Tax season is usually a headache, but for seniors, it’s a whole different ballgame. You’re likely using Form 1040-SR, that specialized tax return with the big print and the simplified layout. It’s great. It’s easier on the eyes. But here’s the thing: that basic two-page form doesn't actually cover everything. If you have a side hustle, won a small jackpot at the casino, or need to claim specific deductions like student loan interest for a grandkid’s education you’re still paying for, you need more. You need 1040-SR Schedule 1.

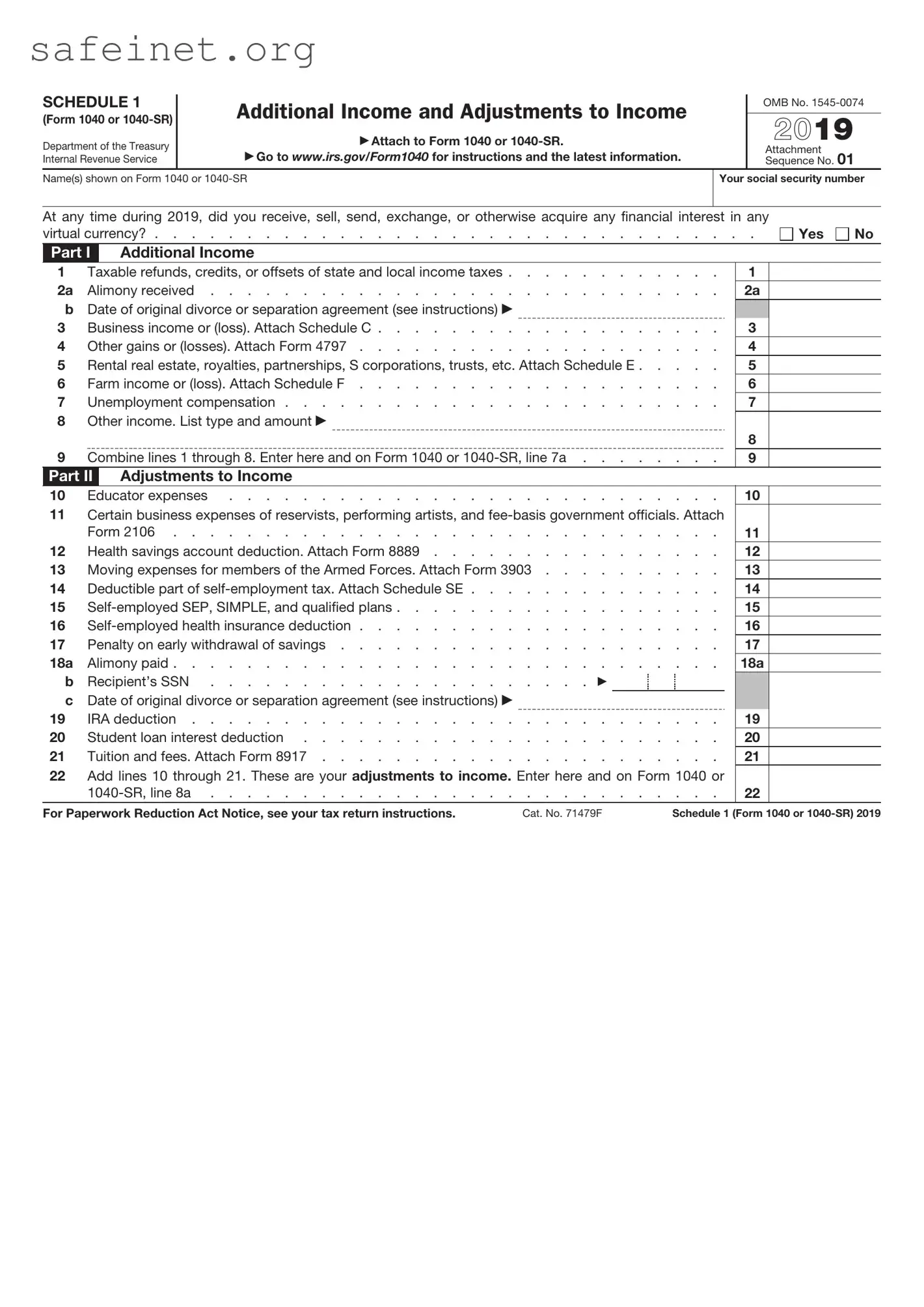

Most people think "Additional Income and Adjustments to Income" sounds like something meant for corporate accountants or high-flying investors. Honestly, it’s mostly just a "catch-all" bucket. It’s where the IRS puts everything that didn't make the cut for the front page of the 1040-SR. If you ignore it because it looks complicated, you’re probably leaving money on the table or, worse, begging for an audit.

The Reality of 1040-SR Schedule 1 and Your Side Income

Let's talk about Part I of this form. This is the "Additional Income" section. Now, if your only income is Social Security and a pension, you can probably skip this. But who lives that simply anymore? Maybe you’re consulting part-time. Maybe you finally sold that vintage collection on eBay.

The IRS wants their cut.

Taxable refunds, credits, or offsets of state and local income taxes go here. If you itemized last year and got a refund from your state, you might have to report it on line 1. It feels like double-dipping from the government, and frankly, it kind of is. Then there’s alimony. This is a tricky one. If your divorce was finalized before 2019, that money is generally taxable income. If it was after January 1, 2019? Usually not. The IRS doesn't make it easy to remember that distinction, but Schedule 1 is where you have to prove you know the difference.

