You've probably looked at your portfolio recently and winced. If you're holding names like ExxonMobil, Chevron, or even the smaller shale players, the sea of red is hard to ignore. It feels counterintuitive, doesn't it? We’re constantly hearing about global instability and "energy security," yet the market is treating oil companies like they’re going out of style.

Honestly, the reason why are oil stocks down isn't just one thing. It's a messy, overlapping pile of oversupply, cooling geopolitical tempers, and a massive shift in where big money is actually flowing.

Basically, the "scarcity" fear that drove prices up for the last couple of years has evaporated. We’ve entered a period where there is simply too much oil and not enough urgent demand to soak it up.

The Wall of Supply: Why the Market is Flooded

The biggest headache for energy investors right now is a literal wall of crude hitting the market. For a long time, the narrative was that we weren't drilling enough. That's dead. In fact, it’s the opposite.

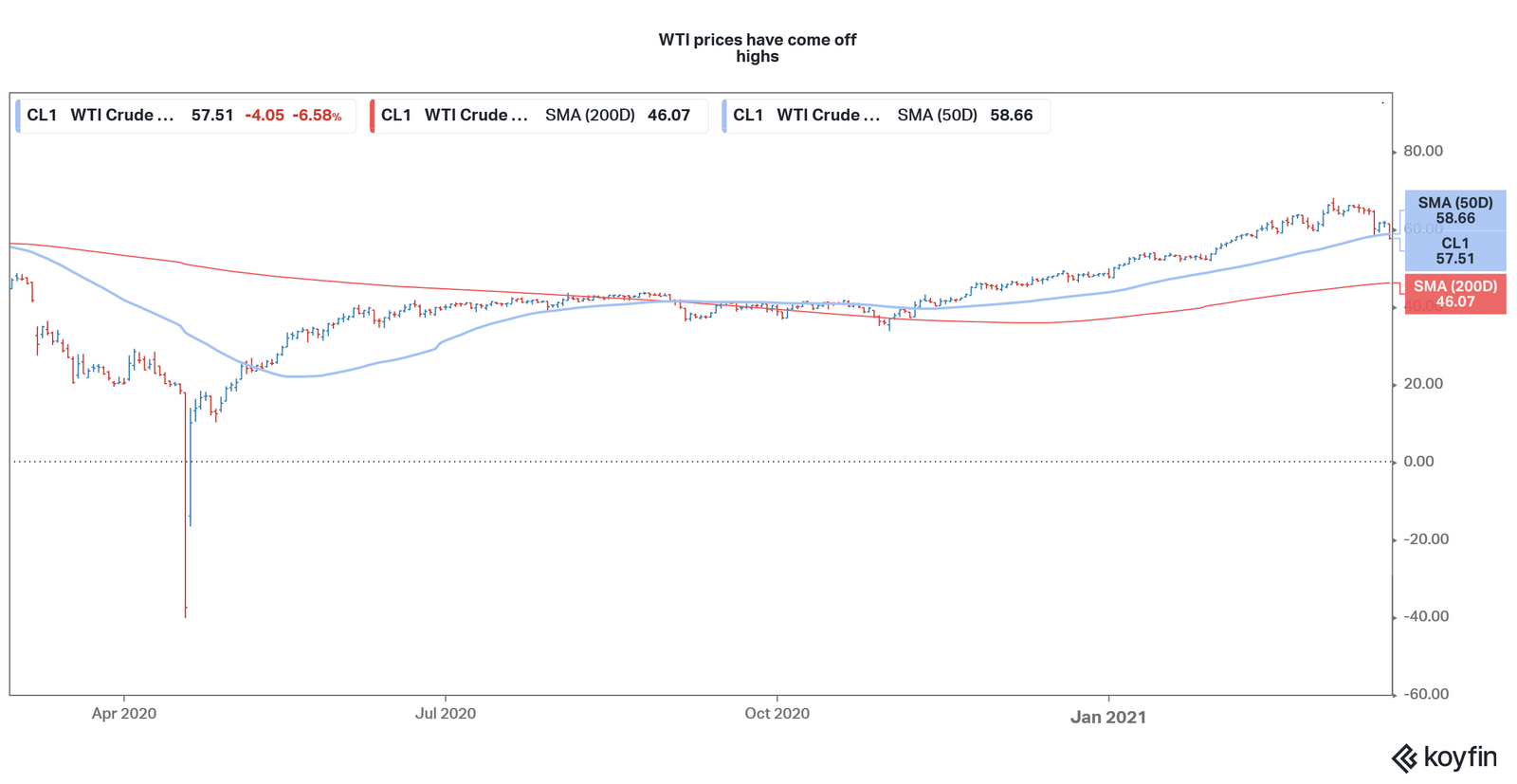

The U.S. Energy Information Administration (EIA) recently dropped a bombshell in its short-term outlook, predicting that global oil production will outpace demand throughout 2026. When you have more barrels than buyers, the math is simple and brutal: prices tank. Brent crude is already hovering around $59, and many analysts expect it to dip into the low $50s before the year is out.

