Tax season is basically a collective fever dream for Americans. You sit there, staring at a screen, wondering why your paycheck looks so much smaller than the number on your offer letter. Most of us go straight for a state income tax calculator to make sense of the damage. But here’s the thing: most of them are kinda lying to you. Not on purpose, usually, but because state tax code is a tangled mess of credits, local surcharges, and "convenience of employer" rules that no simple web form can fully capture.

It’s annoying.

Actually, it's more than annoying—it's expensive. If you live in a place like Oregon or Maryland, your state tax bill might be the second biggest check you write all year. Getting the math wrong means you’re either under-withholding and facing a surprise bill in April, or you're giving the government an interest-free loan you can't afford.

The Gritty Reality of the State Income Tax Calculator

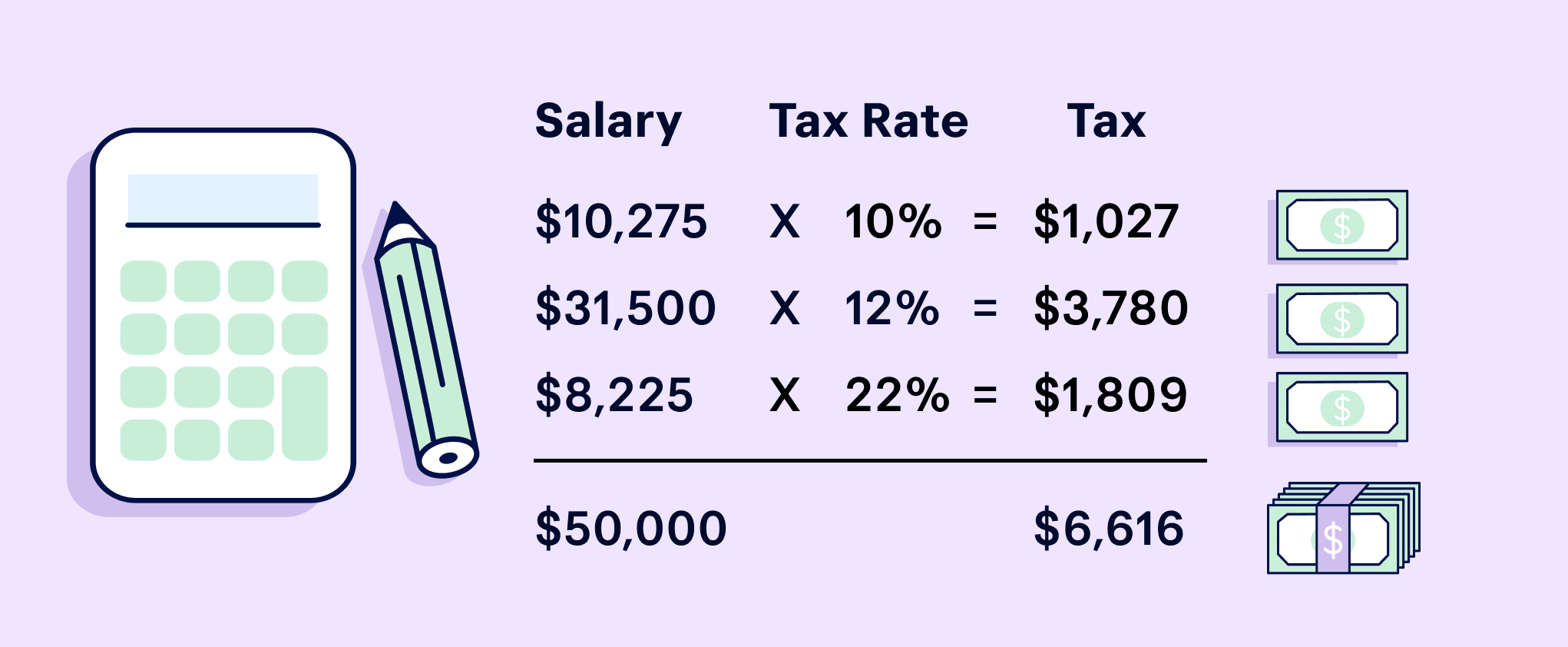

Most people think state tax is a flat percentage. It isn't. Unless you live in one of the few "flat tax" states like Illinois or Indiana, you're dealing with a progressive system. This is where a state income tax calculator starts to get complicated. You’ve got different brackets that kick in at weird intervals. In California, for example, the top rate hits 13.3% if you’re a high earner, but that only applies to the portion of your income over a certain million-dollar threshold.

If you just take your salary and multiply it by a percentage you saw on Wikipedia, you're doing it wrong.

The real magic—or nightmare—happens with adjustments. Every state has its own version of the federal Adjusted Gross Income (AGI). Some states, like Pennsylvania, don't allow the same deductions for retirement contributions that the IRS does. You might think your 401(k) contribution is lowering your tax bill across the board, but in some jurisdictions, the state still wants its cut of that money right now. This "decoupling" from federal rules is why your tax software often asks fifty questions about whether you have specific types of interest or out-of-state municipal bonds.

Why Your Location Is More Than a Zip Code

Where you lay your head isn't always where you pay your taxes. This is the biggest trap for remote workers. If you live in New Jersey but your company is based in New York City, you’re dealing with a "convenience of the employer" rule. New York is notorious for this. They basically say that if you could have gone into the office but chose to work from your couch in Jersey, they get to tax your income as if you were sitting in Manhattan.

You’ll usually get a credit in your home state for taxes paid to another state, but the math is never a 1:1 swap. A standard state income tax calculator might tell you what you owe New York, but it might not accurately predict how much New Jersey will let you deduct.

