Look, I get it. We live in a world of instant Venmo transfers, tap-to-pay phone wallets, and biometric crypto-stamps. But here is the thing: paper checks aren't dead. Not even close. You might go three years without touching a checkbook, and then suddenly, you're signing a lease for a classic brownstone or paying a contractor who refuses to lose 3% of his profit to a credit card processing fee.

That’s when the panic sets in. You stare at that little rectangular slip of paper and realize you haven't actually filled one out since 2014. You don't want to mess it up. If you void it, you’re out a check; if you write the wrong amount, you're in for a massive headache with your bank. Understanding a write a check example isn't just a "boomer skill"—it's a basic financial literacy requirement that keeps you from looking like an amateur when high-stakes money is on the line.

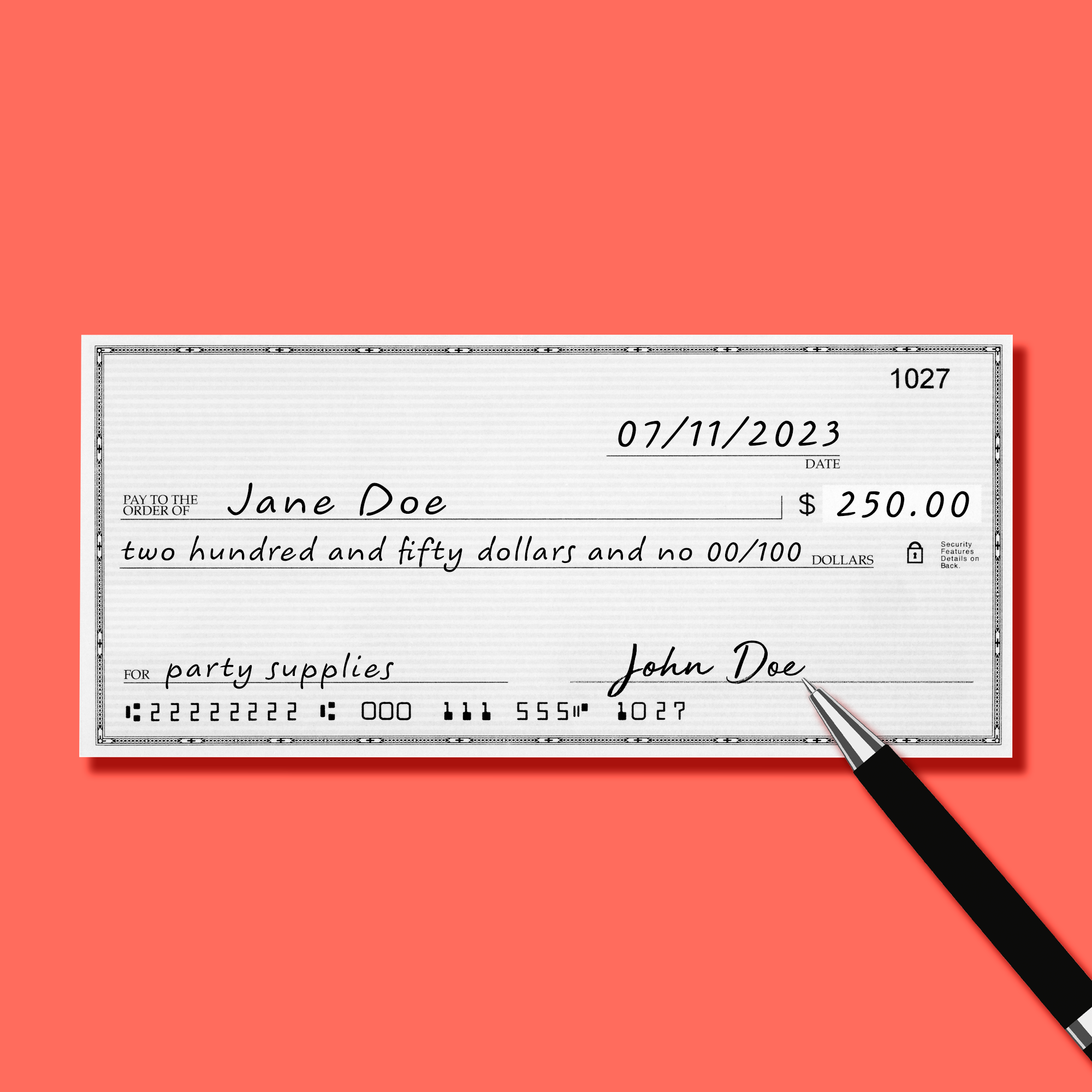

The Anatomy of a Perfect Check

Let’s break down the basic components. It’s basically a legal contract on a tiny piece of paper.

At the very top right, you have the Date. Don't get fancy here. Just write it out. Some people post-date checks, which means they write a future date hoping the person won't cash it until then. Honestly? It's a gamble. Most banks don't even look at the date anymore, and their automated systems might process it the second it’s scanned anyway. If you don't have the funds in your account today, don't write the check today. It’s that simple.

Then there is the Pay to the Order of line. This is where you name names. If you’re paying a person, use their legal name, not a nickname. If it's a business, make sure you have the exact entity name. Writing "The Landlord" instead of "Oak Ridge Property Management, LLC" is a fast track to getting your payment rejected.

