Independence Day usually means one thing: the smell of charcoal. You’ve got the burgers, the slightly melted potato salad, and that one neighbor who buys the illegal fireworks every single year. But lately, the conversation around the picnic table has shifted. Instead of just talking about the parade or the local fireworks display, people are obsessing over money robots and happy 4th of July celebrations as a weirdly perfect pairing.

It sounds like sci-fi, right?

Money robots—or algorithmic trading bots and AI-driven financial advisors—aren't just for Wall Street sharks anymore. They’re on our phones. They’re running in the background while we’re flipping hot dogs. As we celebrate national independence, a huge chunk of the population is looking for a different kind of freedom. Financial independence. And they’re using "robots" to get there.

There is a certain irony in using automated code to celebrate a holiday rooted in human revolution. But honestly, the surge in interest makes sense. Holidays are when we reflect. We look at our bank accounts, we look at the cost of those overpriced sparklers, and we think, "There has to be a more efficient way to manage this."

The Rise of the Money Robots and Happy 4th of July Traditions

The term "money robot" is a bit of a catch-all. Sometimes it refers to high-frequency trading algorithms that execute thousands of trades a second. Other times, it’s just a robo-advisor like Betterment or Wealthfront that rebalances your 401(k) while you sleep. During the July 4th window, search traffic for these tools often spikes. Why? Because the market is closed.

Investors finally have a second to breathe.

When the New York Stock Exchange shuts down for Independence Day, human traders go to the beach. The bots, however, don't exactly "rest," even if the primary markets are dark. They’re analyzing data from international markets or crypto exchanges that never close.

I talked to a guy last year who spent his entire 4th of July morning tweaking a grid trading bot for Bitcoin. He called it his "financial fireworks." While everyone else was worried about the weather, he was worried about his API keys. This is the new reality. We are outsourcing our greed and our caution to lines of Python code. It’s a bit weird, but it’s remarkably effective if you know what you’re doing.

👉 See also: Astronauts Stuck in Space: What Really Happens When the Return Flight Gets Cancelled

Why the Mid-Summer Milestone Matters

July 4th acts as a psychological "halfway point" for the year. It’s the time when you realize those New Year’s resolutions about "saving more" are currently gathering dust in the corner.

Most people use the long weekend to reset. If you’ve been manual trading and losing your shirt because of "gut feelings," a money robot sounds like a savior. It doesn't get emotional. It doesn't get distracted by a third serving of ribs. It just executes. This year, the intersection of money robots and happy 4th of July is fueled by the massive leap in generative AI. We aren't just using simple "if-this-then-that" rules anymore; we’re using LLMs to scan earnings reports and sentiment.

The Tech Behind the "Robots"

Let's get into the weeds for a second. When we talk about these bots, we’re usually talking about one of three things.

First, there are the Arbitrage Bots. These are the scavengers. They look for price discrepancies between different exchanges. If Ethereum is $5 cheaper on one platform than another, the bot snaps it up. It’s tiny margins, but done a million times, it’s a gold mine.

Then you have Trend Followers. These are the most common for retail users. They use indicators like Moving Averages or the Relative Strength Index (RSI). Basically, if the "robot" sees a stock is gaining momentum, it jumps on the train.

Finally, there are Neural Networks. These are the heavy hitters. They try to mimic the human brain to predict where the price will go based on historical patterns.

But here’s the kicker: they aren't magic.

✨ Don't miss: EU DMA Enforcement News Today: Why the "Consent or Pay" Wars Are Just Getting Started

A lot of people think buying a money robot is like buying a literal ATM for your living room. It's not. If the market crashes 20% in an hour—a "flash crash"—some bots will just keep selling all the way to the bottom because that’s what their code tells them to do. Remember the 2010 Flash Crash? That was basically a robot fight that wiped out a trillion dollars in minutes.

Common Misconceptions About Automated Wealth

- "It’s passive income." Kinda, but not really. You still have to monitor the bot. You have to update the parameters. If the market regime changes from "bull" to "bear," your bot might become a very efficient way to lose money.

- "The bots are smarter than humans." They’re faster, not necessarily smarter. They lack "black swan" logic. A bot doesn't know a global pandemic is starting until the price starts dropping. A human can read the news and see the writing on the wall.

- "Only the rich use them." Nope. Platforms like Pionex or even simple recurring buy features on Robinhood are the entry-level versions of money robots.

How to Celebrate Financial Independence Safely

If you’re looking at money robots and happy 4th of July as your gateway into automation, don't just dive into the deep end.

I’ve seen people lose their entire holiday budget because they trusted a "guaranteed" bot they found on a Telegram channel. If someone is selling you a bot that promises 1% profit every single day, they are lying to you. Simple math: 1% compounded daily would make you the richest person on Earth in a few years. It doesn't happen.

Instead, look for transparency. Real money robots—the ones used by actual hedge funds—are boring. They aim for 8% to 12% a year, not 100% a month. They focus on risk management. They use "stop-losses" to make sure a bad trade doesn't turn into a catastrophe.

Real World Example: The "Set it and Forget it" Trap

Take the case of a trader named "Alex" (not his real name, but a real story from a Quant forum). Alex set up a mean-reversion bot before heading out for a 4th of July camping trip. He had no cell service. While he was roasting marshmallows, a geopolitical event caused a massive spike in oil prices. His bot, thinking the price had to come back down, kept "shorting" oil. By the time Alex got back to civilization on July 5th, his account was liquidated.

