If you’ve checked the ticker lately, you might have done a double-take. Gold isn't just "up"—it’s essentially gone vertical. As of mid-January 2026, we are looking at spot prices dancing around $4,600 per ounce. Just a couple of years ago, $2,000 felt like a solid ceiling. Now? It’s the floor.

Honestly, the speed of this move has caught even some of the most seasoned "gold bugs" off guard.

📖 Related: Why the Greatest Place to Work in America is Never the Company You’d Expect

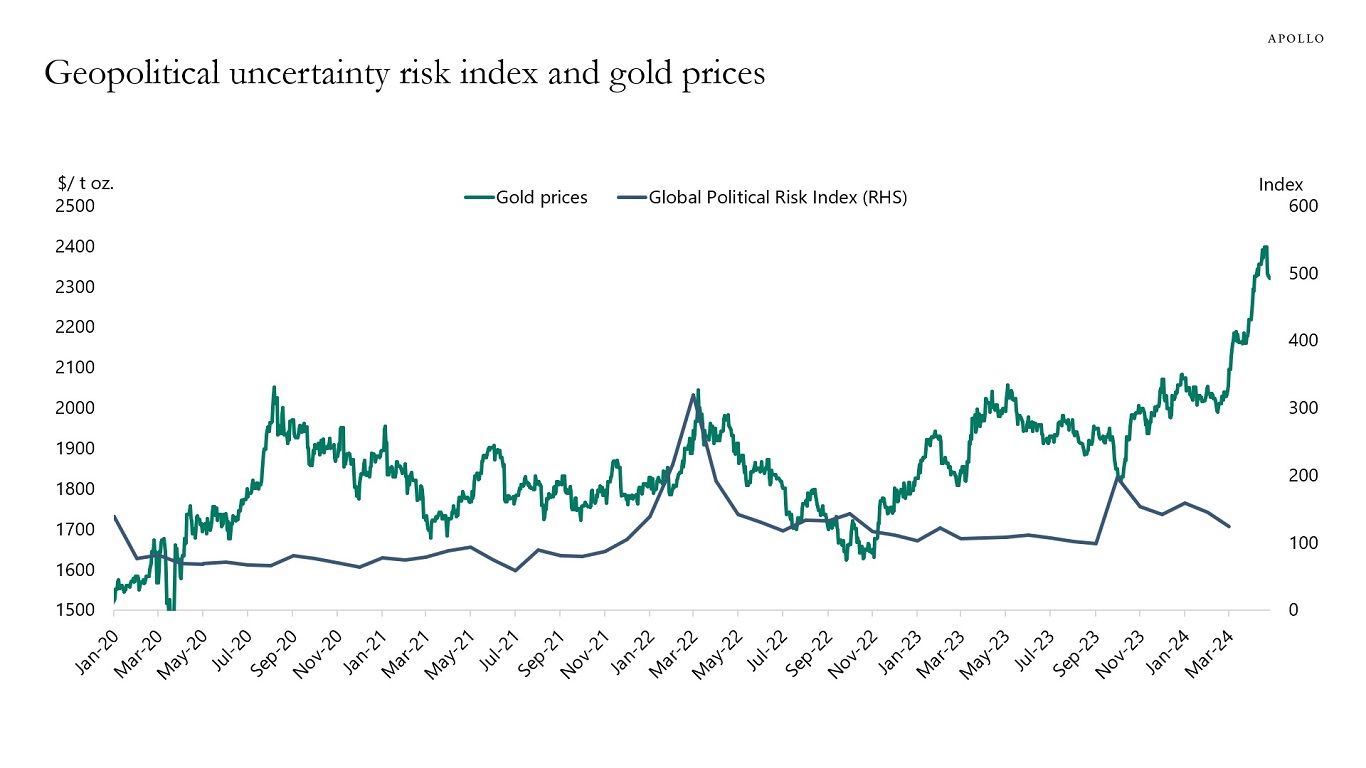

It isn't just one thing. It's a messy, complicated pile-up of global events that turned into a perfect storm for the yellow metal. People are worried. When people are worried, they buy gold. But there’s a lot more under the hood than just "fear." We’re talking about a fundamental shift in how the world’s biggest banks and governments handle their money.

The Breakdown of Institutional Trust

One of the weirdest—and most impactful—drivers right now is what’s happening with the Federal Reserve. Normally, the Fed is the "boring" part of the economy. Not this year.

A criminal investigation into Fed Chair Jerome Powell has sent shockwaves through the markets. Whether you think it’s politically motivated or a legitimate legal issue, the result is the same: uncertainty. For decades, the independence of the U.S. central bank was a given. Now, investors are asking if the Fed is still calling its own shots or if it’s being steered by the White House.

When you lose faith in the referee, you stop betting on the game.

