Death is weird. We spend our whole lives collecting stuff—passwords, property, memories, and a mountain of digital "junk"—but we rarely think about the absolute chaos left behind for the people we love. It’s a mess. Honestly, most of us just assume someone will "figure it out." But if you’ve ever seen a grieving spouse sit at a kitchen table crying because they can't get into a locked MacBook or find the deed to the house, you know that "figuring it out" is a nightmare. This is where an if i die folder comes in.

It isn't just a morbid file under your bed. It's a manual.

People call it different things: a "Legacy Binder," a "Death Folder," or my personal favorite, the "Swedish Death Cleaning" starter pack. Whatever the name, the goal is simple. You are centralizing the logistics of your existence so your family can grieve without having to play private investigator.

What Actually Goes Into an If I Die Folder?

Most people think it’s just a will. It's not. A will is a legal document that tells the state what to do with your money. An if i die folder is the gritty, tactical stuff that a lawyer usually doesn't care about.

Think about your subscriptions. Think about the weird code for the backyard gate or the contact info for that one plumber who knows how to fix the leaky sink.

The Boring (But Essential) Paperwork

You need the heavy hitters here. Birth certificates, social security cards, marriage licenses, and military discharge papers (DD214). If these aren't in one spot, your heirs are going to spend weeks ordering replacements from government agencies that move at the speed of a snail.

Put the original Will and any Trust documents in there. But also, add a "Letter of Instruction." This isn't a legal document. It’s just a plain-English note saying, "Hey, the life insurance is with Northwestern Mutual, and here is the policy number."

💡 You might also like: December 12 Birthdays: What the Sagittarius-Capricorn Cusp Really Means for Success

The Digital Keys

This is where 21st-century estate planning usually fails. We have two-factor authentication (2FA) on everything. If you die and your phone is locked, your family might lose every photo you’ve taken for the last decade. It’s heartbreaking.

You need to document your Master Password for your password manager (like LastPass or 1Password). If you don't use one, you’re making life very hard. Also, write down the PIN to your phone. It sounds simple, but it's the one thing people forget.

The Logistics Nobody Tells You About

Death is expensive and surprisingly bureaucratic.

I remember talking to a probate attorney who told me about a family that lost their house because they didn't know the mortgage was being paid out of a secret side account that ran dry. Nobody knew the account existed.

Money and Bills

List every bank account. Every single one. Even that high-yield savings account you opened three years ago and forgot about. List the credit cards. Mention the recurring bills that are on autopay. If the electric bill is tied to your credit card, and that card gets canceled after you pass, the lights go out. That’s a stressor your family doesn't need while they're picking out a casket.

The "Who to Call" List

This is more than just "call Mom." It’s the CPA. The insurance agent. The HR department at your work. The landlord. Even the person who grooms the dog.

📖 Related: Dave's Hot Chicken Waco: Why Everyone is Obsessing Over This Specific Spot

Handling the "Sentimental" Side Without Getting Mushy

An if i die folder can also hold the stuff that matters to the heart.

Maybe you have a specific wish for your funeral. Maybe you want to be cremated and turned into a tree, or maybe you want a massive party with an open bar and a jazz band. If you don't write it down, your family is going to guess. And they'll probably feel guilty about whatever they choose. Tell them what you want. Give them permission to not spend $10,000 on a mahogany box if you don't care.

The Ethical Will

This is a concept that’s been around for centuries but has recently made a comeback. It’s not about money. It’s about values. You can tuck a letter in your folder that explains what you've learned in life, what you hope for your grandkids, or even just a final "I love you."

Sometimes, the most valuable thing in the folder is a single piece of paper that says, "I'm proud of you."

Security vs. Accessibility: The Great Dilemma

You’re probably thinking: "Wait, I’m putting my life’s secrets in a folder? What if someone steals it?"

Valid point.

👉 See also: Dating for 5 Years: Why the Five-Year Itch is Real (and How to Fix It)

You have to find the balance. Some people use a fireproof safe. That’s smart. Others use an encrypted digital vault like Trustworthy or even a hidden folder on a secure cloud drive. If you go the physical route, make sure at least two people know where the key is. A locked box that nobody can open is just a heavy paperweight.

Common Mistakes People Make

Don't overcomplicate this.

- The "Set it and Forget it" Trap: Life changes. You close accounts. You buy new stuff. You have more kids. You get divorced. An outdated if i die folder can actually be more confusing than having nothing at all. Review it once a year. Maybe on your birthday or during tax season.

- Hiding it Too Well: I’ve heard stories of people putting their documents in safe deposit boxes at banks. Guess what? When you die, the bank often seals that box until probate is settled. Your family might need the documents inside the box to settle the probate. It’s a classic Catch-22. Keep it accessible.

- Being Too Vague: "Money is in the safe" isn't helpful if nobody knows the combination or where the safe is hidden behind the fake wood paneling.

