Debt is heavy. It's a weight you carry into every paycheck, every vacation, and every late-night conversation about the future. Most of us just accept the 30-year grind as a natural law of physics, like gravity or taxes. But then you stumble onto an early mortgage payoff calculator, and suddenly, the math starts talking back to you. It's not just about numbers; it’s about buying back your time.

Most people use these calculators wrong. They plug in a $100 extra payment, see they’ll save $20,000, and think, "Cool," before closing the tab. They miss the nuance. They miss the fact that interest is front-loaded, meaning your bank is getting the "good stuff" right now while you're just chipping away at the remains. If you’ve ever looked at your monthly statement and felt a physical pang of annoyance that only $200 went toward the principal of a $2,500 payment, you know exactly what I’m talking about.

The brutal math of amortization

Let’s be real: banks aren't your friends. The way a standard mortgage is structured—amortization—is designed to ensure the lender gets their profit as quickly as possible. In the early years of a 30-year loan, your payments are almost entirely interest. You're basically renting the money for a decade before you start owning the house.

An early mortgage payoff calculator reveals this leverage. By adding even a small amount to your principal every month, you are effectively "canceling" future interest payments that would have been charged on that specific dollar. It’s a compounding effect in reverse. For example, on a $400,000 loan at a 6.5% interest rate, a single extra payment of $500 in month one doesn't just reduce your debt by $500. It wipes out all the future interest that $500 would have generated over the next 29 years.

That is the "secret sauce" people miss.

You aren't just paying down a balance. You're destroying the bank's ability to charge you for the privilege of holding that balance. It’s aggressive. It’s satisfying. And honestly, it’s one of the few ways the average person can "beat" the financial system without betting on volatile stocks or crypto.

Why the 30-year mortgage is a trap (sort of)

The 30-year fixed-rate mortgage is a marvel of American housing policy. It makes homes "affordable" by stretching the cost over three decades. But the cost of that convenience is staggering. If you look at the total interest paid over 30 years at current rates, you'll often find you are paying back double—sometimes more—what you actually borrowed.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

Using an early mortgage payoff calculator lets you simulate a 15-year or 22-year reality without the legal obligation of a higher monthly payment. Flexibility is king. If you lose your job, you can drop back to the minimum. If you get a bonus, you can nuked a chunk of the principal.

When paying off early is actually a bad move

I know, I know. I just spent five paragraphs telling you how great it is. But finance isn't a one-size-fits-all t-shirt. There are moments when dumping extra cash into your mortgage is actually a mistake.

- The Opportunity Cost Dilemma: If your mortgage rate is locked in at 3% from the "golden era" of 2020-2021, and a high-yield savings account is paying you 4.5%, you are literally losing money by paying off the house early. You're better off putting that "extra" payment into a brokerage account or a CD.

- Inflation is your friend (usually): This is a weird one to wrap your head around. If inflation is 4% and your mortgage is 3%, the "real" value of your debt is shrinking every year. You're paying back the bank with "cheaper" dollars. In this specific scenario, the bank is actually the one losing out on purchasing power.

- Liquidity is life: You can't eat your kitchen cabinets. Once money goes into the mortgage principal, it’s "trapped" until you sell the house or take out a Home Equity Line of Credit (HELOC). If you don't have an emergency fund, that extra $500 payment is a liability, not an asset.

Think of it like this: Your house is a giant, illiquid piggy bank that you have to break with a sledgehammer to get the money back. Keep some cash in your pocket first.

The psychological dividend

Mathematicians will tell you to follow the highest ROI. But humans aren't calculators. There is a "psychological dividend" to owning your home outright that a spreadsheet can't capture. The feeling of waking up and knowing that no matter what happens in the economy, you own the roof over your head? That's worth a few percentage points of "lost" investment gains for many people.

Financial expert Dave Ramsey is famous for pushing the "no debt" lifestyle, while others like Ric Edelman often suggest carrying a mortgage as long as possible for tax and investment reasons. They are both right. It depends on whether you value sleep or spreadsheets more.

