Ever bought a shipping container full of electronic components from a supplier in Shenzhen, only to find out they aren't exactly what you ordered? If you’re sitting in a warehouse in Chicago or Hamburg, your first instinct might be to call your lawyer and scream about a breach of contract. But here’s the thing: unless you explicitly opted out in your paperwork, your local laws might not even apply. You're likely playing by the rules of the Convention on International Sale of Goods, or the CISG.

It’s the invisible backbone of the global economy.

Most people don't talk about it at dinner parties. Honestly, even some seasoned logistics managers forget it exists until a dispute hits a six-figure price tag. Since its inception in Vienna in 1980, this treaty has become the default legal framework for international trade. It covers about two-thirds of all world trade. That's massive. Yet, it remains a "sleeper" law that catches businesses off guard.

What is the Convention on International Sale of Goods anyway?

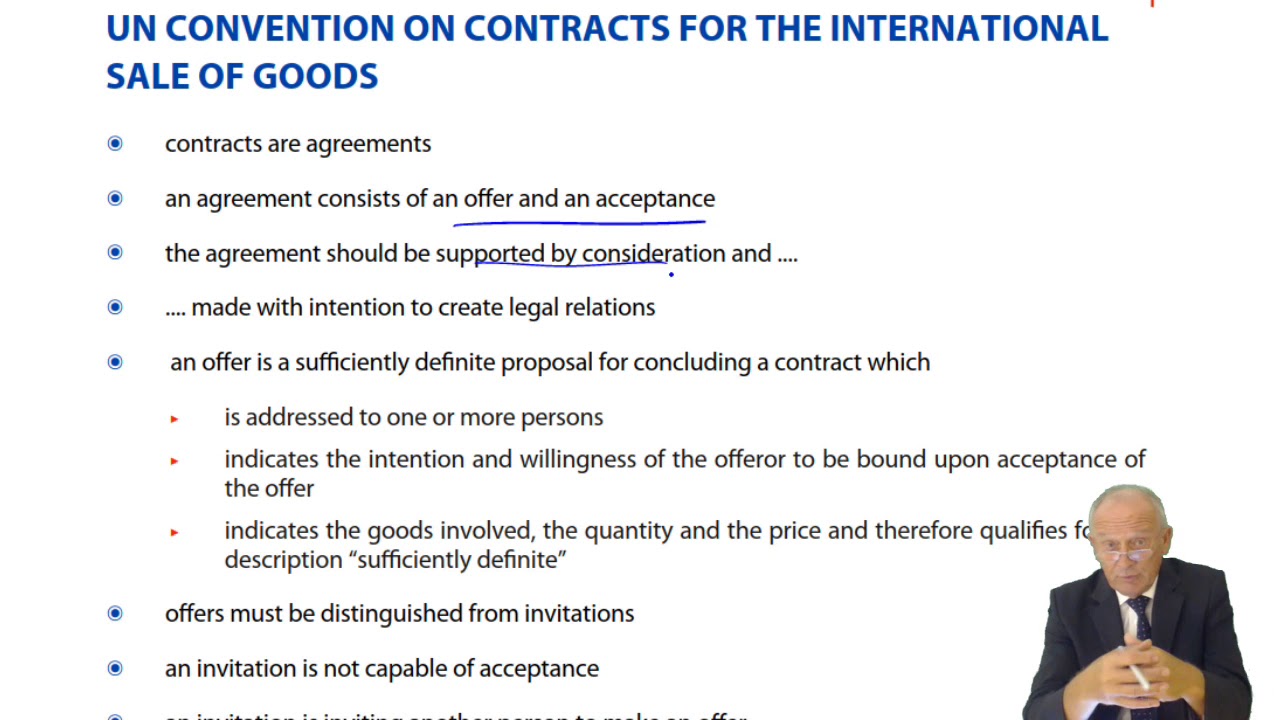

Basically, the CISG is a uniform law. It was created by UNCITRAL (the United Nations Commission on International Trade Law) to stop the madness of "battle of the forms." Imagine a seller in Italy uses their standard terms, and a buyer in Japan uses theirs. If something breaks, whose law wins? Before the Convention on International Sale of Goods, you’d spend years arguing about "choice of law" before even getting to the actual problem.

The treaty simplifies everything.

It provides a set of rules that apply automatically when both parties are located in different countries that have ratified it. Currently, 97 states are parties to it. We're talking big players like the U.S., China, Germany, and Brazil. Curiously, the UK is a notable holdout. They still cling to their Sale of Goods Act 1979. If you're dealing with a British firm, the rules of the game change entirely.

The Mirror Image Rule is Dead

Under old-school common law, if your acceptance of an offer didn't perfectly match the offer, it was a rejection. A "counter-offer." The CISG is much more relaxed, or "flexible," as the legal scholars like to say. Article 19 says that if your reply contains additions that don't materially alter the terms, it’s an acceptance.

