You’re staring at a blinking cursor on a stock investment return calculator website, wondering if that $10,000 you just threw into an index fund will actually turn into a beach house by 2045. It’s a rush. Numbers go up. The graph looks like a majestic mountain peak. But here’s the cold truth: most of these digital tools are basically toy calculators. They give you a "perfect world" number that almost never happens in reality.

Markets aren't a straight line. They’re a jagged, caffeine-fueled mess.

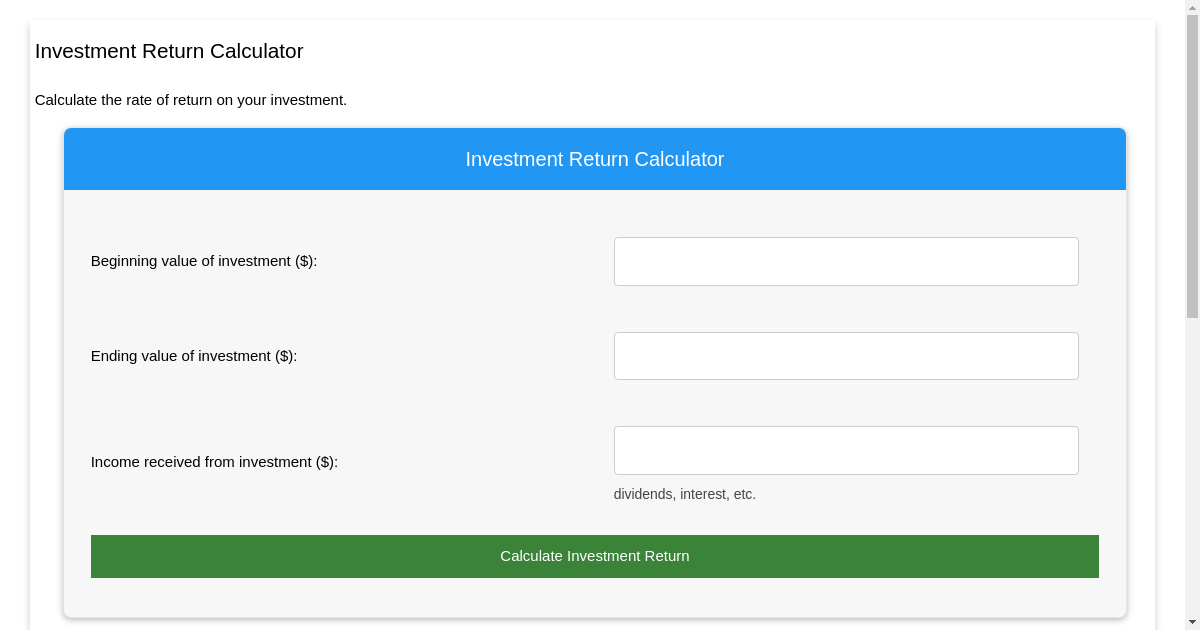

If you’ve spent any time on sites like Bankrate or NerdWallet, you know the drill. You plug in your starting balance, an "estimated return," and a time horizon. It’s fun. It’s addictive. It’s also dangerous if you don't account for the stuff that actually eats your money—taxes, inflation, and that annoying little thing called "sequence of returns risk."

The Math Behind a Stock Investment Return Calculator

Most calculators use a simple Compound Annual Growth Rate (CAGR) formula. It looks like this:

$$A = P(1 + r)^n$$

Where $A$ is your final amount, $P$ is your principal, $r$ is the rate of return, and $n$ is the number of years. It's clean. It's elegant. It's also wildly misleading for a retail investor.

Why? Because the S&P 500 doesn't return 10% every year. It returns 30% one year and loses 18% the next. If you lose 50% of your money in year one, you need a 100% gain just to get back to where you started. A basic stock investment return calculator usually ignores this volatility. It assumes a smooth ride. But the sequence in which you get those returns matters more than the average itself, especially if you’re nearing retirement.

✨ Don't miss: Getting a Mortgage on a 300k Home Without Overpaying

Inflation is the Silent Killer

Let’s say your calculator tells you that you’ll have $1 million in 30 years. Great! Except, thanks to a modest 3% annual inflation, that $1 million in 2056 will only buy you what about $411,000 buys you today. If you aren't clicking the "adjust for inflation" button—or if the calculator doesn't have one—you're planning your future based on a ghost number.

