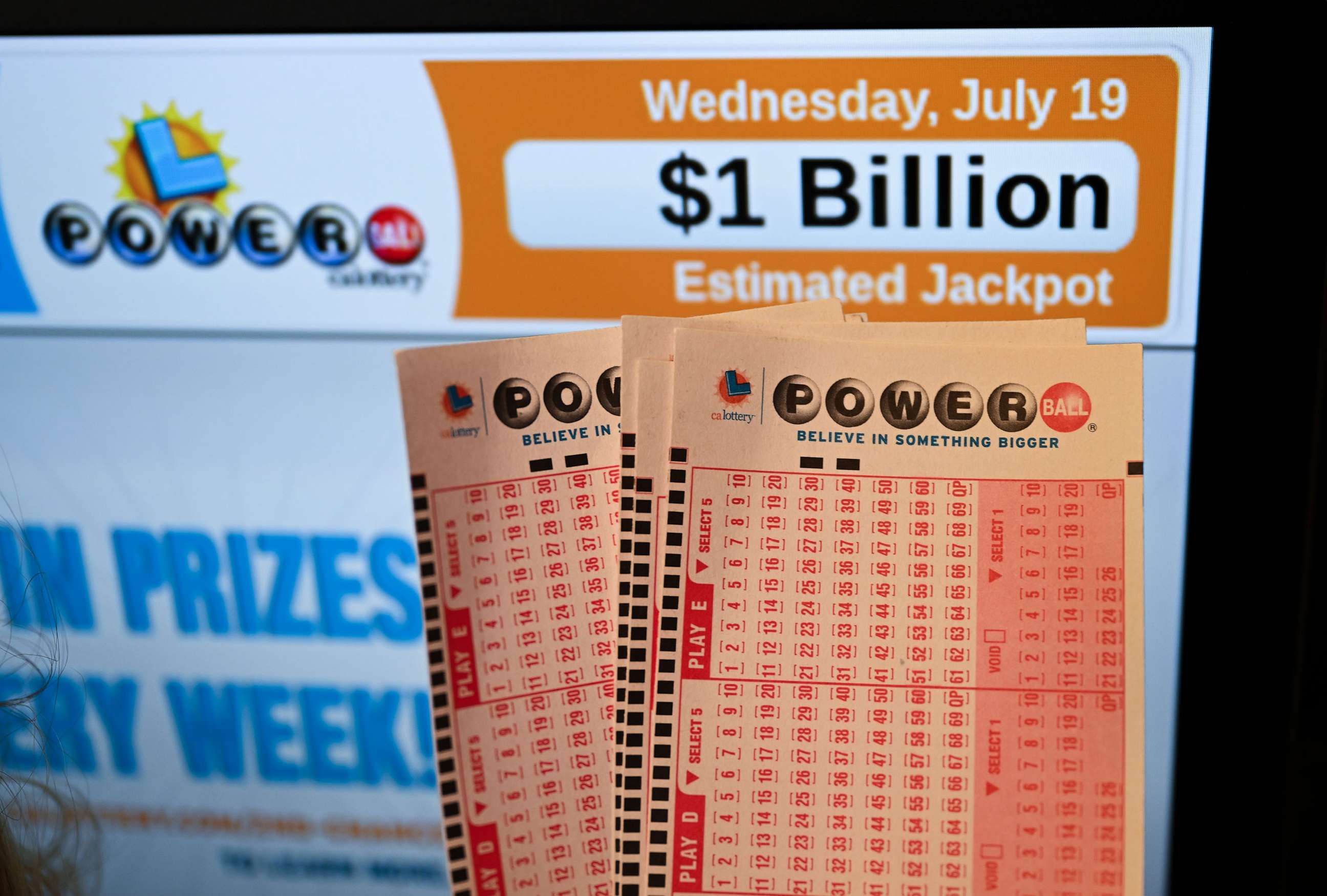

The air feels different when the sign at the gas station shows nine zeros. It’s a specific kind of fever. People who never gamble—the ones who scoff at the "math tax"—suddenly find themselves standing in line at a 7-Eleven, clutching a ten-dollar bill. When you see a Powerball jackpot near 2 billion, it isn't just a lottery anymore. It becomes a cultural event.

It's massive.

