It feels like a lifetime ago that you could snag a 30-year fixed rate under 3%. People were refinancing their homes just because they could. Now? You’re lucky to see anything starting with a six, and for a lot of buyers, that jump from 3% to 7% isn't just a "bummer." It’s a total dealbreaker. It’s the difference between owning a three-bedroom ranch and staying in a cramped apartment for another three years.

So, why are mortgage rates so high right now? Honestly, there isn't just one "bad guy" to point a finger at, though most people love to blame the Federal Reserve and leave it at that. It's more like a messy divorce between the housing market and the economy. To really get it, you have to look at how inflation, the bond market, and global jitters all crashed the party at the same time.

The Fed’s War on Your Wallet

Let's talk about Jerome Powell. As the Chair of the Federal Reserve, he’s basically the thermostat dial for the U.S. economy. When things got way too hot after the pandemic—meaning inflation started spiraling—the Fed had to turn the "cooling" way up. They did this by raising the federal funds rate.

Wait.

The Fed doesn't actually set mortgage rates.

That’s a common myth. What they do is set the rate that banks charge each other for overnight loans. But when it costs banks more to move money around, they pass those costs on to you. It’s a ripple effect. If the Fed raises rates 11 times in two years, your local lender isn't going to keep handing out cheap money. They can't afford to.

It’s Actually About the 10-Year Treasury Yield

If you want to know what your mortgage rate will look like tomorrow, stop looking at the Fed and start looking at the 10-Year Treasury note. This is the real secret sauce. Investors view 10-year government bonds as one of the safest bets on the planet. Mortgage-backed securities (MBS)—which are basically bundles of home loans sold to investors—have to compete with those bonds.

👉 See also: Advertising Marketing News Today: Why The Most Interesting Man is Back

Lenders usually want a "spread" or a profit margin of about 1.7 to 2 percentage points above the 10-year yield. Lately, that spread has been weirdly wide, sometimes hitting 300 basis points. Why? Because the market is terrified of volatility. If investors aren't sure where the economy is going, they demand a higher "risk premium" to buy mortgage debt. That premium gets tacked right onto your monthly payment.

Why Are Mortgage Rates So High When Inflation Is Dropping?

This is the part that drives everyone crazy. You see the headlines saying inflation is cooling off, yet the 30-year fixed rate stays stubbornly stuck in the mud.

Economy stuff is laggy.

Investors are like elephants; they have long memories. They remember the sting of 9% inflation in 2022. They aren't going to lower the rates they demand on mortgage bonds until they are 100% sure that the "inflation monster" is dead and buried. If the labor market stays too strong—meaning everyone has jobs and is spending money—the Fed stays nervous. If the Fed stays nervous, the bond market stays jittery. If the bond market stays jittery, your mortgage stays expensive.

The "Lock-In" Effect Is Making It Worse

Here is a weird twist you might not have considered: the supply of homes is part of the problem.

Think about it. If you have a 2.75% mortgage right now, are you going to sell your house and buy a new one at 7.5%? Probably not. You’re "locked in." This has effectively frozen the housing market. Since nobody is selling, the inventory of "existing homes" has cratered. When supply is low, home prices stay high.

So, not only are you dealing with high interest rates, but you’re also dealing with high principal prices because there aren't enough houses to go around. It's a double whammy that hasn't really been seen in the U.S. market since the late 1970s and early 80s under Paul Volcker. Back then, rates hit 18%. We aren't there yet, but it sure feels heavy compared to the "free money" era of 2020.

📖 Related: What's the Price of Silver Per Ounce Right Now: Why It’s Smashing Records

Global Chaos and the Dollar

We also have to look at the rest of the world. When there’s a war in Ukraine or tension in the Middle East, global investors get scared. They run to the "safe haven" of the U.S. dollar. Usually, high demand for U.S. debt (bonds) can push rates down, but we are in a strange cycle where the government is also running massive deficits.

The U.S. Treasury has to issue a ton of new debt to pay the country’s bills. When there’s a massive supply of new bonds hitting the market, the price of those bonds drops, and the yield (the interest rate) goes up to attract buyers. Your mortgage rate is essentially hitched to that rising wagon.

