Let’s be real for a second. Most people looking at a new credit card are just trying to avoid paying for a suitcase at the airport. It’s the classic "Gold vs. Platinum" internal debate we all have while sitting at a gate, staring at the Sky Club entrance like it’s some kind of exclusive velvet-rope lounge in Vegas. Honestly, the benefits of Delta American Express card options can feel like a maze of "MQDs" and "companion certificates" that require a PhD in loyalty math to understand. But if you actually peel back the marketing fluff, these cards are less about "prestige" and more about keeping money in your pocket when Delta tries to charge you $35 to bring a pair of jeans on a plane.

Stop thinking about these as status symbols. They’re tools.

If you fly Delta even twice a year, the math usually flips in your favor almost immediately. Most people get hung up on the annual fees, which can range from a modest $0 (for the Blue) to a "holy crap" $650 (for the Reserve). But here’s the kicker: the checked bag benefit alone pays for the Gold card after just a couple of round trips. If you're traveling with a partner or kids? You've basically broken even before you’ve even boarded the plane.

The "Free" Suitcase Math and Other Day-to-Day Perks

The most immediate and tangible of the benefits of Delta American Express card ownership is the first checked bag for free. Delta currently charges $35 for the first bag on domestic flights. If you’re a family of four, that’s $140 one way. Total? $280 round trip. Since the Delta SkyMiles Gold American Express Card usually has an annual fee around $150 (often waived the first year), you are literally making a profit on your first vacation. It’s one of those rare times where the bank actually loses out if you use the card correctly.

Priority boarding is another one people overlook. It isn't just about feeling fancy. It’s about bin space. We’ve all been in that stressful situation where you’re in Zone 7, watching the overhead bins fill up with oversized backpacks, knowing you’re going to be forced to gate-check your carry-on and wait 20 minutes at the carousel in Atlanta. The card bumps you up to Main Cabin 1. It’s a small thing, but it saves your sanity.

Then there’s the 20% in-flight savings. If you’re the type who buys a $12 cocktail or a snack box because you forgot to eat before the flight, you get that back as a statement credit. It’s not going to make you rich, but it takes the sting out of paying $15 for a lukewarm wrap.

Why the Takeoff 15 is a Game Changer

Delta recently added a perk called "TakeOff 15." It basically gives cardholders a 15% discount on award travel. This is huge. If a flight costs 30,000 miles, you only pay 25,500. Over a few years, those saved miles add up to an entire extra flight for free. Most people forget this exists and just look at the "miles per dollar" earn rate, which—honestly—is kind of mediocre on these cards compared to something like the Amex Gold or Platinum. You don't get a Delta card to earn miles on groceries; you get it to save miles when you spend them.

📖 Related: Bryce Canyon National Park: What People Actually Get Wrong About the Hoodoos

Moving Up the Ladder: Gold vs. Platinum vs. Reserve

Let's talk about the Delta SkyMiles Platinum American Express Card. It sits in that middle ground with a $350 annual fee. Why would anyone pay that? One word: The Companion Certificate.

Every year after you renew the card, you get a round-trip companion pass for a domestic, Caribbean, or Central American flight. You pay the taxes and fees (usually about $11 to $80), and your friend or spouse flies for free. If you use that to fly from New York to St. Lucia during peak season, that certificate is easily worth $600 to $800. Suddenly, that $350 fee looks like a bargain.

The Platinum card also starts flirting with "status" by giving you an MQD (Medallion Qualification Dollar) headstart. In the new SkyMiles world, status is purely based on how much you spend (MQDs), not how far you fly. Cardholders get a $2,500 MQD boost just for having the card. If you're trying to hit Silver or Gold Medallion status, this is basically a shortcut that skips a few thousand dollars of actual flight spending.

The Reserve: Is it Actually Worth $650?

The Delta SkyMiles Reserve American Express Card is the "heavy metal" of the group. It’s expensive. Like, "I could buy a decent espresso machine for this" expensive.

Who is this for?

- The Lounge Rats: You get unlimited Delta Sky Club access (though there are now caps on visits per year unless you spend a lot).

- The Upgrade Seekers: Even if you don't have Medallion status, having the Reserve card puts you on the upgrade list behind those who do. It’s a "tie-breaker" that actually works.