The lesson? Automation is a tool, not a replacement for a brain.

Actionable Steps for the Long Weekend

You want to actually make progress this July 4th? Don't just watch the sky. Look at your setup.

🔗 Read more: Apple Watch Digital Face: Why Your Screen Layout Is Probably Killing Your Battery (And How To Fix It)

Audit your subscriptions. We talk about money robots, but the most basic robots are the ones taking $14.99 out of your account for a streaming service you haven't watched since 2022. Use a tool like Rocket Money or just go through your bank statement manually. That’s "found money."

Backtest your ideas. If you're interested in automated trading, use a simulator. Most platforms let you "paper trade." Run your robot with fake money for a month. If it survives a volatile week, then maybe—maybe—give it some real capital.

Understand the tax man. Even if a robot makes the trade, you owe the tax. High-frequency trading can create a nightmare of a tax return with thousands of pages of transactions. Make sure your software exports to something like TurboTax or CoinTracker.

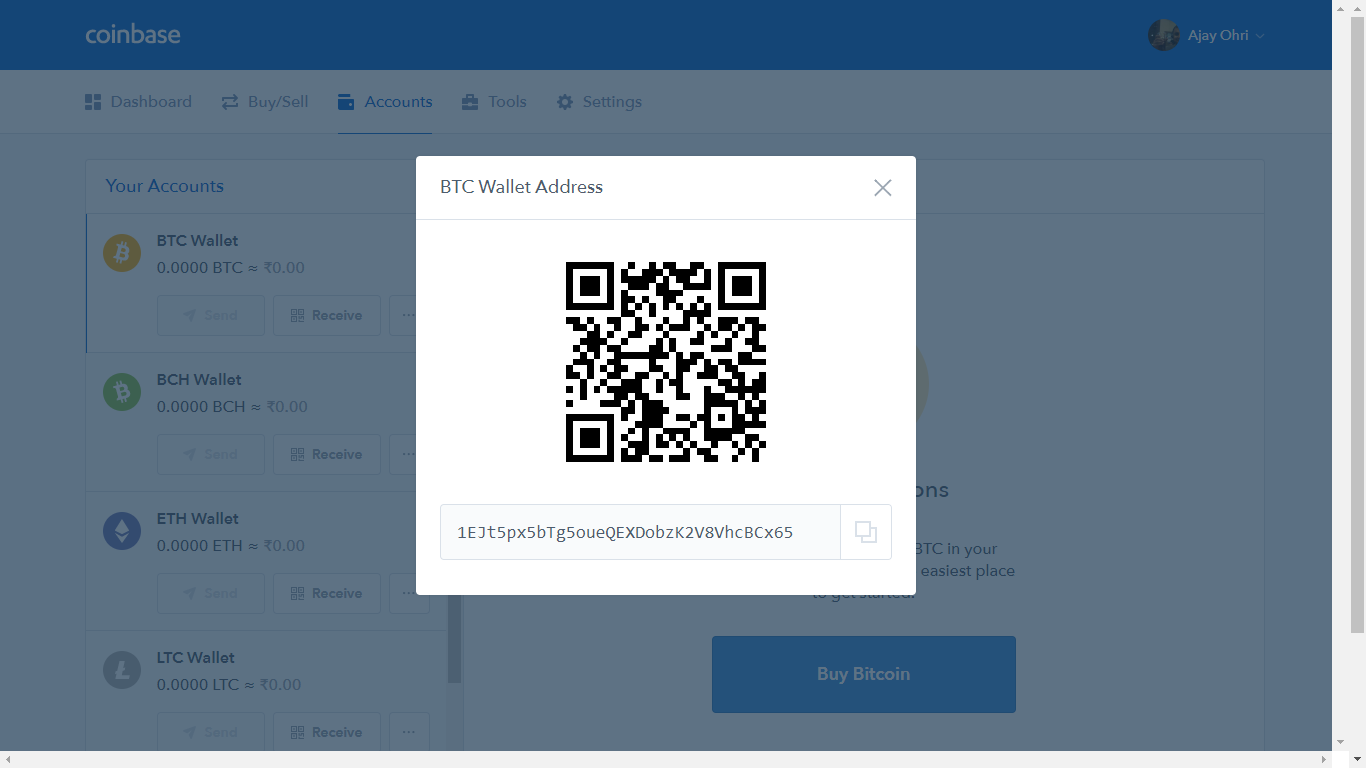

Secure your "Robot." If you’re using an API to let a bot trade on your behalf, enable 2FA. Limit the API permissions so the bot can trade, but cannot withdraw funds. This is the #1 way people get scammed. They give a bot "Withdraw" permissions, and suddenly their "money robot" is sending all their funds to a wallet in an untraceable location.

The 4th of July is about liberty. True liberty is having enough in the bank that you don't have to stress about the price of gas or groceries. Money robots can be a part of that journey, but they’re just the engine. You’re still the driver.

Enjoy the fireworks. Eat too much corn on the cob. But keep one eye on the code.

Next Steps for Financial Automation:

- Review your current portfolio allocation to see if a robo-advisor could lower your management fees compared to a human broker.

- Verify your API security settings on any trading platforms to ensure "Withdrawal" permissions are strictly disabled for third-party tools.

- Set up a "Paper Trading" account this weekend to test an automated strategy without risking your actual 4th of July celebration fund.

- Download your year-to-date transaction history to check if your current automated "buy" rules are actually keeping pace with inflation and market benchmarks.