Let’s be real. Staring at a 1040 us individual income tax return is about as exciting as watching paint dry in a humid basement. It’s two pages of boxes, tiny font, and jargon that feels designed to give you a headache. But here’s the thing: that document is basically the financial DNA of your entire year. Every dollar you earned, every side hustle you tried, and every bit of "help" the government gave you is buried in those lines.

Most people just want to get it over with. They rush through, click "submit" on their software, and pray they don't get a letter from the IRS three years later. Honestly? That's how you leave money on the table. Whether you're a W-2 employee or a freelancer juggling fifteen different clients, understanding how the 1040 actually works changes the game. It’s not just a chore; it’s a scoreboard.

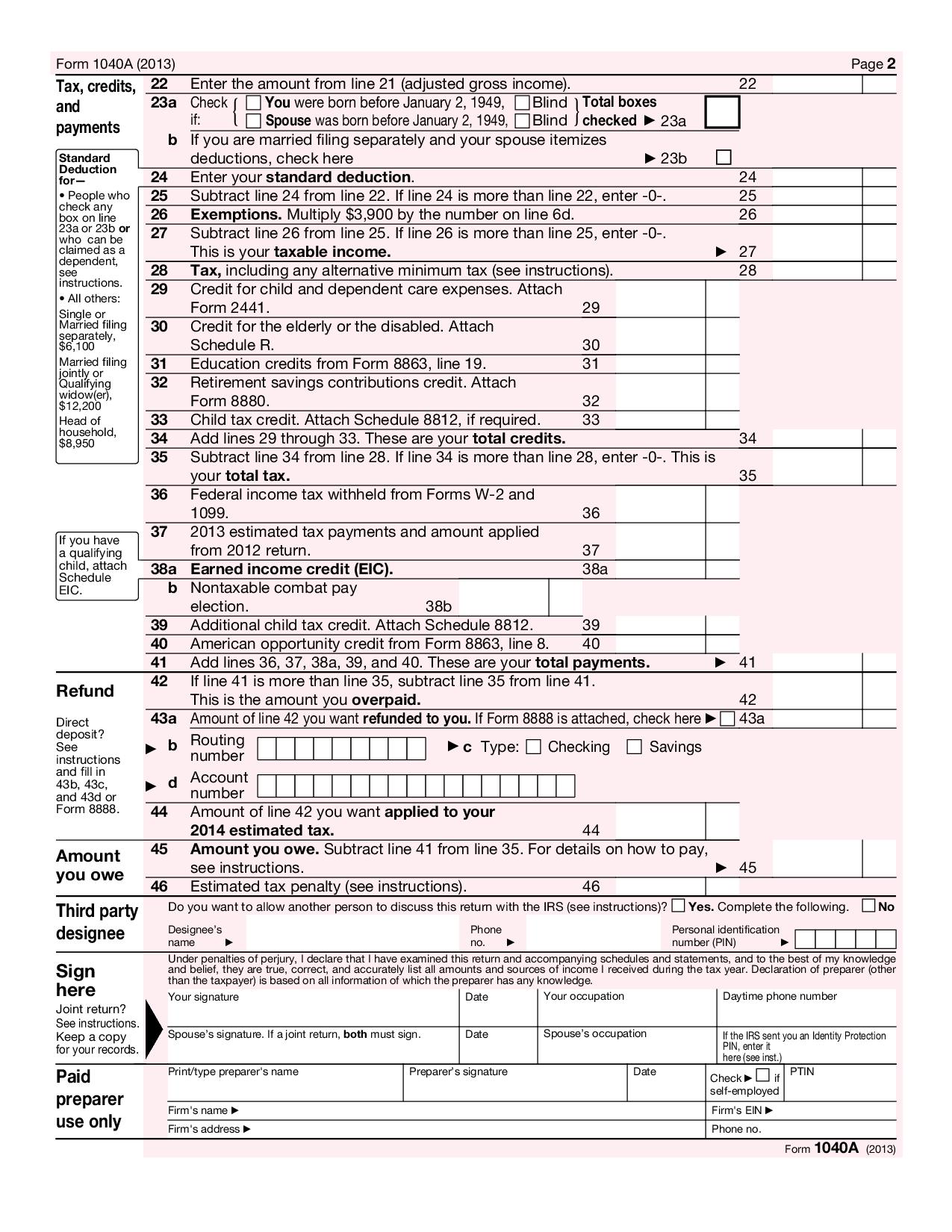

The 1040 is basically a funnel

Think of the 1040 us individual income tax return as a giant funnel. At the top, you throw in everything. Your salary. That $50 you made selling a vintage lamp on eBay. The interest from that high-yield savings account you finally opened. This is your "Total Income." It’s a big, scary number.

