So, you’re looking at the numbers and wondering exactly where things stand.

As of Wednesday morning, January 14, 2026, the current Dow Jones Industrial Average is hovering around the 49,131 mark. It’s been a bit of a bumpy ride lately. Just yesterday, the index took a notable tumble, shedding nearly 400 points.

That 0.8% drop might not sound like a total catastrophe, but in the world of blue-chip stocks, it’s enough to make people sit up and pay attention. Honestly, the market is feeling a little jittery. After a record-breaking sprint at the very start of the year, we’re seeing a classic "pullback."

What’s Dragging the Current Dow Jones Down?

It’s mostly about the banks.

JPMorgan Chase, which is a massive heavyweight in the price-weighted Dow, got hammered yesterday. Their fourth-quarter fees weren't what analysts hoped for, and the stock slid over 4%. When a pillar like JPM moves that much, the whole index feels the gravity.

💡 You might also like: Missouri Paycheck Tax Calculator: What Most People Get Wrong

There’s also this weird political cloud hanging over everything. You’ve probably heard about the friction between President Trump and Fed Chair Jerome Powell. Investors hate uncertainty, and right now, there is plenty of it regarding interest rate cuts and who’s actually steering the ship at the Federal Reserve.

- Financials are struggling: Visa and Mastercard are also feeling the heat due to proposed caps on credit card interest rates.

- The "Sugar High" is Fading: Some strategists, like Barry Bannister over at Stifel, are warning that the easy gains of the last few years are basically over.

- Inflation is... Fine? Surprisingly, the latest CPI data came in relatively cool at 2.7%, but the market didn't really celebrate. It’s like everyone is waiting for the other shoe to drop.

Understanding the 30 Giants

The Dow isn't the whole market. It’s just 30 companies. But they are big ones.

Think about the names in there: Apple, Microsoft, and now Nvidia. Nvidia’s inclusion was a huge deal because it finally gave the Dow some serious AI skin in the game. Even with those tech titans, the Dow is still much more "old school" than the Nasdaq. It’s got Caterpillar, Boeing, and UnitedHealth.