- The Big Spenders: The companion certificate on the Reserve isn't just for economy; it works for First Class and Comfort+ too.

Honestly, if you aren't flying First Class at least once a year using that certificate, the Reserve is probably overkill. Stick to the Gold or Platinum.

👉 See also: Getting to Burning Man: What You Actually Need to Know About the Journey

Dealing With the "Amex Once Per Lifetime" Rule

Here is something the glossy brochures won't tell you: American Express has a "once per lifetime" rule for welcome bonuses. This is a massive factor when considering the benefits of Delta American Express card offers. If you get the Gold card bonus today, you usually can't get it again for several years, if ever.

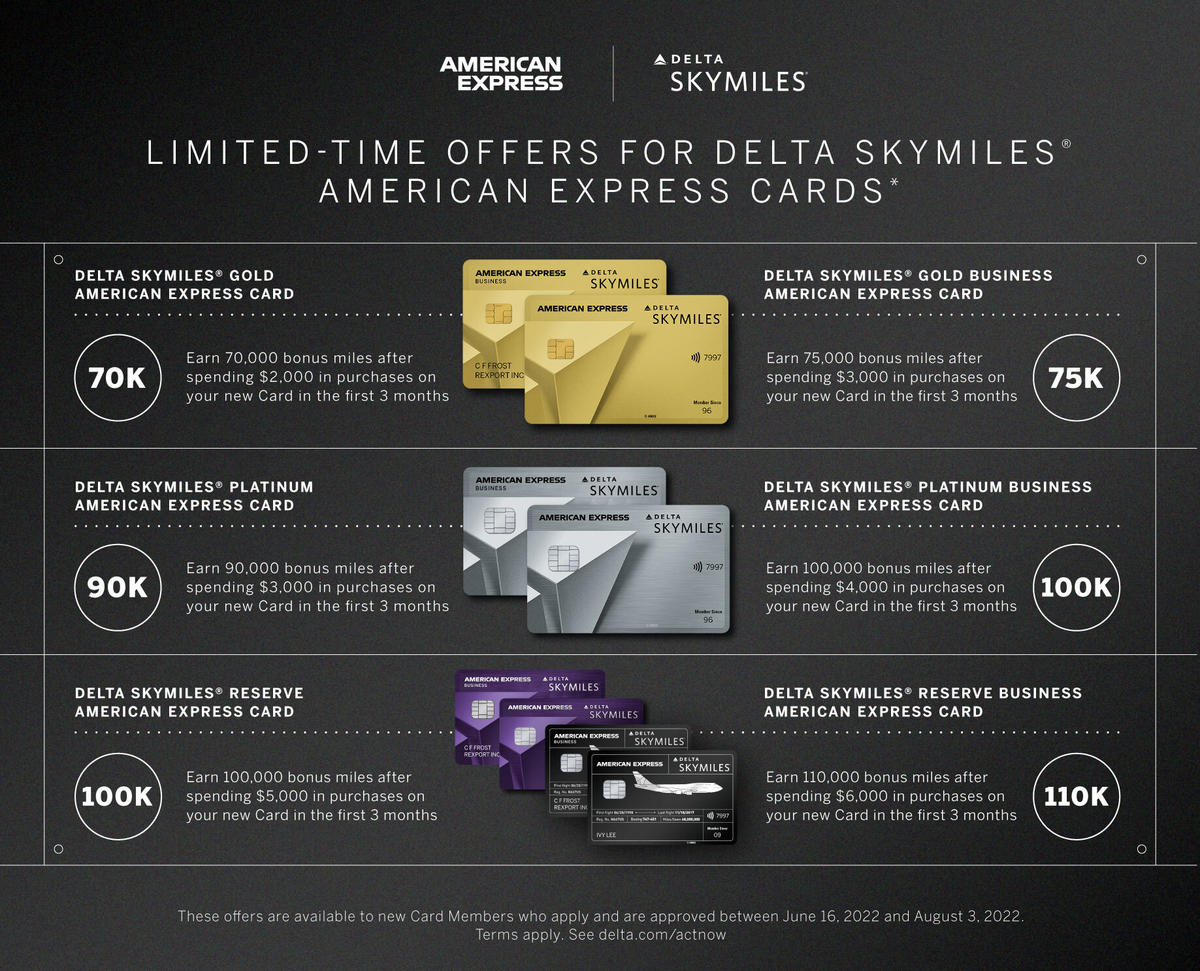

Strategy matters here. Some people start with the Gold to get the lower fee, then "upgrade" to the Platinum later. But if you upgrade, you often miss out on the Platinum's specific sign-up bonus. It’s often smarter to apply for the cards separately over time to harvest those 50,000 to 90,000 mile bonuses. These miles never expire, which is a nice perk compared to some other airlines that "clean out" your account if you don't travel for a year.

