The opening bell at 11 Wall Street isn't just a sound; it’s a physical jolt to the global financial system. Most people assume the New York Stock Exchange hours of trading are a simple 9:30 a.m. to 4:00 p.m. ET window, Monday through Friday. While that’s technically when the "Big Board" is open for the masses, the reality is a lot messier and, frankly, way more interesting if you're actually trying to make money.

If you've ever seen a stock gap up or down significantly before the morning coffee has even finished brewing, you've witnessed the "shadow hours."

Market liquidity is a fickle beast. It doesn't just switch on like a lightbulb. It's more like a sunrise—slow at first, then blindingly bright, then fading into a weird twilight. Understanding these nuances isn't just for day traders with six monitors and a caffeine addiction. It's for anyone who doesn't want to get "picked off" by high-frequency algorithms that thrive on the edges of the official schedule.

The Standard Session: More Than Just the Middle

The core of the New York Stock Exchange hours of trading is the Regular Trading Session. This runs from 9:30 a.m. to 4:00 p.m. Eastern Time.

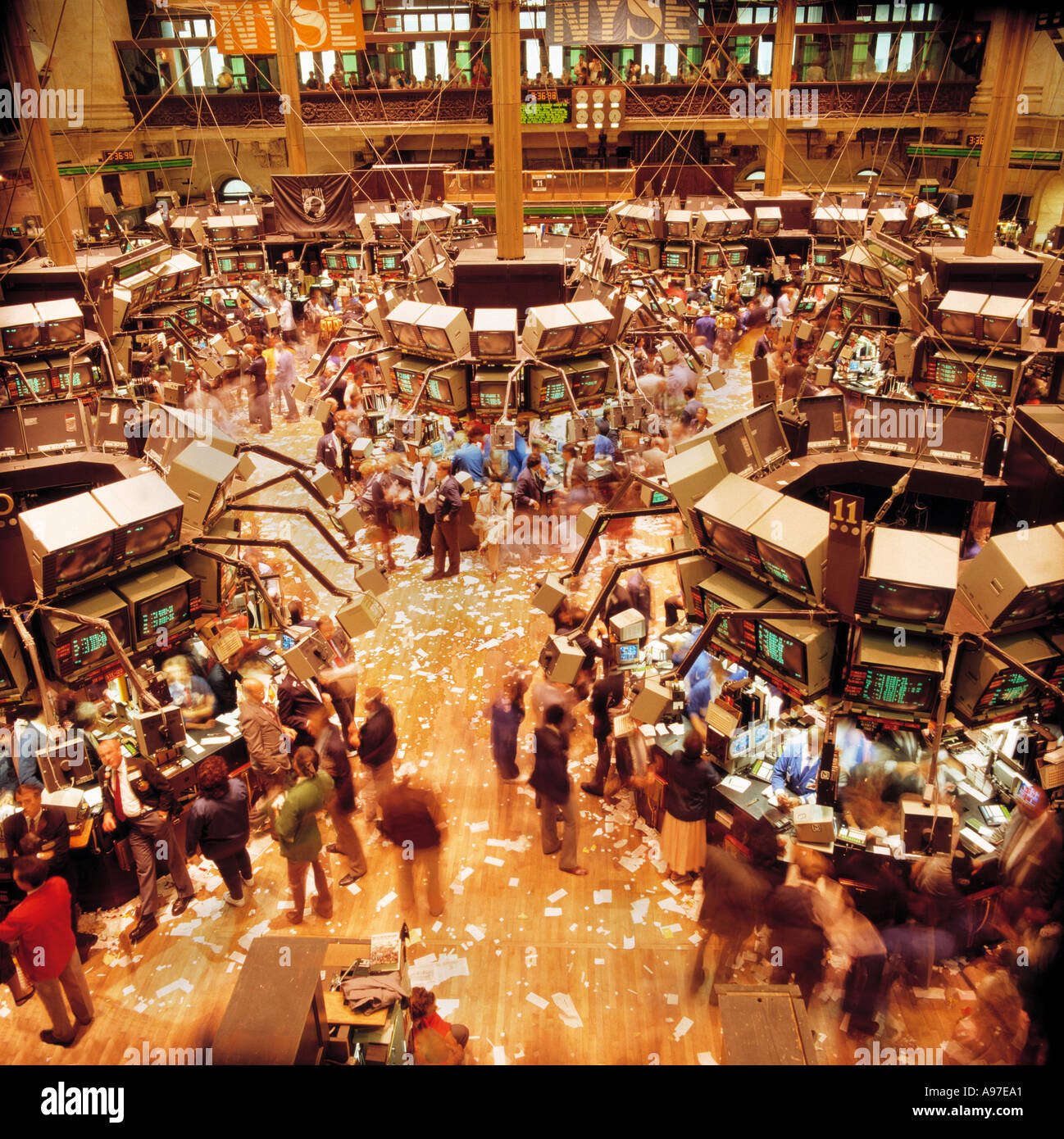

This is when the Designated Market Makers (DMMs) are on the hook to maintain a fair and orderly market. Think of them as the referees. During these six and a half hours, you get the highest volume and the tightest "spreads"—the difference between what a buyer wants to pay and what a seller wants to get. If you’re a casual investor, this is your safe zone.

But here’s the kicker. The most important parts of the day are actually the first and last few minutes. The "Opening Cross" and the "Closing Cross" are specific auctions that consolidate all the overnight or end-of-day interest into a single price. If you place a "Market on Open" (MOO) or "Market on Close" (MOC) order, you're participating in these high-stakes moments.

Pre-Market and After-Hours: The Wild West

The NYSE Arca system, which is the electronic communication network (ECN) arm of the exchange, allows for trading far outside that 9:30-to-4:00 window.

