Ever wonder who actually controls the money in your wallet? It isn’t just some giant computer at the Treasury. It’s basically seven people sitting in a massive, marble building in D.C. Each governor of the Federal Reserve holds a terrifying amount of power over whether you can afford a mortgage or if your grocery bill is going to double by next Tuesday. Most people think the Fed is just Jerome Powell and a bunch of nameless suits. Honestly, that’s a huge mistake. The Board of Governors is the actual engine of the American economy, and their decisions ripple through every single bank account on the planet.

They aren't elected. You can't fire them just because you're mad about gas prices. These are presidential appointees who serve 14-year terms—long enough to see multiple presidents come and go. It’s a weird, insulated world where a single speech about "inflationary pressures" can wipe out billions in stock market value in under ten seconds.

What Does a Governor of the Federal Reserve Actually Do All Day?

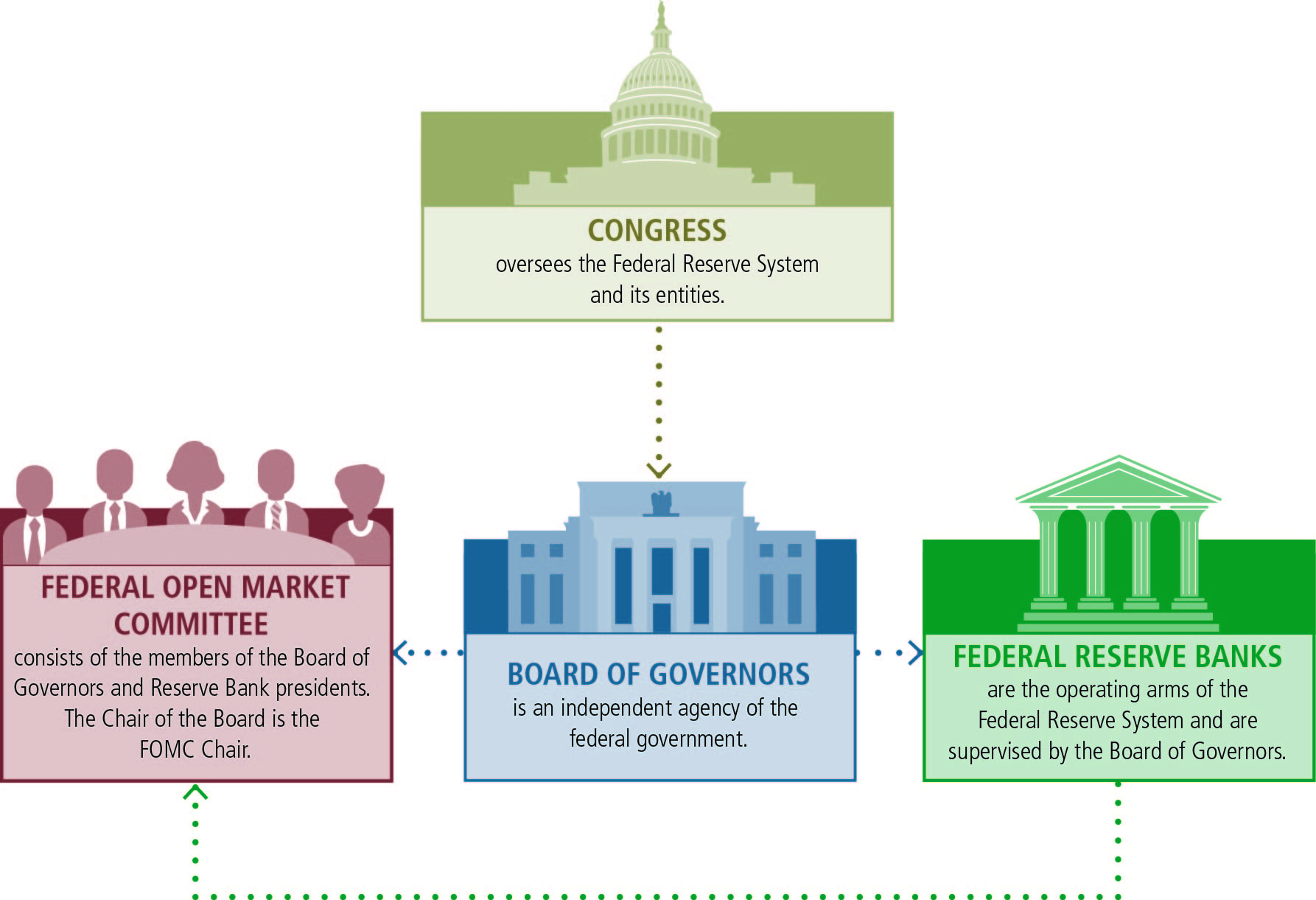

You might think they just stare at spreadsheets. While there’s a lot of that, the job is mostly about high-stakes gambling with the future of the dollar. The Board of Governors, located in Washington, D.C., oversees the 12 regional Reserve Banks. They are the ones who set the "discount rate" and "reserve requirements." If those terms sound like jargon, think of it this way: they decide how much it costs for banks to exist and lend money.

