Tax season is usually a headache. But honestly, the real surprise hits people mid-year when they realize their government checks are smaller than expected—or worse, when they owe the IRS a fortune because nobody took taxes out of their unemployment or Social Security. That is exactly where the Form W-4V voluntary withholding request form comes into play. It’s a tiny piece of paper, barely a page long, but it’s the only thing standing between you and a massive tax bill if you’re receiving specific federal payments.

Most people think government benefits are "tax-free." That's a myth.

While some benefits are exempt, things like unemployment compensation and Social Security are very much on the IRS's radar. If you don't ask the government to take a cut now, they’ll just come for it later. It's basically a "pay now or pay more later" situation. The W-4V is your tool to tell the payer—whether that’s the Social Security Administration (SSA) or a state unemployment office—to hold back a specific percentage of your check for federal income tax.

✨ Don't miss: Netflix and 100 Winchester Circle Los Gatos CA 95032: Why This Address Changed Everything

What Exactly is the W-4V Voluntary Withholding Request Form?

Think of it as the "choice" form. Unlike a job where you must fill out a W-4, federal law doesn't always mandate withholding on government transfers. It's voluntary. If you’re getting Social Security, Tier 1 railroad retirement benefits, or even certain crop disaster payments, the government assumes you’ll handle the taxes yourself.

But will you? Most of us don't.

We spend what hits the bank account. By the time April rolls around, that 10% or 12% you should have saved is gone. The Form W-4V voluntary withholding request form acts as a safety net. You fill it out, send it to the agency paying you, and they do the math for you. It’s a set-it-and-forget-it strategy for tax compliance.

The IRS updated the form recently to keep up with tax law changes, but the core mechanics remain the same. You aren't choosing a dollar amount. You're choosing a percentage. That’s a key distinction. If your benefit amount changes—say, through a Cost of Living Adjustment (COLA)—the amount withheld scales with it automatically.

Who actually needs to use this thing?

It isn't for everyone. If Social Security is your only income and you fall below the standard deduction threshold, you might not owe any federal tax at all. In that case, keep your money. However, if you have a pension, a part-time job, or a spouse who is still working, your benefits likely push you into a taxable bracket.

Specific payments covered include:

- Social Security benefits (the big one).

- Unemployment compensation (states usually handle the form, but federal rules apply).

- Tier 1 railroad retirement benefits.

- Commodity Credit Corporation loans.

- Certain payments under the Agricultural Act of 1949.

