If you look at the back of a dollar bill or glance at a corporate charter, you aren't exactly thinking about a small college in the woods of New Hampshire. But honestly, you should be. Without a nasty, 200-year-old legal brawl known as Dartmouth College v Woodward, the American economy would look totally different. Maybe even unrecognizable.

It started as a petty local power struggle. It ended as the bedrock of the American private sector.

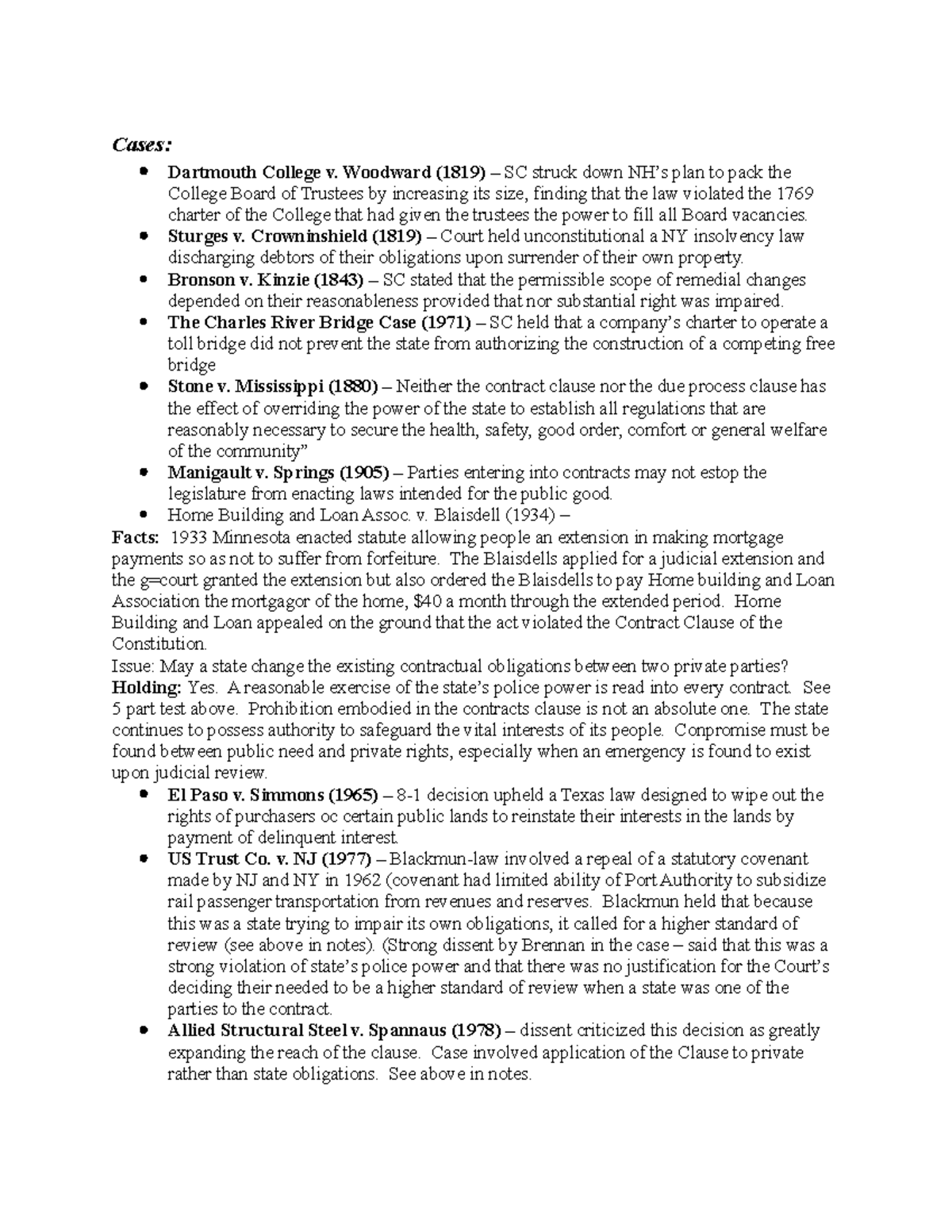

Back in the early 1800s, the state of New Hampshire tried to stage what was basically a hostile takeover of Dartmouth. They wanted to turn a private school into a public university. Simple enough, right? Wrong. This case went all the way to the Supreme Court in 1819, and the decision written by Chief Justice John Marshall fundamentally changed how contracts work in this country. It told every state government in the union: "Hands off."

The Petty Feud That Went Nuclear

Most people think landmark Supreme Court cases start with grand philosophical debates. This one started with a grudge. John Wheelock, the son of Dartmouth’s founder, was the college president and he was, by most accounts, a bit of a pill. He clashed with the school’s board of trustees over everything from religion to how the school was run.

Eventually, the trustees got fed up and fired him in 1815.