The Numbers vs. The Words

This is where people usually trip up. There are two spots for the amount. The little box with the dollar sign is for the numerical value—easy enough. But the long line underneath? That’s for the legal amount written in words.

Here is a pro tip: If the numbers in the box and the words on the line don't match, the bank is legally required to honor the words.

Suppose you’re looking at a write a check example for a $1,250.50 rent payment. In the box, you’d write "1,250.50." On the line, you’d write "One thousand two hundred fifty and 50/100." You always want to draw a straight line from the end of your text to the end of the space. Why? To stop scammers from adding a few extra words and turning your "Fifty" into "Fifty Thousand." It sounds like something out of a 90s movie, but check fraud is actually on the rise again according to recent reports from the Financial Crimes Enforcement Network (FinCEN).

Why Security Still Matters

You’ve probably heard of "check washing." It’s a low-tech but incredibly effective scam where thieves use common household chemicals to erase your ink while leaving your signature intact. They then rewrite the check to themselves for a much higher amount.

To prevent this, use a gel pen. Specifically, a black Uni-ball 207 or something similar. The ink in these pens contains pigments that actually trap themselves in the fibers of the paper. It makes it nearly impossible to "wash" without destroying the check itself. It's a $2 investment that can save you $2,000.

The Memo Line: Your Best Friend

The memo line is technically optional, but you’re doing yourself a disservice if you leave it blank. Think of it as a physical receipt. If you're paying a utility bill, put your account number there. If it's a gift for a wedding, write "Happy Wedding!" This isn't just for the recipient; it’s for your own records. When you're looking at your bank statement six months from now and see a random check cleared for $400, that memo line (which most banks now scan and show in their apps) will tell you exactly what happened.

A Practical Write a Check Example: The Rent Scenario

Imagine you're paying your landlord, Sarah Jenkins, for February rent. The total is $2,100.

- Date: Feb 1, 2026.

- Pay to the Order of: Sarah Jenkins.

- Numerical Box: 2,100.00.

- Legal Line: Two thousand one hundred and 00/100 ----------------.

- Memo: February 2026 Rent - Apt 4B.

- Signature: Your legal signature as it appears on your ID.

The signature is the engine. Without it, the check is just a piece of paper. Don't scribble something unrecognizable if your bank has a very specific signature on file from when you opened the account.

Understanding the Strings of Numbers at the Bottom

If you flip a check over or look at the very bottom, you'll see a bunch of weird-looking numbers printed in Magnetic Ink Character Recognition (MICR) font. These aren't random.

The first nine digits are your Routing Number. This identifies which bank you belong to. The next set of digits is your Account Number. Finally, the last few digits usually correspond to the Check Number located in the top right corner.

Knowing these is useful because if you're ever setting up direct deposit or an auto-pay for a car loan, they’ll often ask for a "voided check." All they're really doing is looking for those numbers at the bottom. You don't actually have to give them a live check; you just write "VOID" in big letters across the front so it can't be used, and they grab the routing and account info from the bottom.

Common Mistakes That Cost Money

People get sloppy. I’ve seen people sign the back of a check before they even get to the bank. Never do that. If you sign the back (the endorsement) and then drop the check on the sidewalk, anyone who finds it can theoretically cash it. Only sign the back when you are physically standing at the ATM or inside the bank branch.

Another big one? Leaving too much space between the dollar sign and your first digit. If you leave a gap, it’s incredibly easy for someone to turn a "$100" check into a "$9100" check. Always start your numbers as far to the left as possible.

💡 You might also like: Synonyms for High Level: Why Most People Use the Wrong Words

The Future of Checks

Why do we still use these things? Mostly because the US banking system is a fragmented patchwork of over 4,000 different institutions. While the Federal Reserve's FedNow service and private systems like RTP (Real-Time Payments) are making instant transfers more common, checks remain a "universal" language. You don't need to know if your contractor uses Zelle or Venmo; you just need their name.

Also, for large transactions like buying a house, a "Cashier’s Check" is often the only accepted form of payment because it is guaranteed by the bank's own funds rather than your personal account. While the process of writing one is different (the bank does it for you), the principles of verifying the payee and the amount remain exactly the same.

Actionable Next Steps

If you haven't written a check in a while, here is how you handle it like a pro:

- Audit your checkbook: Ensure the address printed on your checks is still current. While most banks don't mind an old address, some retail stores might reject them.

- Get the right pen: Buy a pack of black gel pens. It is the single easiest way to prevent fraud.

- Balance as you go: Don't wait for your monthly statement. Whenever you write a check, immediately deduct that amount from your "mental" balance or your banking app. Remember, checks can take days or even weeks to clear. If you forget about a $500 check and spend that money elsewhere, you're looking at a $35 overdraft fee.

- Use the Memo line for taxes: If you’re writing a check for something tax-deductible, like a charitable donation or a business expense, mention it in the memo. It makes your life 100% easier come April.

- Store them safely: A checkbook is essentially a stack of signed permissions to take money from your account. Keep it in a locked drawer, not in your glove box or a junk drawer by the front door.

Understanding how to fill out a check correctly is a small but vital part of managing your financial life. It’s about more than just moving money; it’s about accuracy, security, and making sure your payments get where they need to go without any drama.