The Percentage Trap: Why You Can't Just Pick Any Number

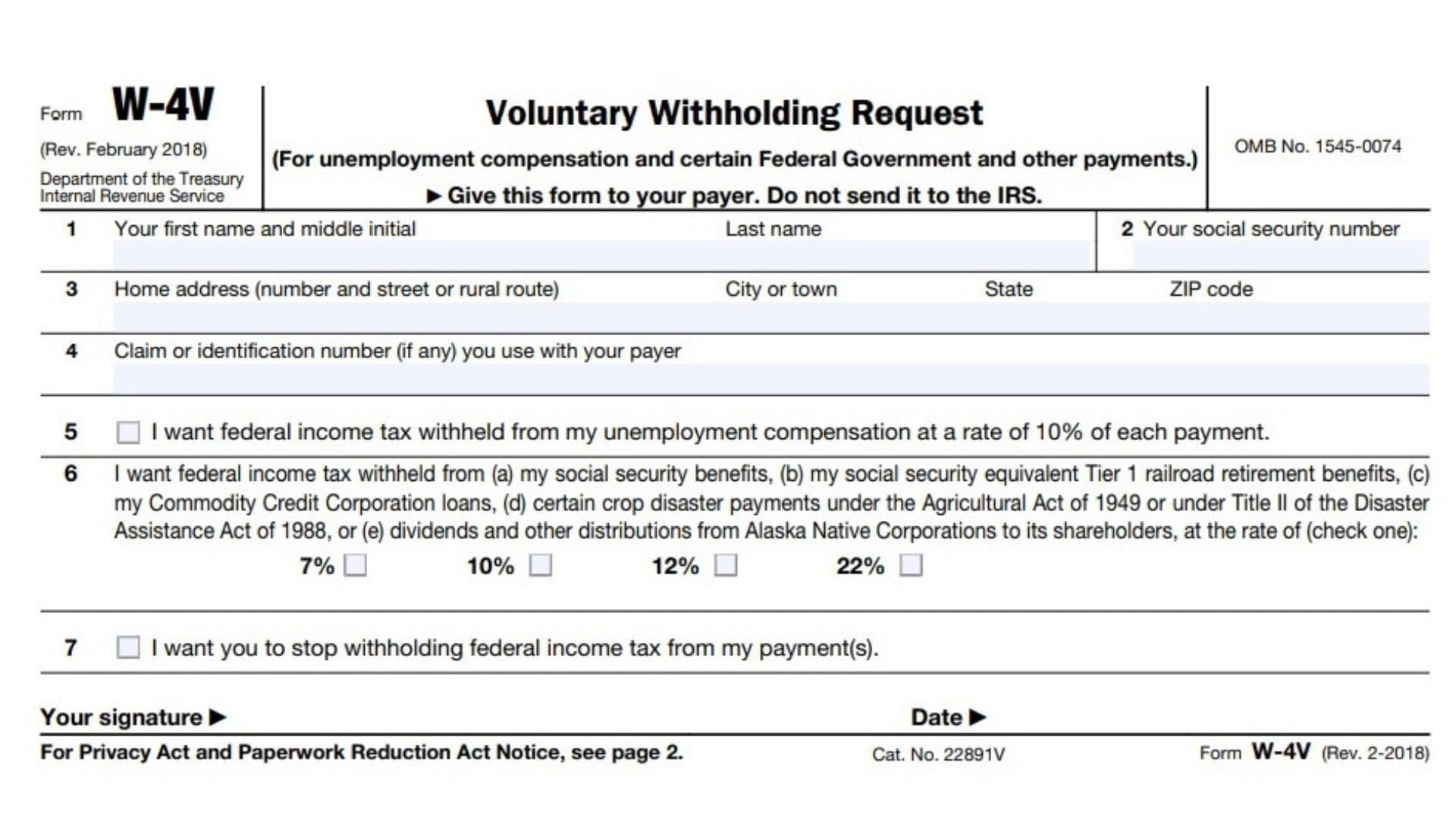

Here is where the IRS gets weirdly specific. You can't just tell the SSA to take out 5 bucks or 50% of your check. The Form W-4V voluntary withholding request form limits your choices to very specific flat rates.

For most federal payments, you have exactly four choices: 7%, 10%, 12%, or 22%.

If you're on unemployment, it's even more rigid. Usually, you’re looking at a flat 10%. You check the box, sign the form, and that’s it. If you need to withhold more because you’re in a high tax bracket—maybe you’re a high-earner who just got laid off—you can’t do it through the W-4V alone. You’d have to make estimated tax payments using Form 1040-ES.

It’s a bit of a blunt instrument.

A Real-World Mess

Let's look at a guy named Mike. Mike retired at 62 and started taking Social Security while working a "fun" job at a hardware store. He didn't file a W-4V. He figured the IRS would just "know." Come April, he realized his hardware store income pushed his total earnings high enough that 50% of his Social Security became taxable. He owed $3,000. If Mike had just ticked the 12% box on a W-4V when he started his benefits, he wouldn't have been scrambling to find three grand in his savings account.

✨ Don't miss: Why Your 90 Day Plan Usually Fails (And How to Actually Fix It)

How to File the W-4V Without Losing Your Mind

Don't send this form to the IRS. That is the number one mistake people make. The IRS designs the form, but they don't process it. You have to send it to the "payer."

- Identify the Payer: If it’s Social Security, you send it to your local SSA office. If it’s unemployment, you usually handle it through your state’s online portal (though they might use a digital version of the W-4V).

- Pick Your Rate: Look at your previous year's tax return. What was your effective tax rate? If you were in the 12% bracket, check the 12% box.

- The "Stop" Command: You can also use this form to stop withholding. If you realize you're overpaying and want that cash back in your monthly check, you check the box in the "Claiming Exemption" or "Stopping Withholding" section.

It usually takes 30 to 60 days for the change to kick in. Don't expect your next check to be different if you mailed the form on a Tuesday. Government bureaucracy moves at the speed of a cold snail.

The Unemployment Nuance

Unemployment is a different beast. During the pandemic, millions of people learned the hard way that unemployment is taxable income. Many states didn't make the withholding option obvious. If you're filing for benefits now, look for the "Tax Withholding" section in the application. Often, they won't even call it a Form W-4V voluntary withholding request form—they’ll just ask, "Do you want 10% taken out for federal taxes?" Say yes. Just say yes.

Social Security and the 85% Rule

This gets technical, but it’s vital. The IRS uses a "combined income" formula to see if your Social Security is taxable. If you’re a survivor, a retiree, or receiving disability (SSDI), you need to run these numbers.

Combined Income = Adjusted Gross Income + Tax-Exempt Interest + Half of your Social Security benefits.

If that number is over $34,000 for an individual or $44,000 for a couple, up to 85% of your benefits could be taxed. If you find yourself in this boat, the Form W-4V voluntary withholding request form isn't just a suggestion; it’s a financial survival tool.

✨ Don't miss: Graphite One Resources Stock Price: What Most People Get Wrong

Common Misconceptions That Cost You Money

People often think filing this form reduces their total tax bill. It doesn't. Your tax liability is your tax liability. All the W-4V does is change when you pay it.

Another big one: "I can just use a standard W-4." Nope.

The standard W-4 is for employees. If you try to hand a standard W-4 to the Social Security Administration, they will look at you like you’re speaking a dead language. They need the W-4V. The "V" stands for Voluntary. It is the only key that fits that specific lock.

Also, it’s not permanent. You aren't signing your life away. You can file a new W-4V whenever you want to change the percentage or stop it entirely. If your spouse retires and your household income drops, you might want to move from 22% down to 7%. That's your right.

Actionable Steps for Tax Control

If you're sitting there wondering if you've messed up, take ten minutes to do a "paycheck check-up."

First, grab your last benefit statement. See if there is a line item for "Federal Income Tax Withheld." If it’s zero, and you have other sources of income, you're likely heading for a surprise in April.

Second, download the Form W-4V voluntary withholding request form directly from IRS.gov. Don't get it from a third-party site that might have an outdated version.

Third, if you’re unsure about the rate, 10% is usually the safest middle-ground for most middle-class retirees or those on unemployment. It’s enough to cover the bulk of the liability without starving your monthly budget.

Finally, keep a copy. If the agency loses it—and they might—you want proof of when you requested the withholding.

Dealing with the IRS is never fun. But filling out one page now is infinitely better than spending three years on a payment plan because you didn't account for taxes on your benefits. Get the form, pick a percentage, and get back to living your life without the "tax cloud" hanging over your head.