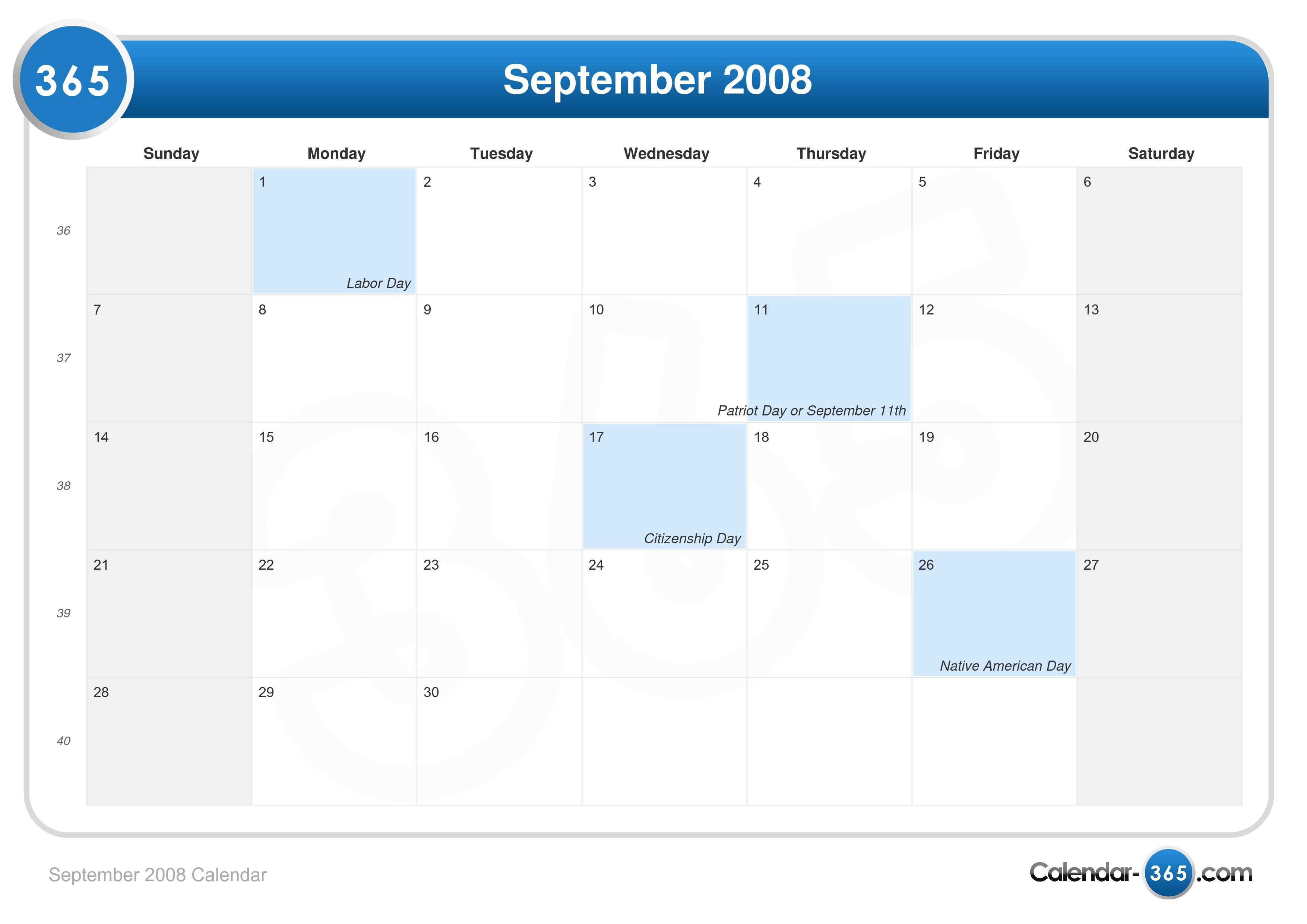

September 2008 wasn't just another thirty-day stretch on a wall planner. Honestly, if you look back at the calendar for the month of september 2008, it looks like the blueprint for a world-altering roller coaster that nobody actually signed up to ride. It started with a Monday, ended on a Tuesday, and in between, the global financial system basically decided to stop working.

You’ve probably forgotten the specifics. Most people have. Memory is funny like that, especially when it involves trauma or math. But for those of us who track time through the lens of history, this specific page of the calendar represents a "before and after" moment for modern civilization.

The Monday that changed everything

It’s weird to think about now, but the first week of that September was almost... quiet? Not really. But compared to what was coming, it felt like the deep breath before a plunge.

Labor Day hit on September 1. Most Americans were grilling burgers, oblivious to the fact that the federal government was about to take over Fannie Mae and Freddie Mac just six days later. That happened on September 7. It was a Sunday.

Imagine being a Treasury official that weekend. Hank Paulson was basically living on caffeine and adrenaline. The government had to step in because the housing bubble hadn't just popped—it had disintegrated. By the time the sun came up on Monday, September 8, the "calendar for the month of september 2008" was already stained with the ink of the largest bailout in history up to that point.

Then came the middle of the month.

