You probably think rare earth metals are actually rare. Honestly, they aren't. You can find cerium or lanthanum in the dirt of your own backyard if you look hard enough. The "rare" part is a total misnomer from the 18th century that just stuck around like a bad habit. The real problem—the thing that keeps Pentagon generals and Tesla engineers up at night—isn't finding the stuff. It's the absolute nightmare of digging it up and refining it without destroying the planet in the process.

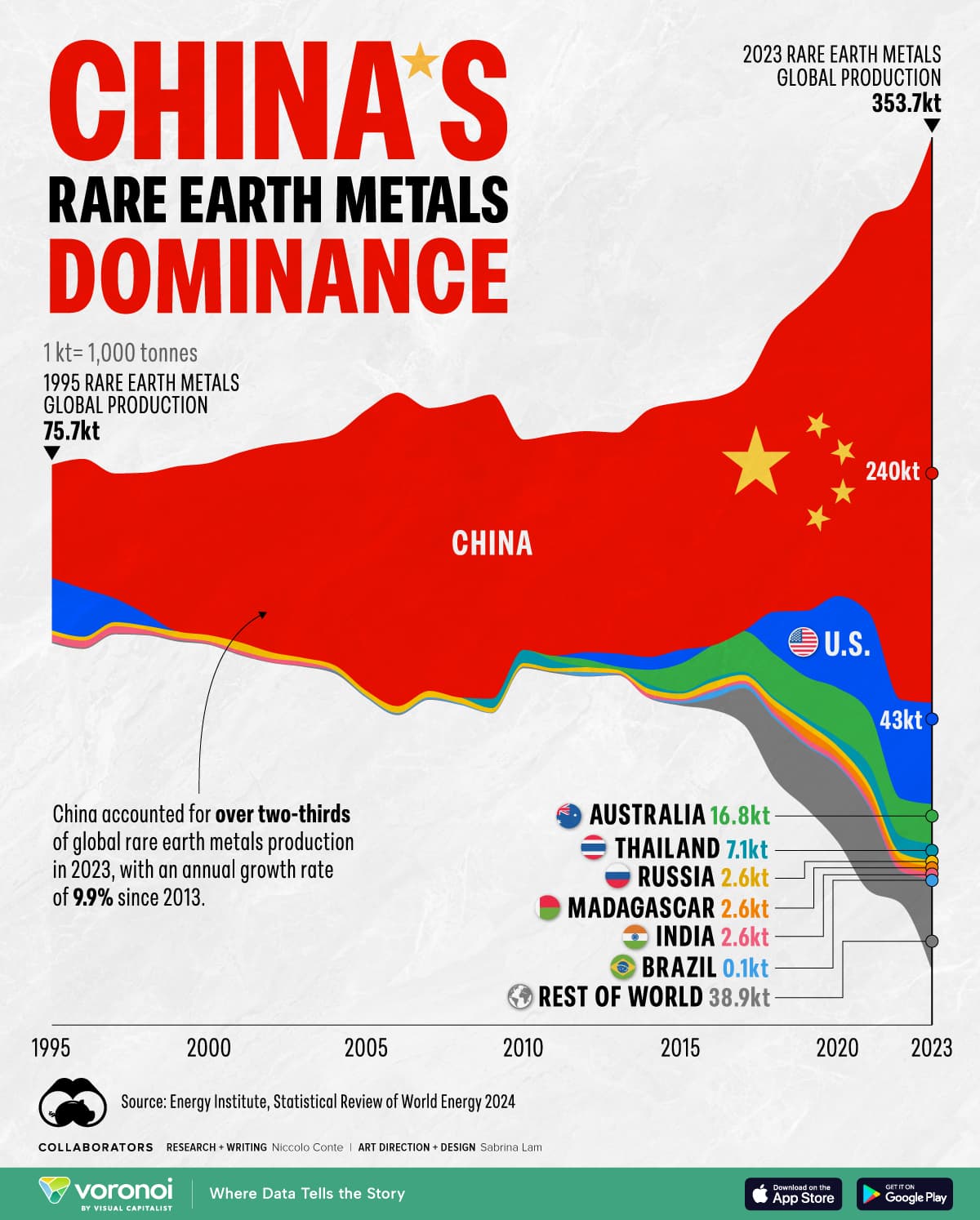

China figured this out decades ago. While the rest of the world was busy offshoring "dirty" industries to save a buck and clean up their own air, Beijing was playing the long game. They didn't just stumble into a monopoly. They built a vertically integrated machine that starts at the Bayan Obo mine in Inner Mongolia and ends in the permanent magnets inside your iPhone's haptic engine.

The messy truth about the China rare earth metals monopoly

It's not just about having the rocks. It's about the chemistry. Rare earth elements (REEs) are a group of 17 metals that look and act so much alike that separating them is like trying to sort grains of salt from grains of sugar using tweezers. It takes hundreds of stages of solvent extraction. It's acidic. It's toxic. Sometimes, it’s even radioactive because thorium and uranium usually hang out in the same ore.

For years, China was the only place willing to stomach the environmental cost. Deng Xiaoping famously said in 1992, "The Middle East has oil; China has rare earths." He wasn't kidding. By the early 2000s, they had effectively bankrupted almost every competitor by flooding the market with cheap supply.

Remember Mountain Pass? It’s a mine in California. It used to be the king of the world for REEs until the late 90s. Then, between environmental lawsuits and China's aggressive pricing, it went dark. It's back now, owned by MP Materials, but here's the kicker: for a long time, they still had to ship their concentrated ore to China for processing. You can dig the hole in America, but the "brain work" of the chemistry was happening across the Pacific.

Why these 17 elements actually matter to you

- Neodymium and Praseodymium (NdPr): These are the rockstars. Without them, you don't have high-strength permanent magnets. No magnets, no EV motors. No wind turbines.