How to Navigate This Mess

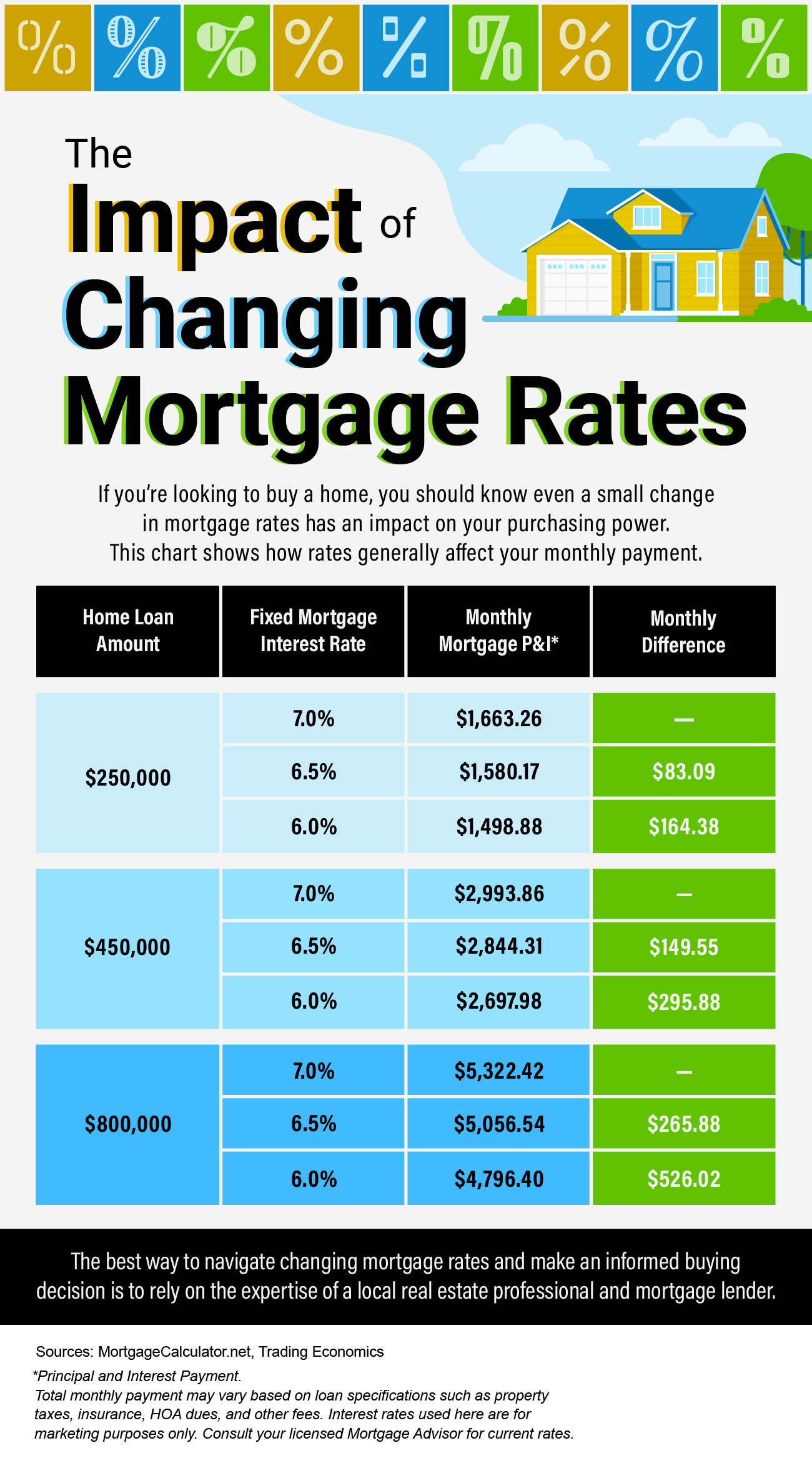

You can't control the Fed. You can't control the 10-year Treasury yield. But you can control how you approach the market. Waiting for rates to drop back to 3% is likely a fantasy; most experts, including those at the National Association of Realtors (NAR) and Fannie Mae, suggest that 5.5% to 6.5% might be the "new normal" for the foreseeable future.

Practical Steps for Homebuyers Right Now

- Focus on the "Buy-Down": Many builders and sellers are so desperate to move inventory that they will pay to "buy down" your interest rate. This involves paying points upfront to lower your rate for the first 2-3 years. It’s a huge win if you plan to refinance later.

- Improve Your Credit Score (Actually): In a high-rate environment, the gap between "Good" and "Excellent" credit can mean $200 a month in savings. If you aren't at a 760 or higher, take six months to pay down revolving debt before applying.

- Look at Adjustable-Rate Mortgages (ARMs): They used to be scary because of the 2008 crash, but modern ARMs have better caps and protections. If you only plan to stay in the home for 5 to 7 years, a 5/1 ARM might give you the breathing room you need.

- Shop Local Credit Unions: Big national banks have massive overhead and often have stricter pricing. Small, member-owned credit unions sometimes keep loans "on their books" rather than selling them to investors, which means they can occasionally offer rates 0.5% lower than the big guys.

- The "Marry the House, Date the Rate" Strategy: It's a cliché for a reason. If you find the perfect house in a neighborhood where prices are rising, it might be better to buy now at 7% and refinance at 5% in two years than to wait for 5% and find that the house now costs $100,000 more.

The reality of why are mortgage rates so high is a mixture of aggressive inflation-fighting, a nervous bond market, and a massive shift in how the world views U.S. debt. It's a tough pill to swallow for anyone trying to get their foot in the door of homeownership. The best move is to stop waiting for a "crash" that might never come and start looking for ways to make the current math work for your specific budget.

Compare different loan types beyond just the 30-year fixed. Run the numbers on a 15-year mortgage if you can swing the payment, as these often carry significantly lower rates. Check for state-specific first-time homebuyer programs that offer down payment assistance or subsidized interest rates to help offset the monthly cost.