What's "material"? Price, payment, quality, quantity, delivery—the big stuff. If you're just nitpicking about how the shipping labels are printed, the contract likely still stands. This keeps commerce moving. It stops people from using tiny technicalities to back out of a deal when the market price of copper suddenly drops.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

Where the Convention on International Sale of Goods Gets Messy

It doesn't cover everything. Don't go looking to the CISG if you're buying a jet engine or a yacht. Article 2 specifically excludes goods bought for personal, family, or household use. It’s strictly for B2B. It also ignores the validity of the contract itself—meaning if a contract was signed under duress or by someone without the authority to sign it, you have to look back at national laws to settle the mess.

Then there’s the issue of "fundamental breach."

This is the holy grail of CISG disputes. According to Article 25, a breach is fundamental if it results in such detriment to the other party as substantially to deprive them of what they were entitled to expect under the contract. It’s a high bar. You can't just cancel a million-dollar order because the packaging was the wrong shade of blue. You have to prove the goods are basically useless for your intended purpose.

Real World Stakes: The Case of the Frozen Mussels

Let's look at a classic example often cited in law schools but very real in practice. A Swiss buyer ordered New Zealand mussels from a German seller. The mussels had a cadmium level that exceeded German health recommendations but was perfectly legal in Switzerland. The buyer tried to declare a fundamental breach.

The court basically said "No."

Because the seller isn't expected to know every specific public law regulation in the buyer’s country unless they are told or if the buyer’s country's rules are identical to the seller's. This is why communication is everything. If you need your widgets to survive a specific temperature or meet a specific local regulation, you have to put it in the contract. The Convention on International Sale of Goods won't read your mind.

Why Some Lawyers Hate It (and why they're wrong)

You’ll find plenty of high-priced attorneys in New York or London who tell you to "Opt Out" of the CISG immediately. They prefer the Uniform Commercial Code (UCC) or English Law. They like what they know.

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

But opting out can be a strategic mistake.

The CISG is often a fair middle ground. If you’re a small American company selling to a giant state-owned enterprise in China, good luck getting them to agree to New York law. They’ll want Chinese law. The CISG is a neutral territory. It’s a "compromise" legal system that doesn't favor one nation’s quirks over another’s.

Also, it’s less formal than the UCC. For example, the CISG doesn't require a "writing" for a contract to be enforceable (Article 11). A series of emails or even a verbal agreement followed by action can create a binding obligation. In a fast-paced digital world, that’s actually quite helpful, even if it makes conservative lawyers sweat.

The "Specific Performance" Quirk

One of the coolest (or scariest) parts of the CISG is Article 46. It allows a buyer to require "specific performance." This means a court can literally force the seller to deliver the exact goods promised, rather than just paying damages. In the U.S., we usually just settle for cash. Under the CISG, if those goods are unique, you might actually get the items themselves.

Common Misconceptions That Kill Margins

"My contract says New York law applies, so I'm safe." Wrong. Because the CISG is a federal treaty ratified by the U.S., it is part of New York law. If you want to avoid the CISG, your contract must say: "The parties hereby exclude the application of the United Nations Convention on Contracts for the International Sale of Goods (CISG)." If you don't use those specific words, you're still in CISG territory.

"I can reject the goods for any defect." Nope. Unlike the "perfect tender" rule in some domestic laws, the CISG leans toward keeping the contract alive. You usually have to give the seller a chance to "cure" the defect (Article 48) before you can walk away.

"The Incoterms cover the legal stuff." Incoterms (like FOB or CIF) only handle the "where" and "when" of shipping and risk. They don't handle what happens if the goods are defective or how to calculate damages. You need the CISG for that.

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

How to Actually Use the Convention on International Sale of Goods to Your Advantage

If you're importing or exporting, you need to stop treating your Terms and Conditions like "flavor text."

First, check the status of the countries you deal with. Most are in. If you're dealing with India, Taiwan, or South Africa, they aren't members. You'll be back to the old-school headache of private international law.

Second, define your "Notice of Non-Conformity." Under Article 39, a buyer loses the right to rely on a lack of conformity if they don't give notice within a "reasonable time." What’s reasonable? It’s vague. In some German cases, "reasonable" was interpreted as a few days. In others, it was weeks. Don't leave it to a judge. Define it in your contract. Write: "Buyer must notify Seller of any defects within 14 days of arrival."

Third, think about interest rates. The CISG says you're entitled to interest on late payments (Article 78), but it doesn't say how much. This is a famous "gap" in the treaty. Specify an interest rate in your contract, or you'll end up arguing about the central bank rates of a country you've never visited.

Moving Forward With Global Trade

The Convention on International Sale of Goods isn't going anywhere. In fact, it's getting stronger as more nations join. It’s designed to be a living instrument.

If you want to stay protected, you should:

- Audit your current international sales contracts to see if you’ve accidentally included or excluded the CISG.

- Update your "inspection" protocols to ensure you’re flagging defects within that "reasonable" window the treaty demands.

- Explicitly state which currency and which interest rate applies to disputes, as the treaty is silent on those specifics.

- Train your procurement team to understand that an email "acceptance" with minor changes might actually be a binding contract under Article 19.

The world is too small to rely on outdated, localized legal thinking. Whether you love it or hate it, the CISG is the language of the global market. Understanding it isn't just for lawyers—it's for anyone who wants to make sure their international deals actually stick.