You’ve seen them everywhere. Those jagged green and red lines crawling across a screen, looking like a digital EKG for the global economy. Most people stare at a graph of stock market performance and see chaos. They see a jagged mess of spikes and dips that look like they’re trying to predict the end of the world one minute and a golden age the next. Honestly, it’s intimidating. But here’s the thing: most of what you’re seeing on that screen is just noise, and if you don't know how to filter that noise, you're basically gambling with your eyes closed.

The Visual Language of Money

A stock chart isn't just a drawing. It’s a psychological map. Every single tick represents a moment where two people—one buyer and one seller—finally agreed on a price. When you look at a graph of stock market history, you’re looking at a record of human greed and fear.

Take the candlestick chart. It’s the industry standard, originally developed by Japanese rice traders in the 1700s. It’s weirdly beautiful once you get it. A green "candle" means the price closed higher than it opened. A red one means it dropped. The "wicks" or "shadows" poking out of the top and bottom tell you how high and low the price swung during that period before settling.

Sometimes the wicks are huge. That means the market was freaking out. Panic. Indecision. Other times, the candles are solid and fat, showing a clear, aggressive trend. If you see a long wick at the bottom of a red candle, it often suggests that while people were selling, someone stepped in and started buying the dip. That’s called a "hammer" formation. It’s a signal that the sentiment might be shifting.

Why 1-Day Charts Are Basically Useless

If you’re checking a graph of stock market data every five minutes, you’re probably driving yourself crazy for no reason. Short-term charts are incredibly deceptive. On a 5-minute scale, a 1% drop looks like a cliff. It looks like a total collapse. But zoom out. Switch that chart to a 5-year view or a 10-year view.

Suddenly, that "cliff" is just a tiny, microscopic blip. It’s a pebble on a mountain.

Real investors—the ones who actually make money over decades like Warren Buffett or the late Charlie Munger—don't obsess over the daily squiggles. They look at the "secular trend." The S&P 500, which tracks the 500 largest companies in the U.S., has historically returned about 10% annually over long periods. But within those years? It’s a rollercoaster. There are corrections (10% drops) and bear markets (20% drops) almost every few years.

📖 Related: Kimberly Clark Stock Dividend: What Most People Get Wrong

Understanding Support and Resistance

Think of the price of a stock like a rubber ball in a room. The floor is "support." The ceiling is "resistance."

When a graph of stock market prices hits a certain low point multiple times and bounces back up, that’s a support level. It’s the price point where buyers collectively say, "Okay, this is too cheap to pass up." They flood in and push the price back up. Conversely, resistance is where the sellers are waiting. They think the stock is getting too expensive, so they dump their shares, creating a "ceiling" that the price struggles to break through.

- Support: Where the buying power exceeds selling pressure.

- Resistance: Where the selling power exceeds buying pressure.

- The Breakout: When the price finally smashes through the ceiling or falls through the floor.

When a stock breaks resistance, that old ceiling often becomes the new floor. It’s a fundamental shift in how the market values that company.

The Volume Secret

Most beginners ignore the little bars at the bottom of the graph of stock market apps. That’s volume. Volume is the fuel.

If a stock price is going up but the volume is low, be careful. It means there isn't much conviction behind the move. It’s a weak rally. It’s like a car trying to go uphill with an empty tank. But if the price spikes on massive volume? That means the "big money"—pension funds, hedge funds, institutional investors—is moving in. You want to follow the big money, not the lonely retail trader in their basement.

Logarithmic vs. Linear Scales

This is a nerdy distinction, but it matters. Most charts you see on the news are "linear." If a stock goes from $10 to $20, it looks the same as a move from $100 to $110. Both are a $10 move.

👉 See also: Online Associate's Degree in Business: What Most People Get Wrong

But wait.

Going from $10 to $20 is a 100% gain. Going from $100 to $110 is only a 10% gain.

