Everyone likes to talk about the 50/30/20 rule. You know the one—Senator Elizabeth Warren made it famous in her book All Your Worth. It’s fine. It’s a classic. But honestly? It doesn’t work for a huge chunk of people anymore. Inflation is a nightmare, housing costs are eating our souls, and trying to stick to 50% for "needs" feels like a cruel joke if you live in a city like Austin or New York. That’s exactly why the 70 20 10 budget calculator has become the go-to for people who want a plan that actually fits the real world.

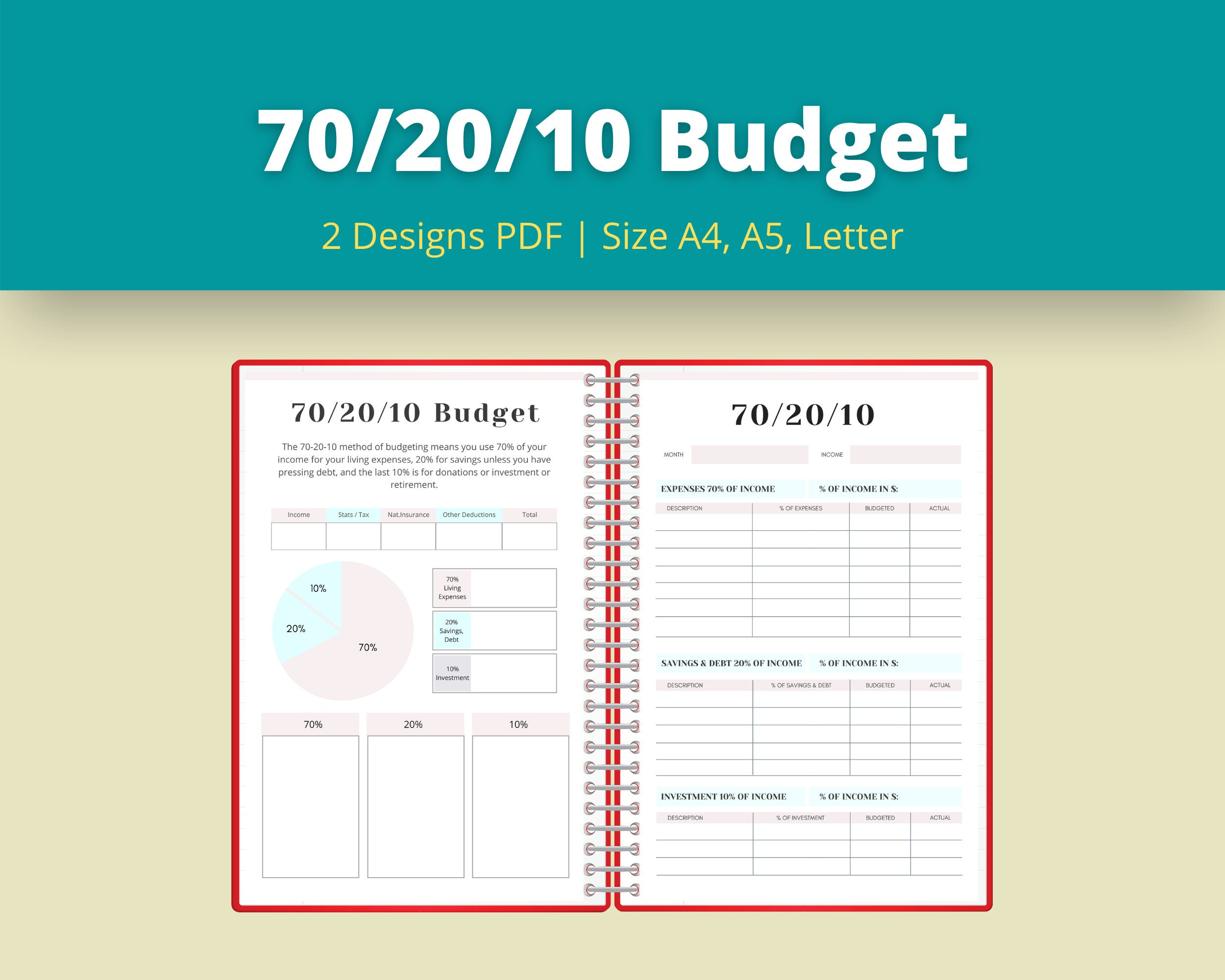

It’s simple. 70% for your life right now. 20% for your future. 10% for the things that make you feel like a human.

