You're standing at the ATM, or maybe you're staring at your Venmo balance, wondering why that "instant" transfer is taking three days. It's frustrating. Honestly, in a world where we can beam 4K video from a satellite to a phone in seconds, the fact that our banking system still takes a nap because it’s a random Monday in October is kind of wild. But that’s the reality of the Federal Reserve system. If you don't keep a close eye on bank holidays 2025 usa, you’re going to end up with a late fee or a bounced check eventually.

Banks don't just close because they want to give tellers a break. They close because the Federal Reserve—the big engine that moves money between institutions—shuts down its settlement services. No FedWire? No ACH? No movement.

The 2025 Schedule: When the Vaults Actually Lock

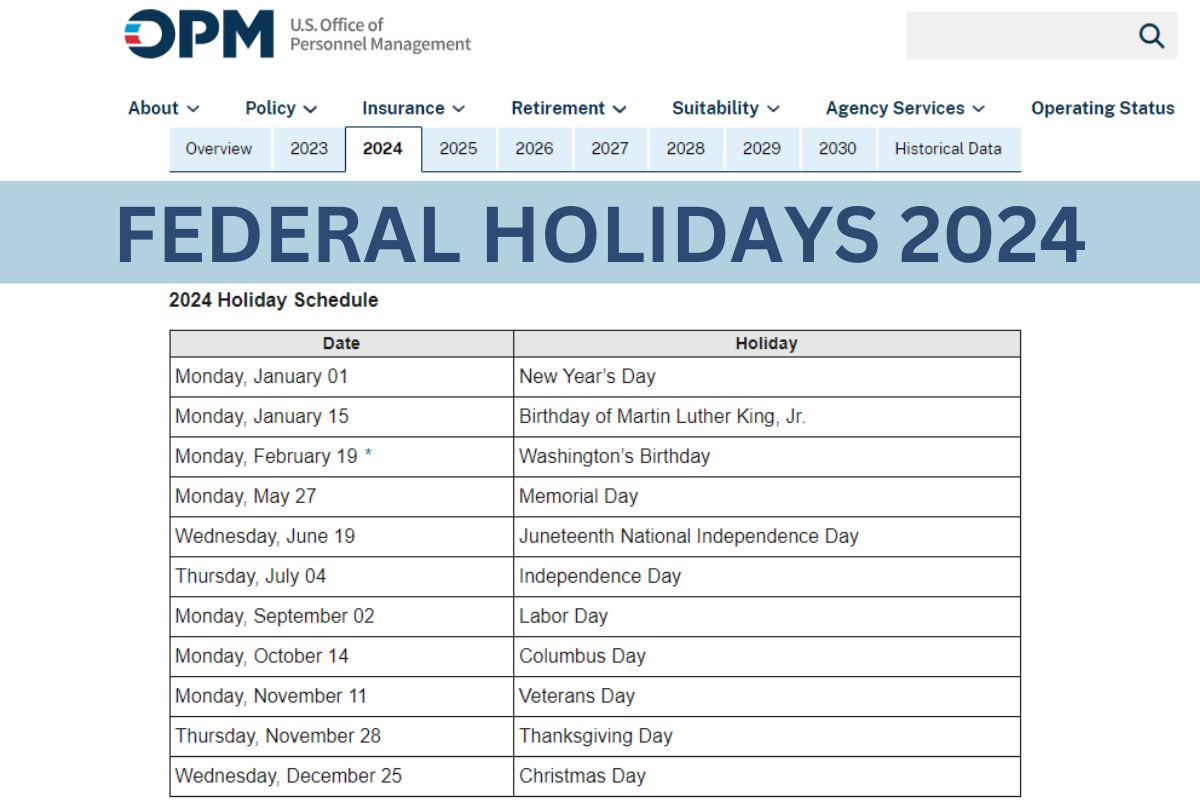

Most people think bank holidays are just "the big ones" like Christmas or the 4th of July. But 2025 has a few quirks. Because some holidays fall on weekends, the "observed" dates shift, which is usually where the confusion starts.

New Year’s Day is straightforward; it hits on a Wednesday. But things get interesting quickly. Martin Luther King Jr. Day lands on January 20th. Then you’ve got Washington’s Birthday (most of us just call it Presidents' Day) on February 17th.

Here is the thing about Memorial Day on May 26th: it’s the unofficial start of summer, but it’s also the first big "payment trap" of the year. If you have a bill due on the 1st of June, and you wait until that Monday to click "pay," you’re already behind.

Juneteenth is officially a federal holiday now, falling on Thursday, June 19th. Independence Day is Friday, July 4th, which means a long weekend for most of the country—and a total standstill for banking transactions. Labor Day is September 1st.

Then we get into the fall. Indigenous Peoples' Day (or Columbus Day, depending on your state's naming convention) is October 13th. Veterans Day is Tuesday, November 11th. Thanksgiving is November 27th. And finally, Christmas Day on Thursday, December 25th.

Why "Observed" Dates are a Massive Headache

When a holiday falls on a Sunday, the banks usually close on the following Monday. If it falls on a Saturday, the Federal Reserve Bank and its branches typically stay open on the preceding Friday, but the "Board of Governors" might be closed. It sounds like a bunch of bureaucratic nonsense because, frankly, it is.

