If you’ve checked your brokerage account lately, you might have noticed a swoosh-shaped hole in your portfolio value. Honestly, it’s been a rough ride for the sneaker king. As of January 18, 2026, the stock price for Nike (NKE) is sitting at $64.38.

That’s a far cry from the triple-digit glory days of 2021. Just look at the last few trading sessions. On Friday, January 16, the stock closed down about 0.33%. It opened at $64.39 and basically wiggled around between a high of $64.59 and a low of $63.68 all day. It’s quiet. Maybe a little too quiet for a company that used to dominate every corner of the market.

The Current State of NKE: By the Numbers

Let's be real—the numbers are kinda messy right now. Nike's market cap has shrunk to about $95.3 billion. For perspective, this was once a $200 billion behemoth.

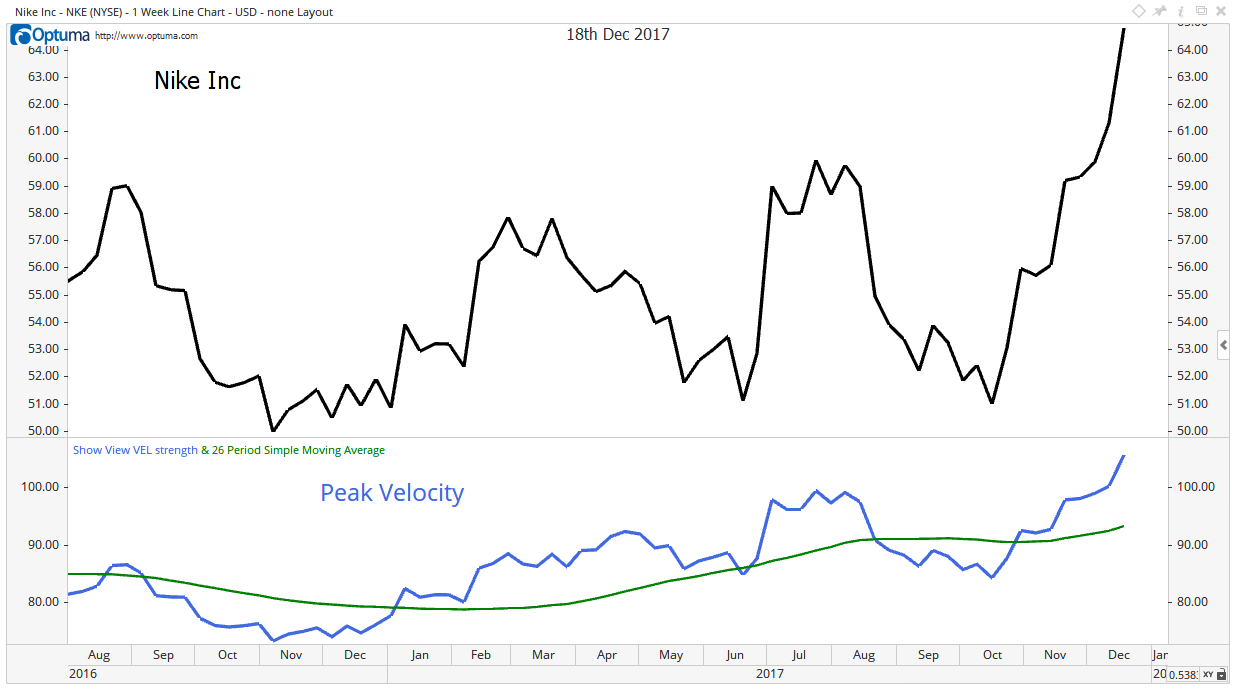

Here is what the last week of trading looked like. You can see the struggle to find a solid floor:

- Jan 16, 2026: $64.38 (Close)

- Jan 15, 2026: $64.59

- Jan 14, 2026: $65.57

- Jan 13, 2026: $66.30

- Jan 12, 2026: $65.64

The stock has a 52-week high of $82.44 and a low of $52.28. So, while we aren't at the absolute bottom, we are definitely closer to the floor than the ceiling. Why? Well, it’s a mix of self-inflicted wounds and global chaos.

