Money feels like a constant. You wake up, check your banking app, and see a number. That number represents a promise backed by the most powerful financial institution on the planet. But it wasn't always this way. If you’re asking when was the federal reserve created, the short answer is December 23, 1913. President Woodrow Wilson sat down and signed the Federal Reserve Act into law two days before Christmas.

It was a quiet ending to a very loud, very messy decade.

Most people think of the Fed as this ancient, immovable object. In reality, the United States spent over a century fighting itself over whether we even needed a central bank. We had two of them before—the First and Second Banks of the United States—and we killed them both. Politics, ego, and a deep-seated American distrust of "moneyed interests" kept us in a cycle of boom and bust that would make a modern day trader's head spin.

Then 1907 happened.

The Panic That Changed Everything

Imagine a world where you go to the bank to withdraw your savings, and the teller just says "no." That was the Knickerbocker Crisis, or the Panic of 1907. It started with a failed attempt to corner the stock of the United Copper Company and spiraled into a full-scale collapse of trust. People were terrified. Lines wrapped around city blocks.

The weird part? The government didn't save the day. A guy named J.P. Morgan did.

Morgan literally locked the country’s top bankers in his library and told them they weren't leaving until they bailed out the failing trusts. It worked, but it scared the living daylights out of the public. If one private citizen had the power to save—or break—the entire economy, something was fundamentally broken. This was the catalyst. This was the moment the gears started turning toward the creation of a centralized system.

The Jekyll Island Mystery

You've probably heard the conspiracy theories. Dark rooms, secret trains, fake names.

🔗 Read more: ROST Stock Price History: What Most People Get Wrong

Some of it is actually true.

In November 1910, a group of men representing the most powerful financial interests in the world met at the Jekyll Island Club off the coast of Georgia. We’re talking Senator Nelson Aldrich, representatives from the Rockefeller and Morgan empires, and Assistant Secretary of the Treasury A. Piatt Andrew. They used aliases to get there. They told people they were on a duck-hunting trip.

Why the secrecy? Because back then, if the public knew Wall Street was designing the new bank, they would have burned the bill before it reached the floor of Congress. They spent ten days hammering out the "Aldrich Plan."

Honestly, the Aldrich Plan failed. It was too "Wall Street" for the Democrats who controlled the government. But it provided the skeleton. When the Democrats eventually drafted the Federal Reserve Act under Carter Glass, they just rearranged the bones. They added more government oversight to make it palatable to the average voter, but the core mechanics—the regional structure and the lender of last resort function—remained.

When Was the Federal Reserve Created and Why the Date Matters

The timing of December 1913 is fascinating because it happened right as the world was about to catch fire. World War I broke out in Europe just months later.

If the Fed hadn't been established when it was, the U.S. might not have been able to finance the war effort or handle the massive shifts in global gold flow. The system was designed to be "elastic." That’s the word they used back then. They wanted a currency that could expand and contract based on what the economy needed. Before 1913, the money supply was weirdly rigid, tied to government bonds that didn't always match up with the needs of farmers in the Midwest or factories in the North.

The Twelve Districts: A Compromise

The U.S. is huge. In 1913, it felt even bigger. One of the biggest hurdles was the "Main Street vs. Wall Street" divide. People in Missouri didn't want their interest rates dictated by a guy in a suit in Manhattan.

💡 You might also like: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

To fix this, they didn't just build one bank. They built twelve.

- Boston

- New York

- Philadelphia

- Cleveland

- Richmond

- Atlanta

- Chicago

- St. Louis

- Minneapolis

- Kansas City

- Dallas

- San Francisco

This decentralized structure was the only way the bill could pass. It gave different regions a seat at the table. Even today, these regional banks provide the "boots on the ground" data that the Board of Governors uses to decide whether to hike or cut rates.