✨ Don't miss: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

For 2025, we don't have many Saturday/Sunday collisions for the major holidays, which makes the calendar a bit cleaner than previous years. Still, you have to be careful.

Most people don't realize that while your local "Bank of America" or "Chase" branch might have its lights off, their mobile app is still running. But—and this is a huge but—the processing doesn't happen. You can deposit a check via your phone on Labor Day. The app will say "Success!" but that money isn't truly "there" until the Fed reopens on Tuesday. If you spend that money on Monday night? Overdraft. It's a trap.

The Fed's Role and Why Your Direct Deposit is Late

Every time you get paid, a system called the Automated Clearing House (ACH) is doing the heavy lifting. This system is old. It was designed in the 1970s. It relies on the Federal Reserve being "awake."

When bank holidays 2025 usa roll around, the ACH system pauses. If your payday is Friday, July 4th, 2025, your employer actually has to submit payroll by Wednesday to make sure you get paid on Thursday. If they miss that window? You aren't getting paid until Monday, July 7th.

Think about that for a second. That's three extra days without your paycheck. If your rent is due on the 5th, you’re in trouble.

Real World Example: The Veterans Day Tuesday Trap

Look at November 11th, 2025. It’s a Tuesday. This is a "mid-week" holiday. Most people don't take the day off. You're at work. Your boss is at work. But the Fed is closed.

I’ve seen dozens of cases where small business owners forget about Veterans Day. They try to run their weekly vendor payments on Monday night, thinking they'll clear Tuesday. Nope. They won't clear until Wednesday. That one-day delay can trigger "failed payment" flags in automated systems like AWS or insurance providers. It's a mess.

🔗 Read more: Dealing With the IRS San Diego CA Office Without Losing Your Mind

Is "Instant" Really Instant?

You've probably seen "Real-Time Payments" (RTP) or the new "FedNow" service being talked about in the news. These are supposed to fix the holiday problem. In theory, FedNow allows banks to move money 24/7/365.

The catch? Your bank has to opt in.

While many big banks are starting to use FedNow, plenty of smaller credit unions and local banks aren't there yet. Even if your bank uses it, the sending bank has to use it too. It’s like iMessage—if one person is on an old flip phone, the whole group chat breaks. Until we have 100% adoption, the 2025 bank holiday schedule remains the law of the land for your wallet.

Regional Variations You Haven't Considered

State holidays are a whole other ballgame. In Massachusetts and Maine, they celebrate Patriots' Day in April. In Texas, you've got Texas Independence Day.

While these aren't "Federal" holidays—meaning the Federal Reserve stays open—your local branch might still be closed. If you need to go into a physical building to sign a mortgage paper or get a cashier's check, you're stuck. Always check your specific bank’s "local branch" locator. A "Bank Holiday" in Boston might look very different from one in Miami.

The Crypto and Fintech Mirage

People love to say, "Bitcoin never sleeps!" or "My fintech app doesn't care about holidays!"

That's half true. The blockchain doesn't sleep. But the "on-ramps" and "off-ramps" do. If you want to move $5,000 from your Coinbase account to your Wells Fargo account on Thanksgiving 2025, you are going to be waiting. The digital world is still tethered to the physical world by some very old, very slow pipes.

💡 You might also like: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

Strategizing Your 2025 Cash Flow

Don't let the calendar win. You need to be proactive.

First, look at your "autopay" settings. Most credit card companies are smart enough to pull funds before a holiday, but some aren't. If you have a bill due on a holiday, manually move the payment date to two business days prior.

Second, if you're a freelancer or a small business owner, send your invoices earlier in months with "Monday holidays." September (Labor Day) and October (Indigenous Peoples' Day) are notorious for causing cash flow gaps.

Third, keep a "buffer" of at least $500 in your checking account specifically for holiday lag. This prevents the "I deposited a check but the money isn't available" overdraft cycle.

2025 Bank Holiday Checklist

Check your payroll schedule if you get paid on the 1st, 15th, or Fridays.

Mark November 11th (Veterans Day) specifically because mid-week holidays are the easiest to forget.

Remember that "Transfer to Savings" might take longer in June due to the Juneteenth/Independence Day cluster.

Confirm if your local credit union follows the federal schedule or adds their own regional days.

Moving Forward Without the Stress

The best way to handle bank holidays 2025 usa is to treat them like they don't exist—meaning, act as if the bank is closed every Friday. If you get your financial tasks done by Thursday afternoon, the Federal Reserve's nap schedule won't affect your life.

Planning for these gaps isn't just about avoiding fees; it's about peace of mind. Nobody wants to spend their Christmas Eve wondering if their mortgage payment cleared. Take five minutes now to put these dates in your digital calendar with a "two-day prior" alert. Your future self will thank you.

Your Action Plan:

- Open your calendar app right now.

- Manually input the 11 federal bank holidays for 2025.

- Set a recurring reminder for the Wednesday before every Monday holiday to check your account balances.

- Call your bank and ask if they have implemented "FedNow" for instant settlements yet. If they haven't, you know you need to be extra cautious with your timing.

- If you run a business, notify your clients in December 2024 about how your payment processing will change during the 2025 holiday windows to manage their expectations.