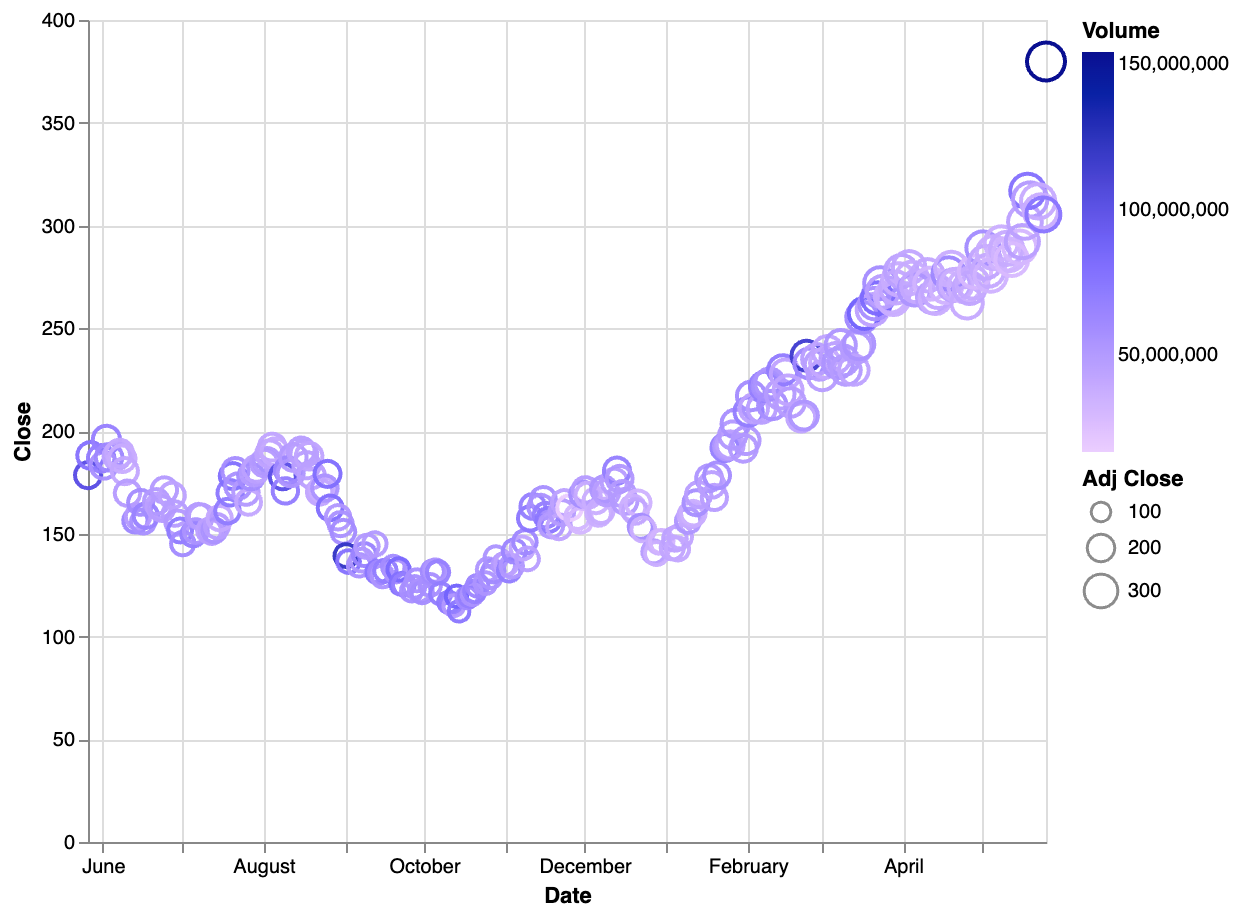

It feels like every time you check the ticker, Nvidia is hitting another "all-time high." It’s almost a running joke at this point. People have been calling it a bubble since 2023, yet here we are in early 2026, and the Santa Clara giant just became the first company to touch a $5 trillion market cap.

If you're asking why is nvidia stock going up, the short answer isn't just "AI hype." It’s actually a lot more mechanical than that. We are witnessing a fundamental shift in how the world builds computers. Honestly, most investors are still trying to value Nvidia like a traditional chipmaker, but that’s a mistake. They aren't just selling silicon anymore; they’re selling the "operating system" for the next century of industry.

The Blackwell Explosion and the "Insane" Demand

The biggest catalyst right now is the full-scale ramp of the Blackwell B300 and GB300 architecture. You might remember the drama last year when everyone was worried about "Blackwell delays." Well, those concerns are dead.

CEO Jensen Huang famously described the demand for Blackwell as "insane," and the Q3 fiscal 2026 numbers backed him up. Revenue hit $57 billion in a single quarter. That’s not a typo. To put that in perspective, that’s more than some established tech giants make in an entire year.