Business Income and the Modern Senior

More seniors are working "gig" jobs than ever before. Whether it’s driving for a rideshare app or selling handmade birdhouses, that’s business income. It lands on Line 3. But wait—you don’t just put a number there. You usually have to fill out a Schedule C first, find your net profit, and then carry that number over to 1040-SR Schedule 1. It’s a bit of a paper trail.

🔗 Read more: The Stock Market Since Trump: What Most People Get Wrong

Other items in this section include:

- Rental Real Estate and Royalties: If you’re renting out a room or a vacation home.

- Unemployment Compensation: Yes, even if you’re "retired," if you drew unemployment at any point in the year, it’s taxable.

- Gambling Winnings: That trip to the casino? If you won enough to get a W-2G, it’s going here.

- Prizes and Awards: Even that local bake-off cash prize technically counts.

The "Above-the-Line" Deductions You’re Missing

Part II is where the magic happens. This is the "Adjustments to Income" section. These are the "above-the-line" deductions. They are way better than standard itemized deductions because they lower your Adjusted Gross Income (AGI). A lower AGI can lead to lower taxes on your Social Security benefits and might even keep your Medicare premiums from spiking.

If you’re a retired teacher who still subs occasionally and buys your own supplies, look at Line 11. You can deduct up to $300. It’s not a fortune, but it’s your money.

Health Savings Accounts (HSA) and Retirement Accounts

This is a big one for people using 1040-SR Schedule 1. If you contributed to an HSA and didn’t do it through payroll deductions at a job, you claim that deduction on Line 13. It’s a straight-up reduction of your taxable income.

The same goes for IRA deductions on Line 20. If you’re over 70½, you might think you can’t contribute anymore, but the SECURE Act changed those rules. As long as you have "earned income" (like that side job we talked about), you can still put money into a traditional IRA and potentially deduct it right here on Schedule 1.

💡 You might also like: Target Town Hall Live: What Really Happens Behind the Scenes

Self-Employed Expenses

If you’re reporting income in Part I, you better be looking for deductions in Part II. Self-employed individuals can deduct half of their self-employment tax. You can also deduct health insurance premiums if you’re self-employed and not eligible for an employer-sponsored plan (including through a spouse). This is massive. It helps offset the cost of supplemental insurance or dental plans that Medicare doesn't fully cover.

Why Accuracy on Schedule 1 Impacts Your Medicare

People forget how connected everything is. The Social Security Administration looks at your tax return from two years ago to determine your Medicare Part B and Part D premiums. This is known as IRMAA (Income-Related Monthly Adjustment Amount).

If you mess up your 1040-SR Schedule 1 and accidentally inflate your AGI—maybe by forgetting to claim a deduction or incorrectly reporting a one-time gain—you could get hit with a "High Income" surcharge on your Medicare two years down the line. It’s a delayed-onset tax headache. By keeping your AGI lean using the adjustments in Part II, you’re protecting your future monthly cash flow.

Common Mistakes People Make with Form 1040-SR Schedule 1

Don't just guess. One of the biggest blunders is forgetting to attach the schedule altogether. If you have numbers on Line 8 or Line 10 of your main 1040-SR, the IRS expects Schedule 1 to be stapled to it (or attached to the digital file).

Another mistake? Virtual currency. There is a specific question about digital assets. Even if you don't think "crypto" applies to you, if you received any as a gift or a payment for a service, you have to disclose it. Schedule 1 is often where the "other income" from those transactions ends up.

📖 Related: Les Wexner Net Worth: What the Billions Really Look Like in 2026

Then there is the Jury Duty pay. If you gave your jury pay to your employer because they continued to pay your salary while you served, you can actually deduct that amount on Schedule 1. It's a niche rule, but for a senior still in the workforce, it’s a valid way to ensure you aren't paying tax on money you didn't actually keep.

How to Handle the "Other Income" Trap

Line 8z is the "Other Income" catch-all. It’s scary because it’s vague. You have to list the type and the amount. This is where things like hobby income go.

Wait—what’s a hobby versus a business?

The IRS is very picky about this. If you’re doing something for a profit, it’s a business (Schedule C). If you’re doing it for fun but happen to make money, it’s a hobby. You used to be able to deduct hobby expenses, but the Tax Cuts and Jobs Act of 2017 took that away for most people. Now, you often have to report the hobby income on 1040-SR Schedule 1 without being able to subtract the cost of the supplies. It’s a tough pill to swallow, so most tax pros suggest seeing if your activity qualifies as a legitimate business instead.

Moving Forward with Your Filing

Getting Schedule 1 right isn't just about following rules; it’s about financial defense. You’ve spent decades building your nest egg. Don't let a lack of paperwork eat into it.

Actionable Steps for This Tax Season

- Gather Every 1099: Don't just look for 1099-R (Retirement). Look for 1099-G (Government payments), 1099-MISC, and 1099-NEC. These all feed into Schedule 1.

- Review Your Adjustments: Even if you take the standard deduction (which most seniors do because of the higher standard deduction for those over 65), you can still use Schedule 1 to lower your AGI. Check for student loan interest, HSA contributions, and educator expenses.

- Check Your Divorce Date: If alimony is part of your life, double-check the 2019 cutoff. It changes which side of the form the money sits on.

- Audit Your "Other" Income: If you sold items online or won a local raffle, get those receipts ready.

- Calculate Self-Employment Costs: If you worked for yourself, ensure you are claiming the deduction for the employer-equivalent portion of self-employment tax on Line 15.

By focusing on these specific lines, you turn a confusing tax document into a tool for preserving your retirement income. 1040-SR Schedule 1 might seem like extra work, but it is the primary way the IRS allows you to fine-tune your tax liability.