You’re standing in a different state, staring at a bank sign that isn't yours, and you need to deposit a paper check immediately. It’s a classic headache. Most people assume that if they belong to a small credit union in their hometown, they’re tethered to that one physical zip code forever. That’s just not true. Honestly, co op shared branch banking is one of the most misunderstood and underutilized perks in the entire financial world. It essentially turns thousands of independent credit unions into a single, massive, nationwide network that rivals the physical footprint of Chase or Bank of America.

It’s a bit of a "secret handshake" for credit union members.

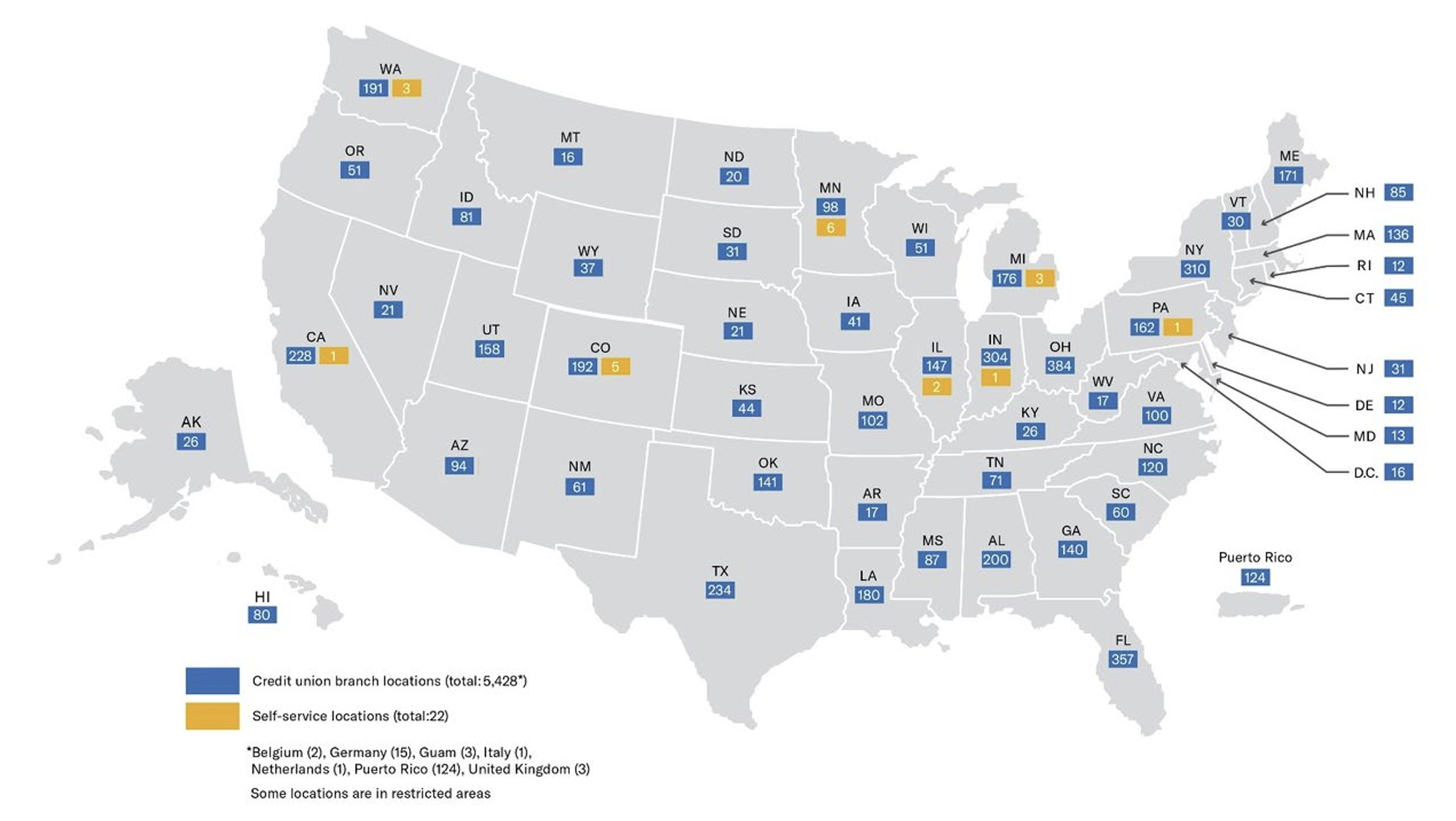

Most folks don't realize that the CO-OP Financial Services network actually encompasses over 5,000 shared branch locations. That is a staggering number. To put that in perspective, that’s more physical "branches" than many of the big-name national banks have. Yet, because each building has a different name on the door—maybe it’s "Navy Federal" on one street and "Local Teachers Credit Union" on the other—people drive right past, thinking they’re out of luck.

How the CO-OP network actually functions behind the scenes

So, how does a credit union in Seattle talk to a credit union in Miami? It’s not magic. It’s a shared data switch. When you walk into a participating guest branch, you’re basically using their staff as a front-end interface for your home institution. You give them your home credit union’s name, your account number, and a photo ID. They tap into the CO-OP system, verify your identity, and suddenly, that teller in a different state can see your balance just like the teller back home.

It's seamless.

But there are rules. You can't just walk in and expect to do complex wire transfers or open a new CD at a guest branch. The system is designed for the "meat and potatoes" of banking. Think deposits, withdrawals, loan payments, and transfers between your accounts. If you’re trying to dispute a charge or change your legal name on the account, the guest branch is going to tell you to call your home branch. They don’t have "deep" access to your sensitive files; they have "transactional" access.

