Money talks. But in the case of japan investment in us infrastructure, factories, and tech, it usually speaks with a very quiet, very disciplined accent. For years, headlines have obsessed over China's economic influence or the rise of domestic tech giants. Meanwhile, Japan has been busy. They aren't just buying Treasury bonds anymore; they are building entire towns in the Midwest and keeping the lights on in thousands of American households.

Think about it.

When you see a Toyota Camry rolling off a line in Kentucky or a Nippon Steel logo on a massive industrial site, you're seeing the physical manifestation of the world's largest creditor pouring capital into the world's largest consumer market. It’s a massive, symbiotic relationship that most people honestly take for granted.

According to the U.S. Bureau of Economic Analysis (BEA), Japan has consistently held the crown as the top foreign direct investor in the United States. We're talking about a cumulative investment position that has hovered around $700 billion and keeps climbing. It's not just "hot money" looking for a quick flip on Wall Street. This is deep, structural capital. It’s the kind of money that stays for decades.

The Shift from "Buying Landmarks" to Building Jobs

If you’re old enough to remember the 1980s, you probably remember the panic. Japan was "buying up America." They bought Rockefeller Center. They bought Pebble Beach. It felt like a hostile takeover of the American Dream. Fast forward to today, and the vibe is completely different.

Japan doesn't want your landmarks anymore. They want your labor force.

Today, Japanese-affiliated companies employ nearly one million Americans. That’s not a typo. From the "Auto Alley" stretching through Ohio, Indiana, and Tennessee to the tech hubs of Silicon Valley, Japanese capital is the bedrock of local middle-class stability. Honda’s massive investment in EV battery plants in Ohio—a multi-billion dollar joint venture with LG Energy Solution—is a perfect example. They aren't just selling cars to Americans; they are betting billions that Americans can build the future of transportation.

Why the US? Why now?

The "why" is actually pretty simple, though the execution is complex. Japan’s domestic market is shrinking. You’ve seen the news about their aging population and low birth rates. There isn't enough room to grow at home.

💡 You might also like: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

The U.S., despite its political bickering and chaotic news cycles, remains the most resilient market on the planet. We have the land, the energy independence, and a legal system that—mostly—protects private property. For a Japanese CEO, the U.S. isn't just a place to sell stuff. It’s a hedge against a stagnant home economy.

Real Talk: The Nippon Steel and U.S. Steel Saga

You can't talk about japan investment in us right now without mentioning the absolute firestorm surrounding Nippon Steel’s bid for U.S. Steel. It’s been a masterclass in how economics and politics collide.

Nippon Steel offered $14.9 billion. That’s a massive premium. They promised to bring world-class technology to aging American mills. They promised no plant closures. But the backlash was swift. From the United Steelworkers union to the White House, the cry was about "national security."

It’s an interesting paradox.

Japan is arguably our closest ally in the Pacific. We share military bases. We share intelligence. Yet, when it comes to the "spine" of American industry—steel—there is still a visceral hesitation to let a foreign company, even an allied one, take the wheel. This friction defines the current era of investment. It’s no longer just about who has the biggest checkbook; it’s about "friend-shoring" and whether we actually trust our friends as much as we say we do.

It's more than just cars and steel

While the big industrial deals get the H2 headings in the New York Times, the smaller stuff is everywhere.

- Logistics: Daifuku, a Japanese company, basically runs the automated systems in many of the warehouses that ship your online orders.

- Food: Think about the brands you buy. SUNTORY owns Jim Beam. That’s as American as it gets, right? Nope. It’s Japanese.

- Energy: Mitsubishi Power is leading massive hydrogen storage projects in Utah. They are literally trying to solve the green energy storage problem on American soil.

The "Invisible" Impact on Your Local Economy

You might live in a state like South Carolina or Alabama and not even realize that your neighbor's paycheck is signed by a subsidiary of a Tokyo-based conglomerate.

📖 Related: Getting a music business degree online: What most people get wrong about the industry

These companies tend to be "quiet" corporate citizens. They don't usually engage in the loud, performative ESG (Environmental, Social, and Governance) battles that American firms do. Instead, they focus on kaizen—continuous improvement—and long-term stability. In many Rust Belt towns, a Japanese factory isn't just a workplace; it's the only thing that kept the town from disappearing after the domestic manufacturers pulled out in the 90s.

