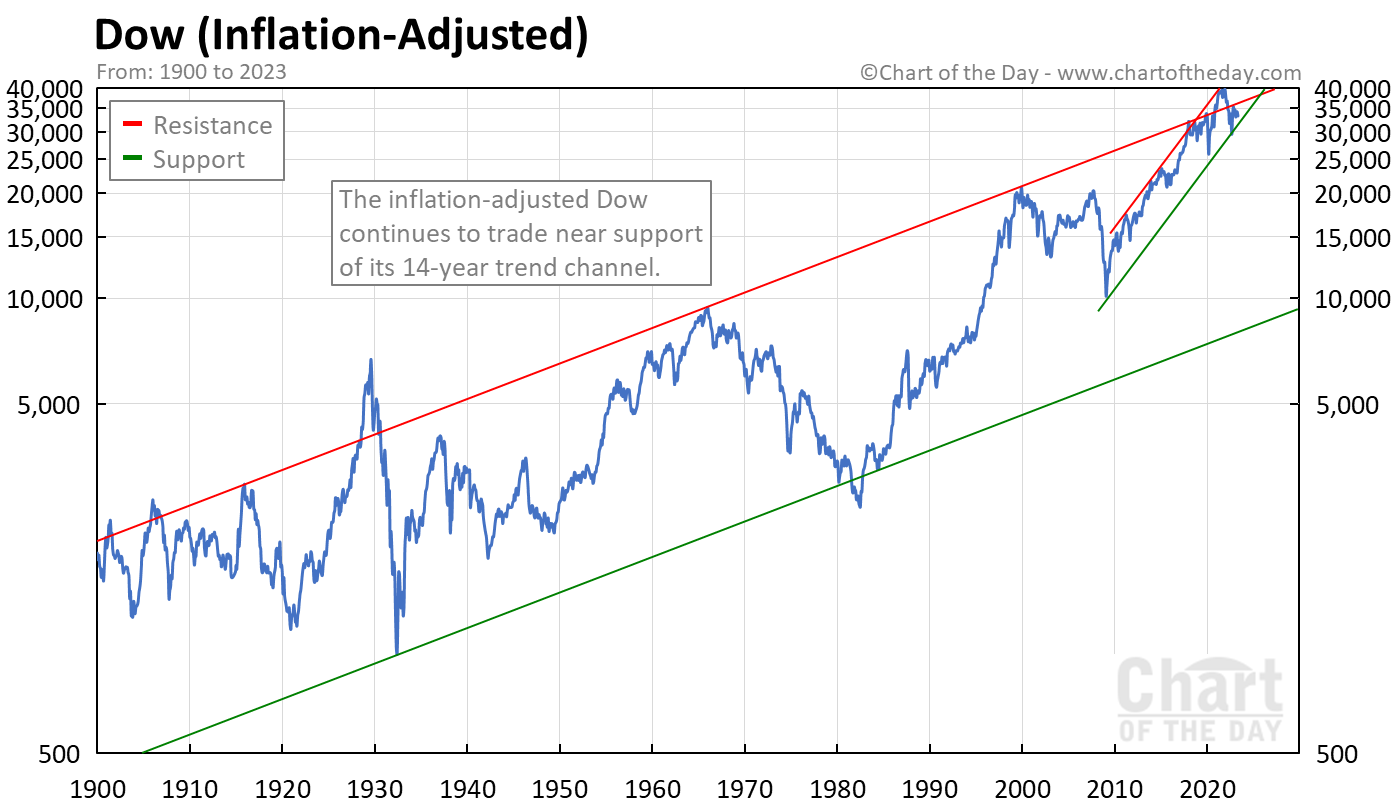

The Dow Jones Industrial Average (DJIA) tracks 30 large, blue-chip companies. It’s been the heartbeat of Wall Street since 1896. But if you look at a standard chart of the Dow over the last 100 years, it looks like a vertical rocket ship. It’s beautiful. It’s inspiring. It's also slightly misleading because it ignores the fact that the U.S. Dollar has lost over 90% of its value since the early 20th century.

