If you’ve walked down 57th and Fifth lately, you’ve seen it. It’s that glass-skinned tower that looks like it’s reflecting every dollar in Manhattan. 717 Fifth Ave NYC isn't just another office building. It’s a trophy. Honestly, in the world of high-stakes New York real estate, it’s basically the equivalent of a rare vintage Ferrari—expensive to maintain, iconic to look at, and currently owned by the biggest names in the game.

The building, often called the SL Green Building or the Glass Tower, has been making serious waves because of who just bought the retail portion. We are talking about Jeff Bezos-level money. In early 2024, Gucci’s parent company, Kering, dropped a staggering $963 million to secure the multi-level retail space. Why? Because in a world of online shopping, physical dominance on Fifth Avenue still carries a weight that an algorithm can't touch.

The Glass Tower’s Identity Crisis and Comeback

People often forget that 717 Fifth Avenue wasn't always this sleek. It was built in 1958. Originally, it had a much more "Mad Men" era feel, designed by Harrison & Abramovitz. It was the Corning Glass Building. Back then, it was a pioneer. It was one of the first buildings to use a curtain wall of green glass, which was a massive departure from the heavy masonry that defined the rest of the street.

Fast forward to the 2000s. SL Green Realty Corp. and Jeff Sutton’s Wharton Properties took control. They saw what others didn't: the retail was worth more than the offices. They spent millions stripping away the old facade and installing those massive, soaring glass storefronts that now house brands like Armani. It changed everything.

You have to understand the layout here to get why the price tag is so high. The building is split. You’ve got the office tower, which is a separate entity in terms of vibe, and then the retail "pedestal." The pedestal is where the real war is happening. When Kering bought those 115,000 square feet, they weren't just buying floor space. They were buying a permanent billboard in the most expensive neighborhood on earth.

What’s Actually Happening Inside 717 Fifth Ave NYC?

The office portion of the building remains a hub for private equity and high-end wealth management. It’s the kind of place where the lobby smells like expensive cologne and the security guards are more polite than some waiters at Michelin-starred restaurants.

Current tenants include major firms like Annaly Capital Management. These aren't tech startups with beanbags and espresso machines. These are firms that want their clients to see the park. The views from the upper floors of 717 Fifth Ave NYC are, frankly, ridiculous. You’re looking straight over the shoulder of the Trump Tower and right into the green heart of Central Park.

📖 Related: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

But the retail? That’s the engine.

- Giorgio Armani has been the anchor here for years. The flagship store is a monument to minimalism.

- The Kering Group (Gucci, Saint Laurent, Balenciaga) now owns the retail dirt.

- Location dynamics: It sits on the "Gold Coast" of Fifth Avenue, which is the stretch between 49th and 59th streets.

What most people get wrong about this building is thinking it’s just a place to shop. It’s a hedge. For a company like Kering, owning the real estate at 717 Fifth Ave NYC is a move to protect themselves against the insane rent hikes that have historically plagued Fifth Avenue. If you own the building, you are the landlord. You don't have to worry about a 20-year lease renewal that doubles your overhead overnight.

The $963 Million Question: Is It Overpriced?

Real estate nerds love to argue about the "per square foot" value of this deal. At nearly a billion dollars for the retail section, it sounds insane. But let’s look at the neighbors.

Across the street, you have LVMH. Bernard Arnault—the world’s richest man depending on the day of the week—has been on a buying spree. Prada just bought their own building nearby for $835 million. There is a "luxury arms race" happening.

717 Fifth Ave NYC is the latest casualty (or victor) of this trend. Basically, luxury brands have stopped wanting to be tenants. They want to be sovereigns. By owning 717 Fifth, Kering ensured that LVMH couldn't swoop in and evict them or control their destiny. It’s defensive buying.

The Nuance of the Office Market

While the retail is booming, the office market in NYC has been... weird. You’ve heard the "doom loop" stories. Empty cubicles. Ghost towns.

👉 See also: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

But 717 Fifth Ave NYC avoids the worst of it. Why? Because it’s "Class A+." In the current market, there is a flight to quality. If a company is going to pay for an office, they don't want a dingy mid-block building on 38th Street. They want the green glass tower on Fifth. The vacancy rates in trophy buildings like this are significantly lower than in the rest of Midtown.

The Architectural Legacy You Probably Missed

The green glass isn't just a color choice. When Harrison & Abramovitz designed it, they wanted to reflect the sky. They used over 3,000 panes of heat-absorbing glass.

There's a specific detail about the lobby that most tourists miss. It features a stunning mosaic by the artist Josef Albers. It's titled "Two Skyward Bound," and it’s a masterclass in mid-century geometric abstraction. It’s one of those "if you know, you know" elements that gives the building a soul beyond just being a giant mirror for tourists' selfies.

The building also has a "L-shape" footprint. This is actually a strategic advantage. It creates more "corner" offices per floor than a standard rectangular building. In New York, more corners mean more prestige. More prestige means more rent. It’s simple math.

Why 717 Fifth Matters for the Future of NYC

If you want to know if New York is "back," look at the transactions at 717 Fifth Ave NYC. When global conglomerates drop a billion dollars on a single corner, they aren't betting on a city that’s dying. They are betting on a city that is becoming an ultra-exclusive playground for the global elite.

It’s a bit of a double-edged sword, right? On one hand, the investment is great for the tax base. On the other, it turns Fifth Avenue into a high-walled garden of brands that most people can't afford to step foot in.