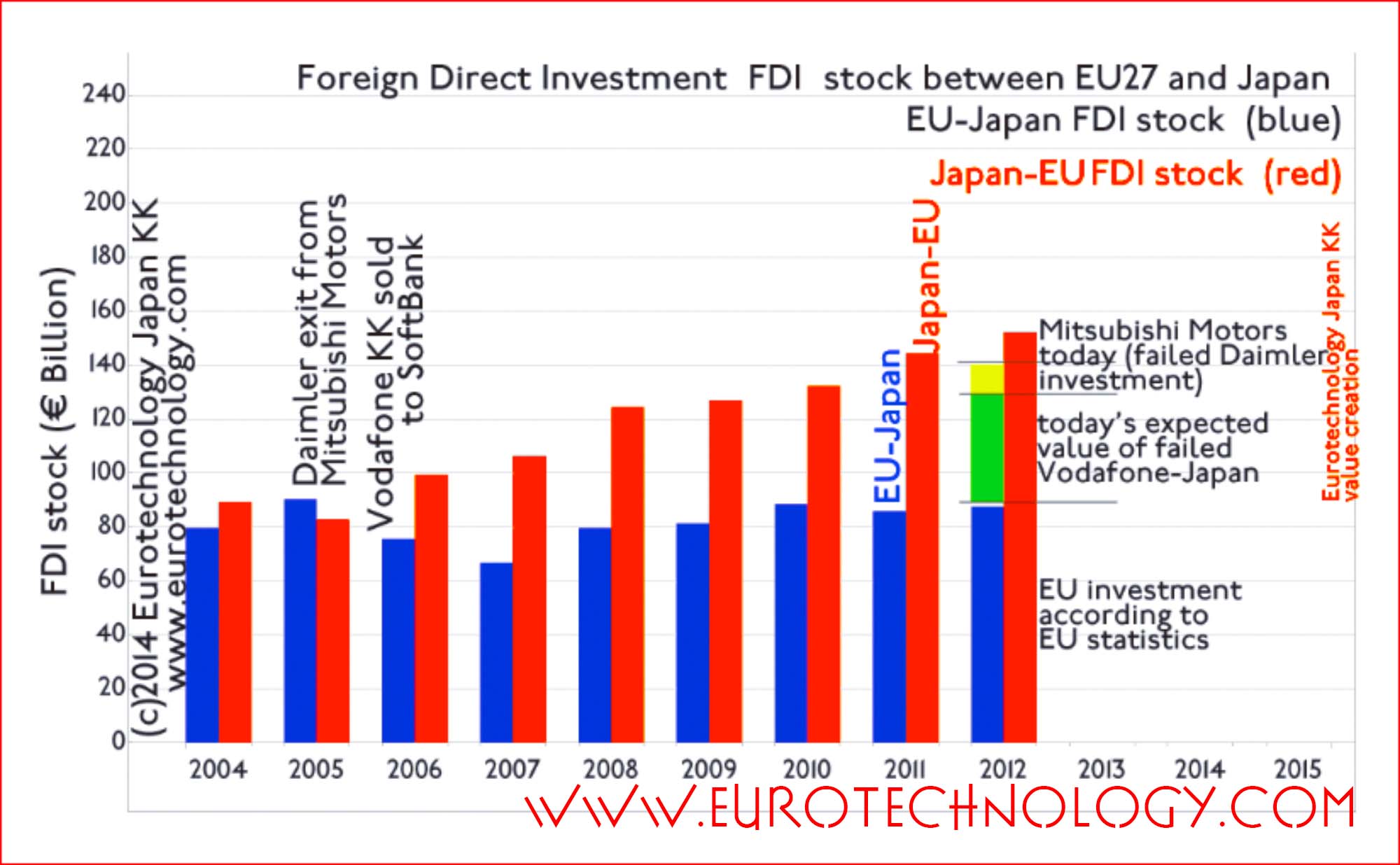

Let's look at the numbers for a second. The BEA data shows that Japanese FDI (Foreign Direct Investment) is heavily concentrated in manufacturing. Over half of it, actually. Compare that to British or Canadian investment, which tends to lean more toward financial services or real estate. Japan is literally building the physical "stuff" of America.