👉 See also: Cost of 10k Gold per Ounce: Why the Market is Acting So Weird Right Now

Why OPEC+ Can't Save the Day This Time

Usually, when prices fall, OPEC and its allies (OPEC+) step in to cut production. They’re the "swing producers" that keep the floor from falling out. But there's a weird tension in the group right now. While they’ve officially paused production increases through the first quarter of 2026, there’s a lot of "cheating" going on behind the scenes.

Countries like the UAE and Kazakhstan have been ramping up capacity. They’ve spent billions on new fields and, frankly, they want to start seeing a return on that investment. If everyone else is selling, why should they stay quiet? This internal friction makes the market nervous that a price war—where everyone pumps at max capacity to steal market share—could be just around the corner.

The "Trump Put" and Easing Geopolitical Fear

Geopolitics used to be the "risk premium" that kept oil stocks high. If there was a whisper of trouble in the Middle East, prices jumped $5. Not anymore.

- The Iran Factor: Earlier this month, everyone was bracing for a massive escalation between the U.S. and Iran. But then, the rhetoric cooled. President Trump hinted at a diplomatic path rather than a military one.

- The Venezuela Shift: There’s been a significant regime shift and the potential return of Venezuelan crude to the global stage.

- The Russia Reality: Despite ongoing sanctions, Russian oil is still finding its way to China and India, albeit at deep discounts.

The "fear" is gone. Investors have realized that the world is actually quite good at finding workarounds for supply disruptions. When the "war premium" vanishes, the stock price follows it down.

Why Are Oil Stocks Down While Natural Gas is Rising?

Here is the part that catches most retail investors off guard. The energy sector is currently splitting in two. While oil is struggling, natural gas is having a "mini-boom."

Why? One word: AI.

The massive data centers required to run artificial intelligence need a staggering amount of 24/7 power. Wind and solar are great, but they’re intermittent. Nuclear takes decades to build. That leaves natural gas as the "dispatchable workhorse" of the 2026 economy. Morgan Stanley recently noted a clear preference for gas over oil, highlighting that gas demand for electricity is surging while oil for transportation is hitting a ceiling thanks to EV adoption and better fuel efficiency.

If you're wondering why are oil stocks down, it’s often because the big institutional "smart money" is rotating out of crude-heavy companies and into firms with heavy natural gas and grid-stabilization assets.

The Efficiency Trap and the "Operational Show Me" Period

We also have to talk about how good oil companies have become at their jobs. It sounds like a good thing, right?

Well, U.S. shale producers are now so efficient that they can stay profitable even at $50 a barrel. They’re using AI-driven drilling and "fracking 2.0" techniques to squeeze more oil out of every well for less money. This means the "supply squeeze" we all expected never happened because technology kept the taps wide open.

But for a stock price to go up, you need a story of growth and rising margins. If a company is just "efficiently surviving" in a low-price environment, the stock becomes a boring utility play rather than a high-growth engine. Investors are bored, and in the stock market, boredom is a sell signal.

Actionable Insights for the "New Normal"

If you're currently staring at your energy holdings and wondering what to do, here’s how to navigate this mess without losing your shirt.

- Check the "Gas-to-Oil" Ratio: Look at your holdings. Are they pure-play oil drillers? If so, they’re likely to face continued headwinds. Companies with a diversified portfolio that includes significant natural gas assets are much better positioned to ride the AI power surge.

- Focus on the Dividends, Not the Chart: Many of the majors like Chevron are still printing cash, even at $60 oil. If you're a long-term investor, the "paper loss" on the stock price matters less than the 4-5% dividend yield. If the dividend is safe, you can afford to wait.

- Watch the $50 Floor: J.P. Morgan research suggests that the U.S. administration won't let oil stay below $50 for long, as that’s where shale production starts to actually break. If we hit $50, that might be the "buy the blood" moment.

- Stop Trading the Headlines: The "breaking news" about a pipeline leak or a minor protest doesn't move the needle like it used to. Focus on the inventory builds. If the weekly EIA reports keep showing builds (more oil in storage), the stocks will stay down regardless of what's happening on the news.

The reality is that the oil market is rebalancing for a world that needs less of it for cars but more of its cousins for electricity. It's a painful transition for stockholders, but it's not a total collapse—it's just a very loud, very red wake-up call.

Next Steps for Your Portfolio:

Review your energy holdings for "Debt-to-Equity" ratios. In a low-price environment, companies with high debt are the first to get crushed. Shift your focus toward "low-cost-of-supply" operators who can survive a prolonged period of $55 Brent. For more specific analysis, you can look into the Q1 2026 earnings previews for the major integrated firms to see how their hedging strategies are holding up against the price drop.