The MQD Headstart: The New Way to Earn Status

In early 2024, Delta completely overhauled how people earn Medallion status. They killed "Medallion Qualification Miles" (MQMs) and "Medallion Qualification Segments" (MQSs). Now, it is all about MQDs.

One of the sneakiest benefits of Delta American Express card ownership—specifically for the Platinum and Reserve—is the "MQD Boost."

- Headstart: You get $2,500 MQDs just for holding the card.

- Spend-to-Status: For every $20 you spend on the Platinum card, you get 1 MQD. On the Reserve, it's 1 MQD for every $10 spent.

If you own a small business and put $100,000 of inventory or advertising on a Delta Reserve card, you’ve just earned 10,000 MQDs. Add the $2,500 headstart, and you're at $12,500. That’s Gold Medallion status without ever stepping foot on a plane. For consultants or business owners who value the "Skip the Line" perks and free upgrades, this is the most efficient way to climb the ranks.

Real-World Limitations and the "Fine Print"

It isn't all free champagne and empty middle seats. There are downsides.

✨ Don't miss: Tiempo en East Hampton NY: What the Forecast Won't Tell You About Your Trip

First, these cards are issued by American Express. While Amex is accepted almost everywhere in the U.S., it can still be hit-or-miss in small European towns or parts of Asia. If you're traveling internationally, you absolutely need a back-up Visa or Mastercard with no foreign transaction fees.

Second, the "Companion Certificate" has "blackout" dates or, more accurately, "fare class" restrictions. You can't just use it on any seat on any flight. The plane has to have specific "L, U, T, X, or V" class seats available for economy. If you wait until the last minute to book a holiday flight, you’ll probably find that your "free" ticket is unusable. You have to plan ahead.

Third, the Sky Club access rules have become... contentious. Because the lounges were getting too crowded, Amex and Delta restricted access. Starting in 2025, even Reserve cardholders are limited to 15 days of visits per year unless they spend $75,000 on the card annually. If you're a "road warrior" who hits the lounge 40 times a year, this card just lost a lot of its luster.

How to Maximize Your Value

To truly win the game, you need to treat the card like a coupon book. Most of the benefits of Delta American Express card variants now include "statement credits" for things like:

- Resort Credits: Up to $200 back on eligible Delta Vacations.

- Rideshare Credits: $10 monthly credits for Uber or Lyft (on Platinum/Reserve).

- Resy Credits: Monthly credits for dining at restaurants booked through the Resy platform.

If you actually use these, the effective annual fee drops significantly. For example, if you use the $120 annual Resy credit and the $120 rideshare credit on the Platinum card, your "real" cost for the card is only $110. At that price point, the companion certificate and free bags are basically pure profit.

Actionable Next Steps

- Check your luggage habits: If you check a bag more than twice a year, get the Delta Gold card. It’s a no-brainer.

- Audit your "Player 2": If you travel with a spouse, the Platinum card's Companion Certificate will pay for the annual fee in a single trip.

- Look at the "TakeOff 15": Before you book your next flight with miles, see if the 15% discount justifies opening a card. On a 100,000-mile international trip, that’s 15,000 miles saved—roughly $150 to $200 in value.

- Download the Amex App: Once you have the card, you have to manually "enroll" in many of the credits like the Resy or Rideshare perks. If you don't click the button, you don't get the money.

The reality is that Delta has built a "pay-to-play" ecosystem. You can either be the person paying $35 for a bag and sitting in the last row, or you can use these cards to hedge against those costs. It’s not about being a "frequent flyer" anymore; it’s about being a "smart flyer." Choose the card that matches your actual spending habits, not the one that looks the coolest when you pull it out of your wallet at a bar.