Honestly, the sheer scale of two billion dollars is hard for the human brain to actually process. We can visualize a million. A million is a nice house and a quiet retirement. But two billion? That is generational, empire-building wealth. It is the kind of money that buys professional sports teams or ends up on the Forbes list next to names you recognize from tech giants.

Every time the jackpot creeps toward that historic 2-billion-dollar mark, the math of the game doesn't actually change, but our collective behavior does. The odds remain a staggering 1 in 292.2 million. You are technically more likely to be struck by lightning while being eaten by a shark, or something equally ridiculous. Yet, the ticket sales skyrocket. Why? Because at two billion, the "what if" becomes too loud to ignore.

The psychology behind the Powerball jackpot near 2 billion frenzy

There's this thing called "availability heuristic." Basically, when the news is plastered with stories about a massive jackpot, our brains start to overestimate the chances of winning. We see the flashing lights. We hear about the guy in California who won the record-breaking $2.04 billion in 2022. Suddenly, the impossible feels slightly possible.

The 2022 win by Edwin Castro is the gold standard here. He took the lump sum of $997.6 million. Think about that. Even after the government takes its massive cut—which, let's be real, is a lot—he walked away with nearly a billion dollars. It changed the ceiling for what people expect from the lottery. Before that, a few hundred million felt like the peak. Now, we're spoiled. We see a $400 million jackpot and think, "Eh, maybe next week."

But when it’s a Powerball jackpot near 2 billion, the FOMO (fear of missing out) is real. You don't want to be the only person in the office who didn't pitch into the pool when your coworkers are suddenly buying private islands.

Lottery pools are fascinating. They’re basically a social contract. You’re not just buying a chance to win; you’re buying insurance against being the only person left at your job on Monday morning. If the "Accounting Department Syndicate" hits the big one and you weren't in it, you’re basically the protagonist of a tragic comedy.

💡 You might also like: Passive Resistance Explained: Why It Is Way More Than Just Standing Still

Does the math actually make sense at this level?

Technically, there’s a concept in gambling called "expected value." If the jackpot is high enough, the mathematical value of a $2 ticket can actually exceed $2. But Powerball is tricky.

First off, you have to split the prize if someone else has your numbers. When the jackpot is near 2 billion, so many people are playing that the "duplicate ticket" risk is through the roof. If five people hit the jackpot, your 2 billion turns into 400 million real fast. Still a lot? Obviously. But it kills the mathematical "advantage."

Then there's the tax man.

The IRS is the biggest winner in every lottery. They take 24% off the top for federal withholding immediately, but since you'll be in the highest tax bracket, you’re looking at closer to 37%. Then, depending on where you live—New York or California versus Florida or Texas—you might lose another chunk to state taxes.

- Federal Tax: 37% (effectively)

- State Tax: Varies from 0% to over 10%

- Lump Sum Discount: You usually lose about 40-50% of the "advertised" jackpot if you want the cash now.

So, that 2 billion headline is a bit of a mirage. It's the 30-year annuity value. If you want the cash today, you're looking at maybe 900 million before taxes, and roughly 550-600 million after. Still, nobody is crying about half a billion dollars in their bank account.

Real stories: The 2.04 billion legacy

We have to talk about Altadena, California. That’s where the Joe’s Service Center sold the ticket for the biggest win in history. The owner of the shop, Joe Chahayed, got a $1 million bonus just for selling the ticket. That’s one of the coolest parts of these massive runs—the small business owners who get a life-changing boost just by being the middleman for a lucky moment.

But the winner, Edwin Castro, became a tabloid fixture. He started buying multi-million dollar mansions in Hollywood Hills and Bel Air. It’s the "Lottery Curse" narrative that people love to obsess over. We've all heard the stories of winners who go broke in five years.

📖 Related: What Really Happened With the Women's Orchestra of Auschwitz

Research from the National Endowment for Financial Education has often been cited saying 70% of people who suddenly receive a windfall go bankrupt within a few years. While that specific statistic is actually a bit of an urban legend (the NEFE later clarified they didn't have a study to back that exact number), the sentiment holds some truth.

Sudden wealth is a trauma. It sounds crazy to call it trauma, but it is. Your relationships change. Your cousins you haven't seen in twenty years start calling with "business opportunities." You become a target for lawsuits. This is why, if you ever find yourself holding a ticket for a Powerball jackpot near 2 billion, the very first thing you do isn't buying a Ferrari.

