We've all seen the K-drama posters. A sharp-jawed heir sits in a leather chair, looking broodingly into the distance while a massive glass skyscraper looms behind him. It's a staple of pop culture. But honestly, the reality of the youngest son of a conglomerate—especially in the context of South Korea’s chaebols or America’s dynastic empires—is way messier and more interesting than the scripted version.

Succession isn't a straight line.

Take the Samsung Group. Most people look at Lee Jae-yong, the current chairman. But if you dig into the history of the Lee family, the power dynamics didn't always favor the eldest. In fact, Lee Kun-hee, the man who turned Samsung into a global behemoth, was the third son. He wasn't the "natural" choice by traditional Confucian standards. Yet, he was the one who grabbed the reins. That shift changed the trajectory of the entire Korean economy.

The Succession Myth: Why the Youngest Often Wins

There is this weird, persistent idea that the firstborn is the guaranteed winner. In the world of global business, that's often a lie. Historically, the eldest son carries the weight of tradition. He's trained to maintain the status quo. He’s the "steward."

The youngest son of a conglomerate is different. He’s often the "disruptor."

💡 You might also like: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

Because the youngest isn't expected to lead right away, they sometimes get more freedom. They study abroad in places their older siblings didn't. They tinker with tech startups or venture capital while the eldest is stuck in boardrooms learning the nuances of supply chain logistics. By the time a succession crisis hits, the youngest often has the exact "outsider" perspective needed to pivot a dying legacy brand into the digital age.

Think about the SK Group. Chey Tae-won’s rise and the subsequent family shuffles highlight how internal competition isn't just about birth order; it's about who can survive the scrutiny of the shareholders and the relentless Korean media.

The "Third Generation Curse" is Real

You've probably heard the saying: "Wealth does not pass three generations." The first generation builds. The second expands. The third? They usually spend it all on yachts or ill-advised art collections.

This is where the youngest son often finds himself in a tight spot. He is entering a company that is likely at its peak or starting to slide. He isn't building from scratch; he's fighting to keep a legacy from rotting. It’s a high-stakes game of survival. If he fails, he's the guy who let the family down. If he succeeds, people say he just got lucky because of his last name.

📖 Related: How Much Do Chick fil A Operators Make: What Most People Get Wrong

Kinda sucks, right?

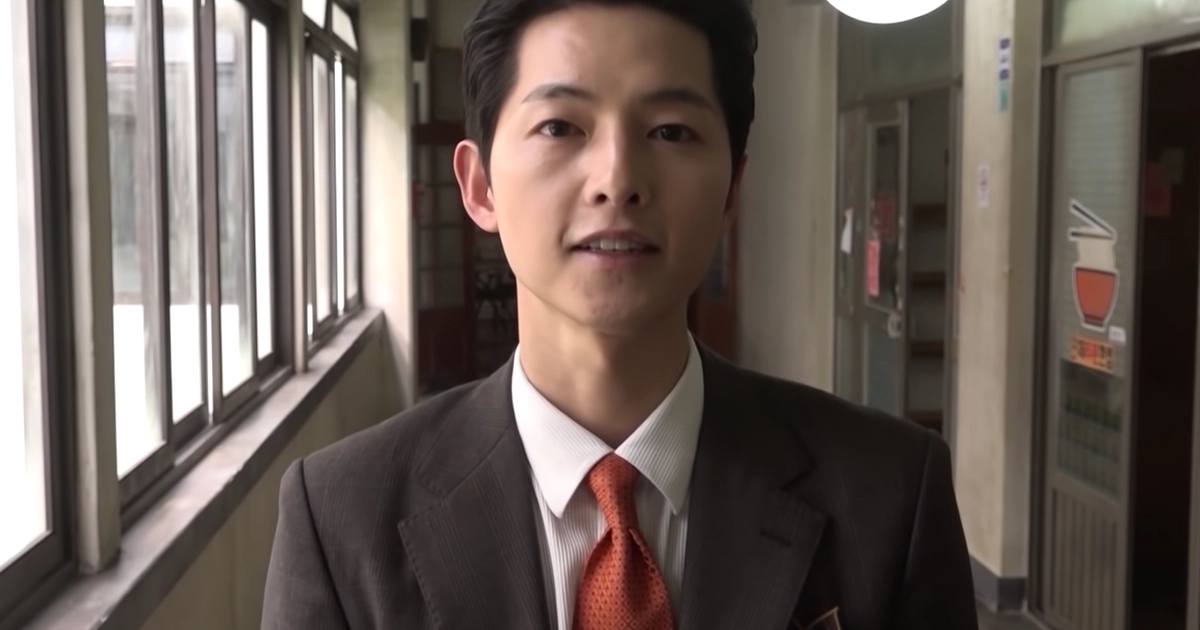

Real-World Dynamics vs. Reborn Rich

In 2022 and 2023, the show Reborn Rich took over the world. It followed a man reincarnated as the youngest son of a conglomerate (the Soonyang Group, a thinly veiled Samsung stand-in). While the time-travel stuff is obviously fiction, the corporate warfare depicted was surprisingly accurate.

It showed the "Succession War" (hugye-jeonjaeng). This isn't just a metaphor. In real life, these battles involve complex cross-shareholding structures. A youngest son might only own 2% of the parent company, but through a web of subsidiaries—a logistics firm here, an insurance arm there—he can effectively control the entire group.

The Heavy Burden of the Last Name

It’s not all private jets.

👉 See also: ROST Stock Price History: What Most People Get Wrong

Being the youngest son of a conglomerate means living under a microscope. Every nightclub appearance, every speeding ticket, and every failed business venture is front-page news. In South Korea, the term "gapjil" refers to the power trips of the elite. One wrong move and the public calls for a boycott.

We saw this with the "nut rage" incident involving Korean Air heirs. While that involved a daughter, the lesson applied to every youngest son in the country: the public has zero patience for spoiled behavior. To survive today, the youngest heir has to be "cleaner" than the founder ever was. They have to be CEOs, but also influencers, and somehow, also relatable "everymen."

It’s an impossible tightrope.

How to Navigate the Legacy

If you're looking at these family empires from an investment or sociological perspective, don't just watch the Chairman. Watch the youngest. They are the ones usually tasked with the "new growth engines." They head the AI divisions, the green energy pivots, and the biotech plays.

The eldest son gets the steel and the ships. The youngest gets the future.

Actionable Insights for Observing Corporate Dynasties

- Check the Shareholding Shifts: Look for when a youngest son suddenly increases his stake in a minor subsidiary. That’s usually a sign of a "merger and acquisition" play to consolidate power before a chairman passes away.

- Follow the "New" Money: If the youngest son is heading a Venture Capital arm, track their investments. These often signal where the entire conglomerate intends to pivot in the next decade.

- Analyze the Education Gap: A youngest heir with an MBA from Stanford or experience at a Silicon Valley firm will manage differently than an elder sibling who rose solely through the internal ranks.

- Public Sentiment Matters: In the modern era, the heir who is liked by the public is the one the board will protect. Corporate social responsibility isn't just PR; it's a survival strategy for the next generation.

The era of the untouchable tycoon is over. Today’s youngest heirs know that their position is precarious. They aren't just fighting their siblings; they're fighting a globalized market that doesn't care about their bloodline. The next time you see a headline about a youngest son of a conglomerate, look past the drama. Look at the balance sheet and the shifting shares. That’s where the real story lives.