I’ve seen people get genuinely depressed when they realize their "millionaire" status is actually "middle-class-with-a-decent-used-car" status in future dollars.

Dividends: The Secret Sauce People Forget to Toggle

When using a stock investment return calculator, there is usually a tiny checkbox that says "Reinvest Dividends."

Check it. Seriously. Since 1926, dividends have contributed roughly 32% of the total return for the S&P 500. If you don't reinvest those payouts, your "mountain peak" graph turns into a small hill. For example, look at the performance of the SPDR S&P 500 ETF (SPY). Between 2000 and 2023, the price appreciation was one thing, but the total return (with dividends) was significantly higher.

If you're just looking at price action, you're only seeing half the movie.

What About Taxes?

Uncle Sam wants his cut. If you’re using a calculator to project returns in a taxable brokerage account, you need to mentally subtract about 15% to 20% for long-term capital gains. A lot of folks forget this. They see a big number on the screen and forget that a chunk of it belongs to the IRS. This is why Roth IRAs and 401(k)s are such big deals—they let the calculator's math actually stay in your pocket.

🔗 Read more: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

Real World Examples: The 2000s vs. The 2010s

Context is everything.

If you used a stock investment return calculator in 1999 and plugged in a 10% return for the next decade, you would have been hilariously wrong. The "Lost Decade" (2000–2009) saw the S&P 500 actually deliver a negative return when adjusted for inflation.

- The Tech Bubble: Wiped out years of gains in months.

- The 2008 Crash: A 37% drop that terrified a generation.

- The Recovery: If you stayed in, you won. If you panicked, the calculator meant nothing.

Compare that to 2010–2019. It was basically a non-stop rocket ship. If you projected a 7% return, you were actually too conservative. The point is, your inputs are just guesses. Smart investors use a range of outcomes—a "best case," "worst case," and "most likely."

The Variance of "Average"

When people talk about the "10% average return" of the stock market, they’re looking at a huge timeframe. In any given year, the market is almost never up exactly 10%. It’s usually up 20% or down 15%. This variance creates "tracking error" in your own life. You might hit your goal five years early, or five years late.

How to Actually Use These Tools Without Getting Fooled

Don't just trust the first number that pops up. You’ve gotta stress test the data.

Most people are too optimistic. We think we can save $1,000 a month forever without fail. Life happens. Cars break. Roofs leak. Kids happen.

💡 You might also like: Getting a music business degree online: What most people get wrong about the industry

Try this: run your numbers with a 5% return instead of 10%. If your plan still works at 5%, you’re in a great spot. If it only works at 12%, you aren’t investing; you’re gambling on a miracle.

Expense Ratios Matter

If you’re invested in an actively managed fund with a 1% expense ratio, and the market returns 8%, you’re only getting 7%. Over 30 years, that 1% difference can cost you hundreds of thousands of dollars. Most basic calculators don't have a field for "fees," so you have to manually lower your expected return percentage to account for them.

The Psychology of the "Big Number"

There’s a weird psychological trap with a stock investment return calculator.

You see that you’ll have $2 million by age 65. You feel rich. You feel "done." So, you might spend a little more today. But that $2 million is a projection, not a promise. It’s based on you actually hitting the "contribute" button every single month for 300 months straight.

Discipline is the variable the software can't track.

Actionable Steps for Your Next Calculation

Stop treating the calculator like a crystal ball. It’s a compass, not a GPS. It shows you the general direction, but it won't tell you where the potholes are.

- Run a "Bear Market" Scenario: See what happens if the market drops 20% right before you plan to stop investing.

- Factor in the Core Inflation: Subtract at least 3% from your expected return to see "today's value" of that future money.

- Update Quarterly: Don't just do this once. Update your calculator inputs every few months with your actual current balance.

- Check Your Fees: Look at the prospectus of your holdings. If your fees are high, drop your expected return input by that same percentage.

- Focus on the Inputs: You can't control the market's return, but you can control your savings rate. Focus on the "monthly contribution" box more than the "expected return" box.

The most accurate way to use a stock investment return calculator is to be your own worst critic. Assume the returns will be lower than average. Assume inflation will be higher. Assume you'll miss a few contributions. If the math still says you're okay, then you can actually breathe easy.

Relying on "best-case" scenarios is how people end up working until they're 80. Use the tool to find your "floor," not just your "ceiling." Real wealth is built in the gap between what the calculator predicts and how much you actually have the stomach to stay invested when the red bars start appearing on the screen.