Honestly, the semiconductor world has been a wild ride lately. If you’ve been watching the mchp stock price today, you’ve probably noticed that Microchip Technology is having a bit of a moment. As of January 16, 2026, the stock is hovering around $74.45 to $75.09, which is a pretty significant jump from where it sat just a few months ago. It’s actually trading near its 52-week high of $77.20.

That’s quite a comeback.

Remember mid-2025? It was rough. The company was dealing with what analysts call a "severe hangover" from the pandemic boom. Customers had too much inventory, interest rates were biting, and things looked sort of bleak. But then Steve Sanghi, the longtime former CEO, came out of retirement. He brought a nine-point recovery plan, and well, it seems to be working.

The Numbers Behind the MCHP Stock Price Today

Let’s talk turkey. Why is the market suddenly so bullish on a company that makes "boring" embedded controllers and analog chips?

Basically, it’s about the "double beat." In their most recent updates, Microchip reported a non-GAAP earnings per share (EPS) of $0.35, which actually topped what the experts were expecting. Even more importantly, they just raised their revenue guidance for the December quarter to $1.185 billion. People love an upward revision.

You’ve gotta look at the big picture here.

Most of the hype in the chip sector has been about the high-end, shiny AI stuff like what Nvidia produces. But Microchip is the "picks and shovels" player. They make the components that go inside the AI servers and industrial machines. For example, they just launched the industry’s first 3-nanometer PCIe Gen 6 switch. That sounds like technical jargon, but it’s basically a high-speed traffic cop for AI data.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

What Wall Street Is Saying

Analysts are getting increasingly loud about this one. Just yesterday, Citigroup’s Christopher Danely boosted his price target for MCHP from $80 to a whopping $92. Piper Sandler also jumped in, raising their target to $85.

Here is the breakdown of the current sentiment:

- Strong Buy/Buy: 15+ analysts

- Hold: 6 analysts

- Sell: 1 lonely analyst (there's always one, right?)

The median price target is sitting around $80.94. If you’re keeping score at home, that implies there is still some "meat on the bone" for investors who didn't get in at the $34 bottom last year.

Why Most People Get the Microchip Story Wrong

A lot of folks think Microchip is just a "lagging-edge" company. They think if it isn't a 2-nanometer processor for a smartphone, it isn't worth owning.

That is a mistake.

Microchip's products are everywhere. They are in your car’s dashboard, the industrial robot at a local factory, and even in aerospace systems. In fact, they recently released the JANPTX family of devices specifically for defense and aerospace. These things are built to survive in environments that would fry a normal chip.

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

The Inventory Correction is Finally Over

This is the real "secret sauce" behind the mchp stock price today. For two years, distributors had way too many chips on their shelves. They stopped ordering. That’s why Microchip’s revenue took a hit.

But Sanghi recently mentioned that "bookings activity was very strong" in the December quarter. That means the backlog is growing again. When the backlog grows, the stock usually follows. The company also closed down its older "Fab 2" manufacturing plant to save $25 million a year. They are getting leaner and meaner.

The Dividend Factor

If you’re a "buy and hold" type of investor, you probably care about the dividend. Microchip has been paying one for 22 years straight.

Currently, the yield is sitting around 2.4% to 2.8%, depending on the exact minute you check the ticker. They paid out $0.46 per share back in December. While most tech companies are stingy with their cash, MCHP has a history of raising that payout. It’s a nice little "participation trophy" while you wait for the stock price to climb.

Is There a Catch?

There is always a catch.

Honestly, the valuation is a bit high. If you look at the adjusted P/E ratio, it’s way above the sector median. People are paying a premium because they expect a massive recovery in 2026. If the economy takes a sudden nosedive or the "AI bubble" pops, these specialty chip makers could get hit.

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

Also, they still have a decent amount of debt. The debt-to-equity ratio is 0.80. It’s manageable, but it’s something to keep an eye on if interest rates don't continue to cool off.

The 2026 Outlook

Management is calling for a "very good calendar year 2026." They are ramping up their factories in Oregon and Colorado (Fab 4 and Fab 5). This should lower their "under-utilization charges." Basically, they won't be losing money on empty factory space anymore.

Actionable Steps for Investors

So, what should you actually do with this information?

- Watch the February 5th Earnings Call. This is the big one. If they confirm the $1.185 billion revenue number and give a strong guide for March, the stock could break through that $77 resistance level.