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Early birds can start as early as 4:00 a.m. ET. Yeah, you read that right. While most of New York is asleep, electronic systems are already matching orders. This early session runs until the 9:30 a.m. bell. On the flip side, the Late Trading Session kicks off at 4:00 p.m. and drags on until 8:00 p.m. ET.

Why does this matter?

Earnings reports. Companies almost never release their quarterly results during regular New York Stock Exchange hours of trading because it would cause total chaos. They wait until 4:01 p.m. or 4:15 p.m. When a tech giant like Apple or Nvidia drops a bombshell report after the bell, the stock might move 10% in minutes.

If you only trade during the day, you're essentially watching the replay of a game that was decided while you were at dinner.

However—and this is a big "however"—trading in these extended hours is risky. The volume is thin. This means a relatively small sell order can tank a stock price because there aren't enough buyers to soak it up. You'll often see "price spikes" that aren't real reflections of value, but just the result of low liquidity. Professional traders call this getting "chopped up."

The Weekend and Holiday Dead Zones

The NYSE is closed on Saturdays and Sundays. It also shuts down for nine major holidays, and sometimes it pulls a "half-day" (closing at 1:00 p.m. ET) on the day after Thanksgiving or Christmas Eve.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

- New Year’s Day

- Martin Luther King, Jr. Day

- Washington’s Birthday

- Good Friday

- Memorial Day

- Juneteenth National Independence Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

If a holiday falls on a Saturday, the exchange usually closes on the preceding Friday. If it's a Sunday, they close the following Monday. It's a system designed in an era of paper and floor runners, and it sticks to its guns.

Why Time Zones Are Your Biggest Enemy

If you're in Los Angeles, your New York Stock Exchange hours of trading start at 6:30 a.m. That's a brutal wake-up call for a lot of people. If you're in London, the market opens in the mid-afternoon. If you're in Tokyo, you're looking at a 10:30 p.m. or 11:30 p.m. start depending on Daylight Saving Time.