Why is the Stock Price for Nike Struggling?

It’s not just one thing. It’s a whole "perfect storm" situation. First, let’s talk about the big elephant in the room: tariffs. In the most recent quarterly report (Q2 fiscal 2026), Nike’s gross margin took a 300-basis-point hit, dropping to 40.6%.

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Why? Because shipping shoes from overseas got a lot more expensive.

Then there's the strategy shift. Under the previous leadership, Nike went "all in" on direct-to-consumer (DTC) sales. They cut ties with a lot of wholesale partners. They thought they didn't need Foot Locker as much. Turns out, they were wrong. People still like trying on shoes in stores.

Now, the new CEO, Elliott Hill, is trying to fix the mess. He’s implementing what the company calls the "Win Now" strategy. Basically, he’s trying to get back to Nike’s roots: sports performance. Less focus on "lifestyle" hoodies, more focus on the best running shoes in the world.

The Leadership Shake-up

Elliott Hill isn't messing around. In December 2025, he cleaned house. He eliminated several C-suite roles, including the Chief Technology Officer and Chief Commercial Officer positions.

He moved Venkatesh Alagirisamy into a massive new Chief Operating Officer role. The idea is to stop the internal bickering between departments and just get shoes made and sold efficiently. He also brought the heads of the four main geographic regions (North America, Greater China, EMEA, and APLA) directly to the top table.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

What the "Smart Money" is Doing

If you look at what the analysts are saying, it’s a divided house.

Some, like Guggenheim, are still screaming "Buy," with price targets up near $75. They think Nike is just too big to fail and that the brand power is still there. Others, like Barclays and UBS, are more "Neutral." They want to see the turnaround actually work before they put their neck on the line.

Interestingly, some insiders are buying. Elliott Hill and a couple of directors bought over $5 million worth of stock late last year. Usually, when the boss buys the stock with his own money, it’s a good sign. But don't get too excited—institutional investors (the big hedge funds) have actually been selling more than they’ve been buying lately.

The China Problem

Greater China used to be Nike’s growth engine. Now, it’s a headache. Between a sluggish economy there and local brands like Anta and Li-Ning stealing market share, Nike is fighting a two-front war. In the last quarter, Nike Direct revenues were down 8% globally, and a big part of that was the struggle in Asia.

Is Nike Still a Good Investment?

That’s the $64 question. Literally.

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

If you’re a dividend hunter, Nike is actually looking decent. They’ve increased their dividend for 24 consecutive years. The current yield is around 2.5%. They just declared a $0.41 per share quarterly dividend in November.

But you aren't buying Nike just for the 2%. You’re buying it because you think they can get back to being the coolest brand on the planet.

Misconceptions About the Price

A lot of people think the stock price for Nike is low just because "nobody wears Nikes anymore." That’s just not true. Revenue was $12.43 billion last quarter. People are still buying the shoes. The problem is profit. They are spending way more on marketing (up 13%) and losing more to tariffs and markdowns.

The company is in the "middle innings" of a comeback, according to CFO Matthew Friend. It’s not going to happen overnight.

Actionable Steps for Investors

So, what should you actually do?

- Watch the $60 Support Level: If the stock drops below $60, it could get ugly fast. If it stays above that, it might be forming a "base" for a future rally.

- Mark March 19 on Your Calendar: That’s the estimated date for the next earnings report. Expect a lot of volatility.

- Look at the Running Category: Nike says their running shoe sales are up 20% for two quarters in a row. This is the heart of the "Win Now" strategy. If this keeps growing, the stock will eventually follow.

- Diversify: Don't put your whole life savings into NKE right now. It’s a turnaround play, and turnarounds are risky.

Nike is a 50-year-old company that has seen plenty of cycles. It survived the 80s, the 2008 crash, and the pandemic. The brand is iconic, but the stock is currently "in the doghouse" with Wall Street. Whether you buy now depends on if you trust Elliott Hill to get the swoosh pointed back up.

Next Steps for You:

Check your current portfolio allocation to see if you're over-leveraged in the consumer discretionary sector before making a move. You might also want to set a price alert for $62.00 to catch any potential dips toward the 52-week low.