You've walked past it. If you’ve ever spent a Saturday dodging tourists on the Upper East Side or rushing toward Central Park, you have definitely seen the glass. It’s that sleek, slightly mirrored tower on the corner of 56th Street. Most people just call it the SL Green building or the former Hugo Boss flagship. But right now, 717 Fifth Avenue is basically the epicenter of a massive shift in how global wealth is parking its cash in Manhattan. It isn't just an office building anymore. It’s a trophy.

Real estate in New York is weird. One year a building is just a place where people trade stocks, and the next, it’s a $963 million chess piece bought by a luxury conglomerate.

The Billion-Dollar Handshake

Let’s talk about the Prada move. That’s the big one. In late 2023 and early 2024, the Prada Group didn't just renew a lease; they decided to own the dirt. They dropped over $800 million to buy their store space and the surrounding vertical real estate at 717 Fifth Avenue. Why? Because when you’re Prada, paying rent to a landlord like Jeff Sutton or SL Green starts to feel like throwing money into a black hole.

It’s about control.

When you own the building, you control the "vibe." You don't have to ask permission to change the facade. You don't worry about a competitor moving in upstairs. Kering—the giants behind Gucci—did the exact same thing right across the street. This isn't a trend; it's a land grab. These fashion houses have so much cash on hand that they’ve decided to become their own landlords. It makes the valuation of the building skyrocket because the tenant is also the owner, meaning they aren't going anywhere.

What’s Actually Inside?

The building itself is a 26-story tower. It was finished back in 1958, designed by Harrison & Abramovitz. If that name sounds familiar, it's because they worked on the United Nations headquarters and Lincoln Center. They knew what they were doing with glass. Originally, it was known as the Corning Glass Building.

It has this distinct L-shaped configuration.

The retail occupies the base—the "pedestal"—which is where the real money is made. Above that, you have about 350,000 square feet of office space. It’s not the tallest building on the skyline. Not even close. But on Fifth Avenue, height is secondary to frontage. Frontage is everything. If you have windows on Fifth, you have a billboard that the entire world sees.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

The Financial Rollercoaster

If you look at the history of 717 Fifth Avenue, it’s a map of NYC’s financial ego. SL Green Realty Corp. and Jeff Sutton’s Wharton Properties owned it for a long time. They are the heavy hitters. But even the pros hit snags. A few years ago, there was a lot of talk about the debt on the building.

Interest rates spiked.

Retail took a hit during the pandemic.

People thought Fifth Avenue was dying. They were wrong. What actually happened was a "flight to quality." The mediocre buildings stayed empty, but the premier spots like 717 became more valuable than ever. When Prada stepped in to buy it, they essentially bailed out the previous ownership's debt structure while securing their own future. It was a win-win that most people outside of Wall Street completely missed.

