Money isn't free anymore. If you've looked at your credit card statement or tried to price out a mortgage lately, you already know that. For over a decade, we lived in a world where borrowing was basically dirt cheap, but that era ended with a violent jolt. Everyone is asking about the current fed funds rate because it's the invisible hand moving every single dollar in the American economy.

As of January 2026, we are navigating a landscape where the Federal Reserve has finally stopped the aggressive hiking cycle that defined the last few years. The target range for the federal funds rate currently sits at 4.25% to 4.50%. This follows the Federal Open Market Committee (FOMC) meetings where Chair Jerome Powell and the board decided to scale back from the 20-year highs we saw throughout 2024 and 2025.

It's a weird spot to be in. We aren't at "emergency" high levels anymore, but we sure aren't back to the 0% days of the pandemic. Honestly, we might never see those 0% rates again in our lifetime. The Fed is trying to stick a "soft landing," which is fancy economist speak for slowing down the economy enough to kill inflation without accidentally triggering a massive recession that puts everyone out of work.

What the Fed is actually doing behind those closed doors

Most people think the Fed just pushes a button and interest rates change. It's actually a bit more manual than that. The current fed funds rate is the interest rate at which commercial banks—think Chase, BofA, or your local credit union—lend their extra reserves to each other overnight.

Federal law requires banks to keep a certain amount of cash on hand. If a bank ends the day with a little too much, they lend it to a bank that has a little too little. The Fed sets a "target range" for this, and then they use "open market operations" to nudge the actual market rate into that window.

Why should you care? Because of the Prime Rate.

The Prime Rate is usually exactly 3% higher than the fed funds rate. So, with the current fed funds rate at a ceiling of 4.50%, the Prime Rate is 7.50%. This is the base for almost all consumer debt. If you have a "variable rate" credit card, your interest rate is calculated as: Prime + [The Bank's Margin]. When Powell moves the needle by 0.25%, your credit card interest moves by 0.25% almost instantly. It’s a direct tax on your debt.

Inflation, the ghost that won't leave the room

The Fed has a "dual mandate." They have two jobs: keep people employed and keep prices stable. Usually, these two goals hate each other. To lower inflation, you usually have to make borrowing expensive, which slows down businesses, which can lead to layoffs.

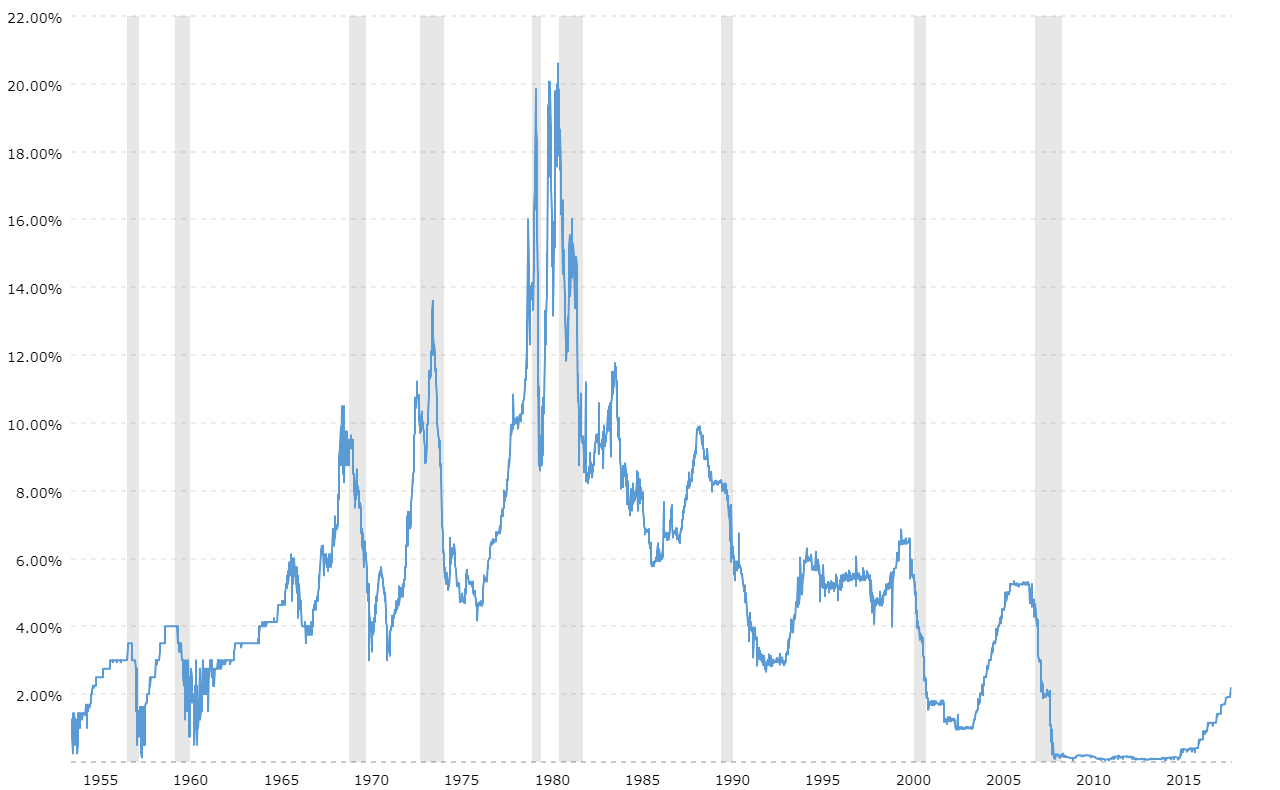

We saw inflation peak at 9.1% in June 2022. It was a nightmare. Eggs were ten bucks. Used cars cost more than new ones. The Fed cranked the current fed funds rate up faster than they had since the early 1980s under Paul Volcker.