✨ Don't miss: Big Lots in Potsdam NY: What Really Happened to Our Store

But from a business perspective, 717 Fifth is a fortress. It has survived the 1970s fiscal crisis, the 2008 crash, and the 2020 lockdowns. Every time, it comes out more valuable.

Practical Insights for Navigating the Area

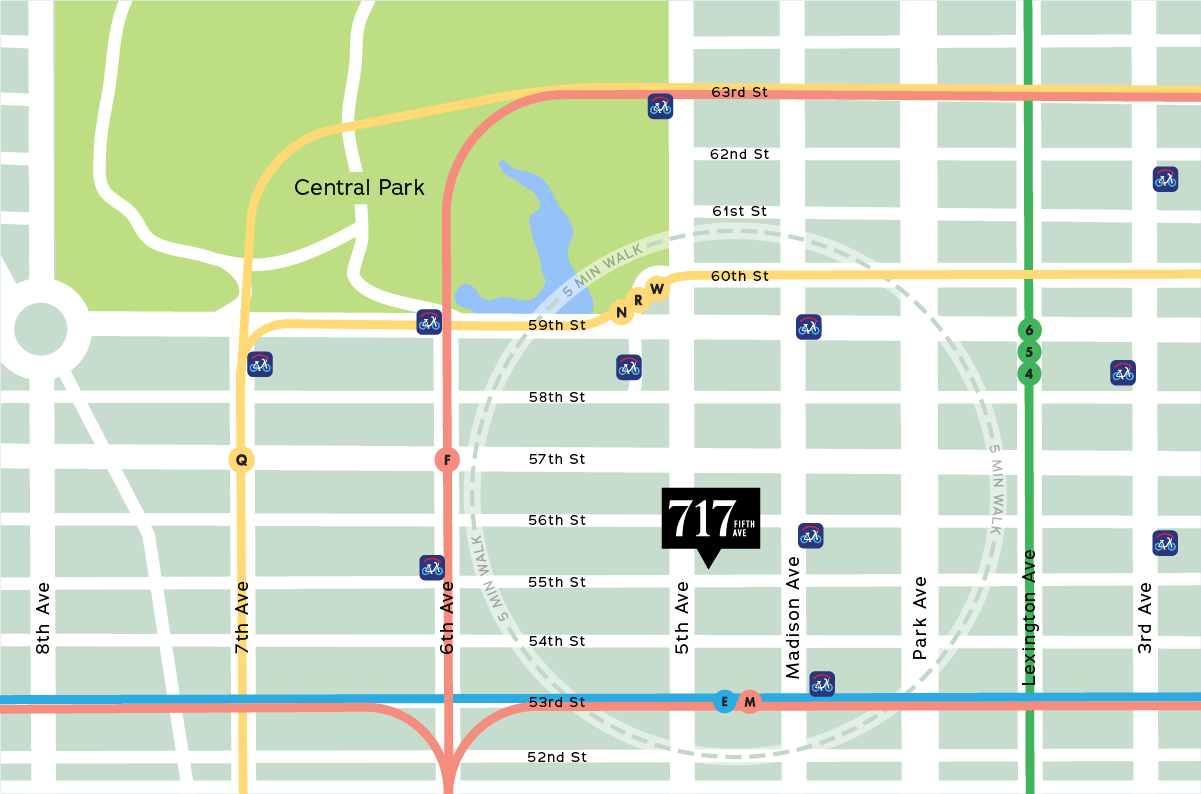

If you’re visiting or looking to do business near 717 Fifth Ave NYC, keep these things in mind.

First, the entrance to the offices is different from the retail. If you’re meeting someone at a private equity firm, don't walk into the Armani store. You’ll look like a tourist. The office entrance is sleek, discreet, and located on the side.

Second, the security is intense. Don't expect to wander into the lobby to see the Josef Albers mosaic without a badge or an appointment. You can try to peek through the glass, though.

Third, if you’re a retail observer, watch the windows of 717 Fifth. The displays here are often the "pilot" designs for the rest of the world. What you see in the glass at 56th and Fifth today will be in a mall in Dubai or Tokyo six months from now.

Actionable Takeaways for Real Estate Enthusiasts:

- Watch the "Owner-User" Trend: The Kering purchase of 717 Fifth is a signal. Watch for other brands (like Chanel or Richemont) to stop renting and start buying their Manhattan flagships.

- Retail is the Value Driver: In Midtown, the "pedestal" of a building can often be worth more than the thirty floors above it.

- Follow the LVMH vs. Kering War: This isn't just about clothes; it’s a land grab. Where one buys, the other will likely try to counter-buy within a two-block radius.

- Architecture Matters for Retention: Buildings with unique features (like the green glass or the Albers mosaic) maintain their "Trophy" status longer than generic steel boxes.

The story of 717 Fifth Ave NYC is far from over. With the new ownership, expect a massive renovation of the retail interiors soon. Kering didn't spend nearly a billion dollars to leave things as they are. They are going to turn that corner into a cathedral of luxury that defines the next twenty years of Fifth Avenue.

Check the building's current permit filings if you want to see the specific floor-by-floor changes coming. The city's Department of Buildings records are public, and they show a lot of "mechanical upgrades" and "interior structural work" slated for the next 18 months. This building is about to get a very expensive facelift.