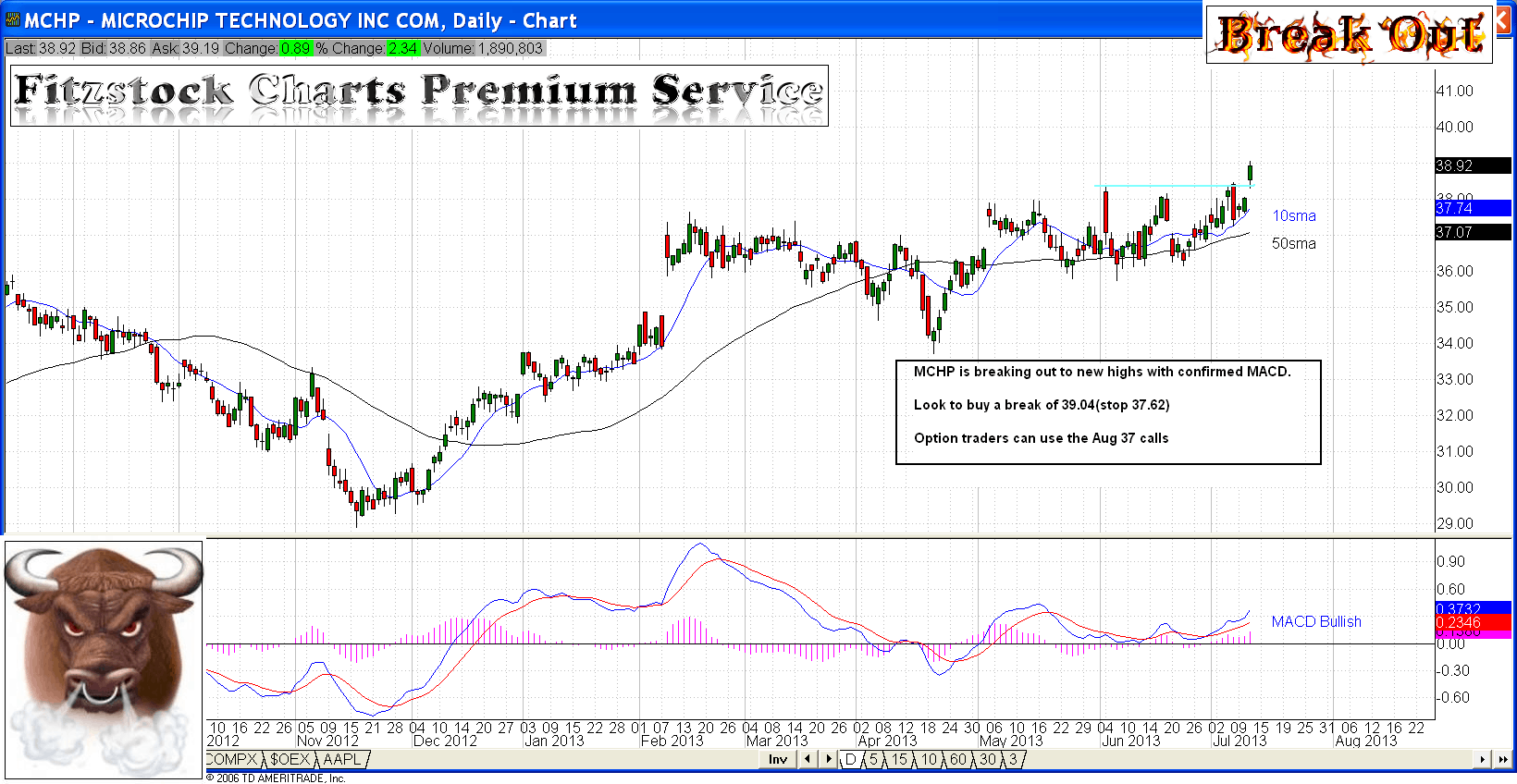

- Check the Moving Averages. The stock is currently trading above its 50-day and 200-day simple moving averages ($62.16 and $65.20 respectively). This is a classic "bullish" signal for technical traders.

- Diversify Your Semi Exposure. Don't put everything into MCHP. While it’s a great industrial play, it doesn't have the same explosive upside as some of the high-end AI design firms. It’s a "steady Eddie" recovery play.

The mchp stock price today reflects a lot of optimism about a cyclical turnaround. If you believe the industrial and automotive sectors are truly bouncing back, this remains one of the cleanest ways to play that trend without the volatility of the pure AI names.

Keep an eye on the $77.20 mark. If it breaks that 52-week high with high volume, it might be clear skies ahead for the rest of the year.