You probably know it better as POSCO. But if you're looking into the roots of South Korea's massive economic engine, you're looking for the Pohang Iron and Steel Company. It's honestly kind of wild how a company started in 1968 with basically zero domestic capital, no technology, and no iron ore deposits ended up becoming one of the most efficient steelmakers on the planet. Most people think of steel as this old-school, "rust belt" industry that’s dying out. They’re wrong.

Steel is everywhere. Your phone, your car, the fridge you just opened—it's all tied back to these massive industrial furnaces. POSCO didn't just build a business; they built a country.

The "Miracle on the Han River" had a steel backbone

Back in the late sixties, South Korea was still reeling from the war. They were poor. Like, incredibly poor. Park Chung-hee, the leader at the time, decided that if the country was going to survive, it needed to stop importing every single screw and girder. He tapped Park Tae-joon to lead the project. People called him "TJ." He was a force of nature.

TJ had a pretty grim motto for his workers: "Right turn sentiment." Basically, he told them that if they failed to build this plant with the money they'd received as reparations from Japan, they should all turn right and drown themselves in the Yeongil Bay. Heavy stuff. But that desperation fueled a level of precision you just don't see in modern corporate culture. They finished the first phase of the Pohang works in 1973, ahead of schedule and under budget.

It’s easy to look back now and say it was an obvious success. It wasn't. The World Bank actually advised against it! They thought a developing nation starting an integrated steel mill was a recipe for bankruptcy.

How the Pohang Iron and Steel Company actually makes money today

Steel is a commodity, which usually means a "race to the bottom" on price. If you can't be the cheapest, you die. But POSCO played it differently. They pivoted toward "World Premium" products. We’re talking about high-strength steel for automotive frames that keeps you safe in a crash without making the car weigh as much as a tank.