But then, the IRS starts letting you shave bits off.

First come the "Adjustments to Income." These are the gems. We’re talking about things like student loan interest or contributions to a traditional IRA. Once you subtract those, you’re left with your Adjusted Gross Income, or AGI. This is arguably the most important number on your entire return. Why? Because your AGI is the gatekeeper. It determines if you qualify for certain credits or if you’re "too rich" for specific breaks. If your AGI is too high, you might lose out on the Child Tax Credit or the ability to deduct certain losses. It's the baseline for your entire financial life in the eyes of the government.

The great debate: Standard vs. Itemized

After you find your AGI, you have a choice to make. It’s the fork in the road for every taxpayer. Do you take the Standard Deduction or do you Itemize?

Since the Tax Cuts and Jobs Act of 2017, the vast majority of Americans—roughly 90%—just take the standard deduction. It’s easy. It’s a flat amount. For the 2025 tax year (the ones you're likely thinking about now), that amount has ticked up again to account for inflation. It’s a big chunk of change that you just get to ignore for tax purposes. No receipts required. No digging through shoeboxes.

✨ Don't miss: Online Associate's Degree in Business: What Most People Get Wrong

But for some, itemizing on Schedule A is still the way to go. If you have massive medical bills that exceed 7.5% of your AGI, or if you live in a state with high property taxes and you have a giant mortgage, those individual deductions might add up to more than the standard amount. It’s a math problem. You want the biggest number possible to subtract from your income. Smaller taxable income equals a smaller check to Uncle Sam. Simple as that.

What actually changed lately?

Tax laws aren't static. They breathe. They shift. Sometimes they grow teeth.

For the recent cycles, inflation has been the biggest driver of change in the 1040 us individual income tax return. The IRS adjusted the tax brackets upward. This is actually good news. It means you can earn more money before being pushed into a higher tax percentage. It’s called "bracket creep" prevention. Without these adjustments, a cost-of-living raise at work could actually result in you taking home less money after taxes.

Then there's the whole 1099-K situation. You might remember the panic about the $600 threshold for Venmo and PayPal transactions. The IRS has been kicking that can down the road for a while, but the reporting requirements are getting tighter. If you’re using those apps for a business, even a small one, the IRS wants its cut. They’re looking for "platform" income more than ever. If you get a 1099-K, you can't just ignore it. It’s already been reported to the government. If it’s not on your 1040, a red flag goes up.

Credits are better than deductions

People mix these up constantly. A deduction lowers the income you’re taxed on. A credit? That’s a dollar-for-dollar reduction in the tax you owe.

If you owe $5,000 in taxes and you get a $2,000 credit, you now owe $3,000. It’s powerful. The Earned Income Tax Credit (EITC) is a big one for lower-to-moderate-income workers. Then there's the Child Tax Credit. These aren't just "nice to haves." For many families, these credits are the difference between a refund and a bill they can't pay. Some credits are even "refundable," meaning if the credit drops your tax bill below zero, the government actually sends you the leftover money.

🔗 Read more: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

The nightmare of the "Underreporting" notice

Nothing ruins a Tuesday like a CP2000 notice. This is what happens when the computer at the IRS notices a mismatch. Maybe you forgot a 1099-INT from a bank account you closed in March. Maybe you didn't report the crypto you sold for a $200 profit.

The IRS matches the forms they receive from employers and banks with what you put on your 1040 us individual income tax return. If they don't line up, the system automatically spits out a notice. It’s not an audit—not yet—but it’s an invitation to pay more. Most of the time, these are avoidable. The secret? Organization. I know, it sounds like advice from a high school guidance counselor, but having a digital folder for every tax document that hits your inbox prevents 99% of these headaches.