- Dysprosium: Added to magnets so they don't lose their "stickiness" when they get hot. Crucial for high-performance engines.

- Europium: This is why your phone screen has such vibrant reds.

- Lanthanum: It's in the lens of your digital camera and the battery of every Toyota Prius ever made.

The 2010 wake-up call and why it failed

Back in 2010, a fishing trawler incident near the Senkaku Islands led to China reportedly cutting off exports to Japan. The world panicked. Prices for neodymium went vertical. Everyone swore they would diversify.

But they didn't. Not really.

Once prices settled back down, the "business as usual" gravity took over. Developing a mine takes 10 to 15 years. It’s expensive. Investors are fickle. Why spend $1 billion on a processing plant in Texas when you can just buy the finished magnet from a supplier in Ningbo for 30% less?

✨ Don't miss: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

The Mountain Pass mine is a great case study in how hard this is. They've spent hundreds of millions of dollars to bring refining capabilities back to U.S. soil. They’re making progress, but China isn't sitting still. In 2021, Beijing merged three state-owned giants into the China Rare Earth Group. This isn't just a company; it's a behemoth that controls roughly 60-70% of global production and even more of the refining capacity.

It’s the refining, stupid

We need to stop talking about mining. Mining is the easy part. The "Great Wall" China built is made of patents and processing expertise. According to data from the International Energy Agency (IEA), China accounts for about 60% of world REE mining but nearly 90% of the refining.

Think about that.

If you find a massive deposit in Australia (like Lynas Rare Earths did) or in Vietnam, you still have to deal with the tailings. You have to deal with the waste. China has refined the process of refining. They have thousands of chemists who have spent thirty years perfecting the separation of "heavy" rare earths like terbium and dysprosium.

The hidden "heavy" problem

Most people lump all rare earths together. That's a mistake. "Light" rare earths like lanthanum are actually in oversupply. We have too much of it. The real struggle is for the "heavies." These are rarer, harder to extract, and China has a near 100% lock on the ionic clay deposits in the south where these are found.