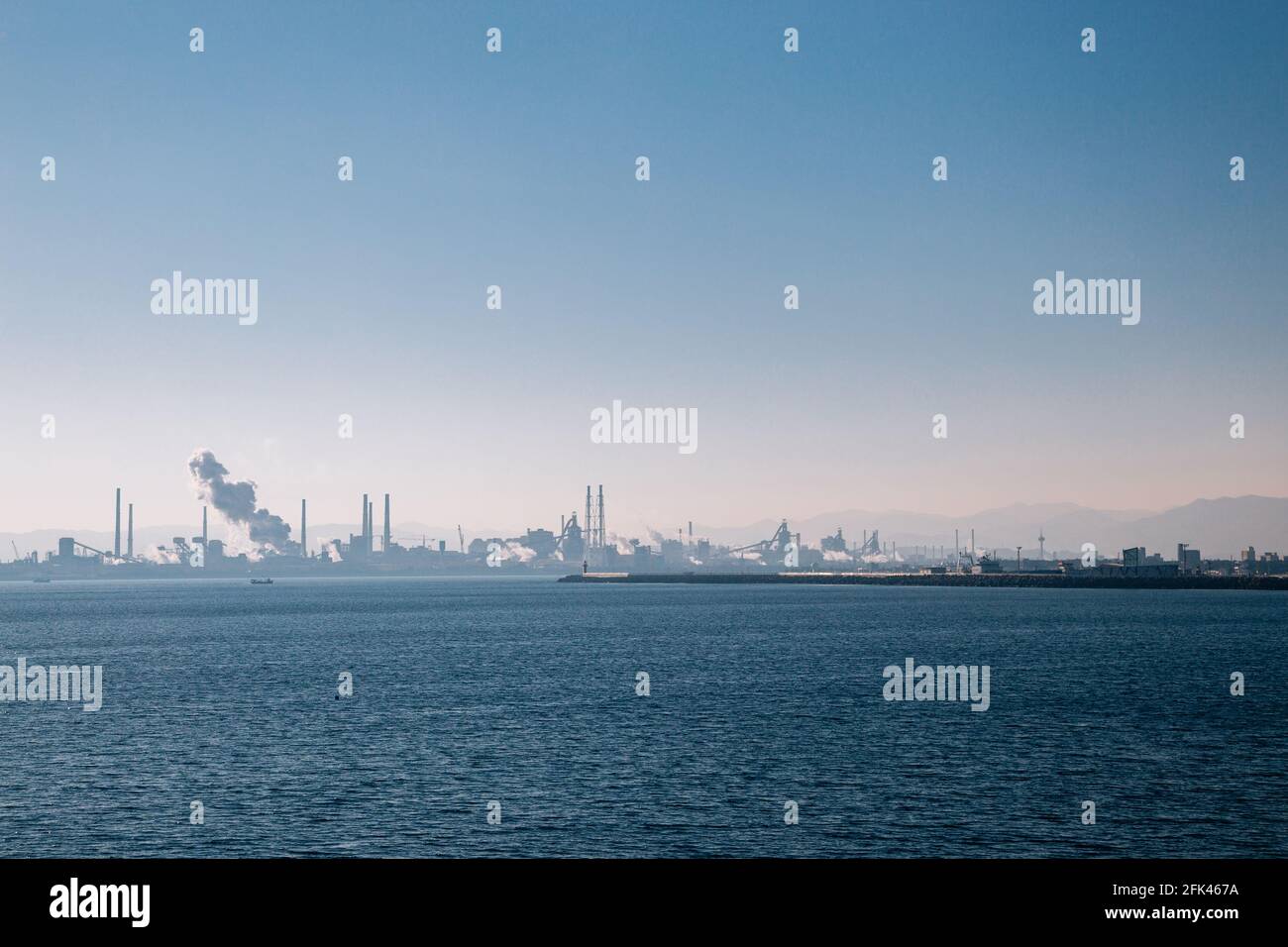

They operate two main hubs: Pohang and Gwangyang. Gwangyang is actually the largest integrated steel mill in the world. It’s huge. If you ever see it from the air, it looks like a small, metallic city.

The company isn't just melting scrap metal. They’ve branched out into:

- Lithium and Nickel: They are betting the house on EV batteries. They want to be a "green materials" company, not just a steel company.

- Hydrogen: They’re experimenting with hydrogen reduction steelmaking. This is a big deal because traditional steelmaking produces a ton of CO2. If they nail this, they stay relevant in a net-zero world.

- Construction and Trading: Through subsidiaries like POSCO International and POSCO E&C, they handle everything from building skyscrapers to trading grain.

The Lithium Pivot: It’s not just about the metal anymore

Let’s talk about the Argentinian salt flats. A few years ago, POSCO bought the "Sal de Oro" salt lake. People thought it was a gamble. Now? It looks like a stroke of genius. Lithium prices have been a roller coaster, but having a captive supply is what separates the winners from the losers in the battery race.

They are building a massive supply chain that goes from raw lithium extraction to cathode and anode production. It's a vertical integration play that mirrors what they did with iron ore fifty years ago. They don't want to buy materials from someone else; they want to own the dirt the materials come from.

Why China is a massive headache for POSCO

You can't talk about the Pohang Iron and Steel Company without mentioning China. Baowu Steel and other Chinese giants have flooded the market with cheap product for years. It’s a constant struggle. When China’s property market slumps, they dump their excess steel on the global market.

This forces POSCO to stay high-end. They can't compete with subsidized Chinese rebar used for simple housing. They have to sell the stuff that goes into LNG tankers or high-performance electric motors. Honestly, it's a high-stress way to run a business, but it's kept them profitable while many US and European mills have struggled or shuttered.

Realities of the environmental footprint

Steelmaking is dirty. There is no way to sugarcoat it. The blast furnaces at Pohang produce a massive amount of carbon. In 2020, POSCO declared they would be carbon neutral by 2050. That is a massive mountain to climb.

They are pushing something called HyREX technology. Traditionally, you use coal (coke) to strip the oxygen away from iron ore. This releases $CO_2$. With HyREX, you use hydrogen instead. The byproduct? Water. It sounds like science fiction, and honestly, it’s still in the pilot stages and incredibly expensive. But if they don't solve this, carbon taxes in Europe and the US will eventually price them out of the market.

What most people get wrong about the "State-Owned" label

There’s this lingering myth that POSCO is a government-run entity. It isn't. It was privatized back in 2000. While the Korean National Pension Service is a major shareholder, it operates as a private multinational. However, the "invisible hand" of the Blue House (the Korean presidency) still feels present sometimes. CEO appointments often get... complicated... when a new government comes into power. It’s a unique Korean corporate quirk called "ownerless company" risk. Since there isn't a single founding family (like Samsung or Hyundai) in control, the leadership can be more susceptible to political winds.

Actionable Insights for Investors and Industry Observers

If you're watching POSCO, stop looking at just the steel price charts. That’s the old way of thinking.

💡 You might also like: Which Rich Country in the World Actually Wins the Wealth Race?

Watch the Lithium conversion plants. The real value of the company over the next decade isn't in the blast furnaces; it’s in their ability to process battery-grade lithium. If the Gwangyang lithium hydroxide plant hits its production targets, the company's valuation should theoretically shift from a "cyclical industrial" multiple to something more akin to a "tech materials" multiple.

Monitor the CBAM (Carbon Border Adjustment Mechanism).

The EU is getting strict. If POSCO can't prove their steel is "greener" than their competitors, they’ll get hit with massive tariffs. Their R&D spend on hydrogen is the most important number on their balance sheet right now.

Keep an eye on the "Value-Up" program.

The Korean government has been pushing for companies to improve shareholder returns. POSCO has been buying back shares and trying to simplify its holding company structure. For a long time, the stock was undervalued because it was "just a steel company." If they can convince the market they are an "energy materials leader," that gap might finally close.

Check the shipbuilding cycle.

South Korean shipbuilders are currently seeing a massive influx of orders for high-tech ships. POSCO is their primary supplier. When Korean shipyards win, POSCO wins. It's a symbiotic relationship that provides a safety net when the general construction market is soft.

The Pohang Iron and Steel Company started as a pipe dream in a country with no resources. Today, it's the benchmark for industrial efficiency. It’s a weird, massive, complex beast of a company, but it remains the most reliable barometer for the health of the global industrial economy.