You’ve probably walked right past it. If you’ve spent any time on the edge of SoHo and Little Italy, the red brick and terracotta facade of 200 Lafayette Street NY NY feels like a permanent fixture of the neighborhood, yet most people don't realize it's basically a case study in Manhattan real estate evolution. It's a gorgeous building. Honestly, it’s one of those structures that reminds you why New York architecture from the late 1800s is so hard to beat. But beyond the aesthetics, the history of this specific address tells a much bigger story about how money, tech, and retail have shifted in the city over the last decade.

Built back in 1894, it started life as a factory. Back then, Lafayette Street wasn't the trendy corridor it is today; it was a gritty industrial hub. The building was designed by John T. Williams, and it carries that classic "Renaissance Revival" vibe that makes photographers stop in their tracks. It’s got these massive windows. Light pours in. For a long time, it was just another underutilized relic of New York's manufacturing past, waiting for the right moment to become something else entirely.

The Massive Transformation of 200 Lafayette Street NY NY

The turning point came around 2012. Before that, the building was a bit of a mess, frankly. It was mostly vacant, a ghost of its industrial self. Then, Jared Kushner’s Kushner Companies and CIM Group stepped in. They bought the 100,000-square-foot property for about $50 million. That might sound like a bargain now, but back then, it was a huge bet on the "creative office" trend. They didn't just slap on a coat of paint. They gutted the interior, modernized the mechanical systems, and added a penthouse with a rooftop terrace that basically redefined what a boutique office space in SoHo could look like.

It worked.

The renovation was so successful that they flipped the building just a year or so later. SJP Properties and Aetna teamed up to buy it for a staggering $150 million. Think about that. The value tripled in roughly 18 months. This wasn't just luck; it was the result of a very specific moment in New York real estate where tech companies were desperate for "cool" brick-and-beam spaces rather than the sterile glass boxes of Midtown.

J.C. Penney and the Great Retail Experiment

One of the weirdest and most interesting chapters in the life of 200 Lafayette Street NY NY involves J.C. Penney. Yes, the department store. In a move that confused a lot of people at the time, the company signed a long-term lease for the entire building. They weren't turning it into a giant store, though. Under the leadership of then-CEO Ron Johnson (the guy who basically built the Apple Store concept), they wanted a "design hub." They wanted to be in the heart of the action, far away from their corporate headquarters in Texas.

👉 See also: Why Saying Sorry We Are Closed on Friday is Actually Good for Your Business

They spent a fortune. The interiors were sleek, minimalist, and expensive. But as Johnson’s vision for J.C. Penney struggled to gain traction nationally, the SoHo office became a bit of a symbol of corporate overreach. Eventually, they moved out, proving that even a perfect location can't save a struggling business model. It was a high-profile vacancy that left people wondering who would take over such a specialized, high-end space.

Who Calls 200 Lafayette Home Today?

After J.C. Penney exited, the building didn't stay empty for long. The beauty of 200 Lafayette Street NY NY is its versatility. It’s got that rare combination of high ceilings and massive floor plates that tech and fashion brands crave.

Logos and tech firms moved in. Specifically, companies like Match Group (the giants behind Tinder and Hinge) and Laxman (a high-end fitness and wellness tech company) have occupied space there. It’s become a hub for what some call "TAMI" tenants—Technology, Advertising, Media, and Information. These are the industries that currently drive the downtown economy.

When you look at the tenant roster, you see a pattern. These aren't old-school law firms or banks. They are companies that use their office space as a recruiting tool. If you're a developer or a creative director, working in a 19th-century factory with a private roof deck in SoHo is a lot more appealing than a cubicle in a skyscraper.

The Real Estate Fundamentals

Why does this building keep its value? It’s not just the brick. It’s the logistics.

✨ Don't miss: Why A Force of One Still Matters in 2026: The Truth About Solo Success

- Corner Exposure: Sitting on the corner of Lafayette and Broome Streets means double the natural light. In Manhattan, light is currency.

- Transit Access: You’re literally steps away from the 6, N, Q, R, W, B, and D lines. If you're running a business, you need your employees to actually be able to get to work.

- The "SoHo" Factor: Being on the edge of the SoHo cast-iron district gives you the prestige without the absolute gridlock of Broadway.

The Economic Shift of the 2020s

The pandemic obviously changed everything for NYC offices, and 200 Lafayette Street NY NY wasn't immune. We saw a massive shift in how companies view "the office." However, boutique buildings in prime locations have actually fared much better than the massive towers in the Financial District.

The "flight to quality" is a real thing. If a company is going to force people to come back to the office, that office needs to be somewhere people actually want to be. 200 Lafayette fits that bill. It’s "human scale." You don’t have to wait 10 minutes for an elevator in a lobby with 500 other people. You can walk out the door and be at some of the best coffee shops in the world in two minutes.

That said, the market is tougher now. Interest rates are higher. Refinancing these types of assets isn't the slam dunk it was in 2015. But because the building is relatively small (around 100,000 square feet), it’s easier to manage than a million-square-foot behemoth.

What People Get Wrong About the Area

A lot of people think SoHo is just for tourists and high-end shopping. That’s a mistake. The commercial "loft" market is the backbone of the neighborhood. When you look at 200 Lafayette, you’re looking at the engine of the local economy. The people working in these offices are the ones filling up the restaurants on weekdays and keeping the local ecosystem alive.