🔗 Read more: FedEx in Maspeth Queens: What Most People Get Wrong

Why big banks don't want you to know about this

The biggest selling point for "Megabanks" has always been convenience. "We have an ATM on every corner," they say. And for a long time, that was a winning argument. Small credit unions were seen as local-only, great for a cheap car loan but terrible if you traveled for work or moved across the country. Co op shared branch banking completely nukes that disadvantage.

If you’re a member of a credit union that participates—and not all of them do, so you’ve gotta check—you effectively have access to more than 30,000 surcharge-free ATMs. That's a larger ATM network than almost any single commercial bank in the United States.

It’s kind of funny. You get the personalized, "we know your name" service of a local institution, but you retain the "I can find a branch in Vegas" convenience of a multinational corporation. It’s the best of both worlds, yet credit unions are notoriously bad at marketing this. They put a tiny, circular "CO-OP" logo on their front door or the back of your debit card, and that’s it. If you don’t know what that logo means, you’re missing out on the primary reason to stick with a credit union long-term.

The limits of the system: What you can’t do

Don't go in expecting the world.

💡 You might also like: Is JPMorgan Chase Bank the same as Chase Bank? What most people get wrong

While the network is vast, it has clear boundaries. For instance, most shared branches have a "check hold" policy that might be more stringent than your home branch. If you deposit a $5,000 check at a guest branch, don't be shocked if they hold the funds for a few extra days. They are taking on the risk for a member that isn't technically "theirs," so they play it safe.

- Cash withdrawal limits: Many shared branches cap your daily cash withdrawal at $500 or $1,000, regardless of what your home branch allows.

- Notary services: Some offer them to guest members; many don't.

- Coin counting: Forget about it. Most won't let guests use their coin machines for free.

- Mediating issues: If your debit card is blocked, the guest teller can't unblock it. You’ll be standing in their lobby on your cell phone calling your actual bank.

There’s also the "participation gap." While thousands of credit unions are in, some choose to stay out to save on the fees they have to pay to the CO-OP network. Before you go on a road trip, you need to use the CO-OP locator app or website. Just because a building says "Credit Union" doesn't mean it's part of the club.

The "Surcharge-Free" ATM vs. Shared Branching confusion

People often mix these two up. They are related but different. Surcharge-free ATMs are exactly what they sound like—you use a 7-Eleven ATM and don't get charged $4.00. Shared branching is much more involved. It’s about the human interaction inside the building.

Shared branching allows you to do things an ATM can’t.

- You can get a printed official check or money order (usually for a small fee).

- You can make a payment on your car loan using cash.

- You can sit down with a human if your phone died and you need to know your balance.

In an era where everything is digital, having a human backup is surprisingly valuable. If you lose your wallet while traveling, a shared branch can sometimes facilitate an emergency cash advance if your home credit union authorizes it. Try doing that with an online-only "neobank" or a giant corporation that requires a three-day waiting period for a replacement card.

Real world scenario: Moving without switching banks

Let’s talk about moving. Switching banks is a soul-crushing chore. You have to move your direct deposits, update twelve different streaming subscriptions, change your Amazon 1-Click, and wait for a new debit card to arrive in the mail. It's a nightmare.

With co op shared branch banking, you don't actually have to switch.

I know people who have kept their small-town Iowa credit union account while living in Los Angeles for a decade. They do 90% of their banking on an app, and for that 10% of the time they need a physical teller or a cashier's check, they just walk into a local California credit union that’s part of the network. It’s the ultimate "life hack" for financial stability. You keep the high interest rates or low-cost loans from your original institution but live your life anywhere.

👉 See also: Robert Edward Grant: Why the Math World is Suddenly Obsessed With Him

Is it actually secure?

Security is the first thing people worry about when they hear their data is being shared across a network. The CO-OP network uses the same encrypted rails that the major card networks (Visa/Mastercard) use. When a guest teller looks you up, they aren't seeing your whole life story. They see a "snapshot" of your account status.

Furthermore, the identification requirements at shared branches are usually stricter than at your home branch. At home, they might know your face. At a guest branch, they are going to scan your ID, maybe ask for the last four of your Social Security number, and verify your address. They have to be careful because if they give money to an impostor, it’s a massive headache for both credit unions involved.

Actionable steps for the savvy member

If you want to actually use this, don't wait until you're in an emergency.

- Check your card right now. Look for the CO-OP logo. It’s usually a stylized "CO-OP" in a circle or a square. If it’s there, you’re likely in.

- Download the CO-OP Locator App. Don't rely on Google Maps. Google Maps often labels everything generically. The official app tells you exactly which branches allow full "Shared Branching" versus just "ATM access."

- Memorize your account number. This sounds silly, but in the digital age, we rely on FaceID. If you walk into a shared branch, they need your specific account number and the exact legal name of your credit union. "The Teacher's one in Dayton" won't work in the search bar.

- Carry a physical ID. Shared branches cannot accept digital IDs or "I have a picture of it on my phone" in most cases. They need the plastic.

The beauty of this system is that it levels the playing field. It allows the "little guy" to act like a "big guy" without losing the community focus that makes credit unions better than banks in the first place. Next time you're out of town and need to handle business, don't look for a branch of your specific bank. Look for the logo. You'll save yourself a lot of stress and probably a few bucks in "out of network" fees.