Interest is a thief. It’s quiet, it’s persistent, and if you aren't looking, it’ll strip the paint right off your financial house. Most of us just glance at that "minimum payment due" on our monthly statements and think, "Yeah, I can swing sixty bucks." But that’s exactly what the banks want. They want you stuck in the loop.

Enter the payment calculator credit card tool.

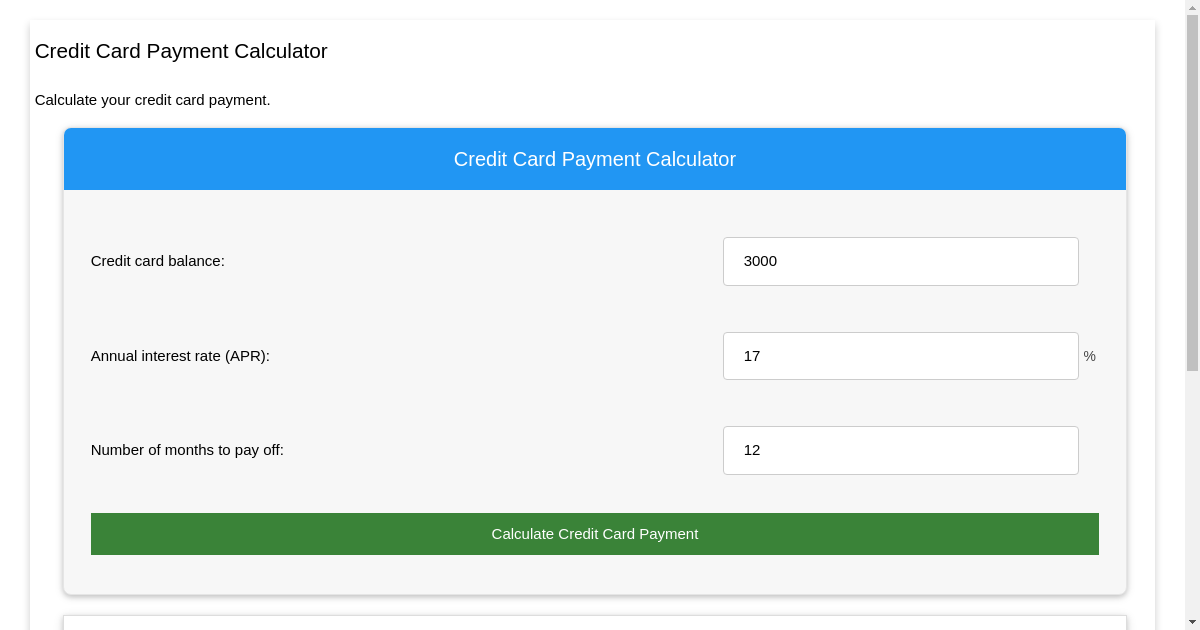

You’ve probably seen a dozen of them online. Bank of America has one, NerdWallet has one, and even the federal government offers basic versions. They look simple enough. You plug in your balance, your APR, and maybe how much you plan to pay each month. Then, click—the math happens. But here is the thing: most people use these tools wrong because they don't account for the weird, jagged reality of how banks actually move money.

The Math the Banks Don't Want You to Do

If you have a $5,000 balance at a 24% APR—which is pretty standard these days for anyone without a flawless credit score—and you only pay the minimum, you are looking at a decade of debt. Maybe more. It's soul-crushing. A standard payment calculator credit card search will show you that if you bump that payment up by just $50 a month, you could shave years off your repayment timeline. Years.

💡 You might also like: COIN Options and High Yield: What Most People Get Wrong About the YieldMax COIN Option Income Strategy ETF

But why do the numbers shift depending on which site you use?

It comes down to the "Daily Balance Method." Most credit card issuers don't just charge you interest once a month on the final number. They calculate your average daily balance. If you buy a $10 pizza on the 5th of the month, you’re paying interest on that tenner for the remaining 25 days. Most basic calculators just use a flat monthly interest rate, which is a lie. It's a small lie, sure, but it adds up when you’re dealing with thousands of dollars.

Then you have the "Minimum Payment Warning." Ever notice that little box on your statement? It was mandated by the Credit CARD Act of 2009. It’s essentially a built-in payment calculator credit card feature required by law to show you how much interest you'll pay if you take the "slow road." It’s usually terrifying. If it isn't scaring you, you aren't reading it right.