Investors have been dumping U.S. Treasuries because they don’t trust the long-term stability of the dollar. In fact, the dollar has lost nearly 12% of its value against major global currencies recently. If your cash is losing value that fast, you're going to park it somewhere that can't be "devalued" by a policy change or a legal scandal.

Why Is Gold Going Up So Much Right Now?

Aside from the drama in Washington, there's a huge "war premium" baked into the price. You've likely seen the headlines. Military raids in Venezuela, threats regarding Greenland, and the ongoing powder keg in the Middle East—specifically involving Iran and the Strait of Hormuz—have made "safe-haven" buying the default move.

But here’s the kicker: it’s not just nervous individuals buying a few coins.

Central Banks Are the New Whales

The biggest players in this rally aren't retail investors. They are central banks.

Countries like China, Poland, and Brazil are buying gold at a rate we haven't seen in generations. The People's Bank of China has been on a buying spree for over 14 consecutive months. Why? Because they saw what happened to Russia's dollar reserves back in 2022. They realized that if you hold dollars, your wealth can be "turned off" by another country. If you hold gold in your own vault, nobody can touch it.

✨ Don't miss: JP Morgan Chase SWIFT Number: Why Most People Use the Wrong Code

- Poland: Added 83 tonnes last year alone, bringing its reserves to 26% of its total holdings.

- China: Holds over 2,305 tonnes now, and they aren't stopping.

- Kazakhstan and Brazil: Actively increasing their gold-to-currency ratios.

This is what analysts call "de-dollarization." It’s a slow-motion exit from the U.S. financial system. As these massive institutions swap their dollars for gold, the price gets pushed higher and higher. There’s a limited amount of gold in the world, and when the people who print the money decide they want the gold instead, the price has nowhere to go but up.

The Interest Rate Tug-of-War

You’ve probably heard that high interest rates are bad for gold. The logic is simple: gold doesn't pay a dividend or interest. If you can get 5% from a savings account, why hold a metal that just sits there?

Well, that logic is currently broken.

Even with core inflation staying stubbornly above targets, most central banks are cutting rates anyway to prevent their economies from stalling. The Fed is expected to cut rates at least twice this year. When rates fall, the "opportunity cost" of holding gold disappears. Suddenly, that 5% savings account is only paying 3%, and with 4% inflation, you’re actually losing money.

Gold starts looking pretty good in that scenario.

What the Experts are Actually Saying

Don't expect this to cool off tomorrow. Major brokerages like Goldman Sachs and JPMorgan have already revised their 2026 targets. They aren't looking at $4,600 as the peak—they’re looking at **$5,000**.

UBS recently noted that if geopolitical risks in the Middle East escalate further, specifically affecting oil exports through the Strait of Hormuz, gold could even touch $5,400. That sounds insane, but considering we were at $2,700 not that long ago, $5,000 is just a Tuesday at this point.

💡 You might also like: Staples Va Beach Va: Why This Store Still Rules the Hilltop Area

There are some skeptics, of course. Some analysts at HSBC warn that we might see a correction later in the year if supply constraints ease. But for now, the "momentum" is overwhelmingly bullish. The RSI (Relative Strength Index) shows the market is a bit overbought, meaning a small dip back to $4,300 is possible, but most experts see that as a "buy the dip" opportunity rather than a crash.

Actionable Steps for the Current Market

If you're watching this rally and wondering what to do, you've got to be smart about it. Buying at all-time highs is always risky, but sitting on the sidelines while your cash loses value isn't great either.

- Check Your Allocation: Most financial advisors used to suggest 5% of a portfolio in gold. With the current volatility in stocks and bonds, many are now suggesting 10% to 15% as a "stabilizer."

- Look Beyond Physical: If you don't want to deal with vaults and security, Gold ETFs (Exchange Traded Funds) like the SPDR Gold Trust are seeing record inflows. They track the price without the hassle of storage.

- Watch the Silver Ratio: Historically, silver follows gold but with more "zip." Currently, silver is outperforming gold on a percentage basis. If gold feels too expensive, silver is often the "poor man's gold" that catches up fast.

- Set "Buy Limits": Don't FOMO (fear of missing out) into a peak. If you want to enter the market, set orders to buy on a 5% or 10% pullback. The market rarely goes up in a straight line forever.

The reality is that gold is doing exactly what it was designed to do: act as an insurance policy when the rest of the world feels like it’s falling apart. Whether it's inflation, central bank politics, or global conflict, the "yellow dog" is the only asset that doesn't require a government's promise to have value.

Keep a close eye on the CPI (Consumer Price Index) data coming out later this month. If inflation stays high while the Fed continues to talk about rate cuts, that $5,000 target might arrive much sooner than anyone expected.

Next Steps for You:

Check your current investment portfolio to see how much "paper" wealth (cash/bonds) you have versus "hard assets." If you are under-diversified, research reputable bullion dealers or gold-backed ETFs to understand the liquidity and fees involved before the next major price jump.