How to use an early mortgage payoff calculator to win

Don't just plug in random numbers. Use a strategy. Most calculators allow you to toggle between three types of extra payments: monthly, yearly, or one-time.

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

- The 13th Payment Strategy: This is a classic. You take your monthly principal/interest payment, divide it by 12, and add that amount to every monthly check. By the end of the year, you've made one extra full payment. On a 30-year loan, this typically shaves about 4 to 6 years off the term. It’s painless because it’s baked into your monthly budget.

- The Tax Refund Nuke: This is for the person who isn't great at monthly budgeting. Every year in April, you take your tax refund—let's say $3,000—and throw it at the principal as a one-time "lump sum." When you run this through an early mortgage payoff calculator, you’ll see it has a massive impact if you do it early in the loan.

- The Penny-Pincher Approach: Rounding up. If your mortgage is $1,842, pay $1,900. It sounds small. It feels small. But over 360 months, that extra $58 prevents thousands of dollars in interest from ever existing.

Avoid the "Payoff Service" scams

You might get letters in the mail from companies offering to "manage your early payoff" for a fee. They often call it a "bi-weekly payment program." Do not pay for this. You can do the exact same thing for free. Just send the extra money to your servicer yourself. Most modern banking portals have a specific box for "Additional Principal." Make sure you check that box. If you don't, the bank might just apply it as an early payment for next month's total bill, which does absolutely nothing to save you interest.

The impact of interest rates on your strategy

The effectiveness of an early mortgage payoff calculator changes drastically depending on when you bought your home.

If you bought in 2023 or 2024 with a 7% or 8% rate, your "return on investment" for paying down the principal is a guaranteed 7% or 8%. That’s hard to beat in the stock market after you account for taxes and risk. In this environment, the calculator becomes your best friend. It shows you that you're not just a victim of high rates; you have a tool to fight back.

Conversely, if you're sitting on a 2.75% rate, the calculator might actually be a warning sign. It might show you that after 10 years of extra payments, you’ve only saved a relatively small amount of interest because the rate was so low to begin with. In that case, the calculator is telling you to take that money and go buy an index fund instead.

Tax implications you can't ignore

In the U.S., the mortgage interest deduction is a big deal—if you itemize. When you pay off your mortgage early, you lose that deduction. For high earners, this can slightly change the math. However, with the standard deduction being as high as it is now, fewer people are itemizing anyway. Don't let the "tax break" tail wag the financial dog. Paying $1 in interest to save $0.25 on your taxes is still losing $0.75.

Actionable steps to start today

If you're ready to stop wondering and start doing, here is the playbook.

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

Step 1: Get your current statement. You need your exact remaining balance and your interest rate. Don't guess.