Why Your APR Isn't What You Think It Is

We talk about APR like it's a static number. It isn't.

Most cards have variable rates tied to the Prime Rate. When the Federal Reserve nudges interest rates up, your credit card gets more expensive almost instantly. If you used a payment calculator credit card tool six months ago, those results are probably garbage now. You have to re-calculate every time the market shifts.

Honestly, the "grace period" is the only thing saving most people from total financial collapse. If you pay your statement in full, the APR is effectively 0%. But the moment you carry over even $1 from the previous month, that grace period vanishes. Now, you’re paying interest on new purchases the second you swipe the card. This is a nuance most digital calculators ignore. They assume you’ve stopped spending. But who actually stops spending while they’re paying off a card? Life happens. The car breaks. The dog needs the vet.

The Psychological Trap of the "Slider"

Go to any major financial site and look at their repayment tools. They usually have these sleek, interactive sliders. You slide the "monthly payment" bar to the right, and the "total interest" graph shrinks. It feels good. It feels like progress.

But it’s gamification.

Real debt repayment is gritty. It’s about the "Debt Avalanche" vs. the "Debt Snowball." If you’re using a payment calculator credit card to figure out your strategy, you need to decide if you care more about math or momentum.

- The Avalanche: You target the highest interest rate first. It’s mathematically superior. You pay the least amount of money over time.

- The Snowball: Dave Ramsey made this famous. You pay off the smallest balance first to get a "win." It’s mathematically "dumb" but psychologically brilliant.

A calculator can show you the dollars, but it can't show you your own discipline. I’ve seen people use a calculator, get a perfect plan on paper, and then abandon it because they didn't see a $0 balance fast enough.

How to Get an Honest Result

If you want a truly accurate picture, you can't just use a generic web form. You need to look at your specific card’s "Schumer Box"—that table on your agreement that lists all the fees. Are there annual fees? Are there "residual interest" charges?

Residual interest is the ghost that haunts your mailbox. It’s interest that accrues between the time your statement is printed and the time your payment actually lands. You might pay off your "full balance," only to find a $4.12 charge the next month. It’s annoying. It’s petty. And it's how they keep you in the system.

When using a payment calculator credit card, always round up your APR by 1% to account for these fluctuations and potential late fees. If the calculator says you'll be done in 18 months, plan for 20. Expecting the best-case scenario in debt repayment is a recipe for a relapse into overspending.

✨ Don't miss: Sri Lankan Rupee to INR: What Most People Get Wrong

Moving Beyond the Screen

A calculator is just a map. It isn't the car.

You can spend all day tweaking numbers on a screen, but unless you change the "input"—your actual cash flow—the output remains the same. The real value of these tools isn't the "total interest paid" figure. It's the "date of freedom."

Seeing "August 2027" as your finish line makes the debt real. It gives it an end. Without a date, debt feels like a life sentence. With a date, it’s just a project.

Actionable Steps to Take Right Now

- Find your actual Daily Periodic Rate. Divide your APR by 365. This is what you’re actually being charged every single day. If you have a $2,000 balance at 25%, you’re losing about $1.37 every day just to exist with that debt. That’s a coffee every four days literally set on fire.

- Use a "what-if" scenario. Take your current payment and add exactly $25. Plug that into a payment calculator credit card tool. The jump in time saved is usually shocking because that extra $25 goes 100% toward the principal, not the interest.

- Check for a promotional 0% APR offer. If your calculator shows you’re going to be paying thousands in interest, look into a balance transfer. Even with a 3% or 5% transfer fee, you’ll usually come out way ahead if you can pay it off within the 12-to-18-month promo window.

- Stop the bleeding. You cannot accurately calculate a payoff date if you are still adding to the balance. Use cash or a debit card for the next 30 days. It changes how the money feels.

- Audit your "Minimum Payment." Most banks set the minimum at 1% of the balance plus interest. As your balance goes down, your minimum payment also goes down. Do not let it. Keep paying the original, higher amount. This creates a "self-made" acceleration that cuts months off your timeline without you having to find "extra" money later on.

Debt is a math problem, but paying it off is a behavior problem. Use the tools to see the truth, then change the behavior to change the math. High-interest credit card debt is a financial emergency—treat it like one. No one ever looked back and regretted paying off their credit cards too fast.