Can the West actually catch up?

There’s a lot of noise about "friend-shoring." You’ve got the Minerals Security Partnership, a bunch of countries like the US, Canada, and South Korea trying to build a supply chain that skips China.

It’s harder than it looks.

🔗 Read more: Missouri Paycheck Tax Calculator: What Most People Get Wrong

Take the Lynas refinery in Malaysia. It’s been a political football for years because of concerns over radioactive waste. In the West, "Not In My Backyard" (NIMBY) is a powerful force. To beat China at the china rare earth metals game, you have to be willing to build massive chemical plants.

There are some bright spots.

- MP Materials is finally moving toward "Stage II" production, aiming to produce refined oxides in Nevada.

- Iluka Resources in Australia is building a fully integrated refinery at Eneabba with government backing.

- Recycling. This is the big sleeper. We have tons of neodymium sitting in old hard drives and air conditioners. Companies like Energy Fuels are looking at ways to "mine" old electronics or even the waste from phosphoric acid production.

Misconceptions that drive experts crazy

I hear people say, "We should just reopen old mines." It’s not a faucet you just turn on. If a mine has been flooded for 20 years, it’s a disaster zone. Also, the grades of the ore might not be competitive anymore.

Another one: "We’ll just find a substitute."

Good luck.

Scientists have been trying to build "magnet-free" EV motors for a decade. BMW and Tesla have had some success with induction motors or externally excited synchronous motors that don't use rare earths. But there’s a trade-off. These motors are usually bigger, heavier, or less efficient. In the world of EVs, weight is everything. If you can use a tiny neodymium magnet to do the job of a massive copper coil, you take the magnet every time.

What’s next for the global supply chain?

We are entering a phase of "resource nationalism." China recently tightened export controls on gallium and germanium (not rare earths, but related tech metals) and has new regulations on the entire REE supply chain. They see these metals as a strategic lever.

If you're an investor or just someone worried about the future of tech, you have to watch the "Midstream." Forget who is digging the dirt. Watch who is building the separation plants.

The U.S. Department of Defense is now straight-up handing out grants to companies like Lynas and MP Materials to build domestic capacity. This isn't free-market capitalism anymore. It's industrial policy. It’s the government admitting that the market failed to account for the strategic risk of a single-source supply chain.

💡 You might also like: Why Amazon Stock is Down Today: What Most People Get Wrong

Actionable steps for the "post-China" era

If you're involved in manufacturing, investing, or policy, here is the reality of the situation.

Audit your Tier 3 and Tier 4 suppliers. Most companies know who they buy their motors from. They have no idea where that motor manufacturer gets their magnets. If China decides to squeeze the export of finished magnets—not just the raw ore—most of the global tech industry grinds to a halt in weeks. You need to know exactly how much "China risk" is baked into your components.

Look at the "Hollow" supply chain.

We have a gap in magnet manufacturing. Even if the U.S. refines the ore, we have very few facilities that can actually turn that powder into a high-grade sintered magnet. Support the development of the "metallurgy" phase, not just the "mining" phase.

Bet on circularity.

The most secure mine in the world is the one in our landfills. Technologies that can extract NdPr from e-waste are becoming more viable as prices stay volatile. Look into companies specializing in urban mining.

Keep an eye on Greenland and Vietnam. These are the two "wildcards." Vietnam has massive untapped deposits, and Greenland's Kvanefjeld project has enough rare earths to supply the world for decades—if they can ever get past the environmental and political hurdles.

The dominance of china rare earth metals isn't an accident of geography; it’s the result of thirty years of focused industrial intent. Breaking that dominance won't happen with a few press releases or a single mine opening. It’s going to take a decade of messy, expensive, and technically difficult work.

Basically, the era of "cheap and easy" is over. Welcome to the era of "secure and expensive."