When we talk about the Dow Jones adjusted for inflation, we usually use the Consumer Price Index (CPI) to "deflate" the price. This gives us the "Real Dow."

Take the period between 1966 and 1982. If you just looked at the raw Dow numbers, you’d think the market was just boring and flat. It started around 1,000 and ended around 1,000. No big deal, right? Wrong. Because inflation was absolutely RIPPING through the economy in the 70s, the real value of the Dow actually crashed by about 75% in terms of what that money could actually buy. If you held stocks for those 16 years, you felt like you were breaking even, but your lifestyle would have been decimated.

The 1929 Peak vs. The Modern Era

It took decades for the market to actually recover from the 1929 crash if you account for the cost of living. People often say the market recovered by 1954. And yeah, nominally, it did. But when you adjust for the deflation of the 30s and the subsequent inflation of the 40s, the "break-even" point for someone who bought at the absolute top in 1929 is a moving target that haunts historians.

Why This Matters for Your Portfolio Right Now

Inflation isn't just a buzzword. It’s the "silent tax."

✨ Don't miss: Romanian Currency to US Dollar: Why the Leu Is Surprisingly Stubborn in 2026

Most people check their 401(k) and see a bigger number than last year and feel a sense of relief. But you have to ask: did my 7% gain actually beat the 8% rise in eggs, rent, and gas?

If the Dow Jones adjusted for inflation is stagnant while the nominal Dow is rising, the economy is basically running in place. We saw this clearly in the early 2020s. The Federal Reserve pumped massive amounts of liquidity into the system. Asset prices soared. Houses, stocks, even Pokémon cards went to the moon. But because the supply of money increased so fast, the value of each dollar dropped.

Understanding the "Real" All-Time Highs

Here is a wild stat. There have been several periods in history where the Dow hit a "record high" in nominal terms, but was still 20% or 30% below its inflation-adjusted peak from years prior.

- 1966: A major peak that wasn't truly cleared in real terms for almost twenty years.

- 2000: The Dot-com bubble. If you adjust the 2000 peak for inflation, the market didn't actually produce "real" new wealth for investors until roughly 2013.

- The 2022 Slump: While the nominal drop was scary, the "real" drop was a gut punch because inflation was hitting 9% at the same time the market was falling 20%.

You’ve gotta be careful with the "all-time high" narrative. It’s great for headlines, but it doesn't mean you can buy more stuff than you could in the previous cycle.

How to Calculate the Real Value Yourself

You don't need a PhD in economics to get a rough idea of where we stand. You basically just need two numbers: the current Dow price and the CPI (Consumer Price Index) multiplier.

A common way researchers do this is by picking a "base year"—let's say 1982—and scaling everything to those dollars.

$$RealValue = NominalValue \times \frac{CPI_{Base}}{CPI_{Current}}$$

But let's be real, nobody wants to do math on a Tuesday. The easier way is to look at the "Dow-to-Gold" ratio or use an online inflation calculator that tracks the DJIA. The Dow-to-Gold ratio is a favorite of "hard money" advocates because gold is a finite resource. If it takes 20 ounces of gold to buy the Dow in 1999 and only 10 ounces in 2024, has the Dow really "grown," or has the dollar just shrunk?

The Psychological Trap of Nominal Gains

Humans are wired to like bigger numbers. It’s called "money illusion."

📖 Related: Shift the Paradigm Meaning: Why Most People Use This Term Wrong

If I tell you that you'll get a 10% raise next year, but prices will also go up by 10%, you'll probably feel better than if I told you that your salary will stay the same and prices will stay the same. Even though your situation is identical, that "10%" feels like progress.

Wall Street loves money illusion. It keeps people invested. It makes the "long term" look like a guaranteed win. And generally, the stock market is the best place to beat inflation over decades. But it isn't a smooth ride. There are "lost decades" where the Dow Jones adjusted for inflation goes nowhere. If you are 60 years old and enter one of those decades, you can't just "wait it out" like a 25-year-old can.