September 15. Write that date down. It’s the day Lehman Brothers filed for Chapter 11 bankruptcy. It wasn't just a bank failing. It was a 158-year-old institution vanishing into a black hole of debt.

I remember the photos of employees walking out of the building with cardboard boxes. Those images are the visual shorthand for the 2008 crisis. If you were looking at your desk calendar that Monday morning, you weren't just checking your meeting schedule; you were watching the Dow Jones Industrial Average drop 500 points in a single session.

👉 See also: E-commerce Meaning: It Is Way More Than Just Buying Stuff on Amazon

It wasn't just about the banks

While Wall Street was on fire, the rest of the world kept turning, though it felt a bit wobbly.

On September 10, over in Switzerland, scientists at CERN fired up the Large Hadron Collider for the first time. There were these wild, borderline hilarious rumors that it would create a black hole and swallow the Earth. Given what was happening with the global economy that same week, some people probably would have preferred the black hole.

Google also released the first version of the Android operating system (1.0) on September 23. It's wild to think that the tech we use every single day now—the very foundation of the smartphone wars—was born in the middle of a literal financial apocalypse.

Key dates you might have missed:

- September 12: Metrolink train collision in Los Angeles. A horrific tragedy that led to major changes in rail safety and the implementation of positive train control.

- September 21: Goldman Sachs and Morgan Stanley, the last two major investment banks, officially changed their status to bank holding companies to get more government protection.

- September 28: SpaceX successfully launched Falcon 1 into orbit. It was the first privately developed liquid-fuel rocket to reach orbit. Elon Musk was literally days away from going broke, but that Sunday changed the trajectory of space travel forever.

- September 29: The U.S. House of Representatives rejected the initial $700 billion bailout plan. The Dow responded by plunging 777.68 points. It was the largest single-day point drop in history at the time.

Why the atmosphere felt so heavy

Politics were also reaching a boiling point. The 2008 U.S. Presidential Election was in full swing.

John McCain and Barack Obama were locked in a battle that felt increasingly overshadowed by the "Great Recession." On September 3, Sarah Palin gave her big speech at the Republican National Convention. By the end of the month, the debates were being threatened because McCain wanted to "suspend" his campaign to deal with the economic crisis in D.C.

It was a mess.

If you look at a calendar for the month of september 2008 today, you see a grid. But if you lived through it as an adult, you see a sequence of shocks. It was the month we realized the "experts" didn't really have a handle on the complexity of global derivatives.

✨ Don't miss: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

The cultural vibe of late 2008

Music was weirdly upbeat. "Disturbia" by Rihanna was huge. T.I.'s "Whatever You Like" was everywhere. It’s a strange juxtaposition—listening to "I Kissed a Girl" by Katy Perry while reading headlines about the collapse of the global credit market.

Movies like Burn After Reading and Eagle Eye were hitting theaters. People were looking for an escape, but even the movies felt a bit paranoid.

One thing that often gets lost in the talk about bank failures is the sheer human cost that started to manifest on that September calendar. This wasn't just numbers on a screen. This was the start of the foreclosure crisis. This was the moment retirement accounts started to evaporate.

Lessons that still matter

We like to think we've fixed everything since then. We haven't.

The Dodd-Frank Act came later, but the seeds of our current economic skepticism were planted right there in those 30 days. We learned that "too big to fail" was a real thing, and we learned that the government could, and would, print money to keep the lights on.

When you study the calendar for the month of september 2008, you're looking at the birth of the modern era. You're seeing the moment where the post-9/11 world shifted into the post-Great Recession world.

It’s also a lesson in resilience. SpaceX survived. Android survived. We, as a society, survived—even if things look very different now.

🔗 Read more: Private Credit News Today: Why the Golden Age is Getting a Reality Check

How to use this historical context

If you’re researching this period for a project or just trying to settle a bet about when the market crashed, keep a few things in mind.

First, the "crash" wasn't a single day. It was a rolling disaster. The 29th was the biggest point drop, but the 15th was the structural failure.

Second, look at the correlation between different industries. The travel industry took a massive hit that month as corporate retreats were canceled left and right. The "AIG Effect" became a real term after executives went on a luxury retreat right after getting a government bailout.

Finally, recognize the technological shifts. The launch of the Falcon 1 and the first Android phone in the same month as the Lehman collapse shows that innovation doesn't stop for a crisis. It often accelerates because the old way of doing things is clearly broken.

Actionable Insights for Navigating History:

- Audit your sources: When looking at 2008 data, distinguish between "market days" and "calendar days." Most of the big news broke on weekends when markets were closed.

- Track the volatility: Use the VIX index (the "fear gauge") as a reference point for any date in September 2008 to understand the actual sentiment of the time.

- Compare and contrast: Look at how long it took for the "real economy" (unemployment, housing prices) to catch up to the "financial economy" (stock prices). The pain on the calendar didn't end on September 30.

- Study the precedents: Compare September 2008 to October 1929 or the 2020 pandemic lockdowns to see how liquidity crises differ from structural or health-related shocks.

September 2008 was a brutal teacher. It taught us about interconnectedness, about the fragility of trust, and about how quickly a "normal" Tuesday can turn into a historical landmark.