Most people are drowning in spreadsheets. They track every single latte and then give up by Tuesday because life is too short to categorize every $4 purchase. The 70/20/10 framework is different because it’s a "macro" budget. You aren't obsessing over the small stuff; you're managing the big buckets. If the big buckets are right, the rest usually takes care of itself.

What a 70 20 10 budget calculator actually does for your brain

Budgeting isn't just math. It's psychology. When you plug your numbers into a 70 20 10 budget calculator, you’re basically telling your brain that it’s okay to spend money. That’s the part people miss. Most "financial experts" make you feel guilty for existing. They want you to live on rice and beans until you're 70.

This model flips the script.

The 70% bucket covers your "Living Expenses." This is the heavy lifting. We’re talking rent, mortgage, groceries, utilities, and that annoying car insurance payment. But here’s the kicker: it also includes your fun stuff. The movies, the dinners out, the new shoes. It’s all in there. By lumping them together, you stop stressing about whether a burger counts as a "need" or a "want." If it fits in the 70%, you’re golden.

Then you’ve got the 20%. This is the "Future You" fund. Debt repayment, savings, and investments. If you’re carrying a balance on a high-interest credit card, this 20% is your weapon of choice. Smash that debt first. Once that's gone, it goes straight into your 401(k), IRA, or that high-yield savings account you’ve been meaning to open.

Finally, the 10%. This is the "Giving or Extra" bucket. Some people use it for tithing or charity. Others use it for aggressive debt payoff or a specific "big goal" like a wedding or a down payment. It’s the flexible piece of the puzzle that makes the budget feel personal rather than restrictive.

✨ Don't miss: Finding Real Counts Kustoms Cars for Sale Without Getting Scammed

Why this beats the 50/30/20 rule for most families

Let’s be real. The 50/30/20 rule assumes your "needs" are only half your income. In 2026, with the way rent prices have behaved, that’s almost impossible for a lot of people. If you’re making $5,000 a month and your rent is $2,000, you’ve already used 40% of your budget on just one line item. Add in car payments, insurance, and the price of eggs? You’ve blown past 50% before you’ve even bought a head of lettuce.

The 70/20/10 model is more forgiving. It acknowledges that living is expensive.

By grouping "wants" and "needs" into that 70% category, you get more breathing room. It stops the constant internal debate about whether Netflix is a necessity. Does it fit in the 70%? Yes? Then stop worrying about it. This reduces decision fatigue, which is the number one reason people quit budgeting.

Putting the numbers to work: A real-world example

Let’s look at a hypothetical scenario. Say you’re bringing home $4,200 a month after taxes.

If you use a 70 20 10 budget calculator, your breakdown looks like this:

- Living Expenses (70%): $2,940. This has to cover your rent, utilities, food, gas, and your social life.

- Savings and Debt (20%): $840. This goes to your Roth IRA and maybe an extra payment on your student loans.

- Giving or Goals (10%): $420. You donate to a local shelter or put it toward that trip to Mexico you've been eyeing.

Wait. What if your expenses are $3,200?

This is where the magic happens. The calculator isn't a judge; it's a mirror. If your expenses are higher than the 70% mark, the math is telling you something. You either need to lower your cost of living—harder than it sounds, I know—or you need to pull from the 10% bucket to cover the gap. It gives you a clear target to aim for. Maybe you can’t get to 70/20/10 today. Maybe today you’re at 85/10/5. That’s fine. The goal is to move the needle over time.