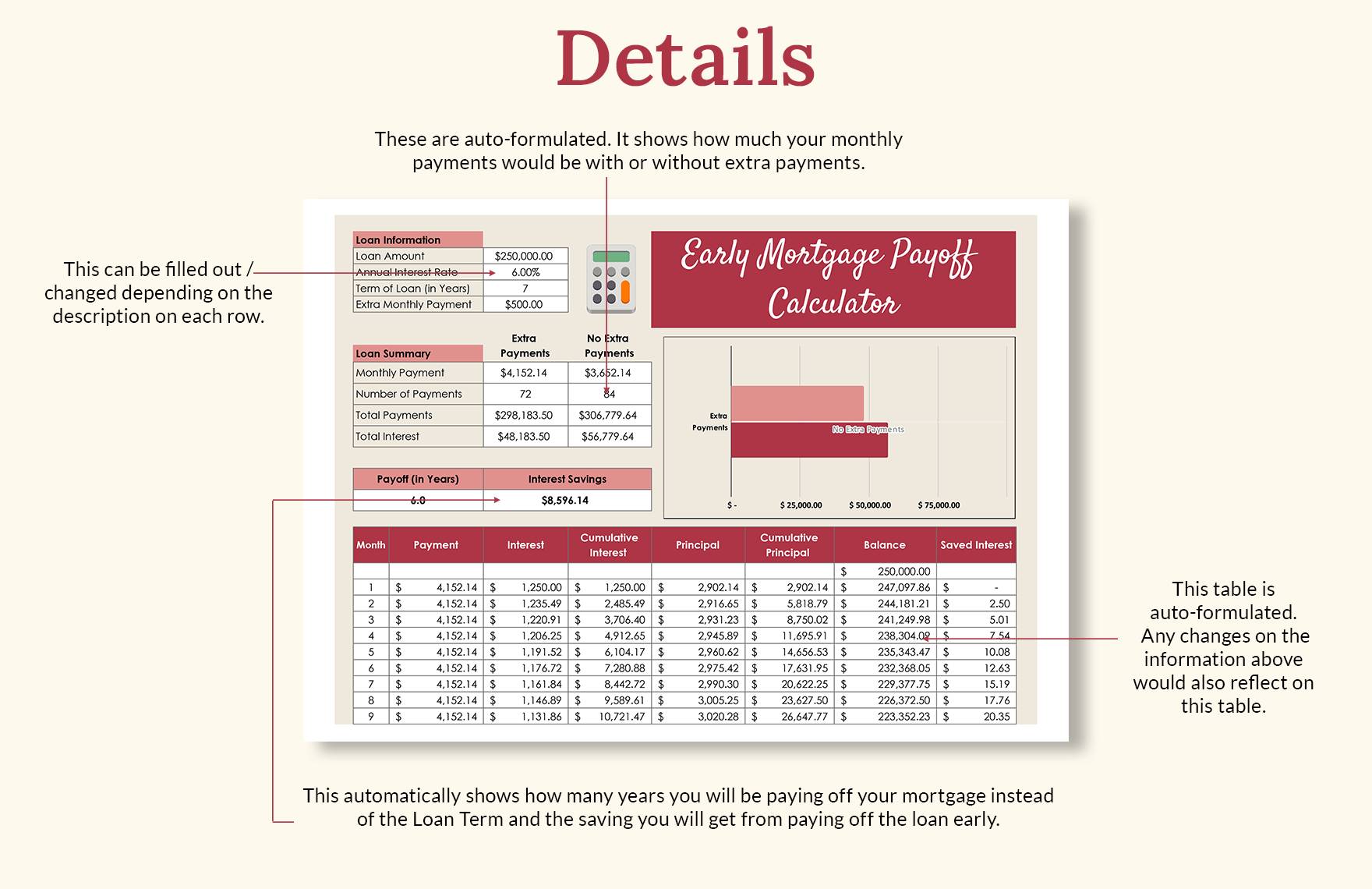

Step 2: Run three scenarios. Use the early mortgage payoff calculator to see what happens if you add $50, $200, or a $5,000 one-time payment. Look at the "Interest Saved" column. That is your "profit."

Step 3: Check your "Escrow" vs "Principal." People often confuse their total payment (which includes taxes and insurance) with the amount that actually affects the loan balance. Your extra payments should only be calculated against the Principal and Interest (P&I) portion.

Step 4: Verify with your lender. Call them or log in to ensure they don't have prepayment penalties. Most residential mortgages today don't have them, but it’s worth the five-minute check. Ask specifically: "If I pay an extra $500 this month, will it be applied directly to the principal balance?"

Step 5: Automate the aggression. If the math looks good, set up a recurring payment. Finance is 10% math and 90% behavior. If you have to remember to send the extra money every month, you eventually won't. If it happens automatically, you'll forget you're even doing it until you see your balance plummeting.

The reality is that your mortgage is likely your biggest monthly expense and your largest source of debt. It’s also the biggest lever you have for building net worth. Every dollar you push into that principal is a dollar that stops working for the bank and starts working for your retirement. Whether you want to be debt-free by 45 or just want to save $50,000 in interest over the next decade, the calculator is the first step toward taking control of the narrative. It turns a 30-year "sentence" into a strategic game you can actually win.