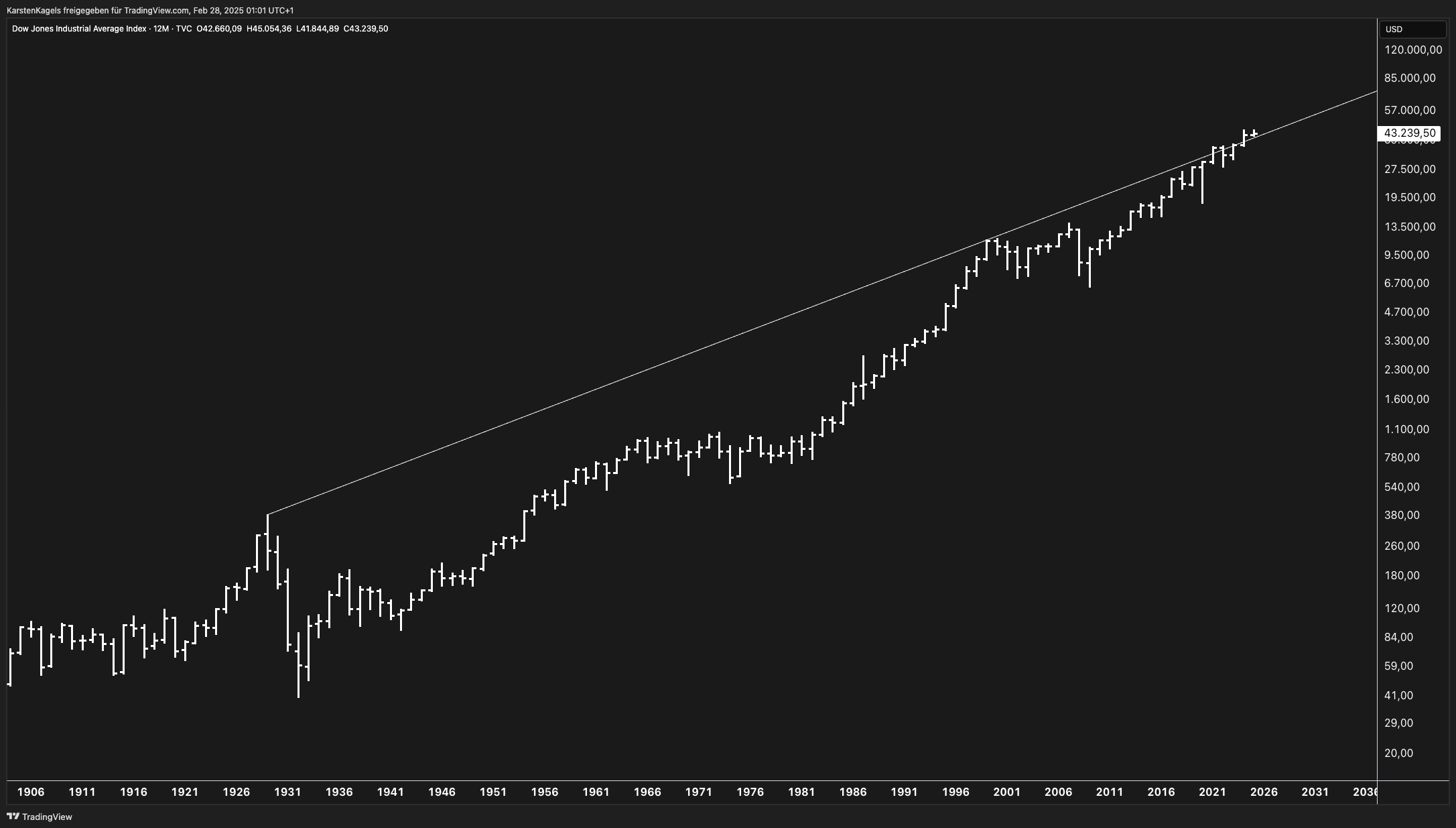

When Boeing has a bad day—which, let’s be real, has happened a lot recently—the Dow feels it more than the S&P 500 does. That’s because the Dow is price-weighted. Basically, the more expensive the stock's individual share price, the more it moves the entire index. It's a bit of an archaic system, but it's the one we've used since 1896.

📖 Related: Why Amazon Stock is Down Today: What Most People Get Wrong

Recent Winners and Losers

Even on a down day, someone is usually making money. Nike and Walmart have actually shown some some strength this week. Walmart, in particular, has been getting a boost from its AI integrations with Google’s Gemini.

On the flip side, the laggards are names like Goldman Sachs and Boeing. The industrial side of the Dow is grappling with a cooling manufacturing sector. If you look at the S&P Global Purchasing Managers Index, things are expanding, but just barely. It’s a delicate balance.

The 2026 Outlook: Slow Grind or Recession?

There is a huge split in what the experts think will happen next.

J.P. Morgan’s research team is still pretty bullish, forecasting double-digit gains by the time we hit December. They think the "AI wave" and fiscal stimulus will keep the engine running.

👉 See also: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

But then you have the skeptics. They point to the "K-shaped" economy. That’s the idea that wealthy people are doing great, but everyone else is starting to hit a wall. If personal consumption slows down—and it makes up about 70% of the U.S. GDP—the Dow is going to have a hard time staying near 50,000.

Key Factors to Watch This Month:

- More Bank Earnings: We’ve got Bank of America and Citigroup reporting today. Their outlook on consumer debt will be a massive signal.

- The Fed Investigation: Any more drama between the White House and Jerome Powell is going to cause immediate volatility.

- The Budget Gap: Congress is staring down another spending bill deadline. We’ve been here before, but the market still gets nervous about government shutdowns.

Navigating the Volatility

If you're watching the current Dow Jones to decide what to do with your 401(k), try not to obsess over the daily 400-point swings.

The index is still up over 2% for the year so far. That’s actually a very strong start historically. Most analysts agree that while the "easy money" has been made, the underlying corporate earnings are still relatively healthy.

Actionable Steps for Investors

Keep an eye on the 10-year Treasury yield. When it flirts with 4.2% or 4.5%, it usually sucks the air out of the stock market. If yields stay high, the Dow will likely continue this "sideways grind" for a while.

Also, watch the tech-to-value rotation. If people start pulling money out of high-flying tech stocks to put into "boring" Dow companies like Procter & Gamble or Coca-Cola, it might actually stabilize the index even if the Nasdaq keeps falling.

Diversification is a cliché for a reason. Don't let the headlines about a 400-point drop scare you out of a long-term plan, but do keep an eye on those bank margins—they’re the canary in the coal mine for 2026.