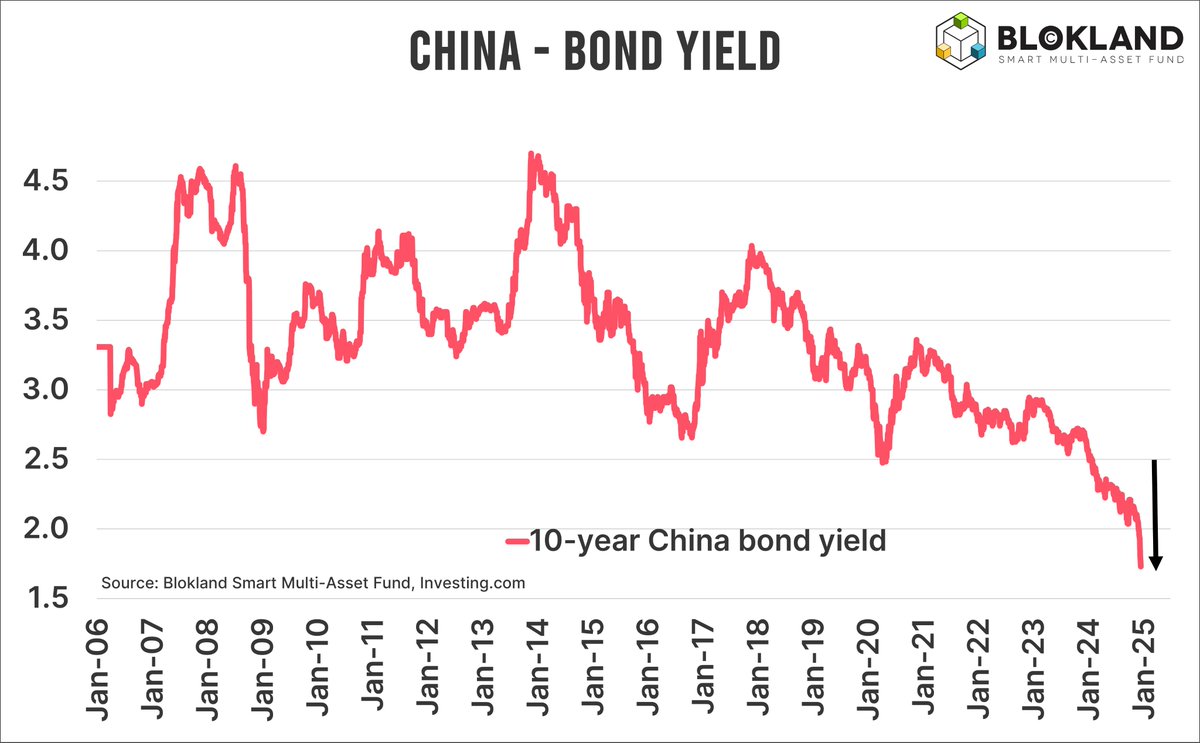

Money is moving. It's moving away from the flashy tech stocks of Shenzhen and into the quiet, steady world of government debt. If you've been watching the 10 year china bond yield, you've seen something that looks less like a financial chart and more like a slow-motion slide. It’s been hitting record lows. People are worried. Or they're greedy. Or maybe they're just looking for a place to hide.

Basically, the 10 year china bond yield is the pulse of the world’s second-largest economy. Right now, that pulse is slow. When yields drop, it means bond prices are going up because everyone is scrambling to buy them. Why? Because they’re scared of the alternatives. Real estate is a mess. The stock market feels like a gamble. So, investors pile into government bonds, pushing the yield down to levels we haven't seen in decades.

It's a weird vibe in the markets right now.

The PBOC vs. The Market: A Cold War Over Rates

The People's Bank of China (PBOC) is in a tough spot. They want to keep the economy moving, which usually means keeping interest rates low. But they don't want them this low. Pan Gongsheng, the Governor of the PBOC, has been pretty vocal about the risks of a "one-way bet" on bonds. He’s basically telling the market, "Hey, stop buying these so fast, or you're going to get burned when rates eventually go back up."

But the market isn't listening.

Investors are looking at the deflationary pressure in China—prices aren't rising, and in some sectors, they’re falling—and they figure the 10 year china bond yield has nowhere to go but down. It’s a classic standoff. The central bank even started "borrowing" bonds from primary dealers so they could sell them and manually push yields higher. It’s a bit of a desperate move, honestly. Imagine trying to stop a flood with a garden hose. That’s the PBOC right now.