Why you should probably ignore the "Refund" hype

We all love a big refund. It feels like a gift. A bonus.

In reality, a big refund is just a sign that you gave the government an interest-free loan all year. If you get $3,000 back, that’s $250 a month you could have had in your paycheck to pay down high-interest credit card debt or invest. The goal, theoretically, is to owe zero and get zero back. It’s called "breaking even." Of course, most people prefer the safety net of a refund because they don't want to risk owing money they don't have. But if you're disciplined, adjusting your W-4 at work to get more in your paycheck is the smarter financial move.

Filing status is a trap for some

Picking your filing status seems easy, but it’s where a lot of errors happen on the 1040 us individual income tax return.

- Single: Pretty straightforward.

- Married Filing Jointly: Usually the best deal for couples.

- Married Filing Separately: Rarely a good idea unless you’re trying to isolate your tax liability from a spouse's shady dealings or you have specific student loan repayment strategies.

- Head of Household: This is the one people mess up. You have to be "unmarried" (effectively) and pay more than half the cost of keeping up a home for a qualifying person. The tax rates are better than "Single," so the IRS looks at this status very closely.

If you’re going through a divorce or a separation, the "status" you hold on December 31st is what you are for the whole year. One day can change your entire tax liability.

💡 You might also like: Modern Office Furniture Design: What Most People Get Wrong About Productivity

What about the "Gig Economy" boxes?

If you drive for Uber, sell on Etsy, or do freelance consulting, your 1040 is going to need a friend: Schedule C. This is where you report profit or loss from a business.

The IRS knows that more people than ever are working for themselves. They also know that people love to "fluff" their expenses. You can't deduct your entire mortgage because you check emails at your kitchen table. You need a dedicated home office space. You can't deduct your commute to your main job, but you can deduct mileage between two different work sites. Nuance matters here. Keep a log. Use an app. Do whatever you have to do to prove those miles if you ever get asked.

Common mistakes that trigger delays

Most delays aren't because of a complex tax theory. They're because of typos.

- Social Security Numbers: One wrong digit for a child or a spouse and the whole return gets kicked out.

- Bank Account Info: If you want that direct deposit, double-check the routing number. If it’s wrong, the IRS has to wait for the bank to reject it, then they mail a paper check. It adds weeks.

- Signatures: If you’re filing a paper return (please don't, it's 2026), and you forget to sign it, it’s not a valid return.

- Name Mismatches: If you got married and haven't updated your name with the Social Security Administration, file under the name they have on record.

Digital security is the new frontier

Identity theft involving the 1040 us individual income tax return is a massive business for criminals. They file a fake return in your name early in the season, claim a giant refund, and disappear. You only find out when you try to file your real return and it gets rejected.

The best defense is an IP PIN (Identity Protection Personal Identification Number). You can get one from the IRS website. It’s a six-digit code that acts as a second factor of authentication for your taxes. Even if someone has your SSN, they can't file without that PIN. It’s an extra step, sure, but it’s better than spending six months trying to prove to the IRS that you’re actually you.

Actionable steps for your next filing

Don't wait until April 14th to think about this. Tax season is a marathon, not a sprint.

- Audit your withholding now. Look at your last paystub. If you’re on track for a $5,000 refund and you’re struggling with monthly bills, go to your HR portal and update your W-4.

- Go paperless. Create a specific folder in your email or on your computer labeled "Tax Year 2025." Every time you get a digital receipt for a donation or a 1099, drop it in there immediately.

- Check the "Energy" credits. If you did home improvements—like new windows, doors, or solar panels—the Inflation Reduction Act expanded several credits. These can be worth thousands, but you need the specific manufacturer certification statements.

- Contribute to your 401(k) or IRA. This is one of the few ways to lower your tax bill after the year has ended (for IRAs, you usually have until the filing deadline). It’s an immediate win for your future self and your current wallet.

The 1040 isn't just a form. It's a reflection of your life. Treat it with a little respect, and you'll probably find it's not quite as scary as it looks. Keep your records clean, stay honest with the numbers, and don't be afraid to ask a pro if things get weird. Tax law is complicated, but your filing doesn't have to be a disaster.