When a governor of the Federal Reserve speaks, they are usually trying to manage "expectations." If the public thinks prices will go up, they start buying stuff now, which actually makes prices go up. It’s a self-fulfilling prophecy. So, a governor spends a huge chunk of their time trying to convince the world that everything is under control, even when the data looks like a total mess.

They also sit on the Federal Open Market Committee (FOMC). This is the group that meets eight times a year to decide if interest rates are going up, down, or staying put. Unlike the regional presidents who rotate their voting power, every single governor gets a vote every single time. They are the permanent establishment of American monetary policy.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

The 14-Year Shield

Why 14 years? It seems like forever. It’s meant to be. The idea is that we don’t want a governor of the Federal Reserve worrying about the next election cycle. If they had to run for office, they’d be tempted to keep interest rates low forever to make the economy look "fake good" while letting long-term inflation rot the system. By giving them over a decade of job security, they can make the "painful" choices—like hiking rates during a recession—without getting canned by a grumpy politician.

Actually, it’s rare for a governor to serve the full 14 years. Most of them get burnt out or lured away by massive private-sector paychecks after five or six. But that protection is there as a "firewall" between politics and the printing press.

The Names You Should Probably Know (Besides Powell)

Jerome Powell is the Chair, sure. He’s the face. But the Board is a collective. You’ve got people like Philip Jefferson, the Vice Chair, and Michael Barr, the Vice Chair for Supervision. Barr is basically the "cop" on the beat for the big banks. After the 2023 banking jitters with Silicon Valley Bank, his role became arguably one of the most stressful in the country. He’s the one looking at the "stress tests" to make sure the big guys aren't taking stupid risks with your deposits.

Then you have governors like Christopher Waller or Michelle Bowman. They often represent different "vibes" on the board. Some are "hawks" who want to crush inflation at any cost. Others are "doves" who worry more about people losing their jobs. It’s a constant tug-of-war. If you want to know where the economy is going, you stop looking at the headlines and start reading the "minutes" of their meetings to see who is arguing with whom.

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

Why This Matters for Your Savings Account

When a governor of the Federal Reserve decides that the economy is "overheating," they tighten the screws. This makes it more expensive for you to buy a car. It makes it harder for a small business to get a loan to expand. But, on the flip side, it finally gives you some interest on your savings account. For a decade, savers were basically getting zero. Now, because of the Board’s recent aggressive hikes to fight post-pandemic inflation, you can actually find CDs and savings accounts paying 4% or 5%.

It’s a balancing act. Too much tightening and you trigger a massive recession. Too little and your dollar buys half a loaf of bread instead of a whole one.

The Regulatory "Hammer"

Beyond interest rates, these governors have a massive say in "fintech" and crypto. They are currently debating whether the U.S. should have a "Central Bank Digital Currency" (CBDC). This is a huge, controversial topic. Some governors are worried it will kill privacy, while others think it’s the only way to keep the dollar competitive against China’s digital yuan. When you hear a governor of the Federal Reserve give a talk at a university or a trade group, they are often "floating" these ideas to see how the market reacts.

Common Misconceptions About the Board

- They are part of the government. Sort of, but not really. They are an independent agency. They don’t get money from Congress; they actually make money from interest on the securities they hold and send the "profit" back to the Treasury. It’s a weird hybrid of a public agency and a private bank.

- They can print unlimited money. They can increase the money supply, but it’s not just a "print" button. It’s done through complex bond buying and selling.

- They all agree. Absolutely not. There are often "dissents." If you see a governor formally dissent from a rate decision, pay attention. It usually means a big shift in policy is coming in the next six months.

How to Track What’s Happening

If you actually want to stay ahead of the curve, don't wait for the evening news. The Federal Reserve website posts the full schedule of "Speeches and Testimony." If three different governors are speaking in one week about "labor market tightness," you can bet your house that a rate hike is being discussed behind closed doors.

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

Watch the "Beige Book" too. It’s a report published eight times a year that summarizes economic conditions in each district. The governors use this to argue their points. If the Beige Book says businesses in the Midwest are struggling to find workers, the governors are going to be much more cautious about raising rates further.

Actionable Steps for Navigating Fed Policy

Instead of just worrying about what a governor of the Federal Reserve might do next, you should position yourself to be "Fed-proof."

- Lock in fixed rates now if you think inflation is going to stay sticky. If the governors are sounding "hawkish," your window for a cheap loan is closing.

- Watch the "Dot Plot." This is a literal chart of dots where each governor and regional president "plots" where they think interest rates should be in the future. It’s the closest thing we have to a crystal ball.

- Diversify your cash. Don't keep everything in a standard checking account that pays 0.01%. When the Fed raises rates, move that money into high-yield accounts or Treasury bills.

- Follow the speeches, not the headlines. Read the actual transcripts on the Fed’s "News & Events" page. Journalists often oversimplify things; the nuance in a governor's actual words is where the real money is made.

The Federal Reserve isn't some shadow cabal, but it isn't a simple government office either. It’s a collection of people trying to steer a massive, chaotic ship using data that is often weeks or months old. Understanding the humans behind the "Governor" title is the first step to making sense of why your world costs what it does. Keep an eye on the "Summary of Economic Projections" (SEP). That's where the Board of Governors puts their reputations on the line by predicting where unemployment and GDP are headed. If they start revising those numbers downward, it’s time to batten down the hatches.