Common Misconceptions About Japanese Capital

A lot of people think this is a one-way street or that Japan is "taking profits" out of the country.

Honestly? Most of that money gets reinvested. Because of the tax structures and the need to hedge against currency fluctuations (the Yen has been on a wild ride lately), it often makes more sense for Toyota or Panasonic to keep their dollars in the U.S. and expand their existing footprint.

Another myth is that Japanese companies only hire Japanese managers. While the top tier might have some expats, the vast majority of the leadership in these U.S. plants consists of Americans who have been trained in Japanese management styles. It’s a hybrid culture. "Ameri-panese," if you want to be weird about it.

The Risks: What Could Go Wrong?

It’s not all sunshine and cherry blossoms. There are real risks to this level of interdependence.

- Political Protectionism: As seen with the U.S. Steel deal, the "Buy American" sentiment is at an all-time high. If the U.S. starts blocking more Japanese deals, that capital will find somewhere else to go—likely Southeast Asia or even Mexico.

- Currency Volatility: If the Yen gets too weak, it becomes more expensive for Japanese firms to buy American assets. If it gets too strong, their exports back home suffer.

- The China Factor: Japan is in a tight spot. They need the U.S. for security and as a market, but they are geographically and economically tied to China. Any major conflict in the Taiwan Strait would throw a massive wrench into the supply chains that these investments rely on.

The Innovation Angle

We also need to talk about R&D. Japan isn't just bringing blue-collar jobs; they are bringing some of the world's most advanced patents.

👉 See also: We Are Legal Revolution: Why the Status Quo is Finally Breaking

SoftBank, despite some of its highly publicized stumbles with things like WeWork, has poured tens of billions into the U.S. tech ecosystem via its Vision Fund. Whether it’s AI, biotech, or robotics, Japanese venture capital is often the "silent partner" behind the Silicon Valley startup that ends up changing your life.

Actionable Insights for Professionals and Communities

If you’re a local government official, a business owner, or just an investor looking at the landscape, you need to stop ignoring the East.

For Local Leaders:

Stop chasing the "next Amazon HQ" and start looking at middle-market Japanese manufacturing firms. They value loyalty and long-term partnerships over the tax-incentive bidding wars that define big American tech deals. If you provide a stable workforce and decent infrastructure, they will stay for fifty years.

For Investors:

Watch the "Tier 2" suppliers. Everyone tracks Toyota, but the real money is often in the Japanese companies that provide the specialized sensors, chemicals, and components to the big OEMs. These companies are increasingly moving their production to the U.S. to avoid shipping costs and tariffs.

For Job Seekers:

Learning the basics of Japanese business etiquette or even just understanding the kaizen philosophy can be a huge leg up. These companies are desperate for skilled technicians and managers who "get" their culture of precision and long-term thinking.

The reality of japan investment in us markets is that it’s become a cornerstone of our domestic stability. It’s a weird, beautiful, and sometimes tense marriage of two cultures that couldn't be more different on paper, but work incredibly well in a factory setting.

How to Track This Moving Forward

Don't just watch the stock market. Watch the CFIUS (Committee on Foreign Investment in the United States) filings. That’s where the real drama happens. That’s where you see which deals get the green light and which ones get crushed by political pressure.

Also, keep an eye on the "Sun Belt" states. The migration of Japanese capital from the North to the South is accelerating, following the general trend of the American population. As long as the U.S. remains a high-consumption society with a relatively stable (if noisy) government, the flow of Yen into Dollars isn't going to stop. It’s just going to get more sophisticated.

Keep your eyes on the steel mills and the battery plants. That’s where the future is being built, one Japanese-funded brick at a time.

Practical Next Steps for Engagement

- Review your portfolio for indirect exposure: You likely already own pieces of this through ETFs or mutual funds that hold major Japanese conglomerates with heavy U.S. operations.

- Monitor the Department of Commerce "SelectUSA" reports: These provide the most granular data on which states are winning the most Japanese investment and why.

- Follow the supply chain: If a major Japanese plant is announced in your region, look at the secondary service industries—logistics, specialized maintenance, and even local housing—that will inevitably boom.

- Stay informed on trade policy: Changes in Section 232 tariffs or new "friend-shoring" legislation will directly impact the viability of future Japanese projects on American soil.