Speaking of Daylight Saving Time, the U.S. doesn't always sync up with Europe or Asia. For a few weeks every year in March and October/November, the time gap between the NYSE and the London Stock Exchange (LSE) shifts by an hour. This messes with the "overlap," which is historically one of the most volatile and liquid times to trade. When both the U.S. and European markets are open simultaneously (roughly 9:30 a.m. to 11:30 a.m. ET), the sheer amount of capital moving across the Atlantic is staggering.

The Noon Slump and the Power Hour

There is a rhythm to the day that most beginners miss.

- The Open (9:30 - 10:30 a.m.): Pure volatility. This is where the market "digests" all the news from overnight. Amateurs usually get burned here by jumping in too fast.

- The Lull (12:00 - 2:00 p.m.): Often called the "lunch hour." Volume drops. The big institutional traders in New York actually go to lunch. Prices can drift aimlessly.

- Power Hour (3:00 - 4:00 p.m.): This is when the "smart money" positions itself for the next day. Mutual funds and ETFs have to rebalance their holdings. If the market is going to make a big move, it often happens in the final 60 minutes.

Honestly, if you're a long-term investor, the minute-by-minute fluctuations don't matter. But if you're trying to execute a large buy or sell, doing it at 12:15 p.m. on a Tuesday might get you a slightly worse price than doing it during a high-volume period.

What Happens When the Lights Go Out?

Ever wonder what happens if the NYSE computers fail during New York Stock Exchange hours of trading? It’s happened. In July 2015, a technical glitch shut down trading for nearly four hours.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

The NYSE has "Circuit Breakers." These are regulatory "time-outs" triggered by massive market drops to prevent a total flash crash.

- Level 1: If the S&P 500 drops 7%, trading pauses for 15 minutes.

- Level 2: If it drops 13%, another 15-minute pause.

- Level 3: If it hits 20%, they pack it up and go home. Trading stops for the rest of the day.

These rules were heavily revised after the 2010 Flash Crash, where the Dow Jones Industrial Average plunged nearly 1,000 points in minutes before rebounding. It proved that in an age of algorithmic trading, "hours" are sometimes less important than "circuitry."

Strategies for Navigating the Clock

If you want to handle the New York Stock Exchange hours of trading like a pro, you need to change how you look at your broker app.

First, stop using "Market Orders" during the pre-market or after-hours sessions. Just don't do it. Use "Limit Orders" only. A limit order ensures you only buy or sell at a specific price. In the thin volume of 6:00 a.m., a market order could execute at a price 5% away from where you thought it was.

Second, pay attention to the economic calendar. The U.S. Bureau of Labor Statistics usually releases the "Jobs Report" at 8:30 a.m. ET on the first Friday of the month. That’s a full hour before the NYSE opens. The market reaction happens in the pre-market. By 9:30 a.m., the "big move" might already be over.

Third, acknowledge that "24/7 trading" is becoming the new norm through certain retail brokers (like Robinhood or IBKR), but they aren't trading on the NYSE floor at 2:00 a.m. They are matching buyers and sellers within their own private pools or through specialized ECNs. You aren't getting the full "NYSE" experience at midnight; you're trading in a much smaller, riskier sandbox.

Actionable Steps for Your Trading Schedule

Understanding the clock is the first step toward not being "liquidity" for someone else's profit.

- Check the Holiday Calendar: Before planning a big trade, verify the NYSE isn't closed. You can find the official schedule on the Intercontinental Exchange (ICE) website.

- Avoid the First 15 Minutes: Unless you are a professional scalper, let the "opening prints" settle. Let the gap fill.

- Focus on the Overlap: If you trade international stocks or forex, the 9:30 a.m. to 11:30 a.m. ET window is your best friend for liquidity.

- Use the Closing Cross: If you're worried about price manipulation at the end of the day, use MOC (Market on Close) orders to get the official NYSE closing price, which is the gold standard for fund valuations.

The market doesn't care about your sleep schedule. It operates on a rigid, century-old timeline that has been awkwardly duct-taped to a high-speed digital infrastructure. Respect the hours, and you'll respect your capital.