Wheelock didn't just walk away. He went to the New Hampshire state legislature, which was controlled by Jeffersonian Republicans who hated the Federalist-leaning Dartmouth board. The state decided to "fix" the problem by passing a law that increased the number of trustees and gave the governor the power to appoint them.

Basically, the state tried to legislate the private college out of existence and replace it with a state-run "Dartmouth University."

📖 Related: Target Town Hall Live: What Really Happens Behind the Scenes

The original trustees weren't having it. They sued William H. Woodward—the man who had been the college secretary but defected to the state’s side—to get their records and seal back. This wasn't just about books and stamps. It was about whether a state could rewrite a contract whenever it felt like it.

Daniel Webster and the "Small College" Tear-Jerker

When the case reached the Supreme Court, Dartmouth brought in their big gun: Daniel Webster. He was an alum, a powerhouse orator, and a man who knew how to work a room.

Webster’s argument was centered on the Contract Clause of the U.S. Constitution (Article I, Section 10). He argued that the original 1769 royal charter granted by King George III was a contract. Since the Constitution says states can't pass laws "impairing the Obligation of Contracts," New Hampshire’s attempt to take over the school was illegal.

The legend goes that Webster ended his four-hour argument with a line that supposedly brought tears to John Marshall’s eyes: "It is, sir, as I have said, a small college. And yet there are those who love it!"

Whether Marshall actually cried is up for debate, but he definitely agreed with the logic.

Why the Corporate World Should Thank Dartmouth

You might be wondering why a college dispute is categorized under business. Here’s why: before Dartmouth College v Woodward, the legal status of a "corporation" was shaky.

👉 See also: Les Wexner Net Worth: What the Billions Really Look Like in 2026

Was a corporation just a creature of the state that could be dissolved or changed on a whim? Or was it a "person" with rights?

Marshall’s opinion was a massive victory for the latter. He ruled that a corporation is an "artificial being, invisible, intangible, and existing only in contemplation of law." More importantly, he ruled that a charter is a contract.

This gave businesses a level of security they never had before. If you started a company and got a charter, you didn't have to worry that a new political party winning an election would suddenly seize your assets or change your bylaws. It created a stable environment for long-term investment.

The shift in legal landscape:

- Pre-1819: States often interfered with private charters for political reasons.

- Post-1819: Private property rights within a corporate structure became nearly "sacrosanct."

- Investment Impact: Capitalists felt safe pouring money into railroads, factories, and banks because the "rules of the game" couldn't be changed mid-stream.

Without this protection, the industrial revolution in the U.S. might have stalled. Why build a massive textile mill if the state can just vote to take it over next Tuesday?

The "Reservation" Loophole You Didn't Know About

Wait. If the government can't change contracts, how do we have regulations today?

Justice Joseph Story, who concurred with Marshall, dropped a hint in his opinion that states took very seriously. He suggested that if a state wants to retain the power to change a charter, they have to write that power into the charter from the very beginning.

✨ Don't miss: Left House LLC Austin: Why This Design-Forward Firm Keeps Popping Up

This led to what we now call "reservation clauses."

Nowadays, when a state grants a corporate charter or passes an incorporation law, they include a tiny bit of legalese that says, "We reserve the right to alter or repeal this." If New Hampshire had been smart enough to put that in the original 1769 charter, Daniel Webster would have lost, and Dartmouth would probably be a state school today.

Common Misconceptions About the Case

A lot of people think this case gave corporations the same rights as humans. Not exactly. That happened later with cases like Santa Clara County v. Southern Pacific Railroad (1886). Dartmouth was specifically about the sanctity of the contract.

Another big mistake is thinking this made corporations "untouchable." It didn't. The Supreme Court later clarified in Charles River Bridge v. Warren Bridge (1837) that while contracts are protected, they don't give corporations "implied" monopolies that hurt the public good.

It’s a balance. But Dartmouth was the first real weight on the scale for private enterprise.

What This Means for You Right Now

Understanding Dartmouth College v Woodward isn't just for history buffs. It's for anyone who deals with the intersection of government and business.

- Contractual Security: If you are a business owner, your articles of incorporation are your shield. The precedent set here still protects private entities from arbitrary "legislative takings."

- Regulatory Awareness: Check the "fine print" of state laws. Most states have now bypassed the Dartmouth ruling by passing general incorporation acts that include the right to amend. You aren't as protected as the Dartmouth trustees were, but the principle of the "contract" still limits how far the government can go.

- The "Vestige" of Private Power: This case explains why the U.S. has such a robust system of private universities compared to Europe. It’s why Harvard, Yale, and Stanford can remain independent of the government’s direct control over their curriculum or governance.

If you’re looking to dig deeper into how this impacts modern property law, your next move should be looking into the Takings Clause of the Fifth Amendment. While Dartmouth dealt with contracts, the Takings Clause deals with physical property, and together they form the "double-lock" on your assets.

Take a look at your own state’s incorporation statutes. You’ll likely find a "Reservation of Power" clause—that’s the direct, 200-year-old response to what happened in this case. Reading that fine print tells you exactly where your rights end and the state's power begins.