Now, in early 2026, the data shows inflation is hovering much closer to the Fed's 2% target, but it's "sticky." Services—like healthcare, insurance, and rent—haven't dropped as fast as the price of a gallon of milk. This is why the Fed is being so cautious about cutting rates further. If they cut too fast, inflation could roar back. If they wait too long, they could break the job market. They are walking a tightrope over a canyon.

How this hits your bank account (The Good and the Bad)

Let's talk about the winners and losers here, because there are always both.

✨ Don't miss: When Was Jack Daniels Founded: What Most People Get Wrong

If you are a saver, this is actually a golden era. For a decade, a "High Yield Savings Account" (HYSA) was a joke. You'd get 0.10% and be told to be grateful for it. Now, with the current fed funds rate where it is, you can easily find HYSAs and CDs paying 4% or even 4.5%. It's one of the few times in recent history where you can get a decent return on your cash without risking it in the stock market.

But if you're trying to buy a house? It's tough.

Mortgage rates don't follow the Fed perfectly, but they're closely linked to the 10-year Treasury yield, which reacts to Fed policy. When the Fed was at 0%, you could get a 30-year fixed mortgage for 2.8%. Today, even with the recent slight cooling, you're looking at 6% or 6.5%. On a $400,000 house, that's the difference between a $1,600 monthly payment and a $2,500 monthly payment.

- Credit Cards: Rates are still near all-time highs. If you're carrying a balance, you're likely paying 21-25% interest.

- Auto Loans: It's harder to get "0% APR" deals from manufacturers unless they are desperate to clear inventory. Average new car loans are sticking around 7-8%.

- Business Loans: Small businesses are feeling the squeeze. The cost of "floor plan" financing or lines of credit has doubled since 2021.

Real-world ripple effects you might not notice

The current fed funds rate affects more than just loans. It changes how companies think. When money is free, tech companies hire thousands of people for projects that might not make money for ten years. They call this "growth at all costs."

When the Fed raises rates to 4.50%, investors demand profit now. This is why we've seen so many layoffs in Silicon Valley and the media. Companies are cutting the fat because they can't borrow cheaply to fund losses anymore.

It also affects the dollar's strength. High U.S. interest rates attract foreign investors who want to put their money in U.S. bonds to get that 4.5% yield. This drives up the value of the dollar. A strong dollar is great if you're traveling to Europe (your money goes further), but it’s terrible for American companies like Apple or Boeing that sell products overseas, because their stuff becomes more expensive for foreigners to buy.

What's coming next?

Wall Street spends billions of dollars trying to predict what the Fed will do at their next meeting. They use something called the "CME FedWatch Tool," which looks at futures markets to see where traders are betting the rate will be in six months.

The consensus for the rest of 2026 is "slow and steady." Most analysts expect the current fed funds rate to stay in this 4% range for a while. The Fed is terrified of the "stop-go" mistake of the 1970s, where they cut rates too early, inflation spiked, and they had to jack them up even higher later.

Jerome Powell has been very clear: they want to see "sustained evidence" that the economy is stable before they drop rates toward 3%.

Actionable steps for your money

Don't just watch the news and stress out. Use the current fed funds rate to your advantage where you can and protect yourself where you can't.

✨ Don't miss: Transfer Money from US to India: What Most People Get Wrong

1. Move your "lazy" cash. If your money is sitting in a big-name bank savings account earning 0.01%, you are literally losing money to inflation every day. Find a reputable online bank or a money market fund. You should be earning at least 4% right now. If you aren't, move it today.

2. Attack high-interest debt. Credit card debt is an emergency at these rates. If you have a balance, look into a 0% APR balance transfer card. These usually give you 12 to 18 months of no interest for a small upfront fee. With the Fed keeping rates "higher for longer," that interest isn't going away on its own.

3. Rethink your bond portfolio. If you’re an investor, bonds are actually interesting again. For years, they offered no yield. Now, you can lock in 4-5% yields on government-backed debt. For someone nearing retirement, that's a huge shift in strategy.

4. Don't time the housing market. People are waiting for rates to "go back to 3%." They probably won't. If you find a house you love and can afford the payment at 6.5%, buy it. You can always refinance if rates drop to 5%, but if you wait, you might just be competing with millions of other people who had the same idea, which will drive the house price up even more.

The economy is in a transition period. We are moving from a world of "free money" to a world of "normal money." It feels painful because the change happened so fast, but historically speaking, a 4.5% current fed funds rate isn't actually that high. It’s just high compared to the weirdness of the 2010s. Adjust your expectations, maximize your savings yield, and keep your debt low.