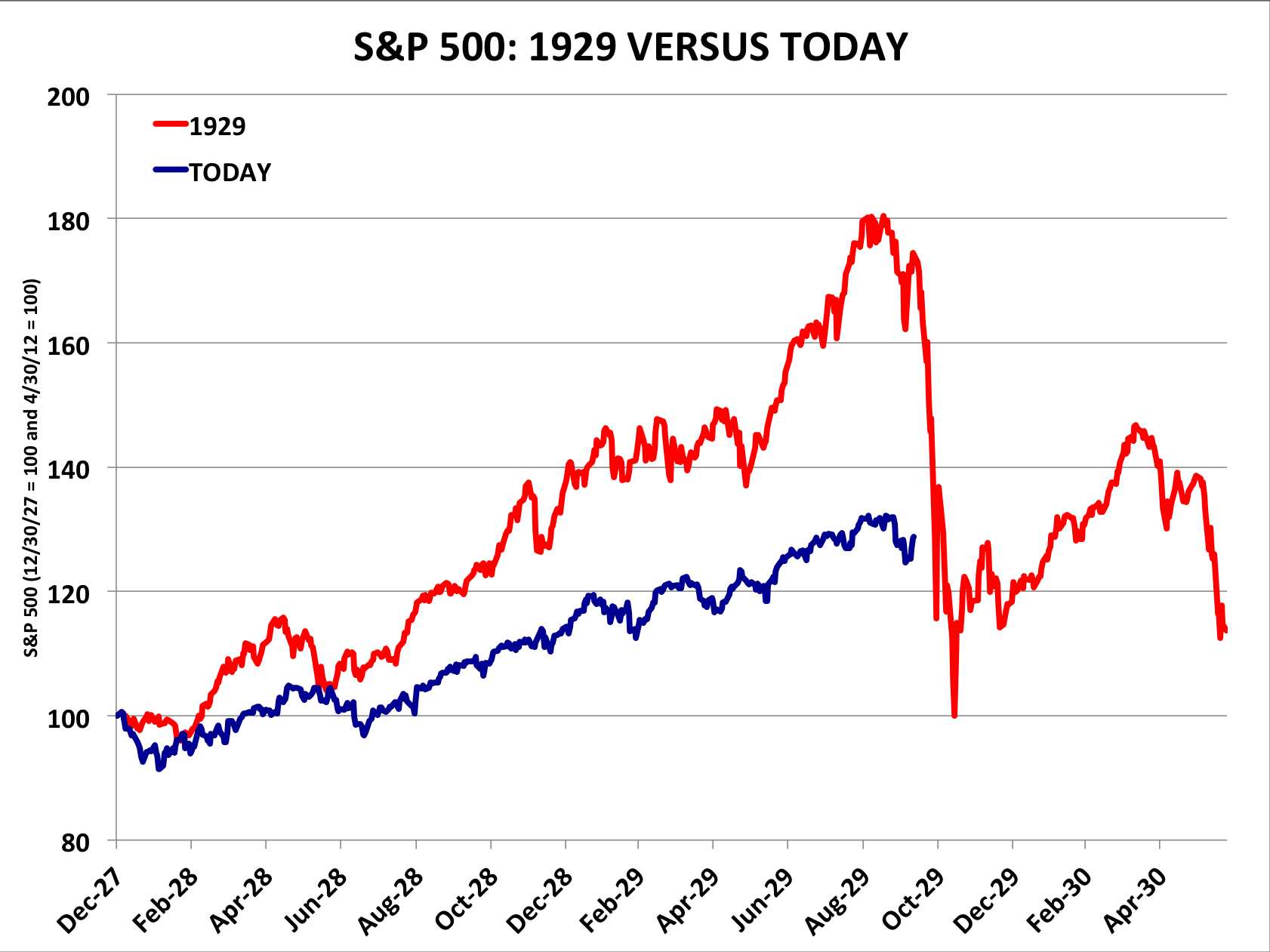

If you’re looking at long-term history, you must use a logarithmic scale. It shows the percentage change rather than the dollar change. On a linear scale, a chart from 1920 looks flat until about 1990 because the dollar amounts were so small back then. A log scale makes the 1929 crash look as significant as it actually was. It gives you a much truer sense of the growth or destruction of wealth over time.

Don't Get Fooled by Technical Indicators

RSI. MACD. Bollinger Bands. Moving Averages.

There are hundreds of "indicators" you can overlay on a graph of stock market data. They look fancy. They make you feel like a scientist. But remember: they are all "lagging" indicators. They tell you what happened, not necessarily what will happen.

The 200-day moving average is probably the most respected one. It’s the average price of the stock over the last 200 trading days. If the current price is above that line, the stock is generally considered to be in an uptrend. If it’s below? It’s in trouble. Simple. Don't overcomplicate your screen with 50 different colorful lines. You’ll just end up with "analysis paralysis."

✨ Don't miss: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

What Really Moves the Needle?

Ultimately, the graph is a reflection of earnings and interest rates. When the Federal Reserve (the Fed) raises interest rates, the graph of stock market indices usually takes a hit. Why? Because it becomes more expensive for companies to borrow money to grow. Also, "risk-free" investments like Treasury bonds start looking more attractive than "risky" stocks.

When you see a massive, vertical drop on a chart, it's usually one of three things:

- An unexpected interest rate hike.

- A disastrous earnings report from a major "bellwether" company (like Apple or Nvidia).

- A "Black Swan" event—something nobody saw coming, like the 2020 pandemic lockdowns.

Moving Forward With Your Analysis

Stop looking for "the perfect entry." It doesn't exist. Even the best traders in the world get it wrong about 40% of the time. They just manage their losses better than everyone else.

If you want to actually use a graph of stock market trends to your advantage, here is what you should do next:

- Switch your timeframe. Stop looking at the 1-day or 1-hour chart. Start with the weekly and monthly views to see the "Big Picture" before you zoom in.

- Identify the trend. Is the line generally moving from the bottom left to the top right? If yes, the trend is up. Don't fight the trend. "The trend is your friend until the end."

- Check the 200-day Moving Average. Is the price above or below it? This single check can save you from buying into a dying company.

- Look at Volume. Ensure the price movement is backed by actual trading activity, not just a few small orders moving the needle.

- Use Logarithmic scales for long-term views. It will give you a much more accurate perspective on historical growth and volatility.

The graph is a tool, not a crystal ball. Treat it like a weather map—it tells you the current conditions and the likely path of the storm, but it can't stop the rain. Master the basics, stay disciplined, and for heaven's sake, stop panic-selling every time you see a red candle.