Then there are the local taxes.

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

People forget about Ohio and Pennsylvania local income taxes. Or New York City’s specific resident tax. If you live in the five boroughs, you’re paying an extra 3.078% to 3.876% on top of the state rate. That’s a massive chunk of change that "generic" calculators often miss because they only look at the state level.

The Federal Deduction That Changed Everything

We have to talk about the SALT cap. For decades, you could deduct all your state and local taxes from your federal return. It was a nice little cushion. Then the Tax Cuts and Jobs Act of 2017 capped that deduction at $10,000.

For a family in a high-tax state like Connecticut or New Jersey, that $10,000 limit is a joke. They hit it just on property taxes alone before they even get to their income tax. This means that using a state income tax calculator today feels a lot more painful than it did eight years ago because the federal government isn't subsidizing your state's high tax rate anymore.

You’re feeling the full weight of every percentage point.

Credits: The Secret Weapon

If you want to actually lower that number you see on the screen, you have to look for credits, not just deductions. Deductions lower the income you're taxed on; credits are a dollar-for-dollar reduction in what you owe.

- Earned Income Tax Credit (EITC): Many states have their own version of the federal EITC. If you're a lower-to-moderate-income worker, this can actually result in a "refund" that is more than what you paid in.

- Child and Dependent Care Credits: States like Colorado have become much more aggressive with these recently.

- Education Credits: Look at 529 plan contributions. In many states, putting money into a college savings fund gives you a direct deduction on your state return.

Most people just click "next" on their tax software. Don't do that. Honestly, the five minutes it takes to read your state's Department of Revenue "What's New" page can save you three hundred bucks.

Real-World Nuances Most Calculators Miss

Let's look at a specific example: Minnesota.

Minnesota has a "working family credit." It’s complicated. It’s based on your income, the number of kids you have, and your filing status. A basic state income tax calculator might estimate your tax at $4,000, but if you qualify for the full credit, that could drop to $2,500.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

Or consider the "Tax Cliffs."

Some states have specific exemptions that vanish the moment you earn $1 over a certain limit. It’s a brutal way to design a system, but it exists. If you’re a freelancer or have a side hustle, you need to be very careful. Earning an extra $500 on a weekend gig could theoretically cost you $1,000 in lost state tax credits. It’s rare, but it happens.

The Problem With Multi-State Filing

If you moved during the year, stop using a simple calculator. Just stop.

Part-year residency is a nightmare for a state income tax calculator to handle. You have to "prorate" your income. This means you’re essentially telling State A: "I lived here for 4 months, so I only owe you for the money I made in those 4 months." But some states calculate your tax rate based on your total annual income from all sources, and then apply that higher rate to the small slice of income they’re allowed to tax.

It’s called "Taxation with Apportionment," and it’s why moving from a no-tax state like Texas to a high-tax state like California in the middle of the year usually results in a much higher bill than people expect.

Actionable Strategy: How to Actually Estimate Your Taxes

Forget just plugging one number into a box. If you want an accurate picture of your finances for the coming year, you need to be a bit more surgical.

1. Pull Your Last Paystub

Don’t guess your income. Look at your "Year to Date" (YTD) gross. If you’re self-employed, look at your net profit after expenses. Taxes are paid on profit, not revenue.

2. Check for "Reciprocity"

If you live in one state and work in another, check if they have a reciprocity agreement. For instance, if you live in Virginia and work in D.C., you only pay taxes to Virginia. The state income tax calculator needs to know your residency state, not necessarily your work state, in these cases.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

3. Account for Pre-Tax Deductions

Your taxable income for the state is usually your gross pay minus health insurance premiums and 401(k) or 403(b) contributions. If you make $80,000 but put $10,000 in your 401(k), you’re usually being taxed on $70,000.

4. Don't Forget the "Use Tax"

Almost every state has a line on the tax return for "Use Tax." This is for stuff you bought online where the retailer didn't charge sales tax. Technically, you owe the state that sales tax. While most people ignore this, states are getting better at tracking it through data-sharing agreements with large retailers.

5. Adjust Your Withholding Mid-Year

If the calculator shows you're going to owe $2,000 at the end of the year, don't wait until April. Go to your HR portal and update your state's version of the W-4. Asking them to take out an extra $80 per paycheck now is way less painful than trying to find two grand in your savings account later.

The reality of state taxes is that they are highly localized and deeply personal. A tool is only as good as the data you give it. If you're an "edge case"—a remote worker, a multi-state freelancer, or someone with significant investment income—treat the results of any state income tax calculator as a loose suggestion rather than a final verdict.

Final Practical Moves

Start by downloading the actual tax tables from your state’s Department of Revenue website. It’s boring, but seeing the brackets with your own eyes helps you understand where your next dollar of income is actually going. If you see that you're only $500 away from a higher tax bracket, you might decide to tuck that extra money into a Traditional IRA instead of taking it as a cash bonus.

Also, keep an eye on "Tax Holidays" and temporary credits. States like Florida and Tennessee don't have income taxes, but they have complex sales tax structures that they occasionally adjust. For the rest of us in income-tax states, the rules change almost every legislative session. What was a valid deduction last year might be gone today.

Check your state's residency requirements if you're planning a move. Some states, like New York and California, are "sticky." They will try to claim you as a resident even after you've moved if you still maintain a home or spend a significant amount of time there. Document your move-out date, change your voter registration, and get a new driver's license immediately. It’s the only way to ensure your state income tax calculator reflects your new reality and not your old one.

Audit your own withholding twice a year. Once in January and once in July. This keeps the surprises to a minimum and ensures you’re keeping as much of your paycheck as possible.