The Role of Dividends

One thing people forget when looking at inflation-adjusted charts is dividends. Most "Real Dow" charts only look at the price of the index. They don't account for the fact that these 30 companies pay you cash just for owning them.

If you reinvest those dividends, your "inflation-adjusted total return" looks a lot better. Dividends have historically grown faster than inflation. That's the secret sauce. While the price of the index might struggle against a rising CPI, the cash flow produced by companies like Procter & Gamble or Home Depot often keeps pace with—or exceeds—the cost of living.

What History Teaches Us About Future Peaks

We are currently in a weird era. The 2020s have been defined by massive debt and fluctuating interest rates. When the government prints money to stimulate the economy, it often flows directly into the stock market first. This creates a "nominal" boom.

But look at the 1940s. Post-WWII, the U.S. had a massive debt load and high inflation. The Dow looked like it was doing okay, but in real terms, it was a struggle. It wasn't until the 1950s—the "Golden Age"—that the Dow Jones adjusted for inflation really broke out.

Why? Because of productivity.

For the Dow to grow in "real" terms, companies have to actually become more efficient. They have to invent new things (like AI or green energy) that create more value for less cost. If the Dow is only going up because the dollar is going down, that's not growth. That's just currency devaluation.

Real-World Evidence: The 2000 Peak

Let's look at a specific example. In January 2000, the Dow closed at roughly 11,722. By early 2012, the Dow was back at 12,000. On paper, you made a tiny profit.

But if you use an inflation calculator, you'll see that $11,722 in 2000 had the same buying power as about $15,500 in 2012. So, even though the number on your screen was higher, you were actually down about 25% in "real" wealth. That is a twelve-year hole. That’s why the Dow Jones adjusted for inflation is the only chart that actually matters for retirement planning.

Actionable Steps for Investors

Don't panic, but do change your lens.

- Stop celebrating nominal highs. Next time you hear the Dow hit a record, check an inflation-adjusted chart (sites like Macrotrends or Advisor Perspectives are great for this). See if we actually cleared the previous "real" peak.

- Focus on "Real" Yield. If your savings account pays 4% but inflation is 5%, you are losing 1% of your wealth every year. The same applies to your stock returns. Aim for a "real" return of 3-5% above inflation.

- Watch the Dow-to-Gold ratio. It’s an old-school metric, but it strips away the noise of the central banks. It tells you how many units of "real stuff" the stock market is worth.

- Diversify into inflation-resistant assets. If you’re worried the Dow is just being propped up by a weak dollar, consider TIPS (Treasury Inflation-Protected Securities), real estate, or commodities. These tend to move with the cost of living.

- Reinvest your dividends. As mentioned, the "Price Only" Dow adjusted for inflation looks bleak. The "Total Return" Dow adjusted for inflation is the stuff of legends. It’s how wealth is actually built.

The market is a tool for building purchasing power, not just collecting bigger numbers. If you keep your eye on the Dow Jones adjusted for inflation, you’ll be miles ahead of the average investor who is just chasing the latest headline.

Success isn't about having a million dollars. It's about what that million dollars can actually buy you when you finally decide to stop working. Keep your math real, and your expectations realistic. It’s a long game, and the "real" numbers are the only ones that count.

Next Steps for Your Strategy

- Review your "Real" performance: Go back through your last five years of returns. Subtract the annual CPI from your annual percentage gain. If the number is negative, it's time to rethink your asset allocation.

- Audit your dividend growth: Check if the companies you own are raising their dividends at a rate that beats inflation. A company raising dividends by 2% when inflation is 4% is effectively cutting your pay.

- Calculate your "Personal Inflation Rate": The CPI is an average. If you don't drive much but spend a lot on healthcare, your personal inflation might be higher or lower than the national average. Use that number to judge your Dow returns.

The goal isn't just to stay afloat; it's to gain ground. By watching the Dow Jones adjusted for inflation, you ensure that your "gains" are actually gains. Without that perspective, you're just watching the scoreboard while the value of the points keeps changing.