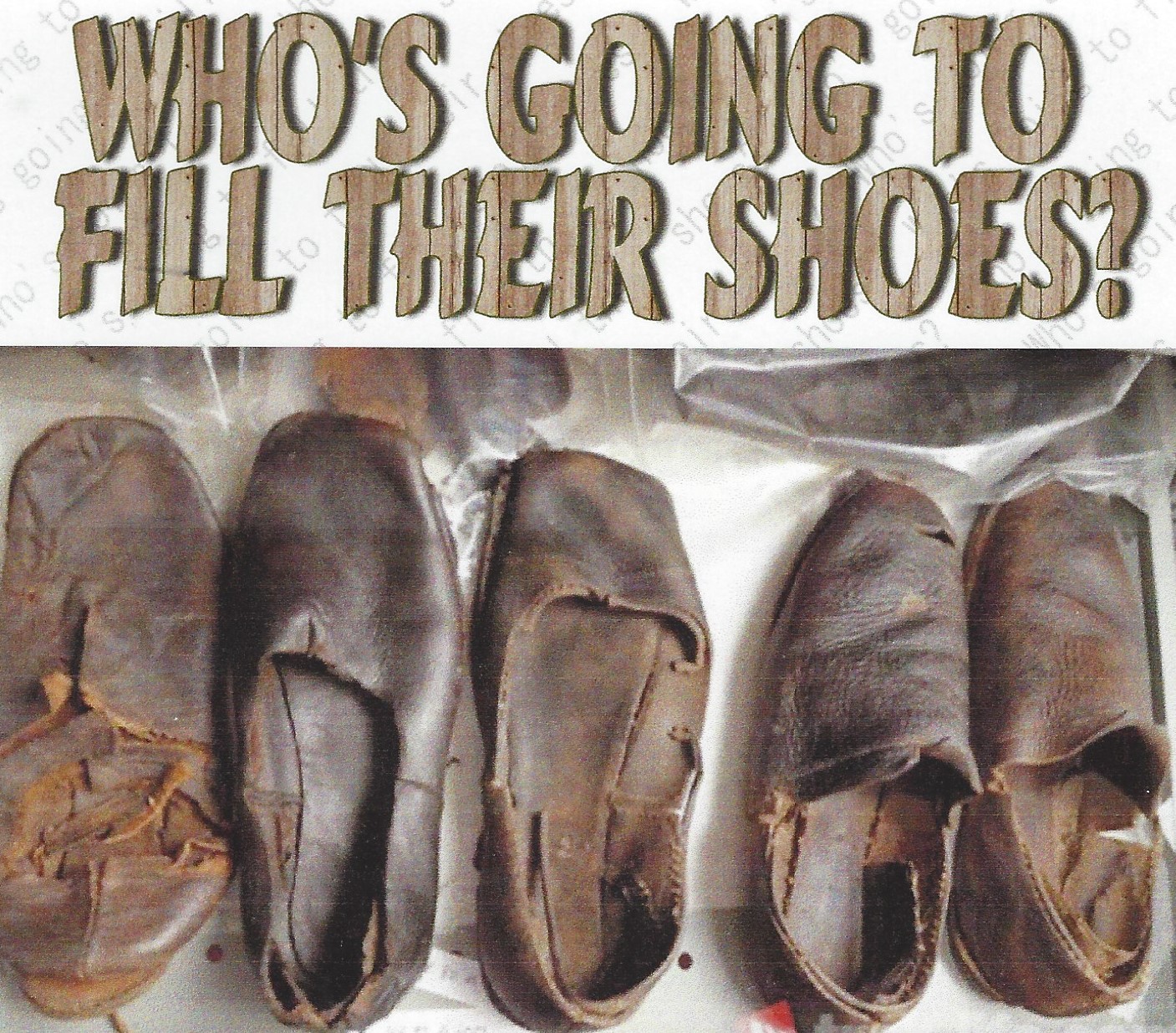

Everyone is getting older. It sounds like a cliché, but in the corporate world, it’s a terrifying mathematical reality that keeps boards of directors awake at night. We’ve spent the last decade watching legendary CEOs, founders, and industry titans build massive empires, yet remarkably few companies have a solid answer to the question of who's going to fill their shoes when the inevitable retirement party arrives.

Succession isn't just a HR checkbox. It's survival.

Look at Disney. Bob Iger came back because the person supposed to fill his shoes, Bob Chapek, didn't quite fit the mold—or at least the board didn't think so. It was messy. It was public. It wiped billions in market cap. That’s the nightmare scenario. Whether it’s a family-owned bakery or a Fortune 500 tech giant, the transition of power is the single most vulnerable moment in an organization’s lifespan.

The Empty Desk Problem

Most companies are actually pretty bad at this. Honestly, it’s human nature to avoid thinking about our own replacement. CEOs often have egos. They like being the "only one" who can steer the ship. But when you look at the data from the Harvard Business Review and firms like Korn Ferry, the "replacement gap" is widening. There is a massive shortage of "ready-now" candidates.

We aren't just talking about a title change. Filling those shoes means inheriting a culture, a set of relationships, and a specific vision that might have taken thirty years to cultivate.

Why the talent pool feels shallow

You’ve probably noticed that middle management has been gutted over the last few years. Efficiency drives and "flat" organizational structures sound great on a quarterly earnings call, but they destroy the training ground for future leaders. Without that middle layer, there’s no bridge. You have the C-suite and then you have everyone else.

If you don't have a bridge, you have to hire from the outside.