It’s hiring a lawyer.

Privacy is the real luxury

Most winners want to stay anonymous. Only a handful of states actually allow that. If you win in a state like Delaware, Kansas, or Maryland, you can keep your name out of the papers. If you're in California? Good luck. The law there says your name is public record.

This leads to the "Lottery Trust" maneuver. People try to claim the prize through a legal entity to shield their identity. Experts like Kurt Panouses, a lawyer who has represented several big winners, emphasize that the "paper trail" you create before turning in the ticket is the most important work you’ll ever do.

The "Near 2 Billion" ecosystem

When the jackpot gets this high, it isn't just about the players. It’s a massive revenue generator for the states involved. Powerball is played in 45 states, plus D.C., Puerto Rico, and the U.S. Virgin Islands.

A huge chunk of every dollar spent goes toward "good causes." In many states, that means public education. In others, it’s senior citizen programs or environmental conservation. While critics argue that lottery revenue often just replaces existing funding rather than adding to it, the sheer volume of cash flowing into state coffers during a 2-billion-dollar run is undeniable.

👉 See also: How Much Did Trump Add to the National Debt Explained (Simply)

It’s also a boom for local news. You’ll see the same segments every time:

- The reporter standing outside a "lucky" bodega.

- The interview with a guy buying 100 tickets.

- The "what would you buy?" man-on-the-street montage.

It’s a ritual. It’s part of the American mythos. The idea that for two dollars, you can buy a 48-hour window where you are allowed to dream about quitting your job and buying a private jet. Most people aren't buying a "chance to win"; they're buying a "license to daydream."

Why we keep playing despite the odds

The math is bad. We know this. But humans aren't rational calculators. We are storytellers.

When the jackpot is small, the story is boring. When the Powerball jackpot is near 2 billion, the story is epic. It’s "The Count of Monte Cristo" level of transformation.

There is also the "near-miss" effect. You check your numbers. You got the Powerball but none of the other five. You won four bucks! Your brain registers this as a "win," which triggers a dopamine hit, encouraging you to play again. You were "so close," even though, mathematically, you were nowhere near the jackpot.

Practical steps if you're joining the 2-billion-dollar chase

If you're going to play, play smart. Don't spend your rent money. That should go without saying, but the "lottery fever" can be intoxicating.

- Sign the back of the ticket immediately. A lottery ticket is a "bearer instrument." That means whoever holds it, owns it. If you drop it in the parking lot and someone else finds it, and you haven't signed it, it's theirs.

- Check the expiration. Tickets usually expire between 90 days and a year. Don't leave a billion dollars in your glove box.

- The "Quick Pick" vs. Personal Numbers debate. Mathematically, it doesn't matter. But if you choose your own numbers and use birthdays, you're more likely to use numbers between 1 and 31. Since many people do this, you’re more likely to split the jackpot if you win. Quick Picks give you a more statistically random spread.

- Take a photo of the ticket. Both sides. Then put it in a fireproof safe or a bank deposit box.

- Keep your mouth shut. If you win, don't post it on Facebook. Don't tell your neighbor. The "quiet period" between winning and claiming is the only time you'll ever be a secret billionaire. Use it to get your life in order.

A Powerball jackpot near 2 billion is a rare phenomenon that turns the whole country into a group of dreamers for a few days. It's a moment where the "American Dream" gets distilled into a tiny piece of thermal paper. Whether you think it's a "sucker's bet" or a harmless bit of fun, there's no denying the electricity in the air when that jackpot starts climbing into the billions.

Just remember: luck is a fickle thing. Enjoy the daydream, but keep your day job for now.

Actionable Next Steps for Participants

- Set a strict "fun budget" for ticket purchases; never exceed what you would spend on a movie ticket or a dinner out.

- Use an official lottery app to scan your tickets rather than relying on manual checks to avoid human error.

- If part of a pool, create a written agreement that specifies how winnings are split and have everyone sign it before the drawing occurs.

- Research your state's anonymity laws beforehand so you know exactly what your privacy options are if the unthinkable happens.

- Consult a certified financial planner (CFP) or a tax attorney before claiming any significant prize to understand the long-term implications of a windfall.