What Most People Get Wrong About the Fed

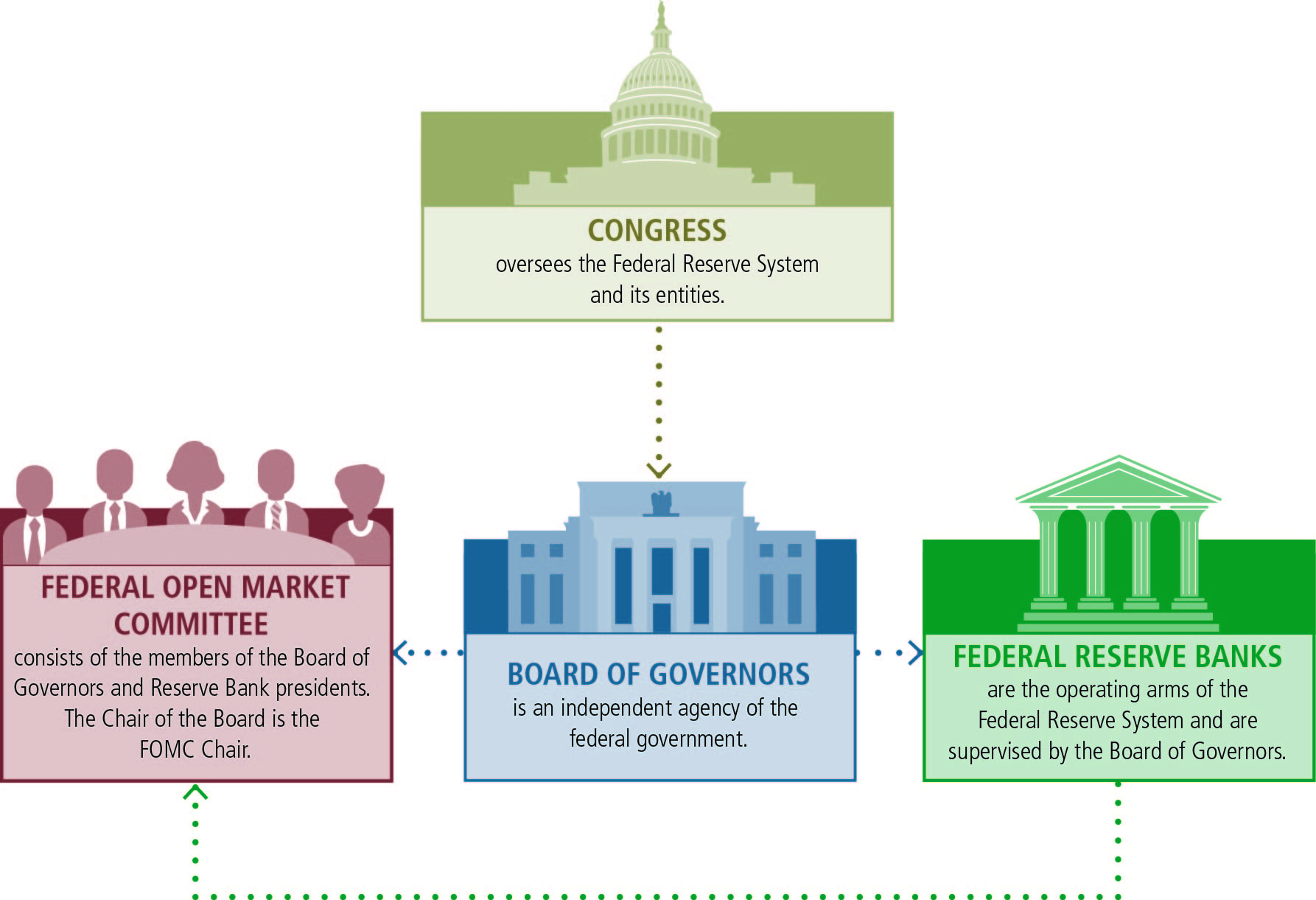

A common myth is that the Fed is "owned" by the government. It’s not. But it’s not exactly a private company either. It’s this weird, hybrid animal.

The Board of Governors is a government agency. The 12 regional banks are organized like private corporations. Member banks (the commercial banks you use) actually own stock in their regional Fed bank. But—and this is a big "but"—they don't get to control it. They don't get a share of the profits in the way a regular shareholder does. Most of the Fed's earnings actually get handed right back to the U.S. Treasury.

In 2022 alone, the Fed transferred about $76 billion to the Treasury. When the Fed loses money, which can happen when interest rates stay high, that transfer stops. It’s a complex relationship that keeps the central bank independent enough to make hard choices without having to run for re-election every two years.

The Evolution of the Mission

When the Fed started in 1913, its job was pretty simple: stop panics and keep the money moving.

It wasn't until the 1970s that we got the "Dual Mandate." Following the chaos of 1970s inflation, Congress told the Fed they had two primary goals:

📖 Related: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

- Maximum employment.

- Stable prices (low inflation).

Lately, people argue they have a third unofficial mandate: financial stability. Basically, making sure the whole house of cards doesn't fall down during a housing bubble or a global pandemic.

The 1913 Legacy in Your Pocket

Every time you look at a dollar bill, look at the top. It says "Federal Reserve Note."

Before when was the federal reserve created, you might have been carrying "National Bank Notes" issued by individual banks. If that bank went bust, your money might be worthless or worth only a fraction of its face value. The 1913 Act standardized the American experience. It turned 48 states (at the time) into a single, cohesive economic engine.

It hasn't been perfect. The Fed messed up big time during the Great Depression by tightening credit when they should have loosened it. They’ve been accused of being too slow to react to inflation in the post-COVID era. But without that 1913 foundation, the dollar wouldn't be the global reserve currency.

How to Use This Knowledge Today

Understanding the history of the Federal Reserve isn't just for trivia night. It helps you decode what's happening with your mortgage, your savings account, and your 401(k).

- Watch the FOMC meetings: The Federal Open Market Committee is the modern version of those guys at Jekyll Island, but they meet in public and release minutes. Their decisions on the "fed funds rate" dictate how much you pay for a car loan.

- Inflation isn't accidental: The Fed targets 2% inflation. Why? Because a little bit of inflation encourages people to spend money rather than hording it under a mattress. Understanding this helps you plan for long-term purchasing power.

- Regional data matters: If you live in the Dallas district, their economic reports might give you a better heads-up on the local job market than a national news broadcast.

The Federal Reserve was born out of a crisis to prevent future ones. While the tools have changed—moving from gold bars to digital ledgers—the mission started in that 1913 December remains the same.

Actionable Next Steps

To get a better handle on how the Fed affects your personal finances right now, check the Summary of Economic Projections (the "Dot Plot") released after their quarterly meetings. This shows you exactly where the Fed officials think interest rates are going over the next three years. It’s the closest thing you’ll get to a crystal ball for the economy. Also, consider looking at the FRED (Federal Reserve Economic Data) database maintained by the St. Louis Fed. It’s free, and it has every bit of data from 1913 to today, allowing you to track the real-time health of the U.S. dollar.