👉 See also: Modern Office Furniture Design: What Most People Get Wrong About Productivity

Hiring an external savior is a gamble. Statistics show that external CEOs are more likely to fail in the first two years compared to internal promotes who already "speak the language" of the company. They don't know where the bodies are buried. They don't know which vice president is actually a secret genius and which one is just good at PowerPoint.

Who's Going to Fill Their Shoes in the Age of AI?

The definition of "the right fit" is changing. In 2026, the person filling those shoes doesn't just need to be a good manager. They need to be a technologist.

If a legacy leader was a "builder," the successor likely needs to be an "adapter." We’re seeing a shift where boards are looking for candidates who understand AI integration, remote work dynamics, and global supply chain fragility. The old guard was great at scaling; the new guard has to be great at pivoting.

Think about the transition at Apple. Tim Cook wasn't Steve Jobs. He didn't try to be. Instead of trying to fill the shoes of a "visionary artist," he brought operational excellence that turned Apple into a multi-trillion-dollar juggernaut. He understood that who's going to fill their shoes doesn't mean finding a clone—it means finding the person the company needs for the next twenty years, not the last twenty.

The "Shadow" Candidates

Sometimes the person who fills the shoes isn't the one with the fanciest degree.

- The Internal Loyalists: These are the people who have been at the company for 15+ years. They know the DNA.

- The Disruptive Outsiders: Usually brought in when the company is failing and needs a "burn it down" approach.

- The "Co-CEOs": A trend that's becoming more popular as the job becomes too big for one human brain.

Netflix tried the co-CEO model with Ted Sarandos and Greg Peters. It’s a way to split the burden. One person handles the "shoes" of the creative side, the other handles the "shoes" of the tech and finance side. It’s basically a recognition that the shoes are now too big for any single pair of feet.

✨ Don't miss: US Stock Futures Now: Why the Market is Ignoring the Noise

The Psychological Toll of Succession

It's weirdly emotional.

Employees get scared. When a long-term leader leaves, the "psychological contract" between the company and the staff breaks. People start updating their resumes. Investors get twitchy.

Succession planning is often treated as a secret, "closed-door" process. That’s usually a mistake. Transparency—or at least the appearance of a plan—stabilizes the ship. When Howard Schultz left Starbucks (the first, second, and third time), the lack of a clear, permanent successor created a vacuum that invited activist investors and unionization pushes. Uncertainty is the enemy of a high stock price.

Real-World Case Studies: Success vs. Disaster

We can learn a lot by looking at the wins and the train wrecks.

The GE Disaster: For decades, Jack Welch was the gold standard of leadership. But his succession process was a televised bake-off that pitted three top executives against each other. Jeff Immelt won, the others left, and the company eventually started to crumble. The lesson? A "Hunger Games" style approach to filling shoes often leaves the winner with a broken company and no supporting cast.

The Microsoft Pivot: When Steve Ballmer stepped down, the shoes were heavy. Satya Nadella didn't just step into them; he changed the outfit entirely. He shifted from Windows-centricity to the Cloud. He changed the culture from "know-it-alls" to "learn-it-alls." This is arguably the most successful "shoe-filling" in history because the successor had the courage to admit the old shoes didn't fit the new terrain.

🔗 Read more: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

How to Identify the Next In Line

If you're looking at your own organization and wondering who's going to fill their shoes, you need to look for specific, often overlooked traits. It’s not just about who hits their sales targets.

- High Learning Agility: Can they unlearn old habits?

- Emotional Intelligence (EQ): In an era of social media scrutiny, a CEO who can't read a room is a liability.

- Resilience: The "shoes" are full of glass these days. Every mistake is global news within ten minutes.

Wait. There's also the "Family Business" factor.

Millions of "Baby Boomer" business owners are reaching retirement age. This is the "Great Wealth Transfer." In many cases, the kids don't want the business. They want to be influencers or painters or tech founders in Austin. This creates a massive crisis for local economies. If there’s no one to fill the shoes of the local manufacturing plant owner, that plant closes. The shoes stay empty, and the town suffers.

Actionable Steps for Succession Planning

Succession isn't a "one-and-done" event. It’s a process that should start years, if not a decade, before the transition.

- Create a "Leadership Pipeline": Don't just look at the top. Look at your managers today. Are you giving them "stretch assignments"? Are you letting them fail in small ways so they don't fail in big ways later?

- Conduct "Stay Interviews": Find your high-potential employees (HiPos) and ask them what they need to stay. If they leave because they don't see a path up, you've lost your future.

- External Benchmarking: Even if you want to promote from within, you need to know what the "market" looks like. Compare your internal stars to external talent. It keeps everyone honest.

- Phased Transitions: The "sudden departure" is a disaster. Ideally, the predecessor sticks around as a "consultant" or "Chairman" for 6-12 months. Not to micromanage, but to pass on the "soft knowledge" that isn't in any manual.

The reality is that nobody ever perfectly fills someone else's shoes. They bring their own. The goal isn't to find a carbon copy; it's to find a successor who respects the foundation while building a new floor.

Companies that fail to address who's going to fill their shoes usually end up in the history books rather than the stock tickers. You have to identify the talent, groom the talent, and then—this is the hardest part—actually step aside and let them lead.

What to do right now

If you are in a leadership position or an owner, perform a "Vulnerability Audit." Ask yourself: "If I disappeared tomorrow, who takes over?" If the answer is "I don't know" or "No one is ready," you are in the danger zone. Start by identifying three people who could potentially take the reins in five years. Give them one project this month that is completely outside their comfort zone. Watch how they handle the pressure. That's your first data point. Leadership isn't taught; it's forged, and you need to start the fire today.