🔗 Read more: Check Gift Card Balance American Express: Why People Get Locked Out and How to Fix It

The yield has hovered around the $2.1%$ to $2.3%$ mark recently, which is wild when you compare it to the US 10-year Treasury, which is often significantly higher. This gap—the "yield spread"—is causing all sorts of headaches for the Yuan. If you can get $4%$ in the US and only $2%$ in China, where are you going to put your cash? Exactly.

Why the property crisis is the real villain here

You can’t talk about China's bond market without talking about the giant, crumbling elephant in the room: Real Estate. For twenty years, if you had extra money in China, you bought an apartment. You didn't buy a 10-year bond. But Evergrande happened. Country Garden happened. Now, that massive mountain of household wealth is looking for a new home.

Safe havens are in high demand.

Banks in China are also struggling. They have tons of cash (deposits) because people are saving more than ever, but they have fewer "safe" businesses to lend it to. So, what do the banks do? They buy government bonds. This massive institutional demand is a huge reason why the 10 year china bond yield stays pinned to the floor. It’s not just speculators; it’s the entire plumbing of the Chinese financial system shifting its weight.

Comparing the 10 year china bond yield to the rest of the world

It’s easy to look at China in a vacuum, but the global context matters.

In the US, the Federal Reserve has been battling inflation by keeping rates high. In Japan, they’ve finally moved away from negative interest rates. China is the outlier. While the rest of the world was worried about things getting too hot, China has been worried about things getting too cold.

The formula for the yield is basically:

$$Yield = \frac{Annual\ Interest\ Payment}{Bond\ Market\ Price}$$

When the price goes up because of high demand, the yield goes down. This inverse relationship is fundamental. If the global market sees China’s yields falling while others rise, it signals a massive divergence in growth expectations. Most analysts at firms like Goldman Sachs or Morgan Stanley have been trimming their China growth forecasts because of this. They see the low yield as a symptom of "Japanification"—a long period of stagnation and low inflation.

What happens if the PBOC loses control?

There’s a real fear of a "bond bubble." If everyone owns the same 10-year bonds and suddenly the economy picks up or the PBOC hikes rates aggressively, the value of those bonds will crater. It could lead to a liquidity crunch. Smaller rural banks in China are particularly vulnerable. They’ve been loading up on these bonds to juice their returns, and a sudden spike in the 10 year china bond yield could wipe out their capital cushions.

Kinda scary, right?

How to actually trade this (or just protect yourself)

If you're an individual investor, you probably aren't buying Chinese sovereign debt directly. But you are definitely feeling the ripple effects.

- Watch the Currency: A falling yield usually weakens the Yuan. If you have exposure to Chinese tech stocks (like Alibaba or Tencent), a weaker Yuan means their earnings are worth less when converted back to Dollars.

- Commodities Connection: Low yields reflect low industrial demand. If China isn't building, they isn't buying Australian iron ore or Brazilian copper. The yield is a leading indicator for the global "reinflation" trade.

- The "Carry Trade": Some sophisticated players borrow in Yuan (where rates are low) to invest elsewhere. This is risky, but it explains a lot of the weird volatility in global currency markets lately.

The consensus among experts like those at Bloomberg Economics is that the yield won't see a massive rebound until the property sector stabilizes. And that hasn't happened yet. We’re seeing "stimulus" packages, but they’ve been more like band-aids than surgery.

Actionable steps for the savvy observer

Don't just watch the headline number.

Keep an eye on the "yield curve"—the difference between the 2-year and the 10-year bonds. In a healthy economy, the 10-year should pay a lot more because you're locking your money away for longer. In China, that curve has been getting flatter. A flat curve is the market's way of saying, "We don't expect much growth in the future."

Also, watch the PBOC's daily open market operations. If they start draining liquidity from the system, they are trying to force the 10 year china bond yield up. If they fail, it means the market is more powerful than the regulators. That’s when things get really interesting.

To stay ahead of the curve, track the "Credit Impulse" in China. This measures the change in new lending as a percentage of GDP. Usually, the credit impulse leads the bond yield by about six to nine months. If credit starts picking up, the yield will eventually follow. Until then, expect the "race to the bottom" to continue as investors seek safety in an uncertain world.

Monitor the spread between Chinese Treasuries and Local Government Financing Vehicle (LGFV) debt. If that spread widens, it means the market is getting nervous about the creditworthiness of local provinces, which often forces even more money into the safety of the 10-year national bond. Check these rates weekly on sites like CCDC (China Central Depository & Clearing) to see the real-time shifts before they hit the mainstream news.