How to Build Your Folder This Weekend

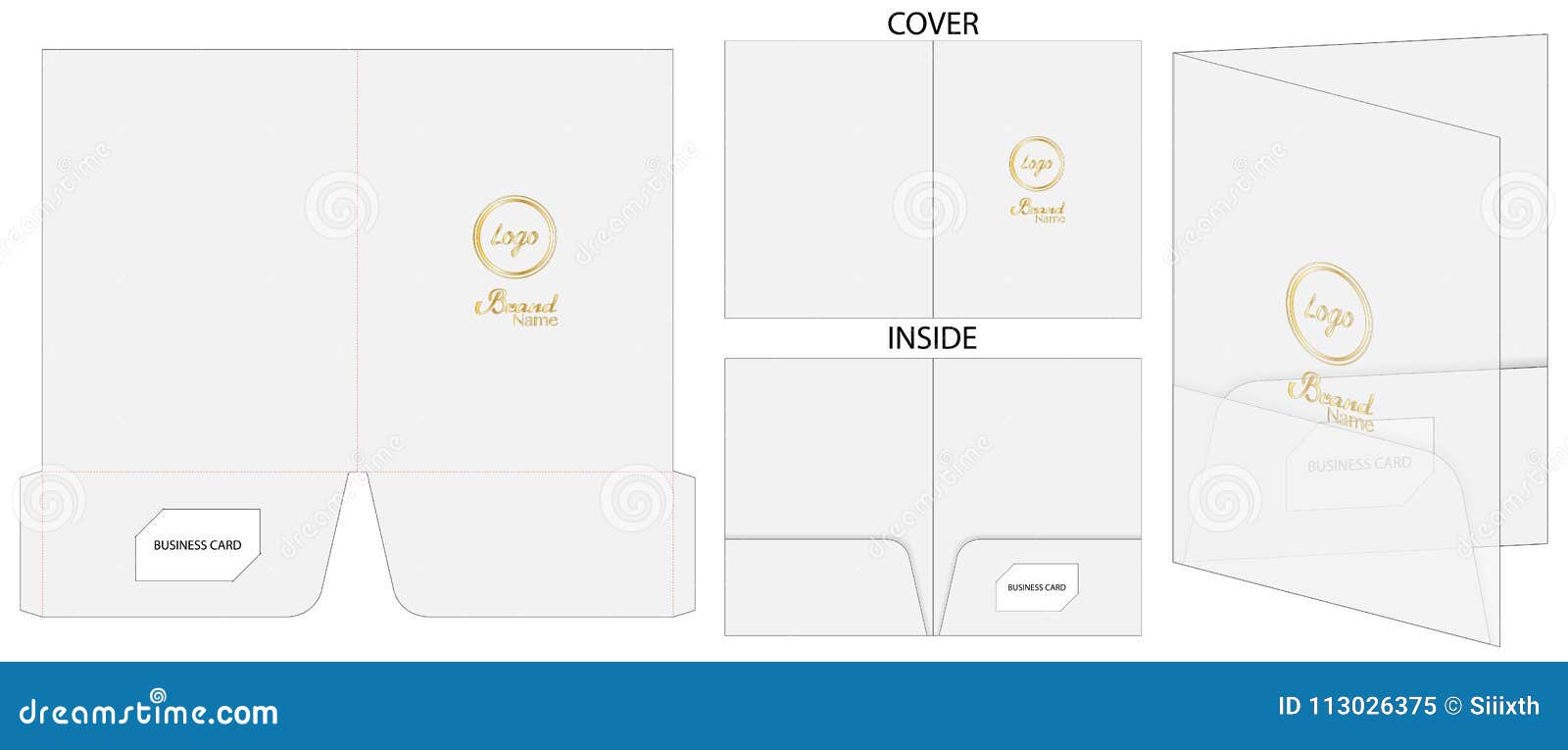

You don't need a fancy kit, though you can buy them online. A simple three-ring binder with some dividers works perfectly fine.

Start with the easy stuff. Grab your passport and your social security card. Put them in a sleeve.

Next, print out a list of your monthly "must-pay" bills.

Then, write down your phone passcode and your computer login.

It feels heavy. It feels a bit dark. But once you close that binder and put it on the shelf, you'll feel an incredible sense of relief. It’s a weird kind of peace of mind. You’re making sure that when the worst happens, the people you love most aren't left searching through drawers for a scrap of paper that might not even exist.

Actionable Next Steps to Start Your Folder

- Buy a bright-colored binder: Make it easy to find. Red or yellow works well so it stands out on a shelf full of black and white books.

- Print your digital life: Go to your password manager and print a "cleartext" emergency sheet. Put this in a sealed envelope inside the folder.

- Scan the essentials: Use your phone to scan your ID, insurance cards, and deeds. Upload them to a secure cloud drive and share that folder with your "legacy contact" (both Apple and Google have these settings now).

- Write the "In Case of Emergency" (ICE) list: Include the names and numbers of your lawyer, doctor, and executor.

- Tell one person: This is the most important part. Tell your spouse, your best friend, or your adult child: "In the office, in the red binder, is everything you need if something happens to me."

- Review the beneficiaries: Open your 401k or IRA right now and make sure the beneficiary listed is actually the person you want to get the money. These designations usually override whatever is in your will.