Why This Corner Matters More Than Others

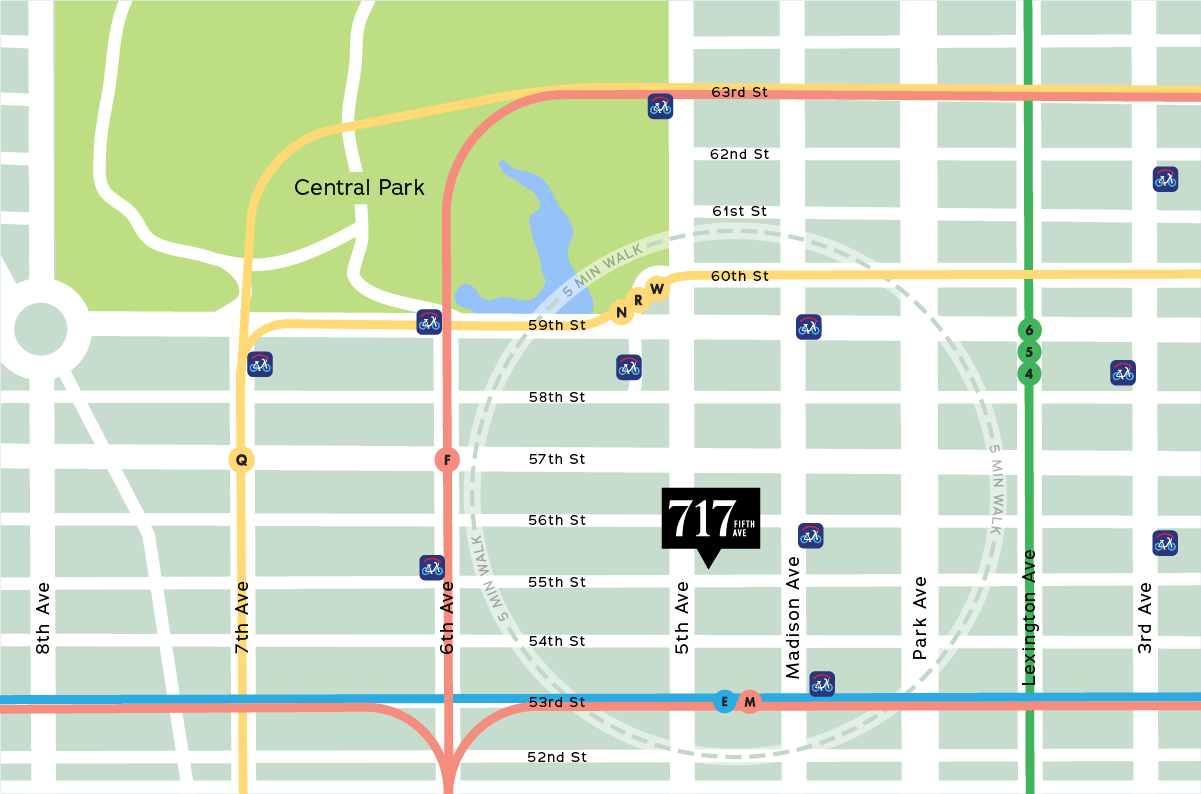

You have to understand the geography of luxury. 57th Street is "Billionaires' Row" with those pencil-thin towers like 111 West 57th. But 56th and Fifth? That’s the commercial heart.

- You’re a stone's throw from Trump Tower.

- You’re across from the Tiffany & Co. flagship (The Landmark).

- The St. Regis is just up the block.

Everything around 717 Fifth Avenue is designed to scream "expensive." If a brand is at this address, they’ve made it. It’s a psychological marker.

The Architecture: More Than Just a Mirror

The building was actually quite revolutionary for the 50s. It was one of the first to use a tinted glass curtain wall. Before this, everything was stone and masonry. It felt light. It felt modern.

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

Honest talk: Today, it looks a bit "corporate chic," but the lobby renovations have kept it from feeling like a time capsule. They’ve added a lot of high-end finishes to compete with the new construction further south. The floor plates are smaller as you go up, which is actually great for boutique hedge funds or family offices that want a full floor to themselves without needing 50,000 square feet.

Privacy is the ultimate luxury in NYC real estate.

Is It a Good Investment Now?

If you’re looking at the numbers, the retail portion is a gold mine. The office portion is a bit more complicated. Manhattan office vacancy rates have been hovering around 15-20% depending on who you ask. However, "Class A" properties in prime locations like 717 Fifth Avenue usually outperform the market.

People want to come to an office if it's on Fifth Avenue.

They don't want to come to an office in a windowless box in Midtown East.

Common Misconceptions

People often confuse 717 Fifth with the GM Building or the Solow Building. It happens. But 717 has that specific black-and-glass aesthetic that makes it look like a sleek smartphone standing on end.

Another mistake? Thinking it’s just one big store. While Prada dominates the mental space, there are dozens of office tenants upstairs. These are the folks who keep the local Sweetgreen in business. It's a vertical ecosystem.

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

How to Navigate 717 Fifth Avenue Today

If you are a business owner or an investor looking at this specific slice of Manhattan, there are a few things you should keep in mind. The market here doesn't move like the rest of the country. It operates on its own gravity.

1. Watch the owner-user trend.

Keep an eye on whether other brands follow Prada's lead. If LVMH starts buying up their footprints, the "landlord" class in NYC is going to have to pivot. This changes how leases are negotiated across the entire district.

2. Evaluate the "Amenity War."

If you’re looking for office space, don't just look at the square footage. Look at the HVAC systems and the touchless tech. 717 has been upgraded, but always check the specific floor's retrofitting.

3. Retail Foot Traffic Data.

Fifth Avenue is seeing a massive return of international tourists, specifically from Asia and Europe. If you're analyzing the value of 717 Fifth Avenue, look at the pedestrian counts at 56th Street. They are currently hitting near 2019 levels, which justifies the insane price tags.

4. Zoning and Air Rights.

New York is always building up. While 717 is a landmark of its era, the "air rights" around it are constantly being traded. It’s worth checking the Department of Buildings (DOB) filings if you’re worried about your view of the park being blocked by a new skinny tower in five years.

The reality is that 717 Fifth Avenue represents the "New York is back" narrative better than almost any other building. It survived the retail apocalypse, it survived the office-is-dead scare, and it ended up being worth nearly a billion dollars. Not bad for a glass box from 1958.

For those looking to get involved in the area, start by researching the local Business Improvement District (BID) reports for the Fifth Avenue Association. They provide the most granular data on who is moving in and who is moving out. Also, keep an eye on the filings from SL Green (SLG) if they retain any management interest—their quarterly earnings calls are a masterclass in Manhattan macroeconomics.