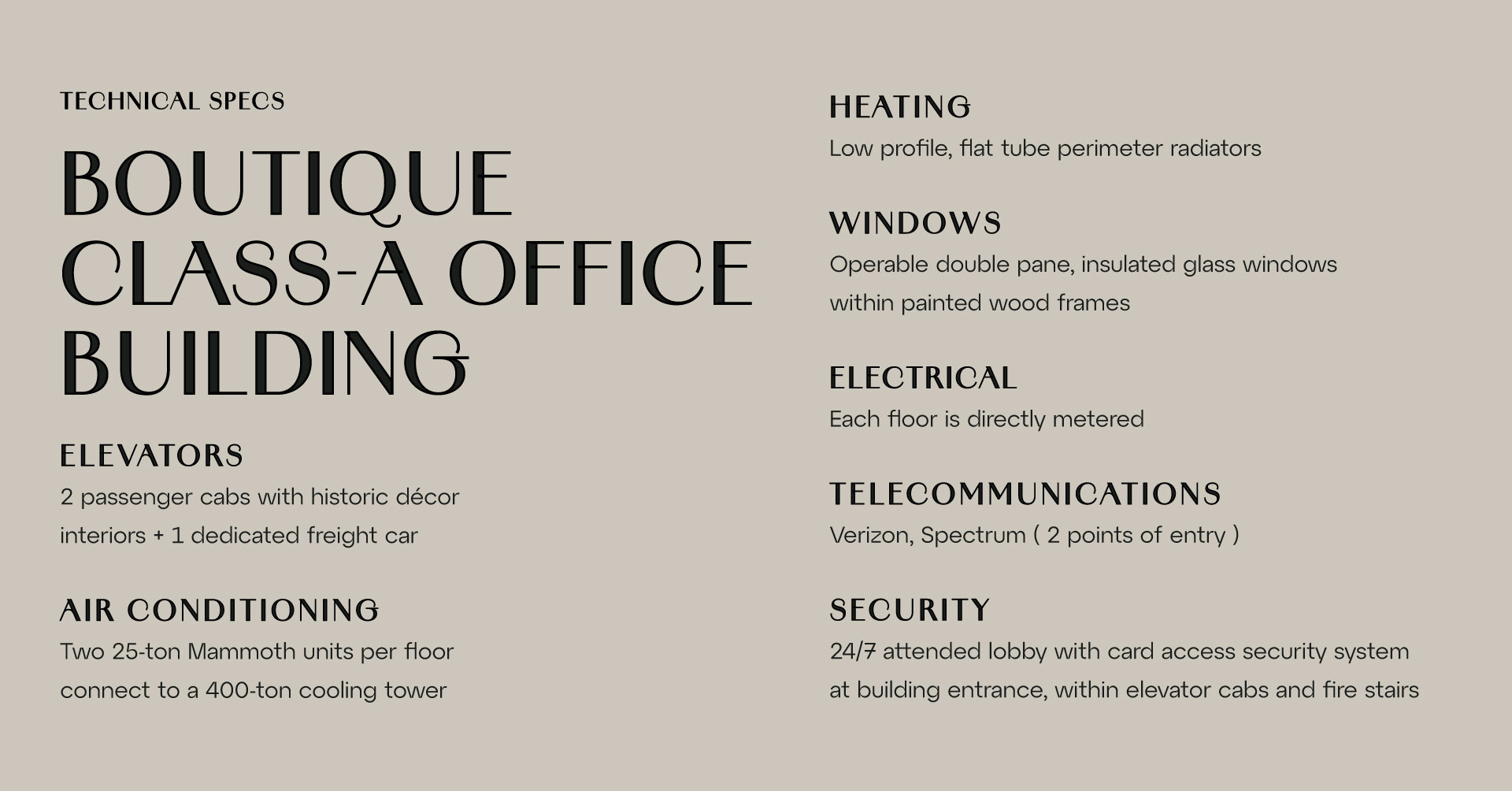

There’s also a misconception that these old buildings are drafty or technologically backwards. Not this one. Because of the 2012 overhaul, the infrastructure is modern. We're talking high-speed fiber, LEED certification vibes, and HVAC systems that actually work. It’s the "best of both worlds" scenario: 1890s charm with 2020s bandwidth.

🔗 Read more: Who Bought TikTok After the Ban: What Really Happened

Actionable Insights for the NYC Real Estate Market

If you are looking at the Manhattan commercial landscape, 200 Lafayette Street NY NY serves as a blueprint for what works. If you're an investor, a business owner, or just a student of the city, here is what you should take away from this building's trajectory:

1. Location within a location matters.

Don't just look at a neighborhood; look at the specific corner. Being on the border of SoHo and Little Italy provides a different energy—and often better transit access—than being in the dead center of the shopping district.

2. Renovation is better than replacement.

The value created at 200 Lafayette came from preserving the "bones" while upgrading the "brains." In a world focused on sustainability, adaptive reuse of 19th-century buildings is almost always a better long-term bet than tearing down and starting over.

3. Tenant diversity is key.

The J.C. Penney era showed the risk of a single-tenant dependency. The current mix of tech, wellness, and creative firms makes the building much more resilient to industry-specific downturns.

4. The "Amenity" is the neighborhood.

While the rooftop deck at 200 Lafayette is great, the real "amenity" is being able to walk to Balthazar or Jack’s Wife Freda. For modern businesses, the surrounding square mile is just as important as the square footage inside the lease.

If you’re tracking the health of New York City, keep an eye on these boutique SoHo assets. They are the "canaries in the coal mine" for the return-to-office trend. As long as buildings like 200 Lafayette stay occupied and vibrant, the downtown market has a very solid floor. It’s a testament to the fact that quality architecture and smart urban positioning never really go out of style. It’s basically the gold standard for what a "cool" office should be in 2026.