🔗 Read more: Finding Obituaries in Kalamazoo MI: Where to Look When the News Moves Online

Common pitfalls that mess up your math

People get weird about the "debt" part.

If you have a credit card with a 24% interest rate, that is an emergency. It is a financial house fire. In this case, your 20% and your 10% should probably both be funneled into that debt until it’s dead. Don't worry about "giving" or "saving for a house" while you're paying a bank 24% for the privilege of carrying a balance.

Another mistake? Forgetting about the "sinking funds."

The 70% bucket shouldn't just be for this month’s bills. It should also account for the stuff that happens once a year. Car registration. Christmas. Your Amazon Prime subscription. If you don't set aside a little bit of that 70% every month for these "surprise" expenses, they will blow up your budget every single time. A good 70 20 10 budget calculator helps you see that these aren't surprises; they're predictable events.

The "Zero-Based" connection

You should probably pair this framework with zero-based budgeting. This doesn't mean you have zero dollars in your bank account. It just means that every single dollar has a job to do. If you have $4,200 coming in, you should know exactly where all $4,200 is going before the month starts.

When you combine the 70/20/10 proportions with a zero-based mindset, you become incredibly powerful with your money. You aren't just "hoping" there's money left at the end of the month. You’re deciding where it goes in advance.

Making it stick without losing your mind

Most people fail at budgeting because they make it too complicated. They buy a $50 planner. They download three different apps. They watch eighteen YouTube videos. Then, they get overwhelmed and stop.

💡 You might also like: Finding MAC Cool Toned Lipsticks That Don’t Turn Orange on You

Don't do that.

Start with the big numbers. Look at your last three months of bank statements. Total everything up. If your "living" category is sitting at 90%, don't panic. Just look for one thing to trim. Can you switch to a cheaper phone plan? Can you cook one more night a week? Every 1% you move from the "Living" column to the "Savings" column is a massive win for your future self.

Expert perspectives on the 70/20/10 split

Financial experts like Dave Ramsey often lean toward even more aggressive saving, but the 70/20/10 rule is frequently cited by investment advisors as a sustainable "forever" budget. Why? Because it’s realistic. It doesn't ask you to live a miserable life. It asks you to be intentional.

The "Giving" 10% is also a secret weapon for wealth. It sounds counterintuitive. How does giving away money help you get ahead? It changes your relationship with money. It moves you from a "scarcity" mindset—where you’re afraid there’s never enough—to an "abundance" mindset. When you can afford to give 10% away, you prove to yourself that you are in control of your finances, not the other way around.

Actionable steps to start today

Stop overthinking. Here is exactly what you need to do right now to make this work.

- Calculate your true take-home pay. Not your salary. The actual amount that hits your bank account after taxes, health insurance, and anything else.

- Multiply that number by 0.70, 0.20, and 0.10. Write those three numbers down on a sticky note. Those are your boundaries.

- Audit your fixed costs. Rent, car, insurance, utilities. If these alone are more than 50% of your total income, you are "house poor" or "car poor." You might need to make a big move, like getting a roommate or selling the car, to truly hit the 70/20/10 target.

- Automate the 20%. This is the most important step. If you wait until the end of the month to save what’s left, nothing will be left. Set up an automatic transfer to your savings or investment account the day after you get paid.

- Review in 30 days. Don't expect perfection. Your first month will be messy. You’ll forget a bill. You’ll overspend on groceries. It’s fine. Just adjust the numbers and try again.

The 70 20 10 budget calculator is a tool for freedom, not a cage. Use it to build a life you actually enjoy living, rather than just a bank account that looks good on paper. If you can get your living expenses down to 70% and keep them there while your income grows, you’ll be shocked at how fast your net worth starts to climb.

Keep it simple. Keep it consistent. And for heaven's sake, stop worrying about the lattes if your housing costs are the real problem. Focus on the big buckets, and the rest of your financial life will start to fall into place.