What’s driving this? The efficiency.

The Blackwell Ultra series (specifically the NVL72 racks) provides a 10x improvement in throughput per megawatt compared to the older Hopper chips. In the world of data centers, electricity is the biggest cost. If a new chip can do ten times the work for the same power bill, big tech companies like Microsoft and Amazon basically have to buy it to stay competitive.

Beyond the GPU: The Networking Secret

Something most people ignore is that Nvidia is quietly becoming a networking powerhouse.

💡 You might also like: Finding the Right Environmental Geotechnical Engineering Design Website Background Image Without Looking Like a Stock Photo Gallery

- Networking revenue hit over $8 billion last quarter.

- The "attach rate" (how many people buy Nvidia's networking gear along with their chips) is now near 90%.

- Their Spectrum-X Ethernet platform is winning over data centers that used to rely solely on Cisco or Arista.

Basically, if you want the fastest AI, you can't just plug an H200 into a random server. You need the whole Nvidia stack. You've got the NVLink connecting the chips, the InfiniBand switches moving the data, and the CUDA software running the show. This "vendor lock-in" is a massive reason why the stock keeps climbing—it’s very hard for a customer to just switch to a cheaper chip without breaking their entire setup.

Why is Nvidia Stock Going Up Despite "Competition"?

You’ll often hear that Google, Amazon, and Meta are building their own "in-house" chips to replace Nvidia. It sounds scary for shareholders. But if you look at the Capex (capital expenditure) numbers for 2026, these same companies are spending $600 billion on AI infrastructure, and a huge chunk of that is still going straight to Nvidia.

Why? Because software is sticky.

Nvidia’s CUDA platform has millions of developers who have spent a decade writing code specifically for Nvidia hardware. Even if Amazon’s "Trainium" chip is cheaper, the cost of rewriting all that software to run on it is astronomical.

The Sovereign AI Wave

Then there’s the "Sovereign AI" trend. Countries like Saudi Arabia, the UAE, and Japan are now building their own domestic AI clusters. They don’t want to rely on US cloud providers; they want their own "AI Factories."

Nvidia is the only company that can ship a "data center in a box" at that scale. In late 2025, the US government even loosened some restrictions on exporting the H200 chips to certain regions, which opened up a massive new revenue stream that wasn't there eighteen months ago.

The Financials: Is It Too Expensive?

Let's talk about the "valuation" elephant in the room.

People see a $5 trillion market cap and assume it's overvalued. But the weird thing is, Nvidia's Forward P/E ratio (price-to-earnings) has actually stayed relatively reasonable because their earnings are growing just as fast as the stock price.

- Gross Margins: Staying in the mid-70% range.

- Cash Flow: They returned $24.3 billion to shareholders in the first half of fiscal 2026 alone through buybacks and dividends.

- Growth: Data center revenue grew 66% year-over-year.

Wall Street analysts, like Keith Weiss at Morgan Stanley and Chris Caso at Wolfe Research, have been hiking price targets into the $250 to $350 range. They’re looking at the upcoming Rubin platform, scheduled for late 2026, which is expected to double the performance of Blackwell.

🔗 Read more: That Diagram of a Fuel Injector Is More Than Just Squiggly Lines

What Could Go Wrong?

It's not all sunshine. There are real risks.

One is supply chain bottlenecks. Nvidia is heavily dependent on TSMC for "CoWoS" (advanced packaging). While Nvidia has booked over 50% of TSMC's capacity for 2026, any geopolitical hiccup in Taiwan could tank the stock instantly.

There's also the "AI ROI" question.

Eventually, the companies spending billions on these chips need to show that AI is making them money. If the software side of AI (like ChatGPT or Copilot) doesn't start generating massive profits for the end-users, the "build-out" might slow down. But for now, the backlog of orders stretches into 2027, giving Nvidia a very comfortable cushion.

Actionable Insights for Investors

If you're looking at Nvidia today, don't just watch the daily price swings. Look at the Cloud Capex reports from the "Big Four" (Microsoft, Google, Meta, Amazon). As long as they keep increasing their budgets for "AI Factories," Nvidia has a floor under its stock price.

Practical Next Steps:

- Monitor the "Attach Rate": Watch for news on Spectrum-X and networking. If Nvidia continues to dominate networking, they aren't just a chip company; they are a systems company.

- Watch the Rubin Roadmap: The transition from Blackwell to Rubin in late 2026 will be the next major "re-rating" event for the stock.

- Check Sovereign AI Deals: Keep an eye on trade department filings. Deals with nations building their own compute power are the "hidden" growth engine for the next two years.

Nvidia isn't just going up because of "hype." It's going up because it has successfully positioned itself as the toll booth for the entire future of computing. Whether that's worth $5 trillion or $6 trillion is for the market to decide, but the fundamental earnings power is, quite frankly, unlike anything we've seen in the history of the stock market.